Japan Gold Corp. (TSXV: JG) (OTCQB: JGLDF) ("Japan Gold" or the "Company") is pleased to announce results from eight additional scout drill holes at the Ryuo Prospect. Drilling has continued to encounter high-grade vein intersections along an 800 m open ended strike zone, following the success of three initial scout drill holes reported in September 2021 (see Japan Gold news release September 14, 2021). The Ikutahara Project in Hokkaido, which contains the Ryuo Prospect, is 100% held by Japan Gold and is not included in the Barrick Alliance (Figure 1).

Highlights: Drill holes IKDD21-004 to IKDD21-011 all successfully intersected gold-mineralized vein structures including the following notable results (all intervals are down-hole lengths):

- IKDD21-010 at the Jinja vein established a significant increase in width and grade 40 m below the previously reported high-grade IKDD21-001 intersection with:

20.00 m @ 6.3 g/t Au & 15.7 g/t Ag from 74.05 m

(incl. 5.10 m @ 15.2 g/t Au & 13.1 g/t Ag from 79.75 m)

(incl. 0.65 m @ 92.0 g/t Au & 64.3 g/t Ag from 82.85 m)

(and 1.15 m @ 9.4 g/t Au & 19.3 g/t Ag from 90.65 m)

- IKDD21-008 and 007 located 500 m and 750 m, respectively, along strike of the Jinja vein intersected high-grade veins along the footwall of a silicified hydrothermal breccia-body interpreted to represent the upper levels of a deeper epithermal vein system, with:

(IKDD21-008) 0.45 m @ 1,395 g/t Au & 768.0 g/t Ag from 254.15 m

(IKDD21-007) 1.00 m @ 30.0 g/t Au & 284.0 g/t Ag from 233.30 m

John Proust, Chairman & CEO commented, "It is very promising that we are encountering significant grade and width of gold mineralization from the results of the 2021 drilling at the Ryuo Prospect. This supports Japan Gold's thesis that there is the potential to discover new high grade gold deposits in Japan. With our 2022 drill program scheduled to start in March, we look forward to updating our shareholders on further drill results from the Ryuo, Saroma and East Kitano-o prospects."

Ryuo Prospect

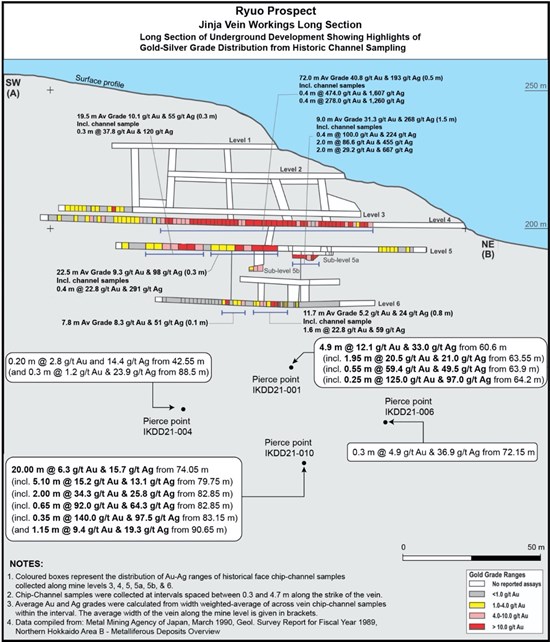

The Ryuo Prospect consists of five areas of workings; Jinja, Shouei, Taisei, Ryuei and Buryu that were developed along a 1.2 km long, open ended trend of alteration and mineralization prior to the government-imposed closure in 1943 (Figure 2). Historical underground sampling in the Jinja vein workings revealed high-grade gold-silver mineralization including 'level 4' of the workings, which was sampled along a 72 m strike length giving an average grade of 40.8 g/t Au and 193 g/t Ag, with an average vein width approximately 0.5 m. Figure 3 illustrates a long-section of the Jinja vein workings with the underground sampling reported by the Metal Mining Agency of Japan (MMAJ)1.

