Kenorland Minerals Ltd. (TSXV: KLD) (OTCQX: NWRCF) (FSE: 3WQ0) ( "Kenorland" or "the Company" ) is pleased to announce the commencement of the Q1 2022 winter exploration program at the Regnault gold discovery within the Frotet Project ( "the Project" ), located in northern Quebec and held under joint venture ( "the Joint Venture" ) with Sumitomo Metal Mining Canada Ltd. ( "SMMCL" ).

Zach Flood , CEO of Kenorland Minerals states, "We're thrilled to have the drills turning again at Regnault. Each program including the initial discovery in 2020 has produced exceptional results. We anticipate further exploration success as we continue to step-out and extend the known high-grade mineralisation to greater depths as well as target the discovery of additional gold bearing structures within the complex."

Q1 2022 Winter Exploration Program

The Q1 2022 program will include up to 10,000 meters of diamond drilling at the Regnault gold discovery. This program follows the recently completed 17,792 meter drill program, of which 9,824m have been reported, including a highlight of 15.40m at 17.96 g/t Au (see press release dated December 20, 2021 ). The company expects assays for the remaining 7,968m to be announced in the coming weeks.

Regnault Drill Program

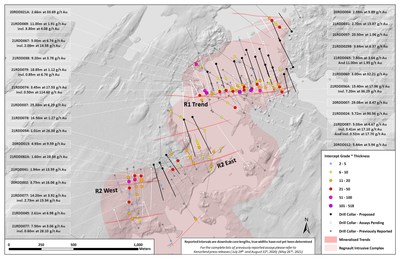

Figure 1. Plan Map of Proposed Drilling along R1 and R2 Structures

Approximately 60% of the proposed drilling will be allocated to step-outs along the R1 structure, targeting down plunge extensions of higher-grade mineralisation along the vein corridor. Twelve drill holes are planned to significantly expand the R1 vein system at depth to approximately 500m below surface beyond the current known extent of approximately 275m vertical depth. Along the R2 Trend, up to 25% of the proposed program will be allocated towards broad-spaced infill drilling to determine the structural framework linking R2 West and R2 East. The remaining 15% of the proposed drill program is designed to expand on known mineralisation and test additional gold-bearing structures north of the R1 corridor.

To date a total of 34,206 meters have been drilled at Regnault including the initial discovery drill program in early 2020. The program will conclude the fiscal 2021 budget approved by the Joint Venture in May 2021 . The upcoming fiscal 2022 budget is expected to be announced later in the first quarter. Exploration at the Frotet Project is co-funded with Joint Venture partner, Sumitomo Metal Mining Canada Ltd. and Kenorland Minerals is currently the operator of the Joint Venture.

About the Frotet Project

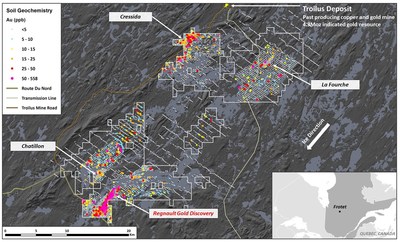

Figure 2. Map of Frotet Project showing Regional Till Sampling Geochemical Results

The Frotet Project was first identified by Kenorland in 2017 after completing a regional prospectivity study over the Abitibi and Frotet-Evans Greenstone Belts of Quebec . The initial 55,921 ha property was acquired through map staking in March, 2017 and optioned to Sumitomo Metal Mining Canada Ltd. ("SMMCL"), a wholly owned subsidiary of Sumitomo Metal Mining Co., Ltd. in April, 2018. Two years of property-wide systematic till sampling led to a maiden drill program in 2020 which resulted in a significant grassroots discovery at the prospect now named Regnault. The project is currently under Joint Venture agreement between SMMCL and Kenorland Minerals Ltd., with interests being held at 80% and 20% respectively. Under the Joint Venture, exploration is funded pro-rata and Kenorland is presently the operator of the project. Any party which does not contribute and is diluted below a 10% interest, converts its interest to an 2% uncapped net smelter royalty.

QA/QC and Core Sampling Protocols

All drill core samples were collected under the supervision of Kenorland employees. Drill core was transported from the drill platform to the logging facility where it was logged, photographed, and split by diamond saw prior to being sampled. Samples were then bagged, and blanks and certified reference materials were inserted at regular intervals. Groups of samples were placed in large bags, sealed with numbered tags to maintain a chain-of-custody, and transported from Chibougamau to BV laboratory in Timmins, Ontario .

Sample preparation and analytical work for this drill program was carried out by Bureau Veritas Commodities, Timmins , Ontario. Samples were prepared for analysis according to BV method PRP70-250: individual samples were crushed to 2mm and a 250g split was pulverized for analysis and then assayed for Gold. Gold in samples was analyzed by fire assay with AAS finish and over-limits re-analyzed gravimetrically. In zones with macroscopic gold the samples were first screened, and the fine fraction was fire assayed with AAS finish. Multi-element geochemical analysis (45 elements) was performed on all samples using BV method MA200 where a 0.25g split is heated in HNO3, HClO4, and HF to fuming and taken to dryness. The residue is dissolved in HCl and analysed by a combination of ICP-ES/MS. All results passed the QAQC screening at the lab, and all company inserted standards and blanks returned results that were within acceptable limits.

Qualified Person

Mr. Jan Wozniewski , B. Sc., P. Geo., OGQ (#2239) is the "Qualified Person" under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

About Kenorland Minerals

Kenorland Minerals Ltd. (TSX.V KLD) is a mineral exploration Company incorporated under the laws of the Province of British Columbia and based in Vancouver, British Columbia , Canada. Kenorland's focus is early to advanced stage exploration in North America. The Company currently holds three projects in Quebec where work is being completed under joint venture and earn-in agreement from third parties. The Frotet Project is held under joint venture with Sumitomo, the Chicobi Project is optioned to Sumitomo, and the Chebistuan Project is optioned to Newmont Corporation. In Ontario , the Company holds the South Uchi Project under an earn-in agreement with a wholly owned subsidiary of Barrick Gold Corporation. The Company also owns 100% of the advanced stage Tanacross porphyry Cu-Au-Mo project as well as an option to earn up to 70% from Newmont Corporation on the Healy Project, both located in Alaska, USA .

Further information can be found on the Company's website www.kenorlandminerals.com

Kenorland Minerals Ltd.

Zach Flood

President and CEO

Tel: +1 604 363 1779

zach@kenorlandminerals.com

Kenorland Minerals Ltd.

Francis MacDonald

Executive Vice President

Tel: +1 778 322 8705

francis@kenorlandminerals.com

Cautionary Statement Regarding Forward Looking Statements

This news release contains forward-looking statements and forward-looking information (together, "forward-looking statements") within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as "plans", "expects', "estimates", "intends", "anticipates", "believes" or variations of such words, or statements that certain actions, events or results "may", "could", "would", "might", "will be taken", "occur" or "be achieved". Forward looking statements involve risks, uncertainties and other factors disclosed under the heading "Risk Factors" and elsewhere in the Company's filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/kenorland-minerals-begins-drilling-at-regnault-quebec-301459161.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/kenorland-minerals-begins-drilling-at-regnault-quebec-301459161.html

SOURCE Kenorland Minerals Ltd.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2022/12/c7823.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2022/12/c7823.html