January 21, 2022

Gold Mountain Mining Corp. ("Gold Mountain" or the "Company") (TSX: GMTN, OTCQB: GMTNF, Frankfurt: 5XFA) is pleased to announce that it has filed the updated technical report (the "Technical Report") on its 100% owned Elk Gold Project located 57 km from Merritt in South Central British Columbia. The Technical Report is being filed following Gold Mountain's press releases dated December 7 2021 (the "Press Release"). Gold Mountain confirms there are no material differences in the results of the Technical Report and the information disclosed in the Press Releases.

Highlights:

Gold Mountain increases its resource estimate at its flagship Elk Gold Project to: 806,000 oz of Measured & Indicated Resources at 5.8 g/t AuEq and 262,000 oz of Inferred resource at 5.4 g/t AuEq.

The updated Resource Estimate represents a 24% increase of Measured and Indicated ounces and 65% increase of inferred ounces.

37 new diamond drill holes were completed in the Siwash North Zone which incrementally expanded the vein models along strike and down dip and connected the Siwash North Zone with the Gold Creek Zone, historically viewed as a satellite deposit.

10 diamond drill holes were completed in the Lake and South Zones leading to maiden Mineral Resource estimates in the two satellite zones which demonstrate the multiple zone potential for the Elk Gold Project.

This update to the mineral resources followed the Company's successful Phase 2 drill program that consisted of 13,900 metres of diamond drilling where all 47 holes hit mineralization.

The resource update is following Gold Mountain's 13,900m Phase 2 drill program which began in May and wrapped up in November. The Company continued to step out and infill its well established, high-grade intercepts in Siwash North, increasing the zone's measured and indicated resource to 735,000oz at 5.9 g/t AuEq and inferred resource to 229,000oz at 5.4 g/t AuEq. This included drilling to the south of the Siwash North Zone which allowed the Company to merge the Gold Creek and Siwash North geological models.

Additionally, Gold Mountain continued exploring the property by drilling in known mineralized Satellite zones including; the Lake and South Zones. By leveraging and evaluating the historical drill data set for these zones, the Company was able to fill spatial data gaps and establish a combined maiden resource of 71,000oz measured and indicated at 4.3g/t AuEq and 33,000oz inferred at 5.7g/t AuEq.

Finally, the Company continued relogging the asset's historical core that was drilled by previous owners of the property. HEG Exploration Services Inc. identified and sampled core from historical drill holes located in the Siwash North Zone which helped further refine the vein model interpretation and add additional veins to the geological model.

1 Elk Gold Resource Update - Summary

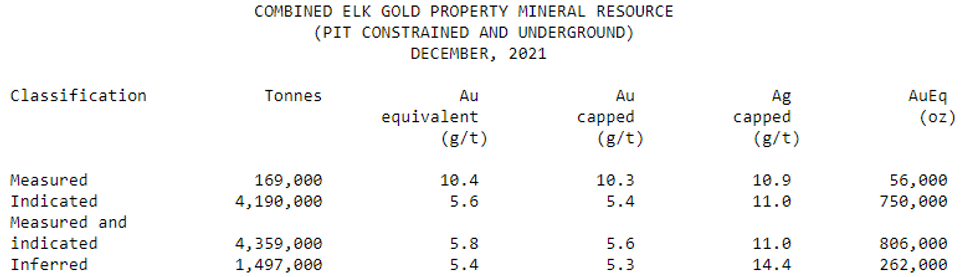

The table below summarizes the updated resource estimate at the Elk Gold Project:

Combined Elk Gold Property Mineral Resource (Pit-Constrained and Underground) Dec 2021 Au Au Ag Capped Equivalent Capped Classification Tonnes (g/t) AuEq (Oz) Measured 169,000 (g/t) (g/t) 10.4 10.3 10.9 56,000 Indicated 4,190,000 5.6 5.4 11.0 750,000 Measured + Indicated 4,359,000 5.8 5.6 11.0 806,000 Inferred 1,497,000 5.4 5.3 14.4 262,000

CIM definitions were followed for classification of Mineral Resources.

Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. Results are presented in-situ and undiluted. Mineral resources are reported at a cut-off grade of 0.3 g/t AuEq for pit-constrained resources and 3.0 g/t AuEq for underground resources. The number of tonnes and metal ounces are rounded to the nearest thousand. The Resource Estimate includes both gold and silver assays. The formula used to combine the metals is: AuEq = ((Au_Cap*53.20*0.96) + (Ag_Cap*0.67*0.86))/(53.20*0.96) The Resource Estimate is effective as of October 21, 2021.

Mineral Resource Estimate Assumptions

For details relating to data verification, key assumptions and parameters and methods used for the Resource Estimate, please see the Technical Report a copy of which is filed on Gold Mountain's SEDAR Profile.

Elk Gold Project Technical Report

The Elk Gold Project Technical Report and Preliminary Economic Assessment has been prepared in accordance with the requirements of NI 43-101 and was prepared independently by the following qualified persons ("QPs"): Andre De Ruijter P. Eng., Greg Mosher P. Geo. and L. John Peters, P.Geo. The Technical Report entitled "NI 43-101 Technical Report and Resource Update on the Elk Gold Project, Merritt, British Columbia Canada" dated January 21, 2022 with an effective date of December 7, 2021 has been filed on Gold Mountain's SEDAR profile at www.sedar.com. Gold Mountain confirms there are no material differences in the results of the Technical Report and the information disclosed in the Press Releases.

Qualified Person

The foregoing technical information was approved by Grant Carlson, P.Eng., a Qualified Person, as defined under National Instrument 43-101 and the Chief Operating Officer for Gold Mountain.

About Gold Mountain Mining

Gold Mountain is a British Columbia based gold and silver exploration and development company focused on resource expansion at the Elk Gold Project, a past-producing mine located 57 KM from Merritt in South Central British Columbia.

Additional information is available at www.sedar.com or on the Company's new website at www.gold-mountain.caFor Further information, please contact

Gold Mountain Mining Corp.

Kevin Smith, Director and Chief Executive Officer

Phone: 604-309-6340

Email: ks@gold-mountain.ca

Website: www.gold-mountain.ca

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward- looking statements include statements that are based on assumptions as of the date of this news release and are not purely historical including any information or statements regarding beliefs, plans, expectations or intentions regarding the future and often, but not always, use words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive board, shareholder or regulatory approvals; the price of gold; and the results of current exploration. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Gold Mountain disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. For a comprehensive overview of all risks that may impact the Company, please see the Annual Information Form for the year ended January 31, 2021 a copy of which was filed on November 4, 20201 and is available on SEDAR. The TSX has not reviewed and does not accept responsibility for the adequacy or accuracy of the content of this News Release.

GMTN:CA

The Conversation (0)

14 January 2021

Gold Mountain Mining

Exploring and Developing Highly Prospective Gold Assets in British Columbia

Exploring and Developing Highly Prospective Gold Assets in British Columbia Keep Reading...

19h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00