September 14, 2025

Initial assays returned for visible gold zone logged in diamond drill core~40m south of the Bronzewing Mining Lease, with drilling continuing

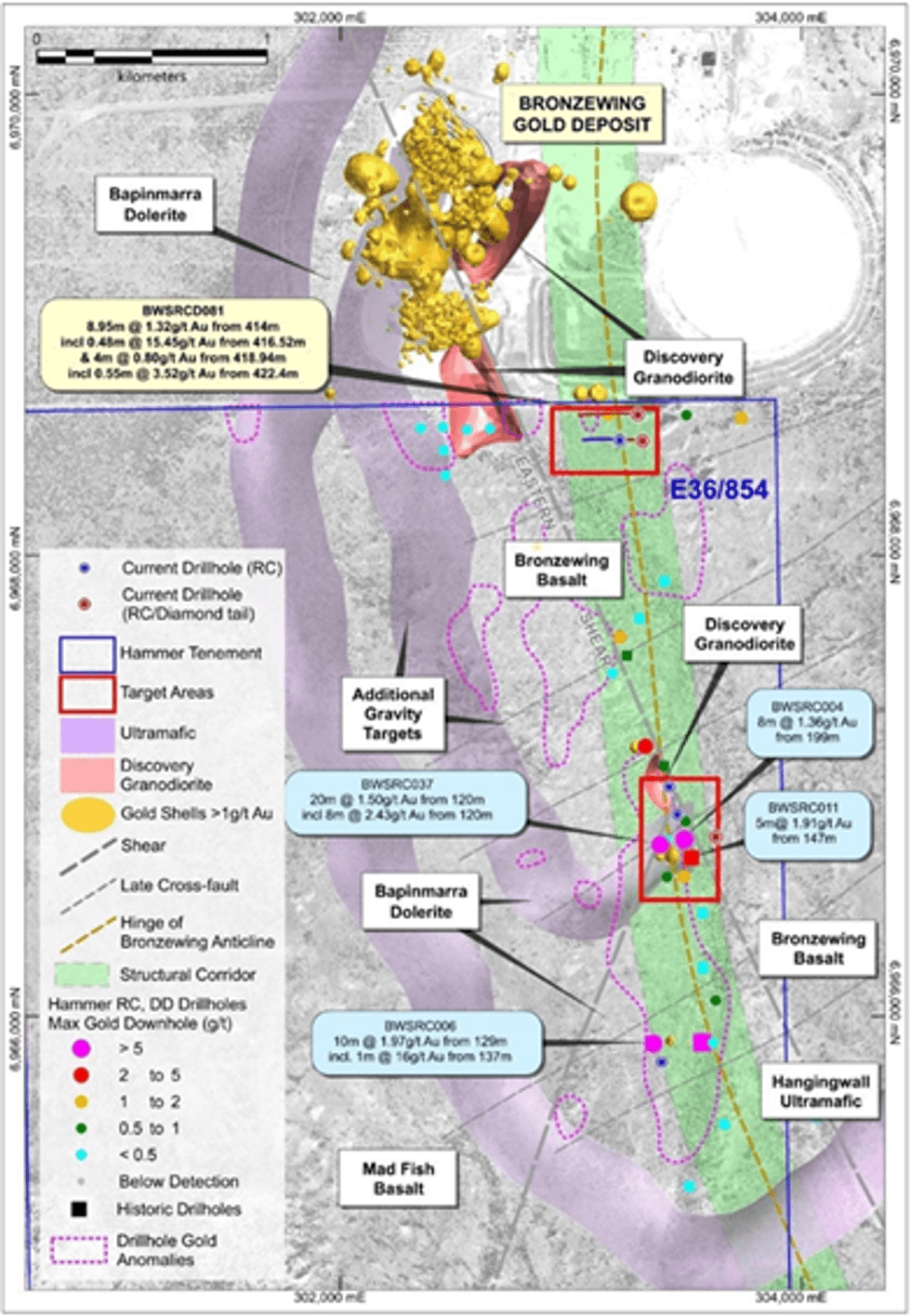

Hammer Metals Ltd (ASX: HMX) (“Hammer” or the “Company”) is pleased to provide an update on recent exploration progress at its 100%-owned Yandal Gold Project in Western Australia. Diamond drilling continues with the first batch of assays now received for the zone of visible gold reported to the ASX on 2 September 2025. Drilling of the diamond tail to drill-hole BWSRCD081 was completed a depth of 561.7m.

The diamond drilling program has continued with two diamond tails completed at the Bronzewing Central Target, located approximately 1.7km to the south of the Eastern Target Zone. A follow-up diamond tail will commence shortly at the Eastern Target, with drilling anticipated to conclude towards the end of September. Results from this program will continue to be submitted to the laboratory in batches, with results anticipated to be received throughout September and into mid-October.

- Partial results received from the diamond tail of drill-hole BWSRC081 with the visible gold zone returning 15.5g/t Au over 0.48m from 416.5m. This high- grade zone is reported within a broader intercept of:

- 8.95m at 1.32g/t Au from 414m, including:

- 0.48m at 15.5g/t Au from 416.5m; and

- 0.55m at 3.52g/t Au from 422.4m.

- 8.95m at 1.32g/t Au from 414m, including:

- Follow-up drilling along strike from these intercepts is scheduled to commence in the coming days to define the extent of the south-trending zone of gold mineralisation with a diamond tail of drill-hole BWSRCD086.

- Drill results indicate the inadequacy of historical air-core drill testing with a significant search space now open on the boundary with the historical Bronzewing Mining Lease.

- Diamond drilling at the Central Target, located ~1.7km to the south of the Eastern Target and within the same structural corridor, has encountered zones of intense locally massive quartz veining associated with brecciation below historical Hammer gold drilling anomalies of:

- 20m at 1.5g/t Au from 120m in drill-hole BWSRC0037, including:

- 8m at 2.4g/t Au from 120m; and

- 4m at 3.9g/t Au from 120m.1

- 20m at 1.5g/t Au from 120m in drill-hole BWSRC0037, including:

- Assay results from the remaining program will be progressively released in the coming weeks.

Hammer’s Managing Director, Daniel Thomas, said:

“The confirmation of high-grade gold mineralisation at Bronzewing South is a significant step in our search for an economically viable gold target at our Yandal Gold Project. High-grade mineralisation can be traced with multiple intercepts to the north of our project area, with the mineralised structure interpreted to extend for hundreds of metres.

“We will now look to test this structure approximately 100m further south on our project area. We are very much looking forward to follow-up drilling at the Eastern Target, as we enter a zone without any previous drilling coverage.

“The team is encouraged by the observations in recent drilling at the Central Target and the potential for this corridor to be connected to the Eastern Target drilling some 1.7km to the north. This corridor is largely untested below the ineffectual air-core drilling and, with a prominent shear zone interpreted to connect these targets, it is of high interest to the team in our search for a significant gold discovery.”

Click here for the full ASX Release

This article includes content from Hammer Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00