Summary of Drilling Results at Ryuo and the Implications for Ongoing Exploration:

Drilling at the Ryuo Prospect recommenced in September 2021, following the three previously reported 2021 scout drill holes. Additional drilling comprised step-outs from the Jinja vein high-grade intersection in drill hole IKDD21-001 of 4.90 m @ 12.1 g/t Au & 33.0 g/t Ag, and along the 1.2 km corridor of historical workings and alteration that define the prospect. Eight diamond drill holes were completed, IKDD21-004 - 011 for 2,379.6 m.

Jinja Vein

Three new drill holes at the Jinja vein were oriented to step-out approximately 50 m, both laterally and down-dip from the high-grade intercept from IKDD21-001 (Figure 2). Figure 3 illustrates a long-section of the Jinja vein workings with the IKDD21-001, 004, 006, & 010 vein pierce-points.

IKDD21-010 intersected the Jinja vein 40 m down-dip of the IKDD21-001 intersection, and gave a downhole mineralized interval of 20.0 m @ 6.3 g/t Au & 15.7 g/t Ag which included a number of high-grade intervals, up to 140 g/t Au (See Figures 2, 3, 4, 7 and Table 1).

This intercept represents a dramatic increase in width and grade of the vein structure to depth. Very fine-grained colloform-crustiform and ginguro banded vein textures indicate the drill hole has intersected the upper portion of the vein zone and that high-grade mineralization should continue to depth.

Drilling will recommence in March 2022 to test and expand the deeper and lateral extensions of the Jinja vein shoot.

Ryuei and Buryu Veins

The Ryuei and Buryu vein targets are located between 500 m and 800 m to the southwest along strike of the mineralized structure hosting the Jinja vein. Historical workings exploited veins hosted in silicified hydrothermal breccias at Ryuei and Buryu, and drill holes IKDD21-008 and IKDD21-007 were located to test at depth below these workings (Figure 2).

Drillhole IKDD21-003 (previously reported) intersected a mineralized interval of 2.12 m @ 6.3 g/t Au & 12.6 g/t Ag from chalcedonic quartz veins hosted in a wide (>100 m downhole length) hydrothermal breccia.

IKDD21-008 was drilled from the same pad as IKDD21-003 at a steeper angle, targeting the depth extension and potentially better developed veins within the throat of the hydrothermal breccia. The drillhole intersected silicified hydrothermal breccia hosting banded quartz veinlets between 100 and 250 m downhole. Immediately below the lower contact of the breccia a 0.45 m wide quartz-sulphide vein gave an ultra high-grade assay of 0.45m @ 1,395.0 g/t Au & 768.0 g/t Ag from 254.15 m (Figures 2 & 5).

IKDD21-007 located a further 250 m along strike to the southwest of IKDD-008 drilled the same silicified hydrothermal breccia body encountering numerous veinlets along its length with a peak result of 1.00 m @ 30.0 g/t Au & 284.0 g/t Ag from 233.30 m downhole (Figure 2 & 6).

Laterally extensive silicified hydrothermal breccias are mapped along the axis of the 1.2 km long, open ended Ryuo alteration corridor. Such hydrothermal 'eruption' or 'vent' breccias are typical paleosurface manifestations of epithermal vein systems. The presence of extensive silicification, abundant mineralized quartz veinlets, strongly anomalous pathfinder elements including antimony, and the tapered vertical geometry of the breccia indicate strong vectors to epithermal-vein development at depth along the length of the prospect. Drilling at Ryuei and Buryu has yet to test the same elevations as the vein zone intersected in IKDD21-010 at Jinja. The 2022 drilling will target this structure at similar and deeper elevations across the Ryuo prospect.

Shouei Vein Zone

IKDD21-009 targeted the Shouei vein workings to the east of the Jinja vein but failed to intersect any significant veining beneath the workings. The drill hole was allowed to continue and encountered a broad and locally intense quartz-vein stockwork breccia zone between 260 and 289 m (Figures 2 & 3). This broad vein zone is anomalous in gold and silver along its length albeit at low levels, and hosts an included interval of 3.60 m @ 3.0 g/t Au & 22.3 g/t Ag from 360.40 m (Figure 2, 3 & Table 1).

