- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

November 15, 2023

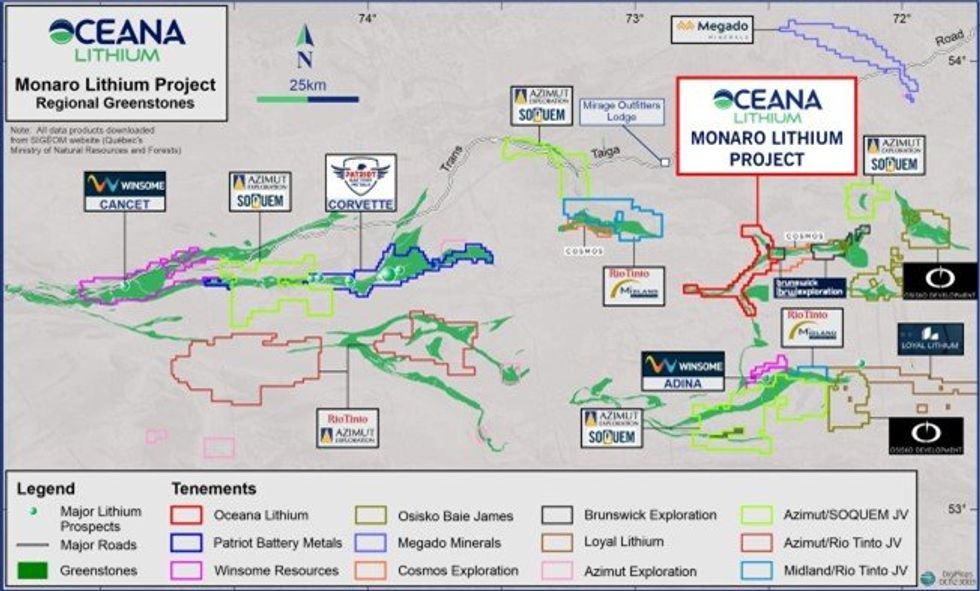

Oceana Lithium Limited (ASX: OCN, “Oceana” or “the Company”) is pleased to announce that the first phase of field exploration work has been completed at the Monaro Lithium Project in James Bay, Québec. Oceana has an option to acquire a 100% interest in the Monaro project (refer ASX Announcement 5 July 2023), which comprises 207 mineral claims covering an area of 104km2 along the western portion of the Duhesme Lake metavolcanic-sedimentary greenstone belt that can be traced about 40km along strike and 4-5km across (Figure 1).

Highlights

- First phase field exploration program completed at Monaro Project

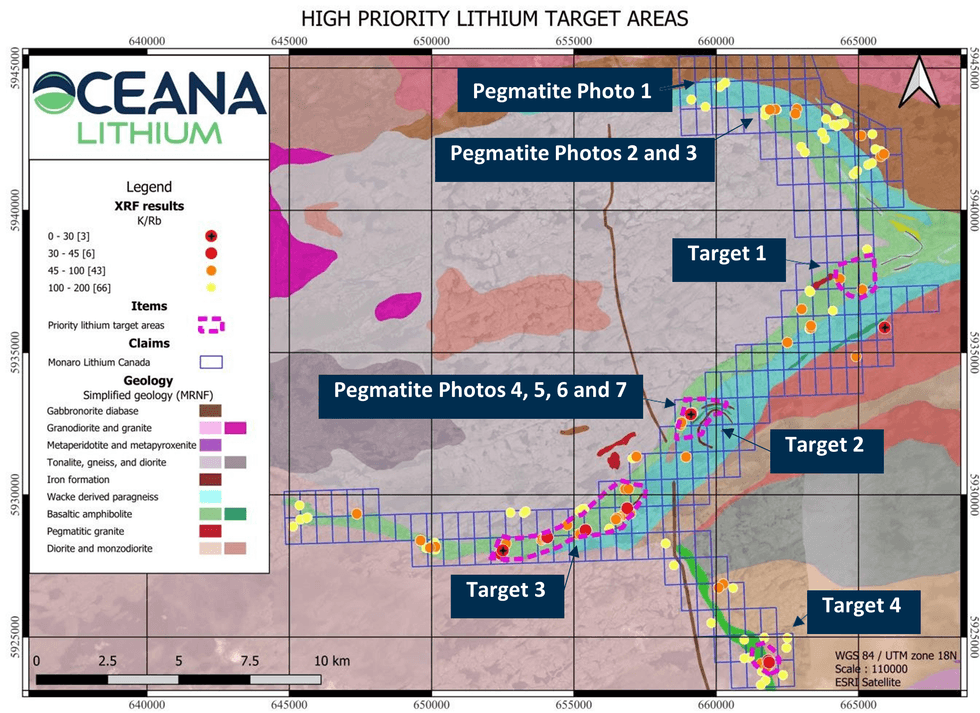

- Elevated levels of Rubidium (Rb) and low Potassium (K) to Rubidium ratios coincident with favourable geology and magnetic signatures have delineated several high-priority Lithium targets for further investigation

