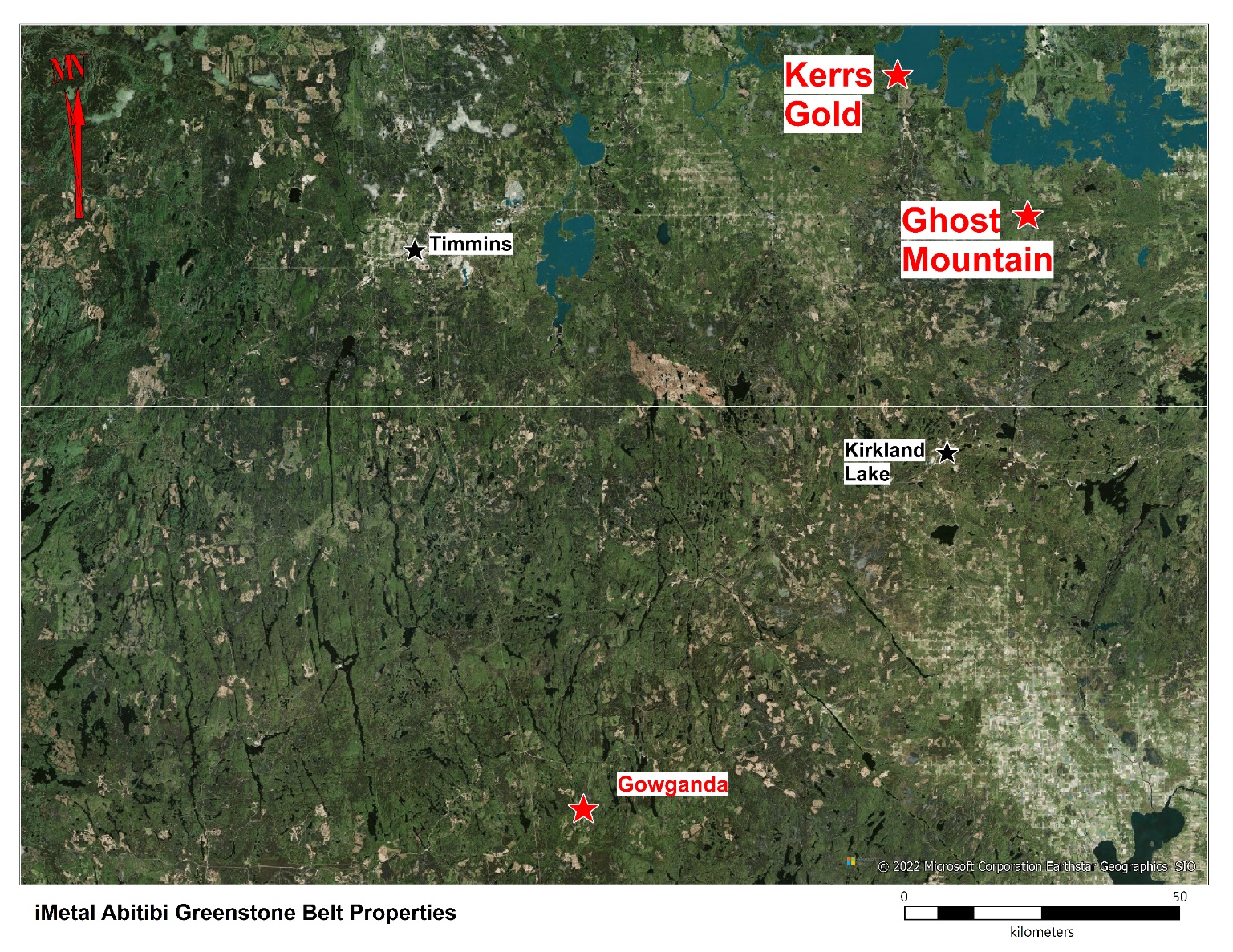

iMetal Resources Inc. (TSXV:IMR)(OTC PINK:ADTFF)(FRANKFURT:A7V2) ("iMetal" or the "Company") is pleased to announce the completion of a drone magnetics survey at its 220-hectare Ghost Mountain property, located 42 kilometres northeast of Kirkland Lake, Ontario, in the Abitibi Greenstone Gold Belt

"The recent successes at Agnico Eagle's Holt and Holloway Mine, 5 kilometres east of the Ghost Mountain property necessitates a closer look at Ghost Mountain. The Drone mag survey was the first step generating exploration targets. Upon receipt of the final report from Abitibi Geophysics, we will dispatch field crews to ground truth anomalies and prospect the ground for gold mineralization targets," commented iMetal President & CEO Saf Dhillon.

