May 21, 2023

Ora Gold Limited (“Ora” or the “Company”, ASX: OAU) is pleased to announce further high-grade gold intercepts from reverse circulation (RC) drilling at the Crown Prince Gold Prospect (M51/886).

Highlights:

- Further assay results from the company’s RC drilling at the Garden Gully Gold Project have been received.

- High-grade gold results returned from South-Eastern Ore Body (SEB). These results come from the down dip parts of the SEB structure and Au-bearing quartz lode within fresh, sheared-dolerite (i.e. primary zone / fresh rock). Best intercepts include:

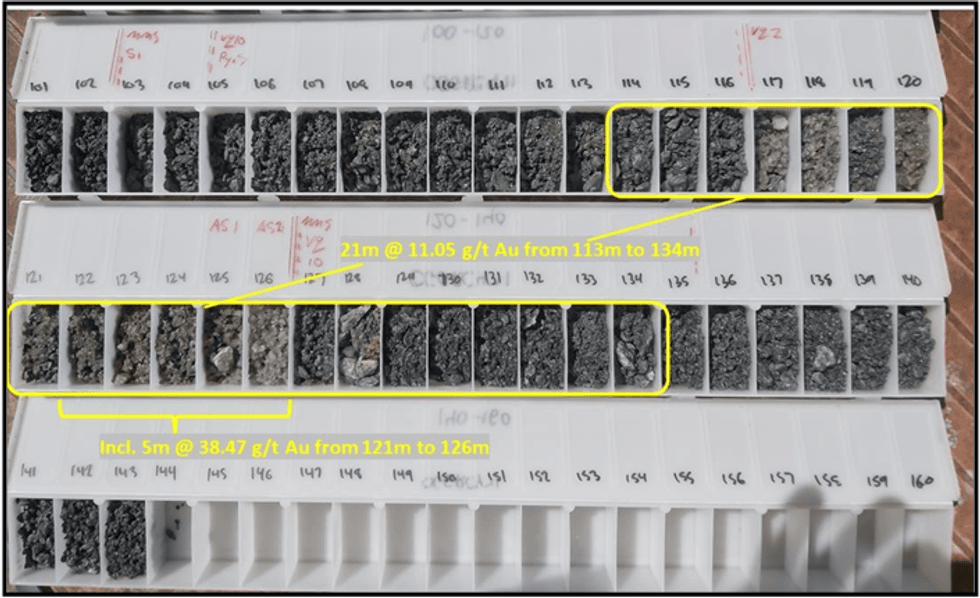

- 21m @ 11.05g/t Au from 113m in OGGRC471, incl. 9m @ 22.24g/t Au from 121m

- 24m @ 3.96g/t Au from 27m in OGGRC477 incl. 8m @ 7.27g/t Au from 35m

- 17m @ 1.85g/t Au from 101m in OGGRC480, incl. 7m @ 3.5g/t Au from 111m

- 5m @ 6.13g/t Au from 182m in OGGRC468, and 3m @ 3.45g/t Au from 195m

- These results include assays from hole OGGRC471 which is the deepest hole drilled at the newly delineated SEB ore body. This drill hole highlights good mineralisation continuity at depth. The mineralised zone is open below this hole.

- The high-grade CVX lode within SEB was intersected at 113m metres downhole well below the top of fresh rock and base of oxidation and down dip from previously reported high grade intersections (refer ASX release 8 May 2022).

