(TheNewswire)

Ivanhoe Electric to continue Earn-In on the Ivory Coast projects

Highlights

-

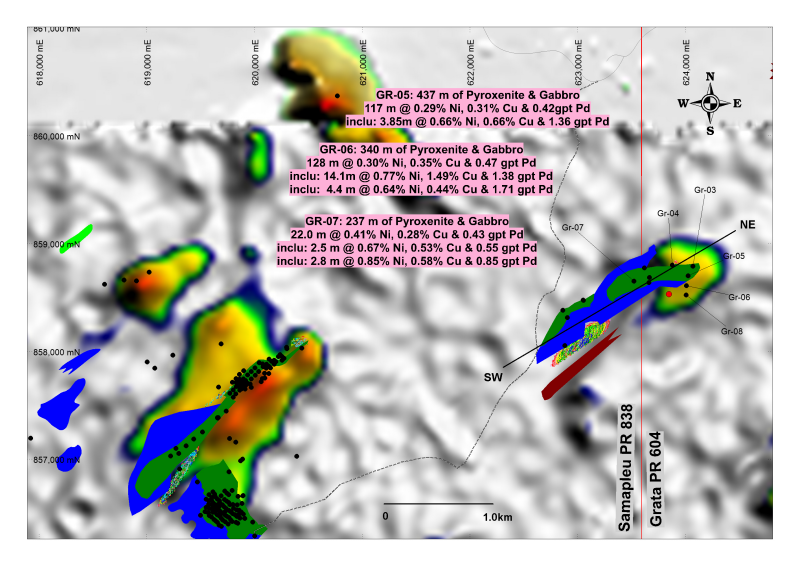

GR-05 returned 117m @ 0.29% Ni, 0.31% Cu 0.42 gpt Pd

-

GR-06 returned 128m @ 0.30% Ni, 0.35% Cu 0.47 gpt Pd including 14m @ 0.86% Ni, 1.49% Cu 1.38 gpt Pd (several lengths of massive and semi-massive sulphide)

-

GR-07 returned 22m @ 0.41% Ni, 0.28% Cu 0.43 gpt Pd

-

Results are pending for 13 holes drilled at Grata since January 2022.

