May 14, 2025

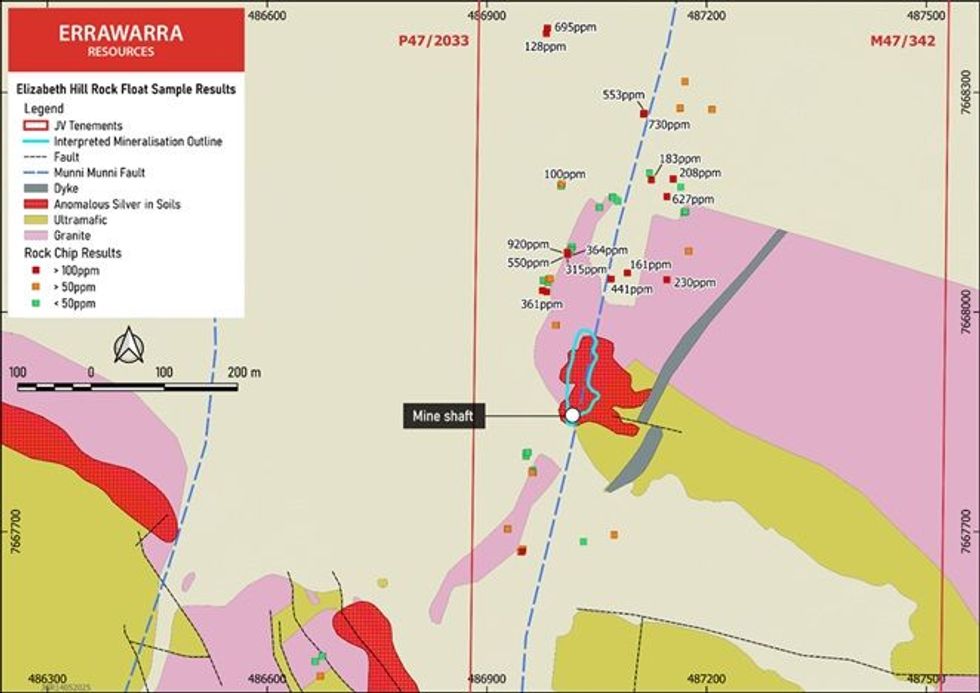

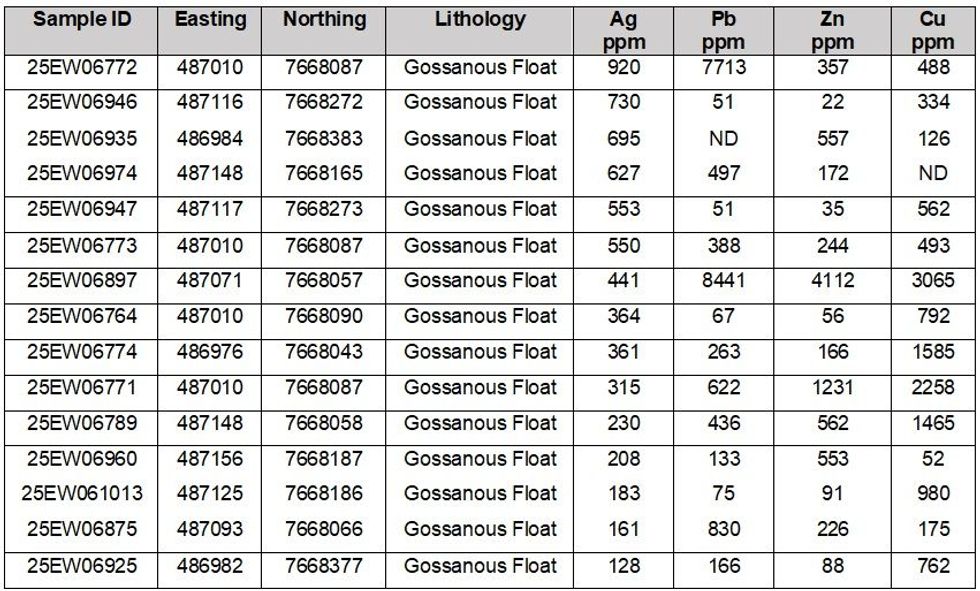

Errawarra Resources Ltd (ASX: ERW) is pleased to advise that recent surface sampling at its Elizabeth Hill Project has returned multiple elevated portable XRF (pXRF) silver (Ag) readings including high grade results up to 920g/t Ag.

