Kenorland Minerals Ltd. (TSXV: KLD,OTC:KLDCF) (OTCQX: KLDCF) (FSE: 3WQ0) ("Kenorland" or the "Company") is pleased to announce the commencement of drilling at the O'Sullivan Project (the "Project"), located in the Abitibi greenstone belt of Quebec and held under an option agreement with Sumitomo Metal Mining Canada Ltd. ("Sumitomo").

2025 Fall Exploration Program

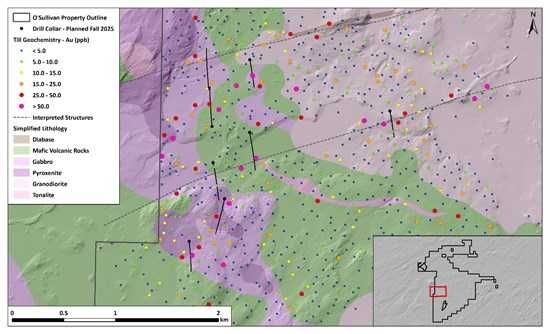

A total budget of $1.72 million has been approved by Sumitomo for the fall 2025 exploration program. The program will comprise up to 2,925 metres of diamond drilling, representing the first test of a target area defined through five years of systematic exploration. Drilling will focus on a series of interpreted structures and coincident geophysical anomalies within a folded sequence of mafic volcanic and mafic-ultramafic intrusive rocks. Kenorland is operator of the Project, with drilling activities expected to conclude by early December.

Figure 1. Plan map of planned drill hole locations with geology and gold-in-till geochemistry

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6489/273910_1f9631acd4c8aa08_001full.jpg

Target Area

During the 2025 exploration campaign, the Company completed infill till sampling and an induced polarisation ("IP") survey across the target area. This work followed earlier geochemical surveys carried out in 2020 and 2021, a property-wide airborne versatile time-domain electromagnetic survey, and detailed mapping completed in 2023. The underlying geology consists of broadly folded, mafic-dominant volcanic rocks with minor interbedded rhyolite, intruded by early mafic-ultramafic sills that have developed penetrative fabrics and are locally cross-cut by east-northeast-trending shear zones. The folded stratigraphy lies immediately west of an interpreted early syn-volcanic granodiorite pluton. The fall 2025 drill program is designed to test several strong, discrete chargeability and conductivity anomalies identified by the recent IP survey that coincide with interpreted structures and lithological contacts. Drilling will cross multiple lithological settings within a structural corridor highlighted by gold-in-till anomalism, prospective for orogenic gold mineralisation.

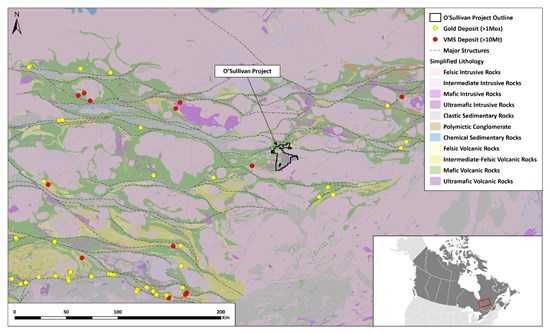

Figure 2. Regional geology with significant gold and VMS deposits and O'Sullivan Project location

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6489/273910_1f9631acd4c8aa08_002full.jpg

About O'Sullivan Project

The O'Sullivan Project covers 27,587 hectares of mineral tenure within the Abitibi greenstone belt along the Casa Berardi Deformation Zone ("CBDZ"). The CBDZ is one of the primary structures that controls orogenic gold mineralisation in the belt and hosts the active Casa Berardi mine that has produced over 2.0 million ounces of gold since 1988, with recent proven and probable reserves of 1.27 million ounces*. Other major deposits along the CBDZ include the Douay gold deposit (2.52 million oz Au inferred and 511,000 oz Au indicated)** as well as the Nelligan gold deposit, having a 5.16 million oz Au inferred and 3.12 million oz gold indicated resource***. The O'Sullivan Project covers approximately 15 kilometres of strike length along the southern margin of the CBDZ where the deformation zone intersects volcanic rocks of the Stoughton-Roquemaure and Kidd-Munro assemblages.

