February 12, 2025

Halcones Precious Metals Corp. (TSX – V: HPM) (the “Company” or “Halcones”) is pleased to announce additional results from the recent field program at the Polaris gold project, Chile (“Polaris” or the “Project”). Polaris is a large, highly prospective gold project that has never been drilled. No modern exploration has been carried out to date other than basic rock sampling and mapping. Surface bedrock sampling performed by Halcones’ geologists has extended the strike length of a trend of assay results, comprising more than 400 rock samples, many grading greater than 1g/t gold, to 3.9 km. This trend remains open for another 2km to the north and 1.5 km to the south before reaching property boundaries.

According to Ian Parkinson, CEO of Halcones, “It is exceedingly rare to see such an extensive and highly mineralized gold trend that has never been drilled. In more than ten years as a senior mining analyst for leading financial institutions, there is not a single project I have seen that shows such extensive mineralization in outcrops and no history of systematic exploration. We are very excited by the prospectivity of this project”.

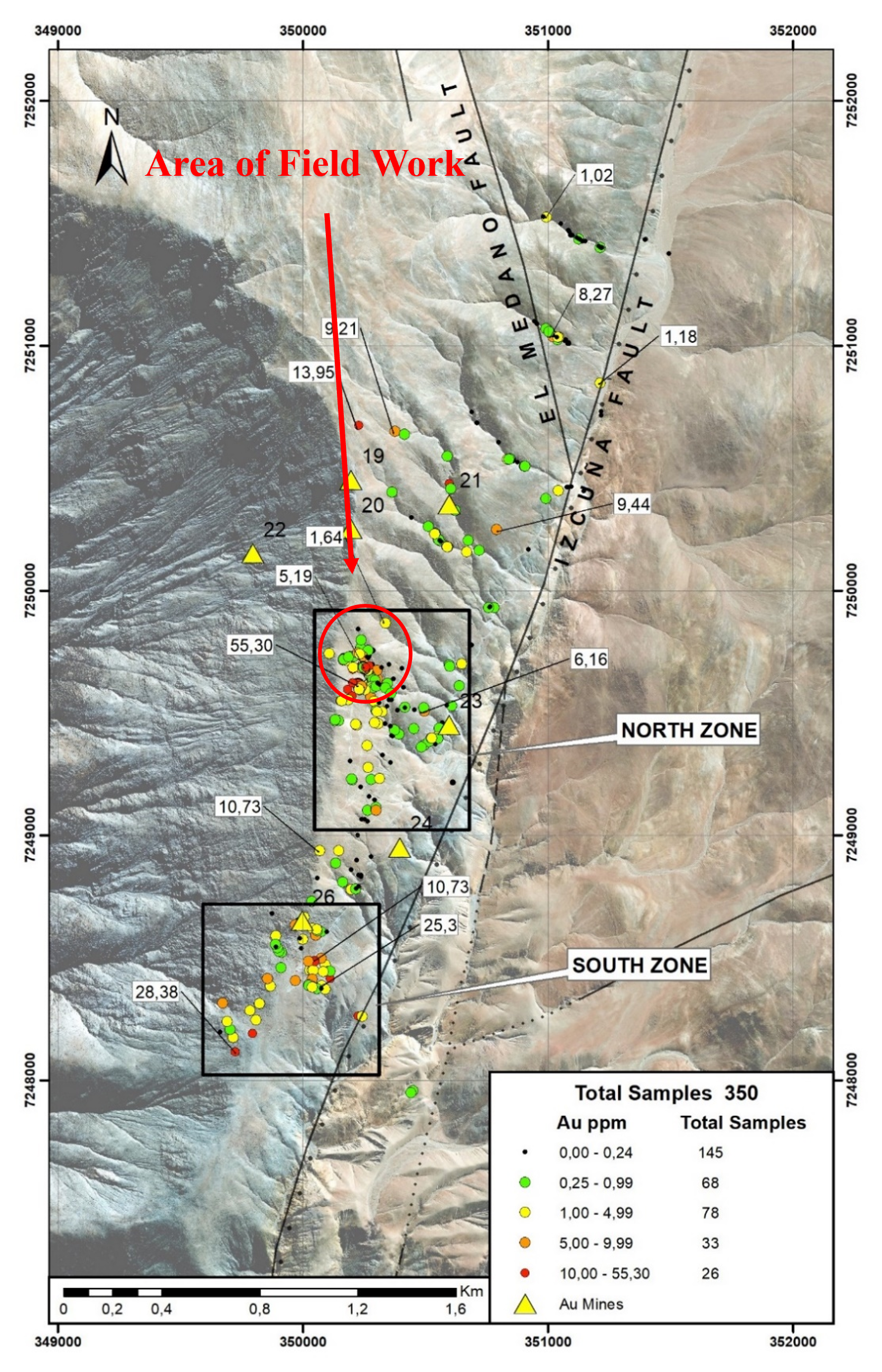

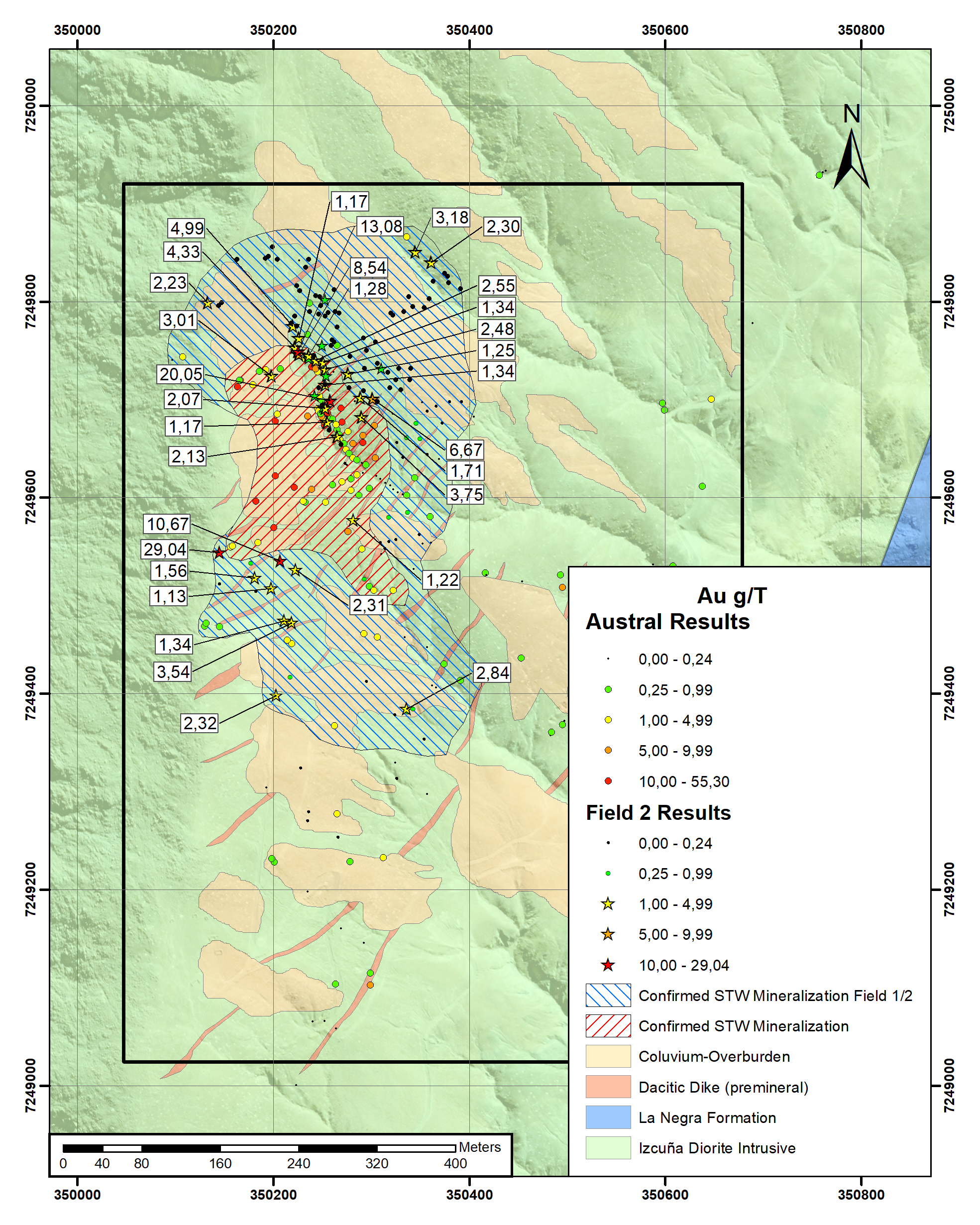

Halcones’ geologists recent field work was focused on mapping and sampling a priority area within the North Zone (Figure 1) resulting in an expanded priority target. This area has consistently returned high grade results from surface sampling. Several highly prospective drill targets have been outlined through this sampling program in the North Zone (see Figure 2). Sampling completed by the Company has increased the gold mineralized footprint by approximately 210% from the area first observed by the optionors of the Project. Company geologists believe that the North and South Zones may merge into a single large gold anomaly, further increasing the potential of the Project. Sampling is limited in the area between the North and South Zone due to the presence of thin overburden cover. The next phase of exploration will focus on better defining the extension of the anomalous gold in this area to confirm the current geological interpretation of the field team. Additional sampling to explore and expand the anomaly to the north and east will also be done as part of the next stage of exploration.

Highlights:

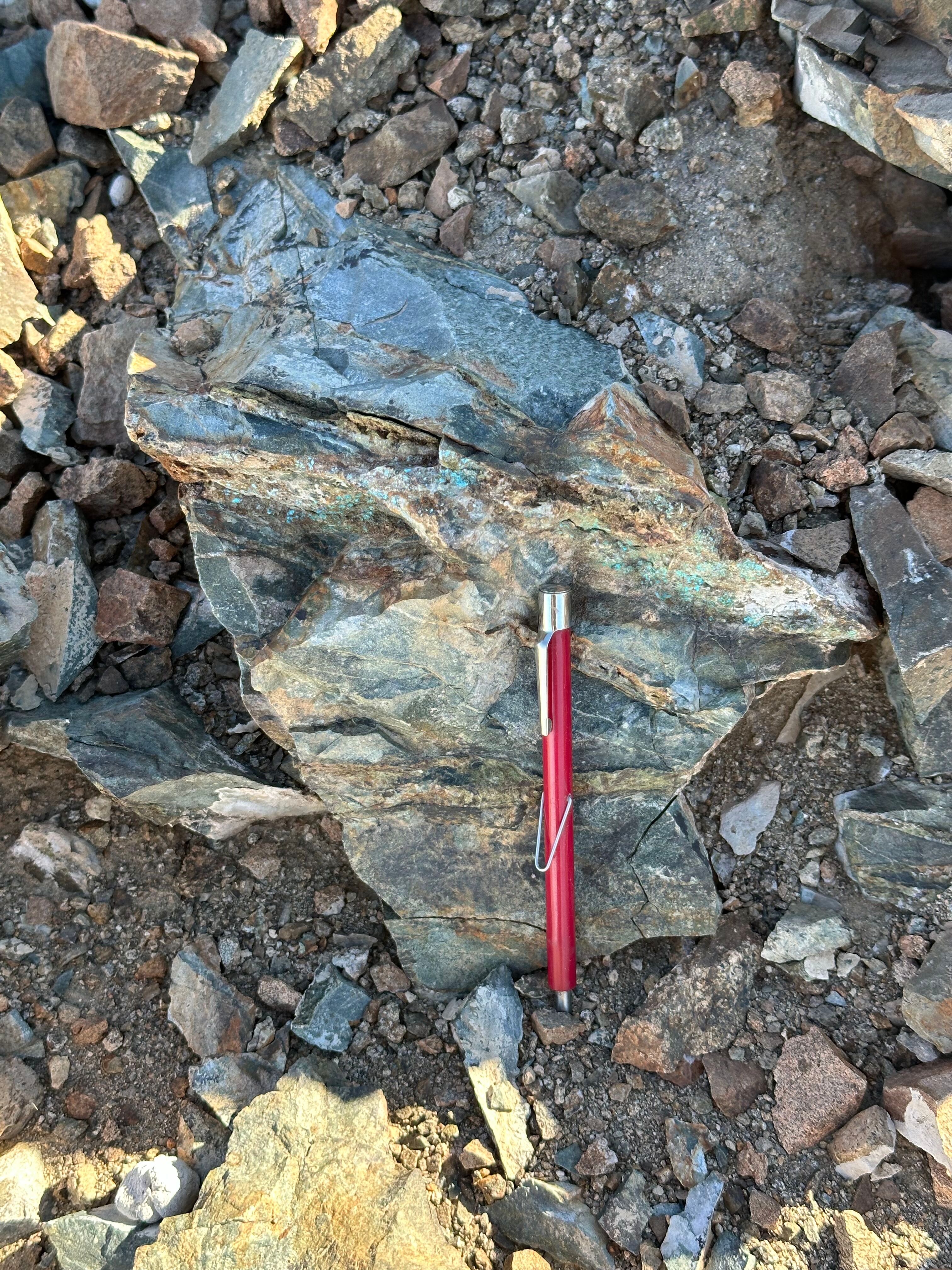

- Select highlights from the last batch of 44 assays include 29.04, 10.67, and 3.54 g/t Au, hosted primarily in stockwork (see Figures 3 & 4). These results are in addition to the 20.05, 13.08, 8.54 and 6.67 g/t Au previously reported (see February 4th,2025 press release for details). The samples consisted of continuous 1m long chip samples to ensure representative sampling. The program prioritized sampling of stockwork as opposed to larger quartz veins. Gold bearing stockwork (see Figures 3 & 4) at surface has been sampled over approximately a 250m X 500m area and the limits of this mineralized zone are unknown. Several high-grade target areas have been identified. However, the entire area may represent a large, bulk minable target if continuity between bedrock samples is established. See Figure 2 for locations of samples.

- The North Zone sample area with the greatest concentration of high-grade surface samples has been expanded to the South. Sampling by Halcones’ geologists returned values consistent with work done by the optionors of the Project and extended the known area of high-grade mineralization to more than double that previously outlined. The approximate surface area of this target containing multiple surface samples above 1 g/t is 12.3 hectares.

- High grade mineralization continues to exhibit a strong structural control. In the reported sampling area (Figure 2), high grade samples continue to occur on the southwest side of a structural break. Approximately 40% of the surface area in the northwest portion of the Project area has a thin layer of colluvial cover and this has seen limited sampling. The Company plans to expand its sampling through this thin cover when approvals are in place.