HIGHLIGHTS:

- pXRF surface sampling has returned multiple high-grade silver (Ag) results up to 920g/t

- Gossanous and ferruginous float has generated new potential Silver (Ag) target areas nearby the historic Elizabeth Hill mine

- High Grade readings have been recorded ~300m to the north and ~150m to the south of the known Elizabeth Hill mineralisation envelope and correlate with the location of the Munni Munni Fault system

- Samples returning elevated Ag readings are typically from iron-rich, gossanous-like material

- Further exploration now planned, including trenching, additional sampling and metal detecting

- Inaugural drilling program to commence in coming weeks

- Samples collected have been dispatched to the laboratory for further analytical testing with results expected in 6-8 weeks

Several pXRF silver target locations have been identified across the project area, with 37 surface samples returning elevated silver results of greater than 50g/t Ag, including areas approximately 150m south of the historic Elizabeth Hill mine site and approximately 300m north of the mine, including a highest recorded silver value of 920g/t Ag.

Executive Director Bruce Garlick commented:

“This is an extremely exciting observation by our field team. The identification of high-grade silver values in areas north and south of the historic mine presents compelling new targets. We will now focus further field work in these areas to determine the potential for extensions to the known mineralisation. Coupled with our upcoming drilling program, due to commence in the coming weeks, this once again highlights the significant exploration potential at Elizabeth Hill.”

The high-grade silver results (>50g/t Ag) are typically associated with iron-rich, gossanous-like float material, which may be indicative of mineralised extensions to the known system.

Further work is now planned to investigate these encouraging areas, including:

1. Additional surface sampling;

2. Metal detector surveys to identify more material in the vicinity; and

3. Targeted trenching to identify potential mineralised structures at surface.

The samples collected have been dispatched to the lab for analytical testing with assay results expected in 6-8 weeks.

The Company cautions that while pXRF readings provide a useful indication of mineral content and approximate grades, they are not a substitute for laboratory-derived assay grades. All samples will be sent to an independent laboratory for accurate analysis, with assay results expected in 6-8 weeks. Portable XRF results reported in this announcement are considered semi-qualitative.

Errawarra will continue to update the market as further exploration results become available.

Click here for the full ASX Release

This article includes content from Errawarra Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

13 February

Top 5 Canadian Mining Stocks This Week: Trinity One Surges 105 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV, and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) said they will no... Keep Reading...

11 February

10 Bodies Found as Mexico Probes January Kidnapping at Vizsla Silver Site

Mexican authorities have recovered 10 bodies as part of an investigation into the January abduction of workers from a mining site operated by Vancouver-based Vizsla Silver (TSXV:VZLA) in the northern state of Sinaloa.Mexico’s Attorney General’s Office said the bodies were located in the... Keep Reading...

10 February

Gary Savage: Silver Run Not Over, US$250 is Easy in Next Leg

Gary Savage, president of the Smart Money Tracker newsletter, breaks down gold and silver's recent price activity, saying that while the precious metals have reached the parabolic phase of the bull market, it's typical to see a correction midway through. "The second phase I think will be several... Keep Reading...

09 February

Panelists: Silver in Bull Market, but Expect Price Volatility

Gold often dominates conversations at the annual Vancouver Resource Investment Conference (VRIC), but silver's price surge, which began in 2025 and continued into January, placed the metal firmly in the spotlight. At this year’s silver forecast panel, Commodity Culture host and producer Jesse... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00