- WORLD EDITIONAustraliaNorth AmericaWorld

September 03, 2023

Lithium exploration and development company Winsome Resources (ASX:WR1; “Winsome” or “the Company”) is pleased to provide an update on exploration at its 100% owned Adina project in the James Bay region of Quebec, Canada.

HIGHLIGHTS

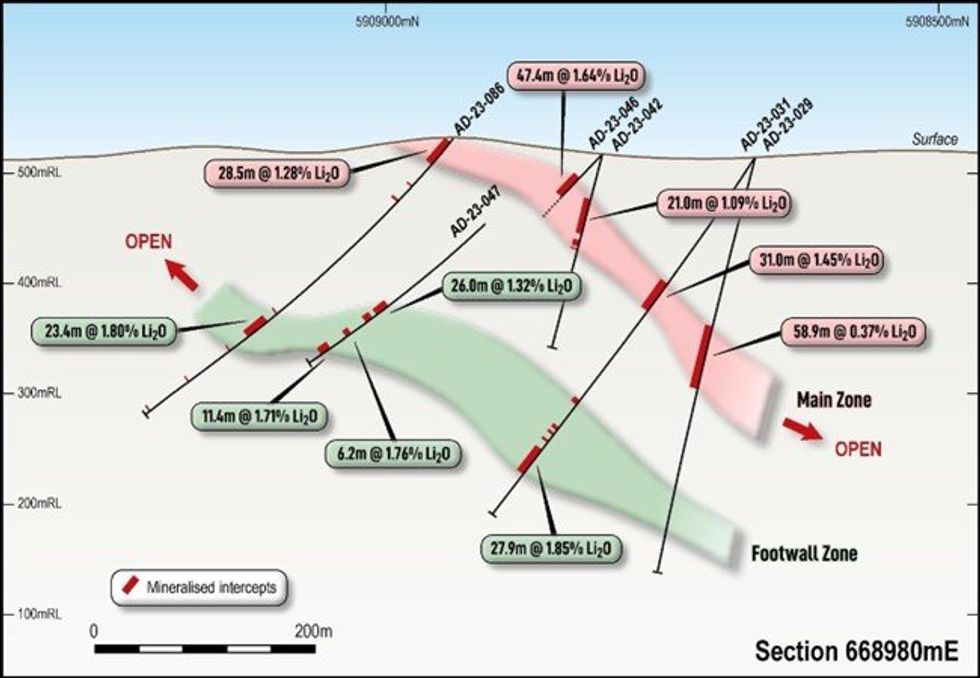

- Assays from up-dip drill testing of the recently discovered Footwall Zone at Adina have confirmed high grade mineralisation continues towards the surface with results including:

- 1.80% Li2O over 23.4m 150m below surface (AD-23-086),

- 1.55% Li2O over 26.4m 125m below surface (AD-23-095), and

- 1.06% Li2O over 16.9m 135m below surface (AD-23-085). (Results detailed in Table 1 below).

- Main Zone intersections from the same drillholes at Adina confirm mineralisation occurs at surface with results including:

- 1.28% Li2O over 28.5m from 2.8m (AD-23-086),

- 1.18% Li2O over 22.2m from 14.8m (AD-23-095), and

- 1.44% Li2O over 10.3m from 13.6m (AD-23-085). (Results detailed in Table 1 below).

- Results are from drilling completed 50 metres north of previous drilling on these sections, with mineralisation remaining open to the north

- Drilling has recommenced on site, with a total of 5 rigs expected to be drilling in the coming weeks.

Exciting new lithium drill intersections have been received from drilling testing up-dip extensions of the Main and Footwall Zones, with results confirming the Footwall Zone continues towards surface.

Drilling has also recommenced on site, with additional rigs being mobilised and fitted with tracks to improve mobility and increase efficiency with rig moves. A total of 5 rigs are planned to be drilling by the end of September or early October.

WINSOME’S MANAGING DIRECTOR CHRIS EVANS SAID:

“It is clearly a positive to have drilling underway again at Adina and we thank both RJLL and Winsome personnel who have worked hard to re-start drilling safely and rapidly. The installation of tracks on the drill rig will significantly improve the efficiency of rig moves and result in improved drilling meterage rates going forward as well as assist access in certain areas.

