July 09, 2024

Grades up to 4,150ppm Li identified along 1.4km trend north of recent discovery

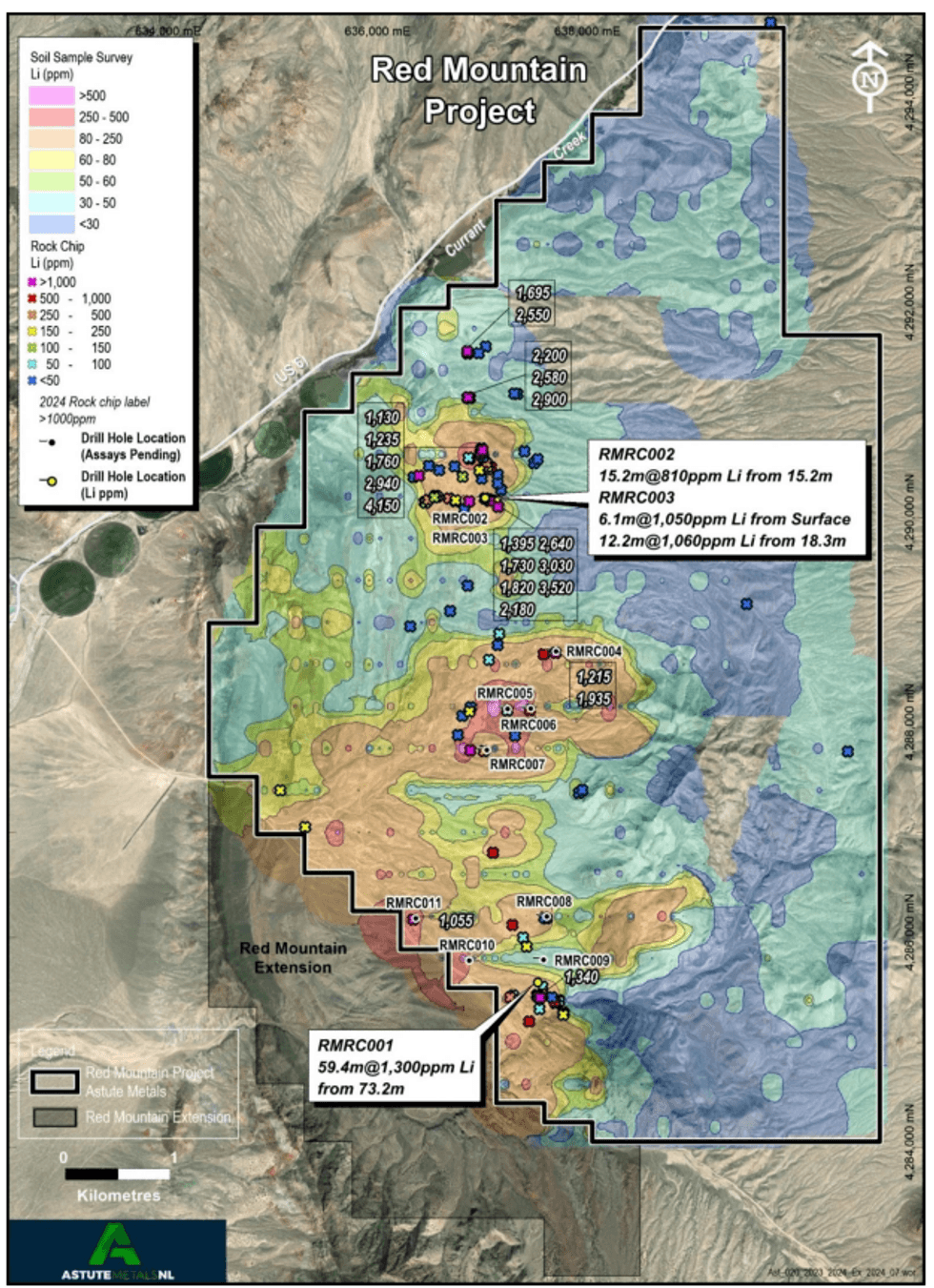

Astute Metals NL (ASX: ASE) (“ASE”, “Astute” or “the Company”) is pleased to advise that rock chip assay results from its 100%-owned Red Mountain Lithium Project in Nevada, USA have returned high-grade mineralisation of up to 4,150ppm Lithium, further enhancing the project’s exploration and discovery potential. Notable results returned up to 1.4km north of the recently reported discovery include:

