- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

August 20, 2023

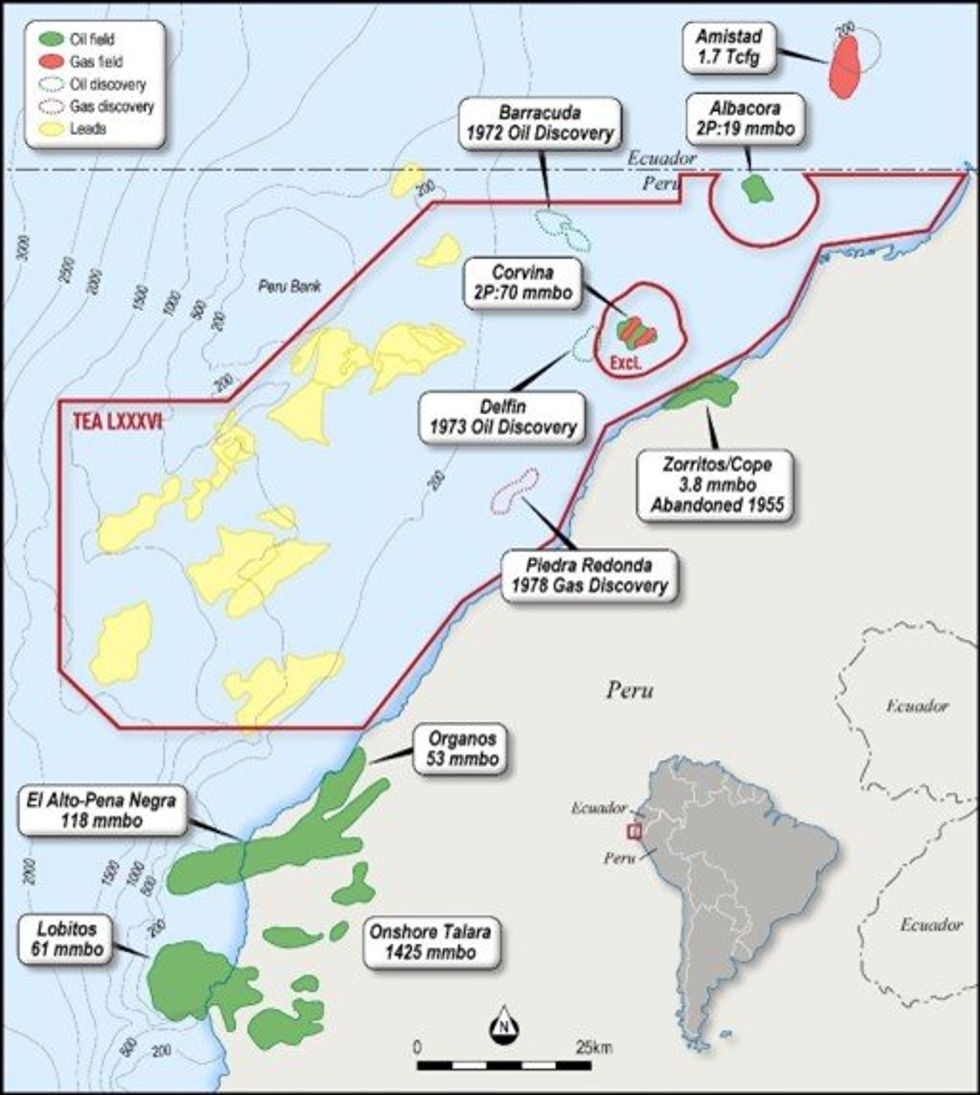

Global Oil & Gas Limited (ASX: GLV) (Global or Company) is pleased to announce that it has executed a Technical Evaluation Agreement LXXXVI (TEA) with the Peruvian National Agency of Hydrocarbons, Perupetro, for a 4,858km2 oil and gas exploration block offshore Peru. The Company now holds 80% of the TEA with project partner, US based oil and gas exploration company Jaguar Exploration, Inc. (Jaguar), holding the remaining 20%. Pursuant to the agreement, GLV shares as detailed in the ASX announcement dated 7 June 2023, and approved at the Shareholders meeting on 15 August 2023, will be issued today.

Highlights

- Global has executed a contract with Peruvian national agency of hydrocarbons Perupetro for a 4,858km2 oil and gas block in proven hydrocarbon bearing basins offshore Peru, including the prolific (+1.6 billion barrels produced) Talara basin

- Block surrounds the excised 27.8 Million barrel Corvina oil field

- Located immediately south of the block is the Alto-Pena Negra oil field, one of Peru’s most productive fields, with total historical production of more than 143 million barrels of oil

- Data from 7 historical 2D seismic campaigns and more than 3,800km2 of 3D seismic has been secured

- A detailed work program is now underway which includes reprocessing 1,000 km2 of 3D seismic data, AVO studies, geological and geophysical studies and developing a portfolio of leads & prospects with a view to potentially generating Prospective Resources

- Manageable two year work program commitment with opportunity to extend for one extra year

Managing Director Patric Glovac commented:

“The acquisition of this highly significant 4,858km2 (over 1.1 million acres) offshore oil and gas opportunity in Peru is transformational for the Company.

The nearby oil discoveries and petroleum refinery close to the offshore block make this an enviable address for global oil and gas players. Seven 2D seismic surveys and more than 3,800km2 of 3D seismic has been received and is now being processed to identify leads, prospects and, potentially, certified Prospective Resources.

The Company is in the process of creating a comprehensive data room to facilitate the process of marketing this opportunity to prospective project investors and/or joint venture partners.

This world-class asset is an incredible opportunity for the Company to comprehensively collate all existing information, potentially generating certified Prospective Resources and compelling drill targets”.

The oil and gas block is located in the Tumbes-Progreso basin, in water depths that range from 100m to 1,500m. Immediately to the south is the Talara Basin which is one of the most productive basins in Peru having already produced more than 1.6 billion barrels.

The block is surrounded by, and incorporates, multiple historic and currently producing oil and gas fields. The southeast of the block borders the Alto-Pena Negra oil field which is one of Peru’s most productive fields, currently producing around 3,000 barrels of oil per day (bopd) with total historical production of more than 143 million barrels of oil.

In the northeast, the block incorporates the excised 27.8 million barrel Corvina oil field which generated past production rates of up to 4,000 barrels of light oil per day (28.45⁰ API).

The southern border of the TEA is also only 70km from the Talara crude oil refinery which received production from the Corvina field.

Click here for the full ASX Release

This article includes content from Global Oil and Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

06 February

Syntholene Energy Corp. Announces $2.0 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it intends to complete a non-brokered private placement of... Keep Reading...

05 February

Angkor Resources Celebrates Indigenous Community Land Titles and Advances Social Programs, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 5, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") is pleased to announce that nine Indigenous community land titles have been formally granted to Indigenous communities in Ratanakiri Province, Cambodia, following a... Keep Reading...

05 February

Syntholene Energy Corp Strengthens Advisory Board with Former COO of Icelandair Jens Thordarson

Mr. Thordarson brings two decades of expertise in operations, infrastructure development, and large-scale business transformation in the aviation industrySyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces the nomination of Jens... Keep Reading...

04 February

The Future of Aviation is Synthetic: Syntholene CEO Highlights Growing Demand for E-Fuel

The global aviation industry is entering a period of rapid transition as airlines seek low-carbon fuel alternatives that meet both performance and regulatory demands. It’s a market Syntholene Energy (TSXV:ESAF,OTCQB:SYNTF) is aiming to supply through its breakthrough synthetic fuel, or... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00