This broad interval of veining represents a previously unknown, blind vein zone. Ongoing drilling will test this wide vein structure at shallower elevations for better developed gold grades.

"The Ryuo results have been extremely encouraging and have advanced our understanding of the geology and the development of a mineralization model for the prospect. This model is now driving the targeting of the next round of drill holes planned to commence in March. In addition, what we learn at Ryuo will help focus ongoing exploration efforts on the numerous other prospects within the Company's large Kitami Region portfolio", commented Andrew Rowe, Vice President of Exploration.

Table 1: Significant Mineralized Intercepts for IKDD21-004 to IKDD21-011

To view an enhanced version of Table 1, please visit:

https://orders.newsfilecorp.com/files/5665/114422_b0e51f23e4463a07_001full.jpg

Table 2: Ryuo Prospect Drill Hole Data

To view an enhanced version of Table 2, please visit:

https://orders.newsfilecorp.com/files/5665/114422_b0e51f23e4463a07_002full.jpg

Ikutahara Project 2022 Fieldwork Program

Drilling will resume at the Ryuo prospect in March with 8 additional drill holes.

Soil samples collected in 2021 at Ryuo have provided new anomalous zones for follow up and the Ryuo soil grid will be expanded along anomalous extensions.

BLEG sampling of drainages in the Ikutahara applications that lie to the south of Ryuo prospect will cover prospective geology between Ryuo and the historical Setose gold mine (Figure 1).

Drill programs for the Saroma and East Kitano-o prospects are in the final stages of permitting and are expected to start in May.

Surface geochemical and geophysical programs are planned for the North Kitano-o and Showa-Ikutahara prospects.

Reference

1Metal Mining Agency of Japan, March 1990, Geological Survey Report for Fiscal Year 1989, Northern Hokkaido Area B-Metalliferous Deposits Overview.

On behalf of the Board of Japan Gold Corp.

"John Proust"

Chairman & CEO

Qualified Person

The technical information in this news release has been reviewed and approved by Japan Gold Vice President of Exploration and Country Manager, Andrew Rowe, BAppSc, FAusIMM, FSEG, who is a Qualified Person as defined by National Instrument 43-101.

Note: The Company's compilation of underground sampling data at Ryuo has been based on data published by the MMAJ and the Company has not resampled the underground workings or re-assayed samples. The MMAJ report does not refer to QA/QC protocols followed historically.

Sampling Techniques and Assaying

The drilling results discussed in this news release are from drill core samples obtained by PQ, HQ and NQ-size triple-tube diamond core drilling using a PMC700 and PMC-400 man-portable drill rigs owned and operated by the Company. The drilling program was fully supervised by Company senior geologists at the drilling site.

Drill core was collected in plastic core-trays at the drill site and transported by road in Company vehicles to its core shed storage facility in the nearby Ikutahara Village, located centrally within the project area. The drill core was carefully logged, photographed and sample intervals marked-up along predicted mineralized and selected unmineralized intervals by Japan Gold KK senior project geologists and VP Exploration.

Sample lengths varied from 0.15 to 1.0 m; depending on the positions of geological contacts and variations in vein texture and composition. The core was split by diamond rock saw supervised by project geologists. Half-core sample was collected from the entire length of each designated sample interval and placed into individual-labelled, self-sealing calico bags for secure packaging and transport to the laboratory. The half-core samples weighed between 0.25 to 5 kg depending on the sample length and core size. A Chain-of-Custody was established between the Company and receiving laboratory to ensure the integrity of the samples during transportation from site to the lab. The samples were sent in batches to ALS Laboratories in Vancouver, Canada for sample preparation and assaying.

