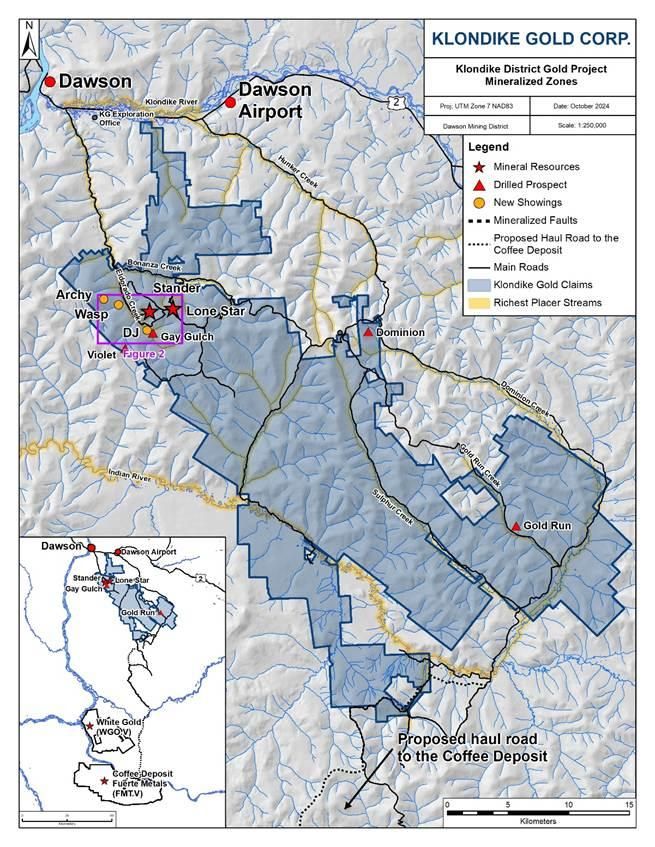

VANCOUVER, BC / ACCESS Newswire / November 6, 2025 / Klondike Gold Corp (the "Company") is pleased to announce assay results from its 2025 Phase 1 diamond drill program, totaling 2,354.70 metres across 13 holes. The program was designed to test the orientation of major structural features interpreted to control gold deposition at the Company's 100% owned Klondike District Property (the "Property") in the Dawson mining district, Yukon, Canada. (See Figure 1).

Highlighted Results Include:

-

Hole EC25-554: 0.25 g/t Au over 64.80 metres from 7.55 to 72.35 metres

Including 1.30 g/t Au over 10.00 metres from 62.35 to 72.35 metres

Hole EC25-557: 0.13 g/t Au over 14.50 metres from 171.50 to 186.00 metres

Hole EC25-557: 0.14 g/t Au over 10.50 metres from 197.00 to 207.50 metres

Hole EC25-561: 0.76 g/t Au over 2.00 metres from 121.50 to 123.50 metres

Hole EC25-562: 0.47 g/t Au over 5.00 metres from 26.00 to 31.00 metres

Hole EC25-566: 5.20 g/t Au over 3.00 metres from 75.00 to 78.00 metres

"These results are highly encouraging," said Peter Tallman, CEO and President of Klondike Gold Corp. "The Phase 1 drill holes were specifically designed to test the orientation of structural controls on specific faults and estimate offset distances rather than to target mineralization directly. The fact that several holes encountered gold mineralization, including a new gold discovery zone in EC25-566, suggests we are on the right path to understanding the geological architecture that originally emplaced the substantial gold endowments within the historic Klondike Gold District."

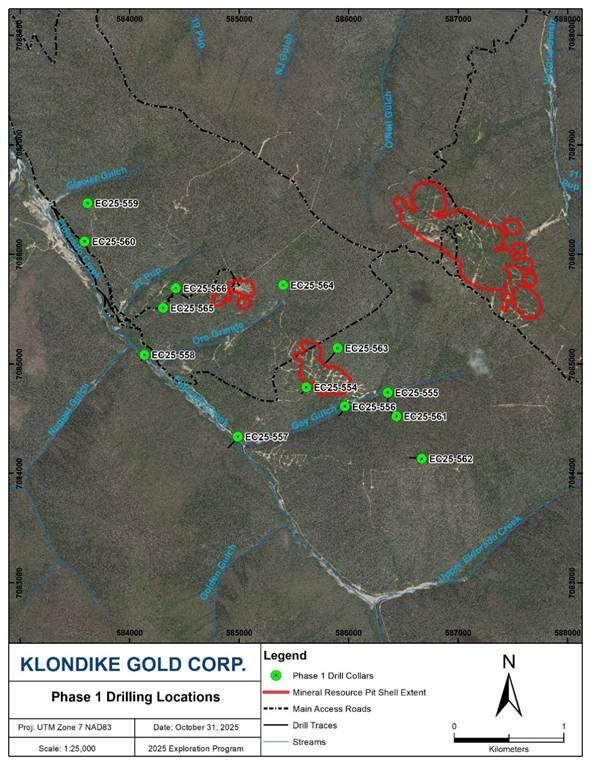

The Phase 1 drill holes were completed outside of previously defined Lone Star and Stander mineral resource areas1, as outlined in Figure 2. Among them, hole EC25-566 intersected 5.20 g/t Au over 3m which is a new discovery of gold mineralization. The intent of Phase 1 drilling was to constrain or discern the relative ages of these structures and to provide information on potential displacement, successfully laying the groundwork for future mineralization-focused drilling later in Phase 3 drilling. Six holes in total intersected notable gold mineralization, highlighting the potential relationship between key structural controls and gold-bearing zones. Locations of the Phase 1 drilling can be referred to in Figure 2. Summary results are shown in Table 1.

