June 07, 2023

Iceni Gold Limited (ASX: ICL) (Iceni or the Company) is pleased to provide a further exploration update on the Everleigh Well Target Area.

Highlights

- A number of very high-grade rock chip assay results have returned from the outcropping gold bearing vein in the Christmas Gift UFF+ anomaly 14UF010B at Everleigh Well, these include:

- 18,207g/t Au 18,179g/t Au 16,776g/t Au 16,659g/t Au 14,780g/t Au

- The high-grade vein is located within a cluster of gold prospectivity indicators and is hosted by altered sediments with boxworks after sulphides.

- Fieldwork is ongoing to track the extent of this vein along strike.

- The Everleigh target area will be prepared for future exploration drilling.

Technical Director David Nixon commented:

“Assay results from the discovery of the second outcropping quartz vein with visible gold in the Everleigh target

area are exciting, as they back up the initial field observations that reported visible gold in outcrop.

The high-grade rock chip results from the vein are supported by the underlying UFF+ soil anomaly, prospectivity indicators (including gold nuggets, workings and anomalous geochemical assays) and the multiple coincident targets generated by existing exploration work.

The Everleigh Well target area continues to deliver in-situ gold bearing rock chips and significant numbers of various sized gold nuggets, where a number of key targets will be prepared for future exploration drilling”.

Christmas Gift

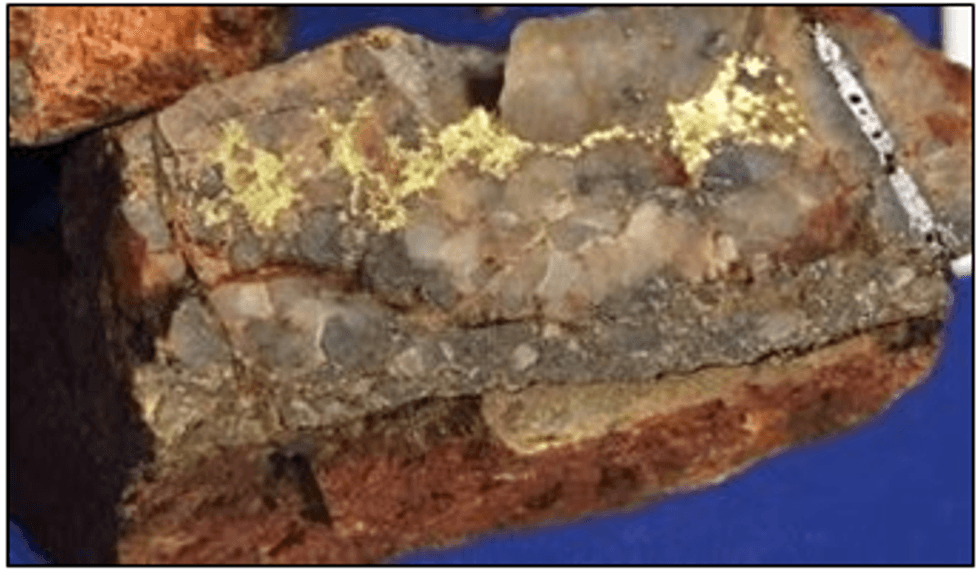

A second high-grade vein has been discovered at Everleigh within the 14UF010B target. The quartz vein was outcropping and contained abundant visible gold associated with boxworks after sulphides. The vein is associated with a cluster of historic workings and scrapings. Gold assays from this high-grade vein are summarised in Table 1, the peak assay returned 18,207g/t Au.

Prospecting activity has also recovered gold nuggets across the Everleigh Well target area. The nuggets found near the vein are angular and show little or no signs of transport. The presence of significant numbers of gold nuggets at surface supports the UFF+, rock chip and drilling results within these prospects.

The Christmas Gift target at Everleigh Well is a multi-element UFF anomaly (14UF010B), coincident with targets E1 (geological), EW01 (geophysical) and SY43 (syenite target).

Fieldwork is ongoing tracking this second high-grade vein along strike in preparation for future exploration drilling.

Click here for the full ASX Release

This article includes content from Iceni Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ICL:AU

The Conversation (0)

1h

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

12h

Canadian Investment Regulatory Organization Trade Resumption - IMR

Trading resumes in: Company: iMetal Resources Inc. TSX-Venture Symbol: IMR All Issues: Yes Resumption (ET): 10:30 AM CIRO can make a decision to impose a temporary suspension (halt) of trading in a security of a publicly-listed company. Trading halts are implemented to ensure a fair and orderly... Keep Reading...

12h

iMetal Resources Intersects 16.65 Metres at 1.24 g/t Gold Within 62.25 Metres at 0.61 g/t Gold at Gowganda West

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company") has intersected 16.65 metres at 1.25 gt gold within 62.25 metres at 0.61 gt gold at its Gowganda West Gold Project, southwest of Timmins, Ontario. Drilling in the West Zone intersected broad levels... Keep Reading...

25 February

Precious Metals Price Update: Gold, Silver, PGMs Boosted by Geopolitical and Trade Tensions

Precious metals are recovering their safe-haven demand appeal this week.Gold, silver and platinum are up this week, all still down from the all-time highs recorded in January. Escalating geopolitical tensions and US trade policy shifts are once again at center stage in this sector of the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00