February 02, 2023

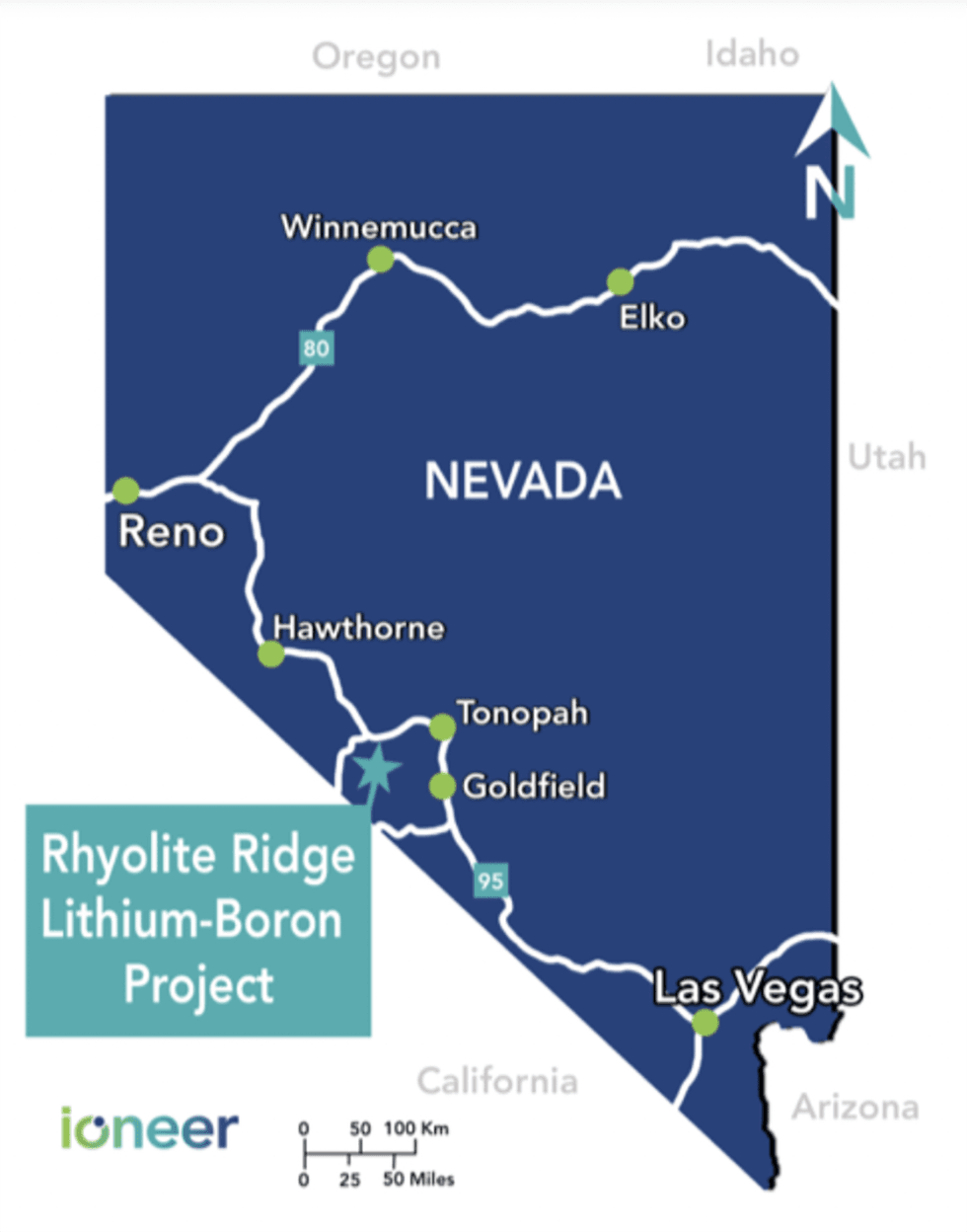

Ioneer Ltd. (ASX:INR, Nasdaq: IONR), Nasdaq: IONR), Nasdaq: IONR) aims to develop a source of both lithium and boron for the US domestic supply chain. The company owns 100 percent of the only lithium-boron deposit in North America and one of two known lithium-boron deposits globally. Its flagship asset, the Nevada Rhyolite Ridge Lithium-Boron Project, is the most advanced lithium development project in the United States and has the potential for future low-cost production. An experienced management team with expertise throughout the natural resources industry leads Ioneer towards its goals.

The Rhyolite Ridge Project is unique both within North America and globally due to its lithium-boron deposits. Both elements are necessary for decarbonisation, making the asset ideal for supporting the United States’ goals of achieving net-zero emissions by 2050. A 2020 definitive feasibility study (DFS) confirmed the project is a world-class lithium and boron asset with a long mine life and strong economics.

Ioneer has entered into a joint venture agreement with Sibanye Stillwater Ltd (Sibanye-Stillwater) (NYSE:SBSW) to advance the Rhyolite Ridge project once a final investment decision is made. Ioneer will remain the operator of the asset, and the new partner will contribute US$490 million in exchange for a 50 percent interest in a joint venture to support the development of the Rhyolite Ridge Project.

Company Highlights

- Ioneer Ltd is an exploration and development mining company with a 100-percent-owned advanced-stage lithium-boron asset in the United States.

- The company’s goal is to reach production and become an important source for the domestic US supply chain with lithium and boron, elements necessary for decarbonisation.

- Rhyolite Ridge, the company’s flagship lithium-boron asset, is the only deposit of its kind in North America and is one of two known lithium-boron deposits globally.

- A definitive feasibility study (DFS) indicates the asset has the potential to become a world-class project with a long mining life and strong economics.

- The DFS forecasts that the Rhyolite Ridge asset can produce batteries necessary for nearly 400,000 EVs per year.

- Ioneer has entered into binding lithium offtake agreements with automotive and electronics manufacturers, securing a future revenue stream once the project reaches production.

- The company has entered into a joint venture agreement with Sibanye-Stillwater to contribute US$490 million in exchange for a 50 percent interest in the project.

- With a term sheet finalised, the U.S. Department of Energy has offered a conditional commitment for a loan of up to US$700 million to develop the Rhyolite Ridge Project

- With debt and equity commitments of nearly US$1.2 billion, Ioneer is primed to commence construction upon final permitting and well positioned to become a cornerstone supplier of lithium to the domestic US EV battery supply chain.

- An experienced management team with expertise throughout the mining industry, including lithium and boron, guide the company towards its mission of supporting the domestic U.S. supply chain.

This Awakn ioneer Ltd. profile is part of a paid investor education campaign.*

Click here to connect with Ioneer Ltd. (ASX:INR, Nasdaq: IONR) to receive an Investor Presentation

INR:AU

The Conversation (0)

16 August 2023

Ioneer Ltd.

Developing a Rare North American Lithium-Boron Deposit Crucial to Clean Technology

Developing a Rare North American Lithium-Boron Deposit Crucial to Clean Technology Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00