- 4,150ppm Li, brown-green claystone sampled 490m north of RMRC002

- 2,900ppm Li, brown claystone sampled 990m north of RMRC002

- 2,550ppm Li, brown claystone sampled 1.40km north of RMRC002

Key Highlights

- 81 rock-chip samples reveal the presence of high�grade lithium claystone mineralisation in outcropping and sub-cropping claystones at Red Mountain.

- North-south trend of high-grade samples extends the claystone mineralisation 1.4km north of hole RMRC002, expanding the prospective horizon at Red Mountain

- Exceptional grades of up to 4,150ppm lithium reported.

- 20 samples return grades over 1,000ppm lithium indicating high-grade clays across the Project.

- Assay results for the remaining eight drill holes expected in two batches by the end of July.

A total of 81 samples were collected and assayed, adding to Astute’s understanding of the prospective horizons at Red Mountain and complementing the initial drill results from its maiden drilling campaign,for which assays for eight holes remain pending. The rock chip assays are shown, along with previous results including the recently announced high-grade lithium discovery, in Figure 1.

These results suggest that the targeted high-grade lithium horizon persists further north than previously interpreted, with a number of high-grade samples located along an approximate north-south trend stretching 1.4km north of the northernmost drill hole, RMRC0021. The extended zone will be tested by future drilling at the project.

Astute Chairman, Tony Leibowitz, said:

“Our exploration team continues to deliver exciting results, with these latest rock chip results returning exceptional lithium grades and further expanding the potential scale of the Red Mountain Project. The latest results come from an area up to 1.4km north of the discovery we announced recently on 18 June and provide further evidence of the scale and potential of this project.

“We are eagerly awaiting the assays from eight drill holes along the initial 4.6km of strike tested by our recent drilling, with these new rock chip results further extending the prospective horizon to over6km – adding a significant new area for drill testing later this year.

“The latest results suggest that Red Mountain could be a very large and significant lithium discovery, and we are looking forward to systematically unlocking its full potential.”

Figure 1. Rock chip and Drill-hole locations, intersections, and gridded soil sample geochemistry over aerial image.

Background

Located in central-eastern Nevada (Figure3), the Red Mountain Project was staked by Astute in August 2023.

The Project area has broad mapped tertiary lacustrine (lake) sedimentary rocks known locally as the Horse Camp Formation2 . Elsewhere in the state of Nevada, equivalent rocks host large lithium deposits (see Figure 3) such as Lithium Americas’ (NYSE: LAC) 16.1Mt LCE Thacker Pass Project3 , American Battery Technology Corporation’s (OTCMKTS: ABML) 15.8Mt LCE Tonopah Flats deposit4 and American Lithium (TSX.V: LI) 9.79Mt LCE TLC Lithium Project5 .

After staking was completed, Astute completed an 819-point soil sampling campaign that revealed strong lithium anomalism in soils, with grades of up to 1,110ppm lithium and a coherent 50ppm+ lithium anomaly that extends over a strike length of 8km and is up to 2.8km wide2 (Figure 1).

After completing the soil sampling campaign, the Company embarked on a rock-chip campaign at Red Mountain designed to test for lithium at strategic locations and across a range of outcropping and shallowly sub-cropping rock types (see Figure 2).. The results of this initialrock chip sampling revealed the presence of strongly mineralised claystone, with 10 claystones grading on average 1,102ppm lithium, ranging from 132-2,190ppm lithium2

In May through June 2024 a maiden Reverse Circulation (RC) drilling campaign was completed at the Project, with initial results indicating the potential discovery of a significant lithium deposit1 .

Click here for the full ASX Release

This article includes content from Astute Metals NL licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ASE:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00