October 08, 2023

Jindalee Resources Limited (ASX:JRL) (Jindalee, the Company) is pleased to advise that it has contracted Alford Drilling from Elko, Nevada to undertake a diamond core drilling program at Jindalee’s 100% owned McDermitt Lithium Project in Oregon, USA (McDermitt, Project).

- Diamond drill rig contracted for McDermitt infill drilling program

- Drilling to commence 1 November 2023, subject to final approvals

- Drilling to provide geotechnical information for McDermitt PFS – due for completion 1H CY 2024

- McDermitt is the largest lithium deposit in the US by contained lithium with 21.5Mt Lithium Carbonate Equivalent (LCE) in Mineral Resource1

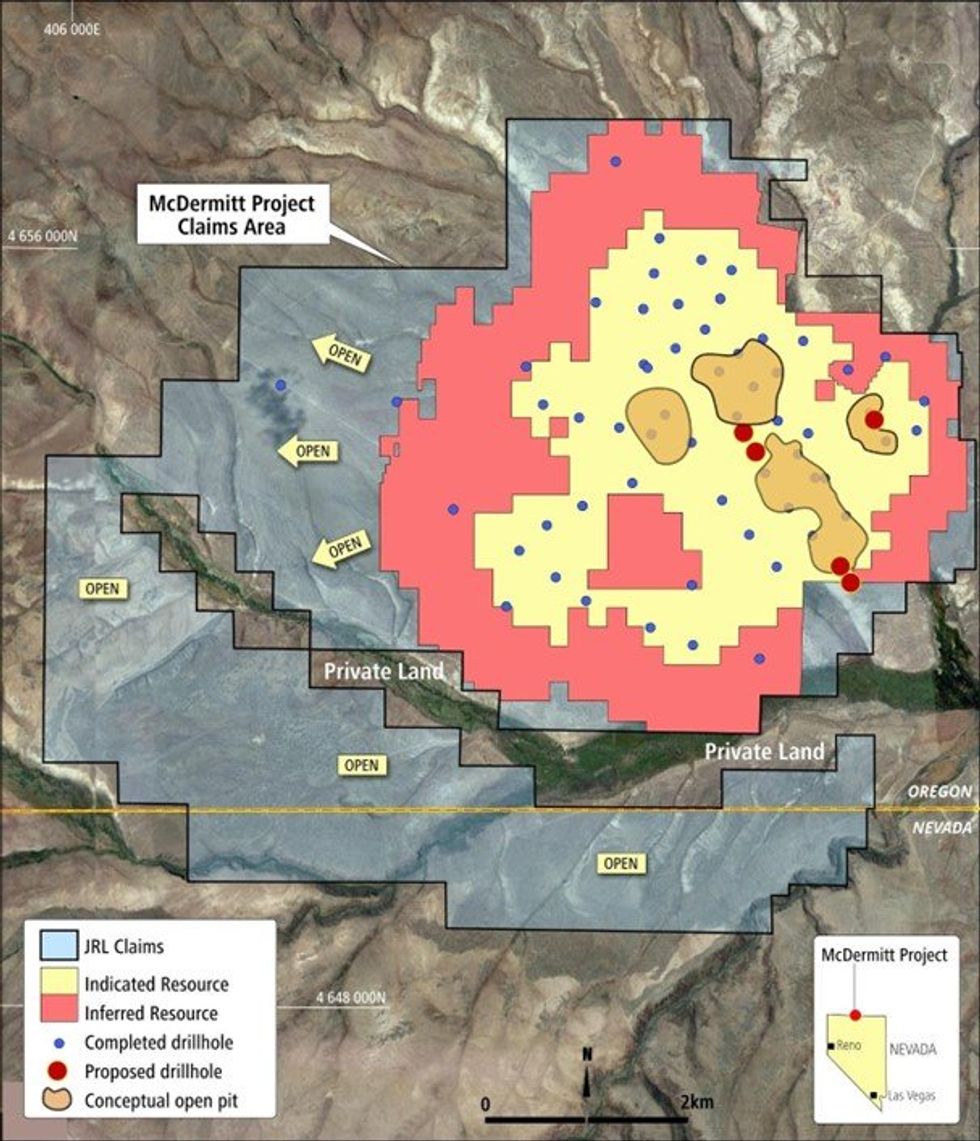

The proposed drilling program comprises five HQ triple tube core holes collared within, or immediately adjacent to, conceptual Pit Shell 5 (nominal 20 years)2 and is primarily designed to provide geotechnical information for the Pre-Feasibility Study3 (PFS), as well as confirm data from earlier reverse circulation (RC) drilling (Figure 1). Drilling is expected to commence 1 November 2023, subject to receipt of final approvals from the Bureau of Land Management, with assays from the drilling expected early 2024.

McDermitt has an Indicated and Inferred Mineral Resource Inventory of 3.0 Billion tonnes at 1,340ppm Li for total of 21.5 Million tonnes LCE at 1,000 ppm cut-off grade1 (Table 1). At 21.5 Mt LCE, McDermitt is the largest lithium deposit in the US by contained lithium in Mineral Resource, and a globally significant resource.

McDermitt is located at the northern end of the McDermitt Caldera, approximately 35km north of the Thacker Pass deposit, owned by Lithium Americas (TSX: LAC). The Thacker Pass Project (Measured, Indicated and Inferred resources of 19.1Mt LCE4) is fully permitted and currently under construction5.

On 3 October 2023 Lithium Americas announced the separation of its Argentinian assets as Lithium Americas Argentina (TSX: LAAC) and the execution of a second tranche subscription agreement with General Motors (NYSE: GM) whereby GM will purchase US$330M in LAC shares, taking GM’s total investment in LAC to US$650M6. GM is now LAC’s largest shareholder with 9.4% of issued capital and has an agreement with LAC to acquire 100% of lithium carbonate from Phase 1 production (40,000 tpa LCE) at Thacker Pass4. At the close of trading on TSX on 6 October 2023, Lithium Americas had a market capitalisation of C$2.51B (A$2.87B).

Jindalee is very encouraged by recent progress at the Thacker Pass Project, which has positive implications for the potential development of McDermitt.

Click here for the full ASX Release

This article includes content from Jindalee Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

JRL:AU

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00