March 19, 2025

Inca Minerals (ASX:ICG) is an Australian exploration company focused on uncovering high-grade gold and gold-antimony mineralization. The company recently acquired Stunalara Metals, a transformational deal that enhances its exploration assets.

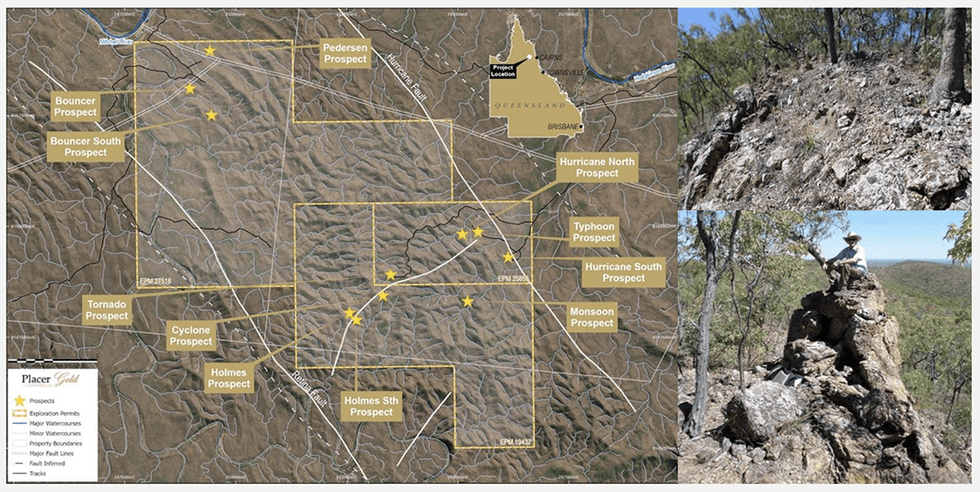

Inca Minerals' flagship Hurricane Project in Northern Queensland presents exceptional exploration potential, benefiting from a highly prospective geological setting. With record gold prices and rising demand for critical minerals, Inca is strategically positioned to seize this growing market opportunity.

Gold and antimony prospects at the Hurricane project

Gold and antimony prospects at the Hurricane projectInca Minerals is committed to advancing its flagship Hurricane Project through a high-impact exploration strategy. The company plans to launch a shallow drilling program in Q2 2025, targeting high-priority gold-antimony mineralization identified through rock chip sampling and structural mapping.

Company Highlights

- The flagship Hurricane project in Northern Queensland features exceptional gold and antimony grades, with assays returning up to 81.5 g/t gold and 35.1 percent antimony. Despite its strong potential, the project remains undrilled, offering a first-mover advantage in an underexplored high-grade system.

- A shallow, cost-effective drilling campaign in Q2 2025 aims to define a maiden gold-antimony resource at Hurricane, with the potential to deliver rapid upside for shareholders.

- Inca Minerals’ acquisition of Stunalara Metals significantly expands its footprint across Queensland, Tasmania and Western Australia, strengthening its exposure to high-value gold and critical minerals like antimony.

- With China restricting antimony exports and global supply tightening, Inca is well-positioned to benefit from rising demand across the energy storage, defense and high-tech sectors.

- Northern Queensland has seen limited modern exploration compared to Western Australia. Inca is leveraging advanced techniques to uncover new high-grade gold-antimony systems.

- Led by an experienced team with a track record of discovery success, Inca maintains a disciplined capital allocation strategy to maximize shareholder value

This Inca Minerals profile is part of a paid investor education campaign.*

Click here to connect with Inca Minerals (ASX:ICG) to receive an Investor Presentation

ICG:AU

The Conversation (0)

18 March 2025

Inca Minerals

Advancing high-grade gold-antimony project in Northern Queensland

Advancing high-grade gold-antimony project in Northern Queensland Keep Reading...

29 April 2025

March Quarterly Activities and Cash Flow Reports

Inca Minerals (ICG:AU) has announced March Quarterly Activities and Cash Flow ReportsDownload the PDF here. Keep Reading...

07 April 2025

Compulsory Acquisition Notice

Inca Minerals (ICG:AU) has announced Compulsory Acquisition NoticeDownload the PDF here. Keep Reading...

03 April 2025

Close of Takeover Offer

Inca Minerals (ICG:AU) has announced Close of Takeover OfferDownload the PDF here. Keep Reading...

31 March 2025

Inca to Raise $1.1M

Inca Minerals (ICG:AU) has announced Inca to Raise $1.1MDownload the PDF here. Keep Reading...

27 March 2025

Trading Halt

Inca Minerals (ICG:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

4h

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

7h

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00