December 13, 2021

New discoveries at Evermore and Achilles North, plus extensions to the Montague-Boulder deposit drive material growth in the Project Resource inventory

Gateway Mining Limited (ASX: GML) (Gateway or Company) is pleased to report a significant increase in the Mineral Resource for its 1,000km2 Gidgee Gold Project, within the Murchison gold district of Western Australia.

HIGHLIGHTS

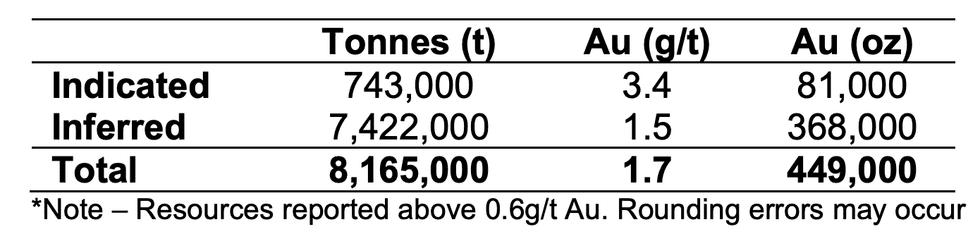

- 87%increaseintotalMineralResourcesfortheGidgeeGoldProjectto449,000oz,including a high-grade Indicated Resource of 81,000oz @ 3.4g/tAu:

- Updated Mineral Resources located predominantly in the upper 100m – representing high- quality shallow ounces with a significant oxide component.

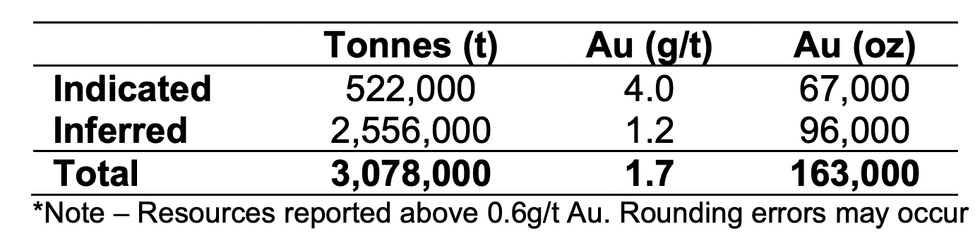

- Updated 163,000oz Mineral Resource estimated for the Montague-Boulder deposit, including an Indicated Resource of 67,000oz @ 4.0g/t Au:

The updated Indicated and Inferred Mineral Resource of 8.165Mt at 1.7g/t Au for 449,000 contained ounces encompasses four deposits and represents an 87% increase on the previous Inferred Resource of 240,000 ounces for the cornerstone Whistler and Montague-Boulder deposits.

The upgrade is based on extensive exploration activities undertaken over the past 18 months, including new Mineral Resources at Evermore and Achilles North/Airport as well as upgrades to the Montague-Boulder deposit.

Importantly, it includes a robust maiden Indicated Resource of 743,000t at 3.4g/t for 81,000 contained ounces.

Click here for the full ASX Release

This article includes content from Gateway Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GML:AU

The Conversation (0)

7h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

8h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

8h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

14h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

01 February

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00