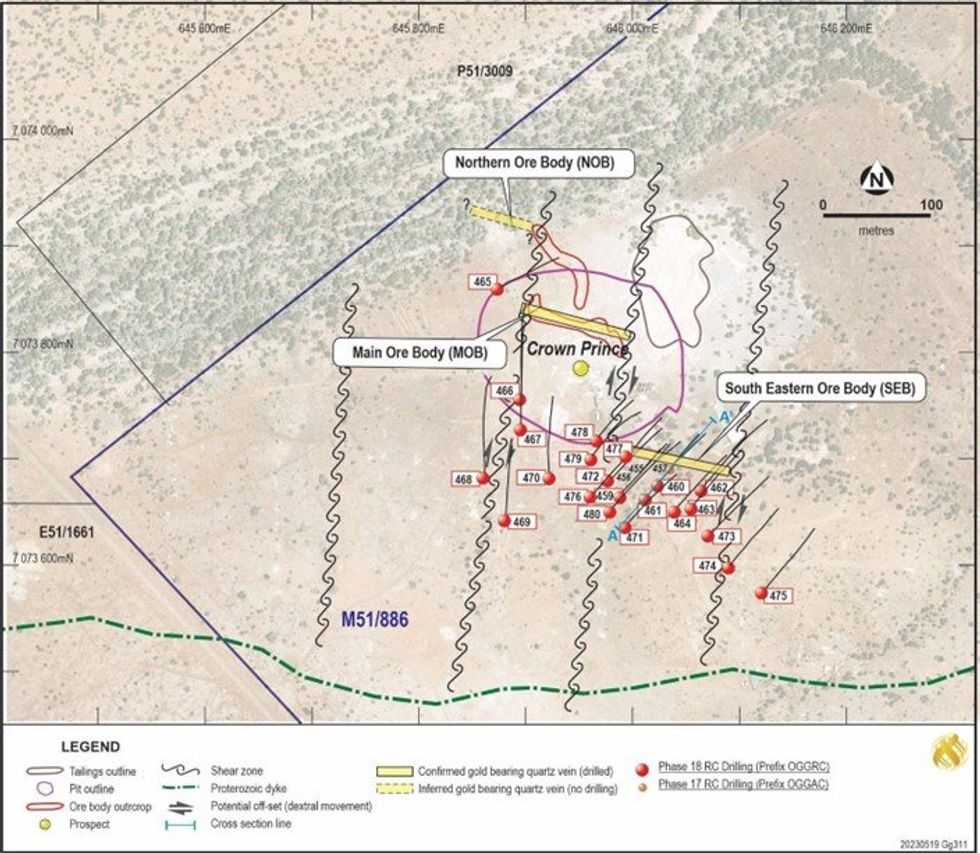

Drill holes in the current program have successfully delineated extensions to mineralized zones along strike of known mineralisation (to the north-west and south-east) and also in down-dip positions. In several areas new zones of gold mineralisation are indicated to be present in the footwall to previously drilled lodes.

The Crown Prince south-east extension (SEB) continues to develop as a key growth area for gold resources at the prospect.

Ora Gold’s CEO Alex Passmore commented: “We are pleased to report further high-grade gold intercepts from Crown Prince Prospect. These results will be used in an upcoming resource estimation. The drilling discussed in this release indicates that the SEB ore body is strongly mineralised in the primary zone i.e. well below the top of fresh rock and we look forward to further drilling in this area. Diamond drilling to target deeper zones is set to commence shortly with shallower up-dip positions being better defined by air-core and slimline RC drilling currently. All data received so far suggests the SEB zone mineralisation commences at shallow depths, is high-grade over good widths and hence is likely to show robust economic outcomes in any conceptual mining scenario.”