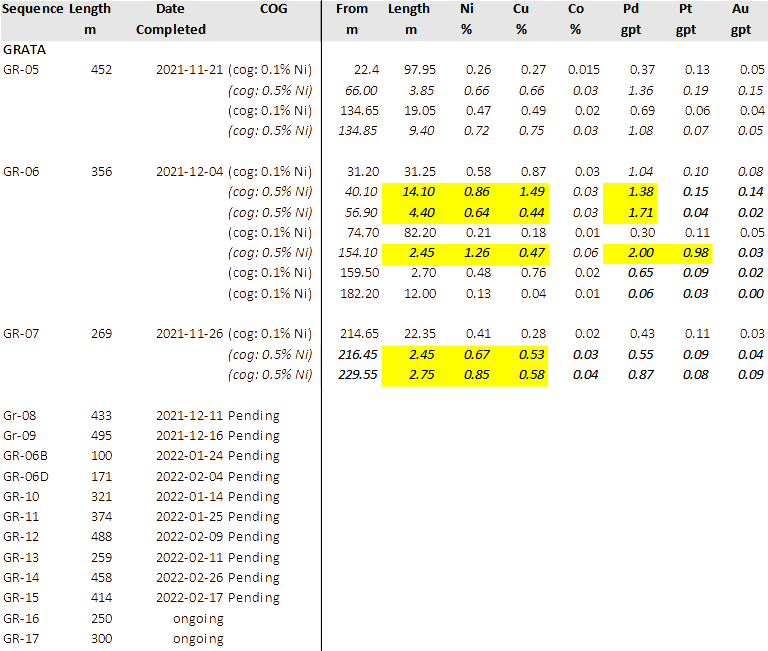

Montréal, Quebec – TheNewswire - March 15, 2022 – Sama Resources Inc. ("Sama" or the "Company") (TSXV:SME ) ( OTC:SAMMF) is pleased to announce drilling results from our 2021-22 drilling campaign at the newly discovered Grata Nickel (" Ni ") – Copper (" Cu ") – Palladium (" Pd ") prospect (" Grata "). As of this Press Release, Sama has drilled a total of 18 drill holes for 6,152 meters (" m ") as a follow-up on the discovery hole GR-03 (Press Release (" PR ") 02-09-2021). Assay results for holes GR-05, GR-06 and GR-07 are summarized in this PR and in Table 1. Although only two-thirds of assay results for GR-06 have been received, results include 14.10m at 0.86% Ni, 1.49% Cu and 1.38 grams per tonne (" gpt ") of palladium (" Pd ") within a larger interval of 128m at 0.30% Ni, 0.35% Cu & 0.47 gpt Pd.

" We are very pleased with the new Grata discovery. Grata has the potential to significantly enhance current Samapleu near-surface mineralisation. Together with our partner Ivanhoe Electric we are working hand in hand at unlocking the vast potential our Ivorian assets into a world-class district. We continue to advance the Ivorian assets in a meaningful way while maintaining our near-zero shareholder dilution mandate ." stated Dr. Marc-Antoine Audet, President & CEO of Sama Resources Inc.

Dr. Audet added: " We will continue exploring the Grata prospect for massive sulphide lenses and accumulations within this large feeder zone of the Yacouba ultramafic-mafic complex while pursuing other promising targets within the Samapleu-Yepleu exploration permits that remain totally un-explored to this date.

Table 1 summarizes results for the 2021-22 drilling campaign. Assays results for 13 holes drilled since January are pending. All measurements are core length and may not represent true geological length.

Grata: Latest discovery in the Yacouba Mafic-Ultramafic ("UM") Intrusive Complex

In September 2021, Sama announced the Grata discovery located 5 kilometers (" km ") east of the Samapleu deposit.

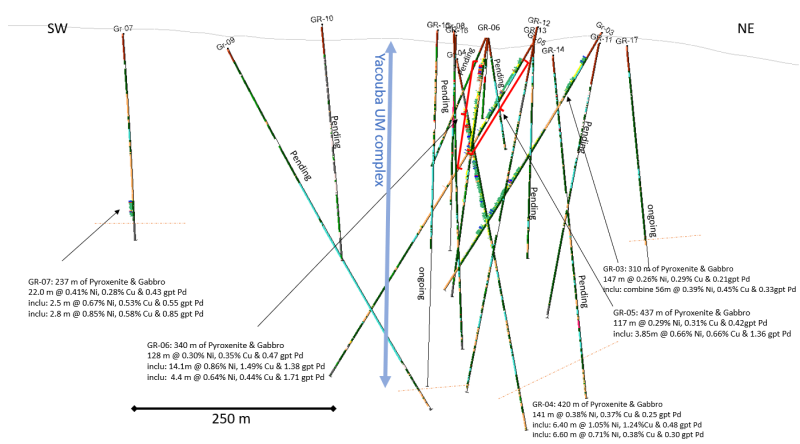

The discovery hole, GR-03, drilled in June 2021, returned a 310 m sequence of pyroxenite and gabbro containing a 147 m interval of disseminated sulfides and several intersections of semi-massive sulphide mineralization. The second hole GR-04 confirmed the width of the mineralized zone, with a 141 m mineralized intersection including 6.40 m and 6.60 m intervals grading 1.05% Ni, 1.28% Cu & 0.48 gpt Pd and 0.73% Ni, 0.38% Cu & 0.30 gpt Pd respectively.

The mineralization at Grata is similar in composition to the Samapleu deposit (" Samapleu ") but shows a larger proportion of chalcopyrite and therefore a higher Cu to Ni ratio. This relationship between Cu and Ni is particularly evident in the GR-06 mineralized zones ( Figure 3 ).