Table 1: Summary of Significant Gold Intervals for Phase 1 Drilling

Hole ID | From (m) | To (m) | Interval (m) 2 | Au (g/t) 3 |

EC25-554 | 7.55 | 72.35 | 64.80 | 0.25 |

Including | 62.35 | 72.35 | 10.00 | 1.30 |

EC25-555 | No significant assay | |||

EC25-556 | No significant assay | |||

EC25-557 | 171.50 | 186.00 | 14.50 | 0.13 |

EC25-557 | 197.00 | 207.50 | 10.50 | 0.14 |

EC25-558 | No significant assay | |||

EC25-559 | Assays Pending | |||

EC25-560 | No significant assay | |||

EC25-561 | 121.50 | 123.50 | 2.00 | 0.76 |

EC25-562 | 26.00 | 31.00 | 5.00 | 0.47 |

EC25-563 | No significant assay | |||

EC25-564 | No significant assay | |||

EC25-565 | No significant assay | |||

EC25-566 | 75.00 | 78.00 | 3.00 | 5.20 |

Following the success of Phase 1, the Company further initiated Phase 2 exploration, focusing on completing a detailed 3D structural and lithologic model for the main resource areas. This work included:

Re-logging over 60,000 metres of historical drill core;

Conducting detailed analysis of local fault systems;

Collecting Short Wave Infrared (SWIR) measurements on Phase 1 drill core from the 2025 season; and

Evaluating correlations between lithology and gold mineralization.

Importantly the evolving exploration model suggests multiple ages and orientations of faulting which has considerable positive implications for guiding expansion of the Company's existing resources at the Lone Star and Stander deposits and broadly for new exploration discoveries throughout the Property.

QUALIFIED PERSONS REVIEW

The technical and scientific information contained within this news release has been reviewed and approved by Peter, Tallman, P.Geo., President of Klondike Gold and Qualified Person as defined by National Instrument 43-101 policy.

ABOUT Klondike Gold Corp.

Klondike Gold is a Vancouver based gold exploration company advancing its 100%-owned Klondike District Gold Project located at Dawson City, Yukon, one of the top mining jurisdictions in the world. The Klondike District Gold Project targets gold associated with district scale orogenic faults along the 55-kilometer length of the famous Klondike Goldfields placer district. Gold mineralization and indicated/inferred mineral resources have been identified at both the Lone Star Zone and Stander Zone1, among other targets. The Company retains a 10% production royalty on the active Montana Creek placer property with payments capped at $9.5M total over 6 years. The Company is focused on exploration and development of its 729 square kilometer property accessible by scheduled airline and government-maintained roads located on the outskirts of Dawson City, Yukon, within the Tr'ondëk Hwëch'in First Nation traditional territory.

ON BEHALF OF Klondike Gold Corp.

"Peter Tallman"

Peter Tallman,

President and CEO

FOR FURTHER INFORMATION:

Telephone: (604) 609-6110

E-mail: info@klondikegoldcorp.com

Website: www.klondikegoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain statements contained in this news release constitute "forward-looking statements". When used in this document, the words "anticipated", "expect", "estimated", "forecast", "planned", and similar expressions are intended to identify forward-looking statements or information. These statements are based on current expectations of management, however, they are subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking statements in this news release. Readers are cautioned not to place undue reliance on these statements. Klondike Gold does not undertake any obligation to revise or update any forward-looking statements as a result of new information, future events or otherwise after the date hereof, except as required by securities laws.

Forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company's securities; fluctuations in commodity prices and changes in the Company's business plans. In making the forward looking statements in this news release, the Company has applied several material assumptions that the Company believes are reasonable, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. The Company seeks safe harbor.

For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedarplus.ca.

[1]The Mineral Resource Estimate for the Klondike District Property was prepared by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc., an independent Qualified Person in accordance with the requirements of NI 43-101. The technical report supporting the Mineral Resource Estimate entitled "NI 43-101 Technical Report on the Klondike District Gold Project, Yukon Territory, Canada" has been filed on SEDAR at www.sedarplus.ca effective November 10, 2022. Refer to news release of December 16, 2022.

[2]Estimated True Widths for reported mineralized vein intercepts are based on oriented core measurements of individual veins where available or measured angles perpendicular to vein margins, and/or 3D models of vein intercepts. The measured and model average "sheeted extensional vein" dip is 35o northeasterly, and typical drill hole dip angle is 55o southwesterly. Other potentially oblique gold-mineralized veins may be present. Differences between individual ETWs and down-hole interval lengths may vary between drill holes depending on drill hole azimuth and inclination, variations in vein zone strike and dip, and overall geometries of the different vein systems.

[3]Primary gold analyses in 2025 are performed by ‘Photon Assay' at MSA Labs using a 500 g subsample analysed for gold in the Prince George laboratory. Overlimit gold results in excess of 350 ppm are re-assayed under alternate parameters. MSA also provides trace element analyses performed at the Langley facility using a 0.5 g subsample digested by Aqua Regia analyzed with an inductively coupled plasma mass spectrometry (ICP-MS) and emission spectroscopy (ICP-ES) for 39 elements. QA/QC includes the insertion and continual monitoring of numerous standards, blanks and duplicates by Klondike Gold. Blanks and standards are obtained commercially from Canadian Resource Laboratories of Langley, British Columbia. Secondary gold check analyses in 2025 are performed by fire assay / atomic absorption method by BV Labs prepared in Whitehorse, YT and analyzed in Vancouver, BC.

SOURCE: Klondike Gold Corp.

View the original press release on ACCESS Newswire