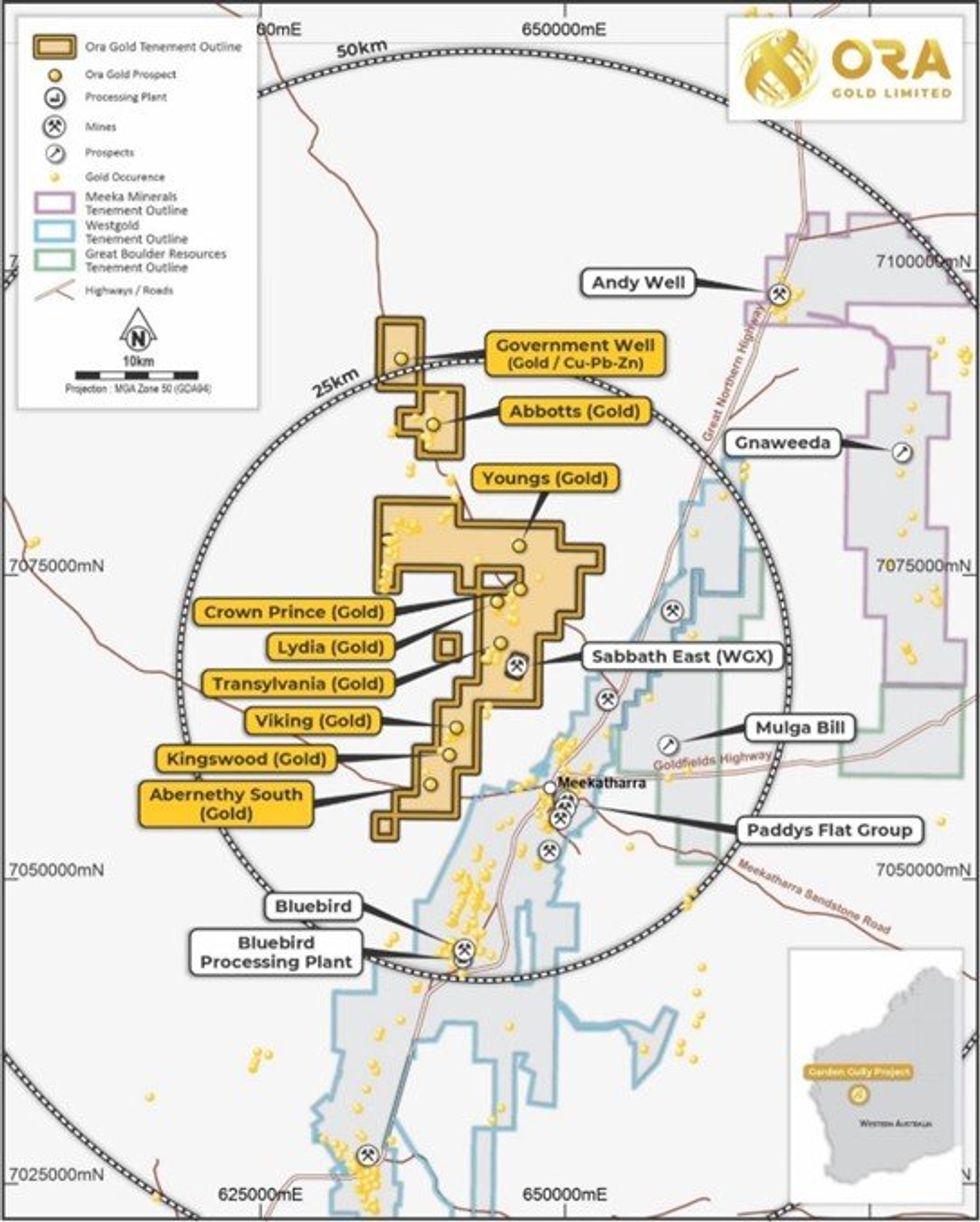

The Crown Prince Prospect is a high-grade gold deposit within Ora Gold’s Garden Gully Project. Crown Prince is located 22 kilometers north-west of Meekatharra in Western Australia via the Great Northern Highway and the Mt Clere Road (Figure 1).

The majority of assay results from an RC drill program undertaken in March and April targeting the Main Ore Body (MOB) and the South East Ore Body (SEB) have been received (Figure 2). Air core and slimline RC drilling is currently underway with diamond drilling set to commence in early June 2023.

The results in this release include a new high-grade extension to the South Eastern Ore Body (SEB) importantly this is the deepest intersection at this ore body thus far (Figures 2,3 and 4). Mineralisation is open at depth.

All hole details and sampling information are included in Table 1. Assay results with more than 0.1ppm Au are included in Appendix 1.

South-Eastern Ore Body (SEB)

Additional high-grade gold intercepts have been returned and are reported in this release. The best intersections are located down-dip from the previously reported mineralized zone at SEB. Primary high- grade gold mineralisation has been confirmed showing the down-dip continuity of the CVX Lode (OGGRC471: 21m @ 11.05g/t Au from 113m in OGGRC471, incl. 9m @ 22.24g/t Au from 121m, refer Figures 3 and 4, AA’ cross section). This intercept is well below the TOFR and will be further tested at depth by diamond drilling (Figure 4).

Click here for the full ASX Release

This article includes content from Ora Gold Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

9h

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

11h

Precious Metals Price Update: Gold, Silver, PGMs Stage Recovery After Crash

It's been a wild week of ups and downs for precious metals prices.Gold, silver and platinum have already recorded new all-time highs in 2026. But this week, the rally reversed course — only briefly, but in a big way, as is the case with such highly volatile markets.Let’s take a look at what got... Keep Reading...

13h

Centurion Minerals Ltd. Announces Revocation of MCTO

CENTURION MINERALS LTD. (TSXV: CTN) ("Centurion" or the "Company") announces that the British Columbia Securities Commission ("BCSC") has revoked the management cease trade order ("MCTO") previously issued on December 1, 2025 under National Policy 12-203 - Management Cease Trade Orders.The... Keep Reading...

03 February

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

03 February

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

03 February

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold (TSX:ELD,NYSE:EGO) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that will create a larger, diversified gold and copper producer with two major development projects that are set to enter production in 2026.Following completion under a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00