- Halcones believes there is potential for a larger tonnage surface deposit of vein and stockwork hosted mineralization within the highly fractured granodioritic rocks adjacent to fault splays associated with the continental scale, Atacama Fault System in the area. Extensive gold mineralization has been identified by surface bedrock sampling over 3.9 km of strike length along these structures on the property to date.

Ian Parkinson, CEO and Director of Halcones:

“We are very excited by the results of our first field program at Polaris. These results have confirmed what we had hoped for at Polaris. In a few weeks of field work we have materially expanded the initial areas of interest and several very clear targets for future drilling have emerged. It is rare to see such broad anomalous gold at surface. Much of the Project area remains sparsely sampled and mapped. Our technical team is currently making plans to get back into the field”.

About The Recent Field Program:

The were two main objectives of the field program.

1) Expand the footprint of the known mineralization in the Northwest corner of the North Zone (See Figure 1).

2) Test and better define the extent of mineralized stockwork as a lower grade bulk tonnage opportunity adjacent to the known vein hosted mineralization.

This first field program has successfully expanded the surface area of mineralization (see Figure 2) and confirmed the presence of extensive stockwork hosted gold mineralization at surface.

Sampling previously performed on Polaris identified the northwest section of the North Zone as a priority area (see Figure 1). In recent field work, Halcones’ geologists increased the density of sampling and expanded the surface footprint of sampling in this priority area (see Figure 2). Halcones’ geologists took a total of 140 samples during the recent field campaign. All assays from this program have been received, of which 31 returned values above 1 g/t Au.