Our clear priority is to continue testing the near-surface extent of the recently discovered Footwall Zone, with these latest results confirming the high grade shallow nature of mineralisation at Adina. We look forward to stepping out in all directions with our next phase of drilling to fully test the extents of mineralisation at Adina ahead of defining our maiden resource later in 2023.”

Commentary on Drilling Results

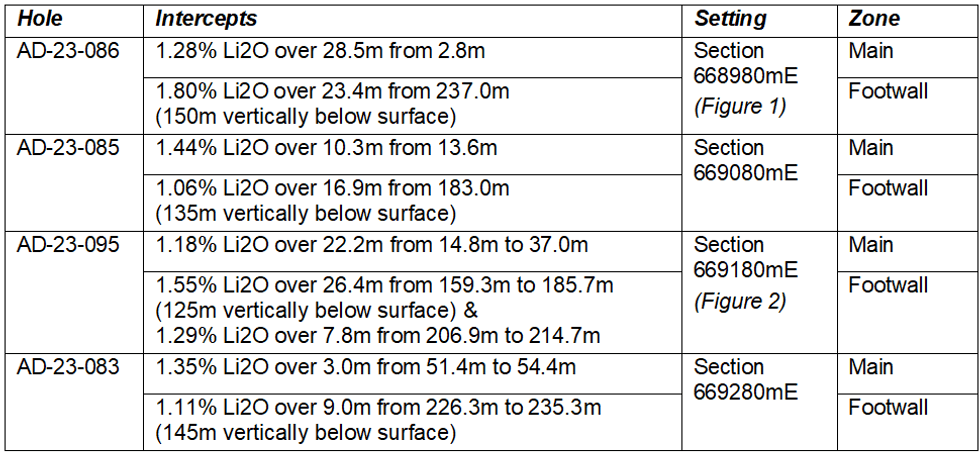

Intersections reported in this announcement confirm the continuity of lithium mineralisation in drilling to the north of Adina Main, up-dip from previous intersections of the Main and Footwall Zones. New results received are shown on Figure 1 with all data from the programme to date included in the Appendices.

Importantly the results confirm the Footwall Zone continues towards surface, adding over 100 metres of mineralisation to the north-south extent of this zone and intersecting the upper contact at approximately 100 metres vertical depth (Figure 2 and 3). Further drill tests are planned to the north of this drilling to test the Footwall Zone closer to surface.

Due to the siting of these drill holes the Main Zone intersections are interpreted to represent partial intersections, being collared into outcropping or subcropping pegmatites from this zone. These holes achieved their target of defining the Main Zone mineralisation at surface for the purposes of resource delineation, but the intersections do not represent the complete 40m+ thickness of this zone (established from previous intersections reported by the Company as summarised in Appendix 2).

Click here for the full ASX Release

This article includes content from Winsome Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WR1:AU

The Conversation (0)

14 November 2025

Nextech3D.ai Poised for Growth as Event-Tech and 3D/AR Revenue Accelerates

Nextech3D.AI (CSE:NTAR,OTCQX:NEXCF,FSE:EP2) is gaining investor attention following H.C. Wainwright’s November 2025 coverage, highlighting renewed optimism about the company’s growth prospects, driven largely by its expanding event‑technology business.The analyst firm maintained a Buy rating... Keep Reading...

31 May 2023

Restructure of the Renard Option

Highlights Reduction of initial payment upon exercise of the option from C$15 million to C$1 million . The balance of the Renard consideration payment delayed until 2026 and 2027. Renard Option restructure preserves shareholder value by deferring material payments by 12 months and extending the... Keep Reading...

09 May 2022

Winsome Further Expands Lithium Exploration Footprint in Quebec

Perth-based lithium exploration and development company Winsome Resources (ASX:WR1; “Winsome” or “the Company”) is pleased to advise it has partnered with geology specialist Mr Glenn Griesbach and with local prospector Mr Marc de Keyser. Highlights: Exclusive option agreement executed for... Keep Reading...

27 April 2022

Quarterly Report for Period Ending 31 March 2022

Winsome Resources Limited (ASX: WR1) ("the Company" or "Winsome Resources ") is pleased to report on its Quarterly activities for the period ending 31 March 2022.Quarter Highlights Exploration Entered into exclusive option agreement to explore and acquire 669 claims in the highly prospective... Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00