Samples were crushed, pulverised and assayed for gold 50 g charge Fire Assay/ AAS Finish (Au-AA24; 0.005 ppm lower detection limit) and a 48 multi-element by 4-acid digest with ICP-MS determination (ME-MS61L; Ag 0.002 ppm lower detection limit). Over-limit Au and Ag samples were re-assayed by fire-assay and gravimetric finish (GRA-22, LDL of 0.5 and 5 ppm for Au and Ag respectively).

Certified Reference Materials (CRMs) were inserted by Japan Gold KK at every 20th sample to assess repeatability and assaying precision of the laboratory. In addition, the laboratory applied its own internal Quality Control procedure that includes sample duplicates, blanks & geochemical standards. They report these results with the certified Assay Report. Laboratory procedures and QAQC protocols adopted are considered appropriate. The CRMs and internal QC-QA results fall within acceptable levels of accuracy & precision and are considered to lack any bias.

About Japan Gold Corp.

Japan Gold Corp. is a Canadian mineral exploration company focused solely on gold exploration across the three largest islands of Japan: Hokkaido, Honshu and Kyushu. The Company has a country-wide alliance with Barrick Gold Corporation to jointly explore, develop and mine certain gold mineral properties and mining projects. The Company holds a portfolio of 31 gold projects which cover areas with known gold occurrences, a history of mining and are prospective for high-grade epithermal gold mineralization. Japan Gold's leadership team represent decades of resource industry and business experience, and the Company has an operational team of geologists, drillers and technical advisors with experience exploring and operating in Japan. More information is available at www.japangold.com or by email at info@japangold.com

For further information please contact:

John Proust

Chairman & CEO

Phone: 778-725-1491

Email: jproust@japangold.com

Website: www.japangold.com

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release contains forward-looking statements relating to expected or anticipated future events and anticipated results related to future partnerships and the Company's 2021 and 2022 gold exploration program. These statements are forward-looking in nature and, as a result, are subject to certain risks and uncertainties that include, but are not limited to, general economic, market and business conditions; competition for qualified staff; the regulatory process and actions; technical issues; new legislation; potential delays or changes in plans; working in a new political jurisdiction; results of exploration; the timing and granting of prospecting rights; the Company's ability to execute and implement future plans, arrange or conclude a joint-venture or partnership; and the occurrence of unexpected events. Actual results achieved may differ from the information provided herein and, consequently, readers are advised not to place undue reliance on forward-looking information. The forward-looking information contained herein speaks only as of the date of this News Release. The Company disclaims any intention or obligation to update or revise forward‐looking information or to explain any material difference between such and subsequent actual events, except as required by applicable laws.

Figure 1: Ikutahara Project, simplified geology and historical mines and workings.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/5665/114422_b0e51f23e4463a07_003full.jpg

Figure 2: Ryuo Prospect, alteration map with all significant drill intersections to date.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/5665/114422_b0e51f23e4463a07_004full.jpg

Figure 3: Jinja Vein workings long-section with composited back sample intervals from historical sampling data, and significant drill intersections to date.

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/5665/114422_b0e51f23e4463a07_005full.jpg

Figure 4: Interpreted cross-section through the Jinja and Shouei vein zones (IKDD21-001, 009, & 010).

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/5665/114422_b0e51f23e4463a07_006full.jpg

Figure 5: Interpreted cross section through the Ryuei vein zone (IKDD21-003 & 008).

To view an enhanced version of Figure 5, please visit:

https://orders.newsfilecorp.com/files/5665/114422_b0e51f23e4463a07_007full.jpg

Figure 6: Interpreted cross section through the Buryu vein zone (IKDD21-007).

To view an enhanced version of Figure 6, please visit:

https://orders.newsfilecorp.com/files/5665/114422_b0e51f23e4463a07_008full.jpg

Figure 7: IKDD21-010 Jinja vein zone with mineralized sample intervals and assay values in g/t for gold (Au) and silver (Ag) (79.40 - 94.95 m).

To view an enhanced version of Figure 7, please visit:

https://orders.newsfilecorp.com/files/5665/114422_b0e51f23e4463a07_009full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/114422