The Project is located approximately 50 kilometres east of the city of Lebel-sur-Quévillon and 150 kilometres northeast of Val-d'Or, Quebec. Local infrastructure includes a power transmission line transecting the property, a railway line approximately 5 kilometres to the north of the Project, and an extensive network of logging roads throughout the property.

The Project is currently under an option agreement with Sumitomo (the "Option Agreement"), whereby Sumitomo can earn an initial 51% interest in the Project by incurring an aggregate of $4,900,000 in mineral exploration expenditures on or before the third anniversary of the Option Agreement (of which $1,200,000 are guaranteed expenditures within the first three years). Kenorland will act as operator of the Project in return for a management fee equal to 15% of the total expenditures during the first earn-in period.

Following the earning of a 51% interest, Sumitomo has the option to earn an additional 19% (for a total of 70% interest), by delivering a NI 43-101 compliant feasibility study on the Project disclosing mineral resources in the measured and indicated categories of not less than 1,500,000 ounces of gold (or AuEq) within an additional seven years. Once Sumitomo has earned a 70% interest, Kenorland will have the option to forego a minority joint venture interest and immediately vest a net smelter returns royalty interest of 4% on the Project. In the event of joint venture participation, any party which dilutes to below a 10% interest will exchange its joint venture interest for a net smelter returns royalty of 3% (subject to a 1% buyback for $1,000,000).

*Technical Report Summary on the Casa Berardi Mine, Northwestern Québec, Canada. Prepared for Hecla Mining Company, effective date December 31, 2023.

**Technical Report on the Douay and Joutel Projects Northwestern Québec, Canada. Prepared for Maple Gold Mines Ltd., effective date March 17, 2022.

***NI-43-101 Technical Report, Nelligan Gold Project, Québec. Prepared for IAMGOLD Corporation, effective date December 31, 2024.

The mineral resources and reserves discussed for properties along the CBDZ are not located on the O'Sullivan Project. The Company has not verified this information and it is not being treated as current mineral resources or reserves of the Company. The information is provided for geological context only.

Qualified Person

Cédric Mayer, M.Sc., P.Geo. (OGQ #02385), Senior Project Geologist at Kenorland, "Qualified Person" under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

About Kenorland Minerals

Kenorland Minerals Ltd. (TSXV: KLD,OTC:KLDCF) is a well-financed mineral exploration company focused on project generation and early-stage exploration in North America. Kenorland's exploration strategy is to advance greenfields projects through systematic, property-wide, phased exploration surveys financed primarily through exploration partnerships including option to joint venture agreements. Kenorland holds a 4% net smelter return royalty on the Frotet Project in Quebec which is owned by Sumitomo Metal Mining Canada Ltd. The Frotet Project hosts the Regnault gold system, a greenfields discovery made by Kenorland and Sumitomo Metal Mining Canada Ltd. in 2020. Kenorland is based in Vancouver, British Columbia, Canada.

Further information can be found on the Company's website www.kenorlandminerals.com

On behalf of the Board of Directors,

Zach Flood

President, CEO & Director

For further information, please contact:

Alex Muir, CFA

Corporate Development and Investor Relations Manager

Tel +1 604 568 6005

info@kenorlandminerals.com

Cautionary Statement Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (together, "forward-looking statements") within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as "plans", "expects", "estimates", "intends", "anticipates", "believes" or variations of such words, or statements that certain actions, events or results "may", "could", "would", "might", "will be taken", "occur" or "be achieved". Forward-looking statements involve risks, uncertainties and other factors disclosed under the heading "Risk Factors" and elsewhere in the Company's filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273910