August 07, 2023

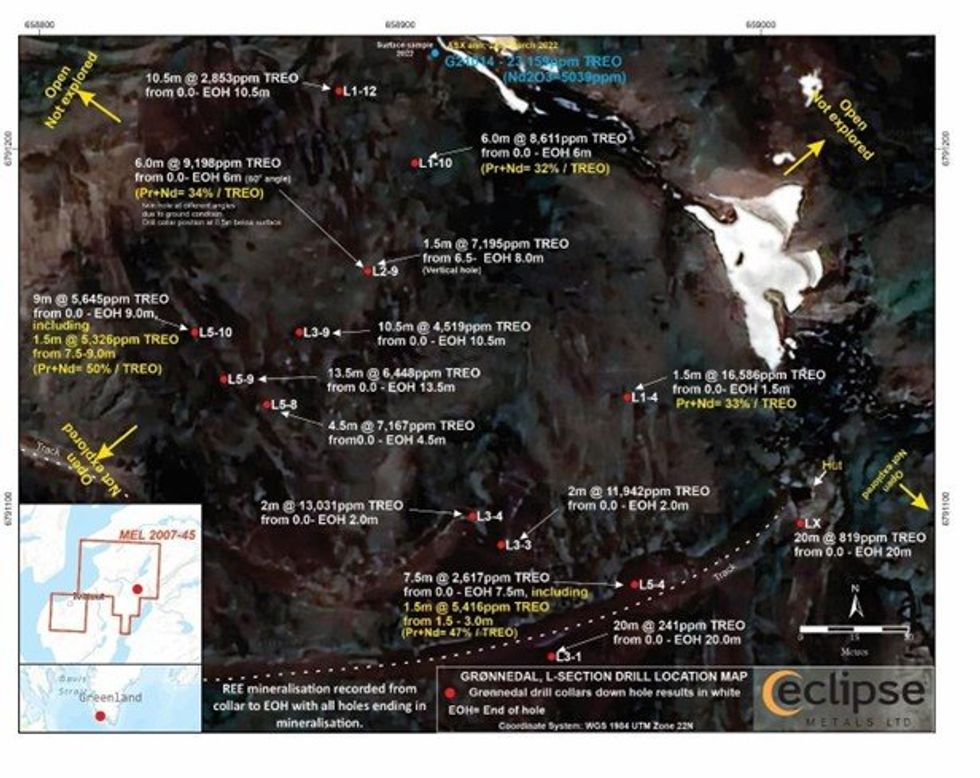

Eclipse Metals Ltd (Eclipse or the Company) (ASX: EPM | FSE: 9EU) is pleased to announce drill hole sample assay results for samples from its 2022 maiden percussion drilling program on the Grønnedal REE prospect within its 100% owned Ivigtût multi-commodity project in SW Greenland. Assay results, together with previous geological and geophysical assessments indicate that REE mineralisation at Grønnedal is widespread and deep-seated.

- Maiden drilling program at Grønnedal returns rare earth element (REE) mineralisation for full length of all drill holes

- Drilling results confirm high ratios of up to 50% of praseodymium and neodymium (Pr+Nd).

- Best total rare earth oxides (TREO) assay results from shallow1 drilling program at Grønnedal include:

- from 0.0m - 22m @ 9,052ppm TREO – EOH1 22.0m

- from 0.0m - 20m @ 7,132ppm TREO - EOH 20.0m (60°)

- from 0.0m - 6.0m @ 9,198ppm TREO - EOH 6.0m (34% Pr+Nd in TREO)

- from 0.0 - 1.5m @ 16,586ppm TREO - EOH 1.5m (34% Pr+Nd in TREO)

- from 0.0 - 6.0m @ 8,611ppm TREO - EOH 6.0m

- from 0.0 – 9.0m @ 5,645ppm TREO – EOH 9.0m, including 1.5m @ 5,326ppm TREO 7.5 - 9.0m - EOH (50% Pr+Nd in TREO)

- Assay results recorded low uranium values which are well below the Greenland Government’s recently legislated maximum of 100ppm

- REE mineralisation at Grønnedal is widespread and deep-seated

- Diamond drilling to test Grønnedal depth potential expected in Q4 2023

Executive Chairman Carl Popal commented:

“These initial results from shallow drill-holes at Grønnedal confirm the REE-rich nature of the carbonatite body and indicate the presence of several promising targets from surface which remain open at depth and along strike. The geophysical assessment confirmed the deep - seated nature of the host to this REE mineralisation, suggesting a sizeable REE target. With recent approval of the 2023 Grønnedal diamond drilling program, the company is poised to initiate an in-depth assessment of the REE potential.

The prospective nature of REEs at both Grønnedal and Ivigtût aligns with our strategic goal of developing the project as an asset to be a world-class player in metals and minerals crucial for the green energy industry. Eclipse is dedicated to actively exploring the Grønnedal prospect, as well as the nearby historical Ivigtût pit throughout the course of 2023."

Results in this release relate to 27 shallow percussion drill holes completed at Grønnedal, where all drill holes encountered REE mineralisation from surface to end of hole. Eclipse’s maiden drilling program at Grønnedal has provided a better understanding of the geology and geochemistry of the ground and the holes were generally drilled to blade refusal, with limitation of the drill rig handling the ground conditions. A maximum depth of 22m was achieved in some locations (refer to Table 1). The drilling program was completed in October 2022 with samples shipped from Greenland to Australia for laboratory assessment.

Laboratory results for the initial over-limit values (+1,000ppm) for drillhole samples have now been received following further testing using appropriate methods. The complete REO drilling results for Grønnedal are listed in Table 2.

Click here for the full ASX Release

This article includes content from Eclipse Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EPM:AU

The Conversation (0)

25 March 2024

Eclipse Metals

Pursuing Multi-commodity Assets to Support Decarbonization

Pursuing Multi-commodity Assets to Support Decarbonization Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00