- 175 rock samples submitted to ALS Laboratories in Val-d’Or, Québec for whole- rock analysis, with results expected in December 2023

- Oceana has identified over 356 new pegmatite targets to date. Of these, 317 have been ground-checked, leading to the discovery of 131 new pegmatite bodies and 68 pegmatite boulders

- High-resolution LiDAR survey flown over the Monaro claims assisted with pegmatite target identification, measurement and prioritisation

- Monaro’s geology containing both amphibolites and wacke para-gneiss fits well within the current LCT pegmatite spodumene-bearing targeting model for the James Bay area

Experienced Québec-based contractor Explo-Logik conducted a helicopter- supported field program over the project area, under the supervision of Oceana’s Senior Exploration Manager James Abson. The field program consisted of pegmatite outcrop mapping, sampling with onsite XRF analyses for key LCT pegmatite pathfinder elements (Rb, K, Nb, La, Y, Ga, Tl, P, Mn, Cs, Nb, Sn, P and Ta), the determination of K/Rb ratios and pegmatite boulder prospecting.

A high-resolution LiDAR survey was flown during the field season and identified 13 additional targets, which were then confirmed by field inspection.

A total of 152 samples of white mica and feldspars were collected from pegmatite outcrops and a further 23 samples from pegmatite boulders were analysed by XRF to obtain K/Rb ratios. A total of 175 rock samples (including cut channel samples) collected have been sent to the ALS lab in Val-d’Or, Québec for whole-rock analysis. Some of these samples will also be used for petrographic analysis.

The XRF measurement of field samples has established four zones with low K/Rb ratio in relation to geology (Figure 2), including two from outcrops and one boulder with samples showing K/Rb < 30, and clear geochemical trends of highly fractionated pegmatites. These are consistent with established models of fractionated pegmatites and Lithium fertility1. The following encouraging preliminary observations have been made:

- Some of the pegmatites mapped to date are over 1km long and up to 80m wide (Figure 2, Figure 4 and Photo 2);

- The pegmatite K/Rb ratios calculated from 175 outcrop samples and boulders range from highly evolved (a population of 8 pegmatite outcrops and 1 pegmatite boulder with K/Rb ratios ranging from 24.3 to 40.8 and up to 3,179ppm Rb), to poorly evolved with a K/Rb ratio of up to 200;

- The more highly evolved ratios are contained within four zones within the amphibolite lithologies, concentrating within the NE trending limb and the most southerly SE trending limb of the property;

- There appears to be an EW and a NE-SW pegmatite strike direction, as well as a white-grey muscovite variety of pegmatite (possibly older) and a pink-white variety of pegmatite (possibly younger). The former type is possibly of higher interest, especially if with low K/Rb ratio and intruded into the amphibolites;

- It appears that the low K/Rb ratio samples also flank the contact with amphibolite/supracrustal rocks and granitoids, as observed in the Geology Map and Regional Total Magnetic Intensity Map (Figure 2 and Figure 3), and

- Monaro’s geology containing both amphibolites and wacke para-gneiss fits well within the current LCT pegmatite spodumene-bearing targeting model for the James Bay area.

Drill-ready outcrop targets for first phase drilling will be identified once the whole rock results are received, as well as planning for further focused geophysics, channel sampling and soil/till sampling campaign over the highly evolved pegmatite areas to identify additional Lithium-bearing drill targets.

Exercise of the Option over Monaro

Oceana acquired an option to purchase a 100% interest in the 207 mineral claims that comprise the Monaro project in July 2023. The option expires on 31 December 2023, but subject to the listing rules, may be extended at the sole discretion of Oceana to 31 March 2024 (refer to ASX Announcement dated 5 July 2023 and the Company's Notice of General Meeting dated 27 October 2023).

Shareholders will be asked at the forthcoming AGM to be held on 28 November 2023 to vote on the issue of ordinary shares and performance rights (together Consideration Securities) forming part of the deferred consideration option exercise price for the acquisition. The Directors have unanimously recommended that shareholders vote in favour of the issue of the Consideration Securities performance rights (refer to section 6 of Explanatory Statement to Notice of Meeting, ASX Announcement dated 27 October 2023). This will allow the Company to, following further exploration results and should it wish to exercise the Monaro Option, issue the Consideration Securities.

Click here for the full ASX Release

This article includes content from Oceana Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

OCN:AU

The Conversation (0)

12 March 2024

Oceana Lithium

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00