This sampling program has successfully expanded the surface expression of the work completed previously on Polaris. Additionally, stockwork mineralization has been confirmed over a broader area. The presence of mineralized stockwork over an extensive area supports Halcones’ geologist interpretation that bulk tonnage deposit potential exists at Polaris. Sampling has been limited in certain areas due to the presence of a thin layer of colluvial cover. Sampling programs are being planned to test bedrock below this this cover.

Halcones’ geologists have been working with a geological model that Polaris holds potential for a large-scale bulk tonnage open pit operation. The presence of mineralization in stockworks in the wall rocks away from the historically mined, mineralized veins is a crucial component of this model that is present at Polaris. This stockwork is believed to have a similar genesis to the vein hosted mineralization previously exploited by artisanal miners but was never targeted. The stockwork mineralization is not visually obvious due to a general lack of associated sulfide minerals. The 17 known small scale mines in the Project area exploited very high-grade veins with no focus on the stockwork adjacent to the veins.

Figure 1: Polaris Project sampling has identified gold mineralization over a 3.9 km extent in an area that has never been drilled.

Figure 2: Polaris North Zone field program results with recent assays represented.

The stars are Halcones’ samples, the dots are samples by the optionors.

Figure 3: Example of typical mineralized stockwork in outcrop. The rock is highly transected by randomly oriented hairline fractures that commonly contain sub-millimetre to several millimetre quartz veins that are thought to contain the gold. The host is typically tonalite to granodiorite, which has been fractured adjacent to the fault systems in the area. Visually, there are few indications of mineralization.

Figure 4: Example of stockwork mineralization exhibiting larger quartz veinlets. The mineralized rock is characterized by multiple veinlets and fractures at various orientations.

About The Sampling Process

Using a hammer and a rock chisel, a chip sample is carried out uniformly over at least 1 meter sections, ensuring complete collection and homogeneity in order to achieve proper representation of the sample. The sample is collected perpendicular to the dominant strike of the structures and the sample mass must be a minimum of 2 kg. In the event that the outcrop presents some mineralized structure, an independent sample will be taken only from the mineralized structure and an independent sample from the host rock on both sides of the structure. This process is designed to limit bias due to high grading sample collection.

All samples were bagged and sealed on site and delivered directly by the Project Geologist to ANDES ANALITYCAL ASSAY Laboratory in Copiapó, Chile. After sample preparation at ANDES ANALITYCAL ASSAY Laboratory in Copiapó, split pulp samples were shipped to ANDES ANALITYCAL ASSAY in Santiago, Chile for assaying gold by fire assay (AEF_AAS_1E42-FF), and for analyzing 34 other elements, including silver, by four acids (ICP_AES_AR34m1).

ANDES ANALITYCAL ASSAY is an independent laboratory certified with a global quality management system that meets all requirements of International Standards ISO/IEC 17025:2017, includes its own internal quality control samples comprising certified reference materials, blanks, and pulp duplicates.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Mr. David Gower, P.Geo., as defined by National Instrument 43-101 of the Canadian Securities Administrators.

About Halcones Precious Metals Corp.

Halcones is focused on exploring for and developing gold-silver projects in Chile. The Company has a team with a strong background of exploration success in the region.

For further information, please contact:

Vincent Chen, CPA

Investor Relations

vincent.chen@halconespm.com

www.halconespreciousmetals.com

Cautionary Note Regarding Forward-looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, regarding the prospectivity of the Project, the mineralization of the Project, the Company’s exploration program, the Company’s ability to explore and develop the Project and the Company’s future plans. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward- looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Halcones, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of current exploration activities; risks associated with operation in foreign jurisdictions; ability to successfully integrate the purchased properties; foreign operations risks; and other risks inherent in the mining industry. Although Halcones has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Halcones does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

HPM:CA

Sign up to get your FREE

Halcones Precious Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

28 April 2025

Halcones Precious Metals

Advancing a significant high-grade gold project in Northern Chile

Advancing a significant high-grade gold project in Northern Chile Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Halcones Precious Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00