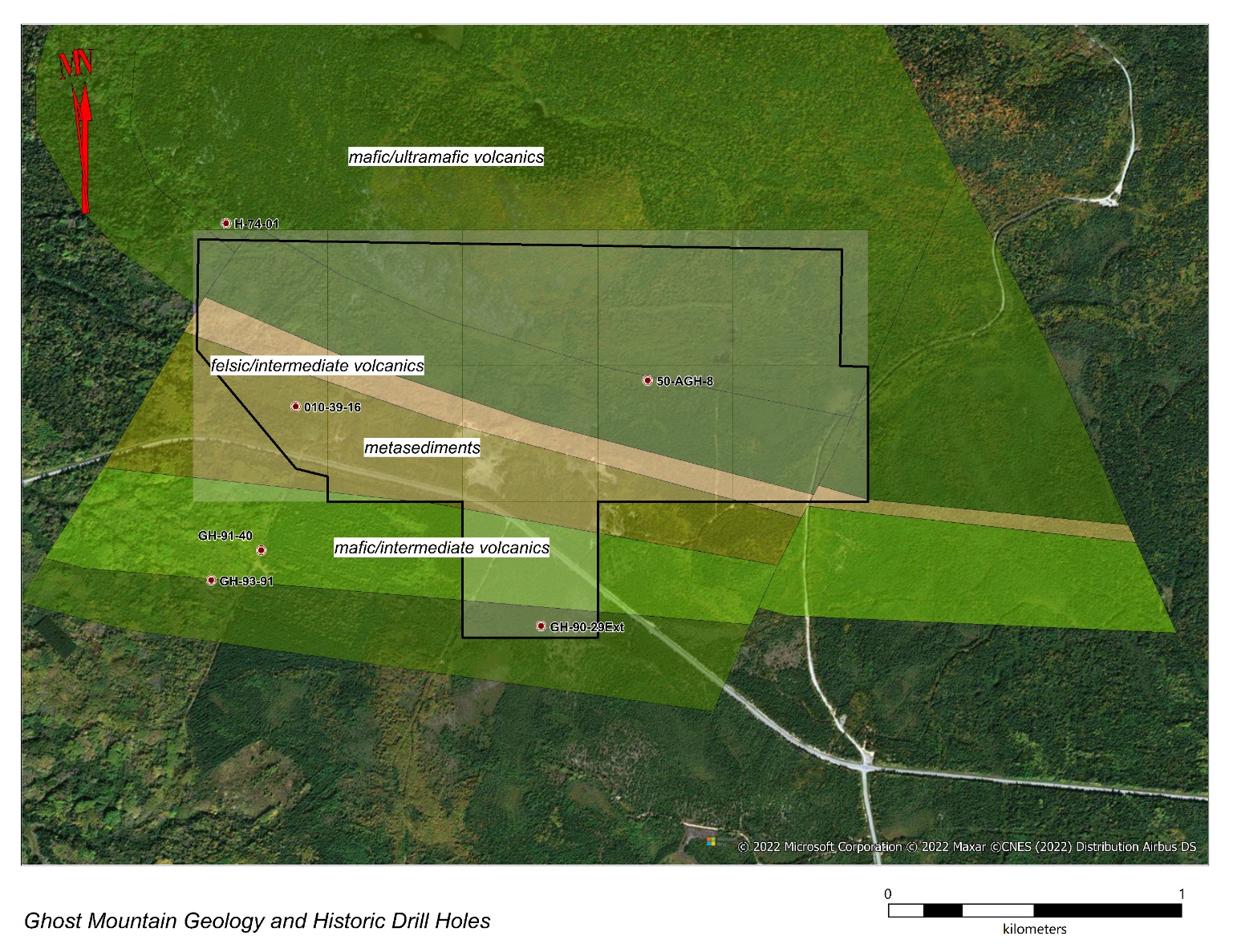

Ghost Mountain has a long, sporadic exploration history going back to the 1950's. Originally, the ground around Ghost Mountain was prospected and drilled for asbestos, with one hole completed on the current claim block. The hole appears to have been drilled perpendicular to stratigraphy, intersecting peridotite from bedrock to full depth at 695ft (211.8m). The next drilling took place in 1974, with one hole drilled within the claim block. Intermediate volcanics, rhyolite, graphitic tuff and andesite were interested, with several areas of quartz veins and sulfides noted. A further drill hole was completed in 1983, in the opposite direction to the 1974 hole, intersecting metasediments and andesites, with local areas of quartz veins and sulfides. One hole was drilled south of the claim block in 1991, with the last 75 metres underlying the current claim block, intersecting mafic and ultramafic volcanics. The ultramafic carried ankerite, sericite and fuchsite, with fracture filling pyrite. The final historic drilling was completed in 1993, with one hole lying within the current property. This hole was an extension of an earlier hole, intersecting mafic to ultramafic volcanics with strong to pervasive ankerite and local sericite and fuchsite. There were no assays filed with any of the drill logs.

The drone magnetic survey was undertaken to highlight geophysical anomalies that may be related to structural zones or corridors which may have acted as conduits and/or hosts for precious metal mineralization. While assay results from the historic drilling are not available, areas of intense alteration, quartz veining and sulfides were noted in the drill logs, supporting the potential of the Ghost Mountain property.

The scientific and technical information contained in this news release has been reviewed and approved by R. Tim Henneberry, P.Geo (British Columbia), a director of iMetal and a qualified person as defined in National Instrument 43-101.

About iMetal Resources Inc.

A Canadian based junior exploration company focused on the exploration and development of its portfolio of resource properties in Ontario and Quebec. iMetal is focused on advancing its Gowganda West Project that borders the Juby Project, an advanced exploration-stage gold project located within the Shining Tree Camp area in the southern part of the Abitibi Greenstone Gold Belt about 100 km south-southeast of the Timmins Gold Camp.

ON BEHALF OF THE BOARD OF DIRECTORS,

Saf Dhillon

President & CEO

iMetal Resources Inc.

info@imetalresources.ca

Tel. (604-484-3031)

Suite 550, 800 West Pender Street, Vancouver, British Columbia, V6C 2V6.

https://imetalresources.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may include forward-looking statements that are subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward looking. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include results of exploration, variations in results of mineralization, relationships with local communities, market prices, continued availability of capital and financing, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements except as required under the applicable laws.

SOURCE: iMetal Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/706021/iMetal-Completes-Drone-Mag-at-Ghost-Mountain-in-Ontarios-Prolific-Abitibi-Greenstone-Gold-Belt