January 29, 2026

Homeland Nickel (TSXV:SHL,OTC: SRCGF) is a Canada-based mineral exploration company targeting critical metals, with a strategic focus on nickel laterite projects in southern Oregon, USA. Recognized as a critical mineral by the US government, nickel underpins Homeland Nickel’s strategy as the company advances assets in what it views as the only US region with the scale and geology capable of supporting a significant domestic nickel supply.

The company has built a portfolio of nine nickel laterite projects originally identified during exploration programs carried out between the 1950s and 1970s. The deposits occur as near-surface laterite lenses formed through the weathering of ultramafic rocks, allowing for efficient surface sampling and auger drilling to quickly delineate mineral resources. This geological setting enables Homeland Nickel to advance multiple projects in parallel while maintaining a cost-effective exploration approach.

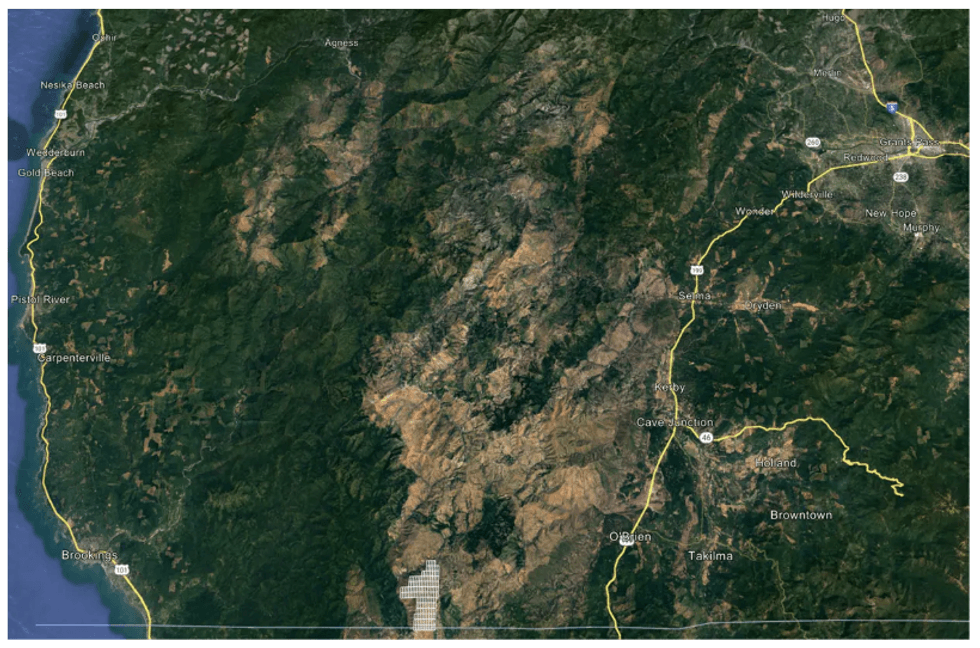

Location map of the Cleopatra Nickel property

Location map of the Cleopatra Nickel property

Alongside project consolidation and exploration, Homeland Nickel also holds a portfolio of mining equities in publicly listed companies. Management considers this portfolio a strategic asset that enhances financial flexibility and offers potential non-dilutive funding opportunities, supporting a disciplined capital allocation strategy as the company progresses its nickel assets through resource definition and technical evaluation.

Company Highlights

- Controls nine nickel laterite projects in Southern Oregon — Cleopatra, Red Flat, Eight Dollar Mountain, Woodcock Mountain, Josephine Creek, Iron Mountain, Peavine Mountain, Rough & Ready and Free & Easy — representing the most comprehensive consolidation of historically identified US nickel laterite occurrences

- Historic resources at Cleopatra (39.5 Mt @ 0.93 percent nickel) and Red Flat (18.8 Mt @ 0.84 percent nickel) provide an advanced starting point with significant expansion potential

- At-surface nickel laterite mineralization supports rapid, low-cost exploration and resource definition compared to underground nickel sulfide projects

- Strategic partnerships with Patriot Nickel (property option) and Brazilian Nickel (ore processing) support advancement toward development while limiting shareholder dilution

- Maintains a portfolio of publicly traded mining equities, providing financial flexibility and optionality to support exploration and development programs

This Homeland Nickel profile is part of a paid investor education campaign.*

Click here to connect with Homeland Nickel (TSXV:SHL) to receive an Investor Presentation

SHL:CC

The Conversation (0)

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00