- WORLD EDITIONAustraliaNorth AmericaWorld

March 06, 2023

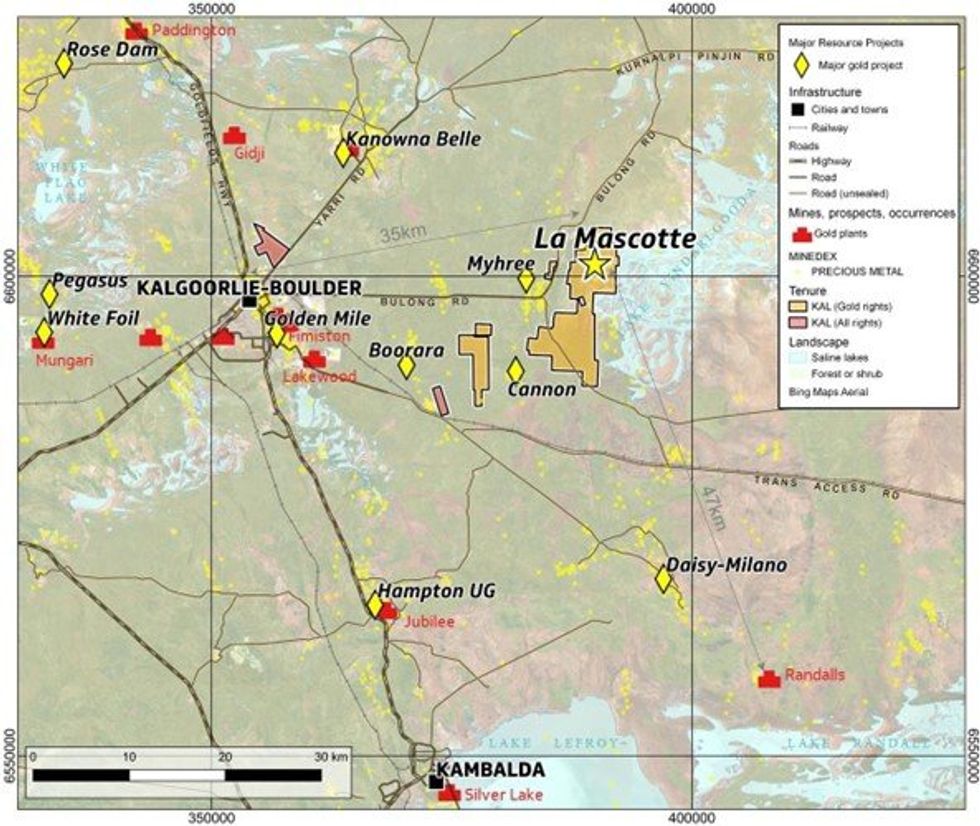

WA-focused gold explorer, Kalgoorlie Gold Mining (ASX:KAL) (‘KalGold’ or ‘the Company’), is pleased to announce the first JORC (2012) Mineral Resource at the La Mascotte gold deposit within the Bulong Taurus project, 35km to the east of Kalgoorlie-Boulder.

Highlights

- La Mascotte is one of the few outcropping gold deposits in the Eastern Goldfields

- First ever La Mascotte JORC (2012) Inferred Mineral Resource Estimate of:

- 3.61 Mt @ 1.19 g/t Au for 138,000 oz (0.6 g/t cut-off)

- Resource is estimated above the 220 mRL, or to a depth of ~140 m below surface on a granted mining lease

- Modelled resource footprint measures 700 m north-south by 500 m east-west, with multiple stacked mineralised horizons demonstrating a total sectional thickness of up to ~175 m

- Mineralisation remains open below 220 mRL at several target areas

- Potential for significant resource growth and upgrade with additional drilling

- KalGold direct expenditure cost of only ~A$5 per gold ounce (including drilling and assays)

The JORC (2012) Mineral Resource Estimate at La Mascotte has been estimated at:

3.61 Mt @ 1.19 g/t Au for 138,000 oz at a 0.6 g/t cut-off (Inferred).

This includes a higher-grade component of 1.35 Mt @ 1.92 g/t Au for 83,000 oz at a 1.0 g/t cut-off.

KalGold Managing Director and CEO Matt Painter said:

“The definition of 138,000 oz of gold from surface only 35km east of Kalgoorlie Boulder is a major milestone in KalGold’s short history. It reinforces our objective of discovering and defining gold resources in the Eastern Goldfields of Western Australia.

“La Mascotte is one of the few remaining outcropping gold deposits in the Eastern Goldfields. This initial JORC (2012) Mineral Resource Estimate highlights our cost-efficient approach to building a mineral resource base and strengthens KalGold’s credentials as a highly effective gold discovery company. For example, the incorporation of historic drill data into this JORC (2012) Mineral Resource Estimate has saved the Company $1.6 million in drilling-related costs, delivering a realised discovery cost of only $5/oz.

“With gold mineralisation remaining open at depth, KalGold will progress the La Mascotte mineral resource with additional work. We look forward to updating investors on our progress throughout CY2023.”

The La Mascotte Gold Deposit

The La Mascotte gold deposit is one of the few remaining outcropping gold deposits near Kalgoorlie- Boulder in the Eastern Goldfields of Western Australia. Located less than 35km east of the city on the sealed Bulong Road, the deposit can be accessed within 30 minutes’ drive from Kalgoorlie.

La Mascotte is located within the (historic gold rush era) Taurus Goldfield, immediately to the east of the Bulong Goldfield. Geologically, the deposit is hosted by a deformed, metamorphosed, felsic-intermediate volcanosedimentary sequence locally intruded by ultramafic to felsic porphyry pods and dykes. This sequence is juxtaposed against a nickel-mineralised ultramafic sequence to the west and north. Separating these sequences is the regionally extensive, deformed Goddard Fault. KalGold believes this fault to be the controlling structure for gold mineralisation throughout the Taurus Goldfield. Further south along strike, this hosts the high-grade Daisy Milano gold mine operations in the Mt Monger Goldfield.

Although outcrop at La Mascotte is poor, gold-mineralised quartz veining and altered felsic-intermediate volcaniclastic rocks are evident as subcrop and float over several hundred metres (Figure 3). Gold nuggets have also been recovered by our prospector partners over the area (Figure 4). Furthermore, shallow excavations in these areas exhibit a prevailing shallow westerly dip of strata, foliation, and veining.

Click here for the full ASX Release

This article includes content from Kalgoorlie Gold Mining Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Kalgoorlie Gold Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 May 2025

Kalgoorlie Gold Mining

Unlocking gold deposits hidden under shallow cover in the heart of Western Australia’s Eastern Goldfields

Unlocking gold deposits hidden under shallow cover in the heart of Western Australia’s Eastern Goldfields Keep Reading...

10 February

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Sign up to get your FREE

Kalgoorlie Gold Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00