The Company is looking at increasing mineral resources at Samapleu and Grata for a future surface mining operation as well as searching for massive sulphide veins and lenses that could have accumulated at depth in traps and embayment's along the feeder system of the Yacouba UM Intrusive Complex.

Figure 1: Newly discovered zone at Grata is located 5 km east of Samapleu showing results for GR-05, -06 and -07.

Figure 2: Cross-section SW-NE at Grata showing results to date for the 2021-22 drilling campaign, Assay results for 13 holes are still pending. The GR-06 hole remained within the Yacouba UM complex for 340 m with mineralization ranging from disseminated to numerous intervals of massive to semi-massive N-Cu rich sulfide veins and stringers.

Table 1: Summary of 2021-22 drilling program at Grata (all intersections are in core lengths)

Co re logging and sampling was performed at Sama's Samapleu and Yepleu field facilities. Sample preparation was conducted at the Bureau Veritas Mineral Laboratory in Abidjan . Sample pulps were delivered to Activation Laboratories Ltd, Ancaster and Thunder Bay, Ontario, Canada, for assaying. All samples were assayed for Ni, Cu, Co, Pt, Pd, Au, Fe and S.

The technical information in this release has been reviewed and approved by Dr. Marc-Antoine Audet, Ph.D Geology, P.Geo and President and CEO of Sama, and a ‘qualified person', as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

ABOUT SAMA RESOURCES INC.

Sama is a Canadian-based mineral exploration and development company with projects in West Africa and now in Canada.

On March 19, 2021 Sama formalised a Joint Venture Agreement Ivanhoe Electric Inc, a private mineral exploration company in which mining entrepreneur Robert Friedland is a significant stakeholder, in order to develop its Ivorian Nickel-Copper and Cobalt project in Côte d'Ivoire, West-Africa. For more information about Sama, please visit Sama's website at https://www.samaresources.com .

ABOUT IVANHOE ELECTRIC INC.

Ivanhoe Electric Inc. is a privately-owned company focused on making technology-enabled metals discoveries for the electrification of everything. The Company deploys proprietary and disruptive technology that de-risks mineral and water discoveries. Ivanhoe Electric is focused on "electric metals" (copper, nickel, gold and silver) mining assets for the electric revolution. For further information, please visit www.ivanhoeelectric.com .

FOR FURTHER INFORMATION, PLEASE CONTACT:

SAMA RESOURCES INC./RESSOURCES SAMA INC.

Dr. Marc-Antoine Audet, President and CEO

Tel: (514) 726-4158

OR

Mr. Matt Johnston, Corporate Development Advisor

Tel: (604) 443-3835

Toll Free: 1 (877) 792-6688, Ext. 5

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain of the statements made and information contained herein are "forward-looking statements" or "forward-looking information" within the meaning of Canadian securities legislation. Forward-looking statements and forward-looking information such as "will", could", "expect", "estimate", "evidence", "potential", "appears", "seems", "suggest", are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements or forward-looking information, including, without limitation, the ability of the company to convert resources in reserves, its ability to see through the next phase of development on the project, its ability to produce a pre-feasibility study or a feasibility study regarding the project, its ability to execute on its development plans in terms of metallurgy or exploration, the availability of financing for activities, risks and uncertainties relating to the interpretation of drill results and the estimation of mineral resources and reserves, the geology, grade and continuity of mineral deposits, the possibility that future exploration, development or mining results will not be consistent with the Company's expectations, metal price fluctuations, environmental and regulatory requirements, availability of permits, escalating costs of remediation and mitigation, risk of title loss, the effects of accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in exploration or development, the potential for delays in exploration or development activities, the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations, currency fluctuations, expectations and beliefs of management and other risks and uncertainties.

In addition, forward-looking statements and forward-looking information are based on various assumptions. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information or forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements or forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking statements or forward-looking information, whether as a result of new information, future events or otherwise.

Copyright (c) 2022 TheNewswire - All rights reserved.