News Release Highlights:

- Homerun has now secured ownership and supply agreements covering the entire Santa Maria Eterna Silica Sand District.

- The new Pedreiras concession is fully permitted with a low royalty rate of R$ 30.17 per extracted tonne.

- The Pedreiras concessions have been drilled to a depth of 8 metres with a 32 million tonne resource filed at the Agência Nacional de Mineração (ANM).

- The Company's target resource under the three CBPM Lease acquisitions now exceeds 200 million tonnes.

Homerun Resources Inc. (TSXV: HMR,OTC:HMRFF) (OTCQB: HMRFF) ("Homerun" or the "Company") is pleased to announce it has signed a binding Letter of Intent (LOI) with Pedreiras do Brasil S.A. ("Pedreiras") a company controlled by Vitoria Stone, dated September 10, 2025, securing the rights to exploit the Pedreiras mining tenement (871.7212021, 246.36 hectares) at the Santa Maria Eterna Silica Sand District in the municipality of Belmonte, Bahia, Brazil, granted under a lease agreement with Companhia Bahiana de Pesquisa Mineral (CBPM).

This LOI enables Homerun to acquire all exploitation rights and obligations currently held by Pedreiras under the CBPM Lease, on a measured resource of 32 million tonnes (auger drilled to 8 metres) filed at the ANM and is fully permitted with a royalty payment to CBPM of R$30.17 per extracted tonne. (the "Acquisition").

This is now the third CBPM lease acquisition by Homerun marking a significant step in the continuing strategic plan to consolidate control over the Santa Maria Eterna Silica Sand District. By controlling the district, Homerun secures uninterrupted access to a unique large-tonnage high-purity silica sand district, solidifying supply chains, enabling a competitive advantage in vertical integration, achieving pricing power and removing market competition. It also strengthens Homerun's position when seeking funding or strategic partners as the Company can offer certainty of secure long-life supply and scale. The Company's target resource over the areas of the three acquisitions now exceeds 200 million tonnes, including a current NI 43-101 mineral resource estimate of 63 million tonnes. This strategic consolidation has been achieved for total capital outlay of US$2.1 million, a fraction of the implied value based on the US$150 per tonne transfer price for the planned primary use-case in the Company's Solar Glass Manufacturing facility which is being built next to these resources.

Brian Leeners, CEO of Homerun stated, "This marks a major milestone for Homerun. With district control we are positioned to unlock the full potential of Santa Maria Eterna. Our team has delivered this consolidation with minimal capital, laying the foundation for significant value creation as we advance towards production. We want to thank our management team for this effort in strategically building significant asset value for Homerun and its shareholders."

The transaction will be settled with US$1,200,000 in Homerun common shares (valued at CA$1.00 per share) and US$200,000 in share purchase warrants (exercisable at CA$1.00 per share). The issuance of the Homerun common shares and warrants will be subject to standard director, shareholder and regulatory approvals and specifically the approval of the TSX Venture Exchange. The Homerun common shares issued under the terms of this agreement will be subject to a standard 4-Month statutory hold period. Pedreiras agrees to contact Homerun regarding the sale of any Homerun common shares and also agrees to limit the sale of the Homerun common shares in any given month to 100,000 if required to sell.

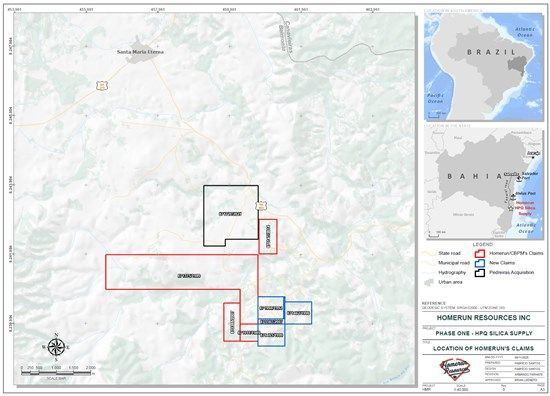

Figure 1: location of existing Homerun controlled claims via CBPM Lease Agreement (red and blue) and the new claims under the Pedreiras Agreement (in black).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4082/266168_b188dd55f4d37bab_001full.jpg

About Homerun (www.homerunresources.com)

Homerun (TSXV: HMR,OTC:HMRFF) is a vertically integrated materials leader revolutionizing green energy solutions through advanced silica technologies. As an emerging force outside of China for high-purity quartz (HPQ) silica innovation, the Company controls the full industrial vertical from raw material extraction to cutting-edge solar, battery and energy storage solutions. Our dual-engine vertical integration strategy combines:

Homerun Advanced Materials

- Utilizing Homerun's robust supply of high purity silica sand and quartz silica materials to facilitate domestic and international sales of processed silica through the development of a 120,000 tpy processing plant.

- Pioneering zero-waste thermoelectric purification and advanced materials processing technologies with University of California - Davis.

Homerun Energy Solutions

- Building Latin America's first dedicated high-efficiency, 365,000 tpy solar glass manufacturing facility and pioneering new solar technologies based on years of experience as an industry leader in developing photovoltaic technologies with a specialization in perovskite photovoltaics.

- European leader in the marketing, distribution and sales of alternative energy solutions into the commercial and industrial segments (B2B).

- Commercializing Artificial Intelligence (AI) Energy Management and Control System Solutions (hardware and software) for energy capture, energy storage and efficient energy use.

- Partnering with U.S. Dept. of Energy/NREL on the development of the Enduring long-duration energy storage system utilizing the Company's high-purity silica sand for industrial heat and electricity arbitrage and complementary silica purification.

With multiple profit centers built within the vertical strategy and all gaining economic advantage utilizing the Company's HPQ silica, across, solar, battery and energy storage solutions, Homerun is positioned to capitalize on high-growth global energy transition markets. The 3-phase development plan has achieved all key milestones in a timely manner, including government partnerships, scalable logistical market access, and breakthrough IP in advanced materials processing and energy solutions.

Homerun maintains an uncompromising commitment to ESG principles, deploying the cleanest and most sustainable production technologies across all operations while benefiting the people in the communities where the Company operates. As we advance revenue generation and vertical integration in 2025, the Company continues to deliver shareholder value through strategic execution within the unstoppable global energy transition.

On behalf of the Board of Directors of

Homerun Resources Inc.

"Brian Leeners"

Brian Leeners, CEO & Director

brianleeners@gmail.com / +1 604-862-4184 (WhatsApp)

Tyler Muir, Investor Relations

info@homerunresources.com / +1 306-690-8886 (WhatsApp)

FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements".

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/266168