Highlights

Successful completion of due diligence by the Clean Elements Fund ("Clean Elements") confirming HMW's world-class status; $20 million placement to proceed with full and final settlement due by November.

RIGI incentive regime approved by the Argentine Government for the HMW Project, providing fiscal stability and significant long-term benefits.

Advancement of Phase 1 construction at Hombre Muerto West (HMW), including completion of Pond 4 design and progress on nano-filtration plant fabrication in Sydney.

No debt and strong cash position of approx. $11m with a further $10m in placement proceeds due in November.

Galan remains funded to complete Phase 1 construction and deliver first lithium chloride production in H1 2026.

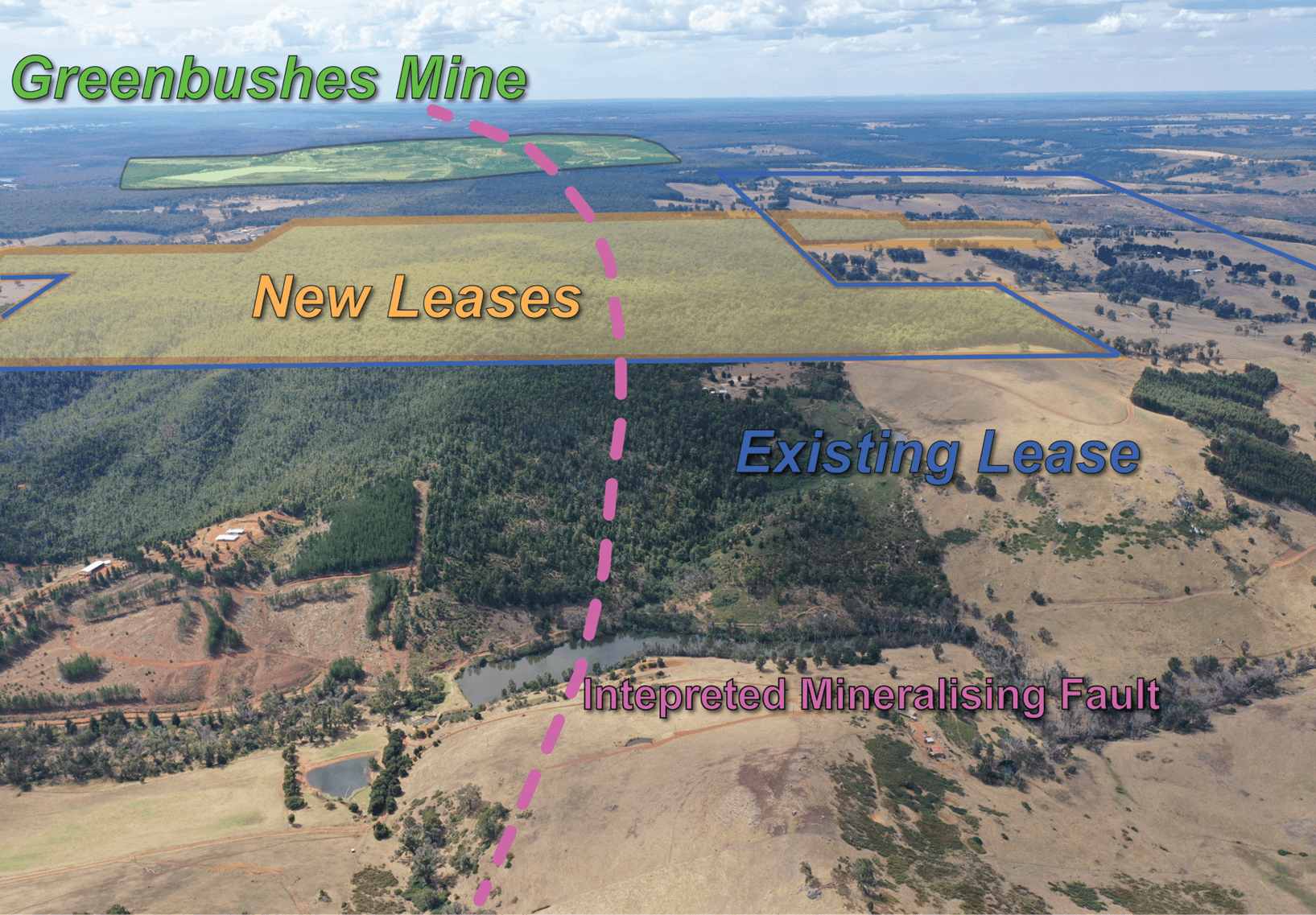

Strategic expansion of Greenbushes South tenure.

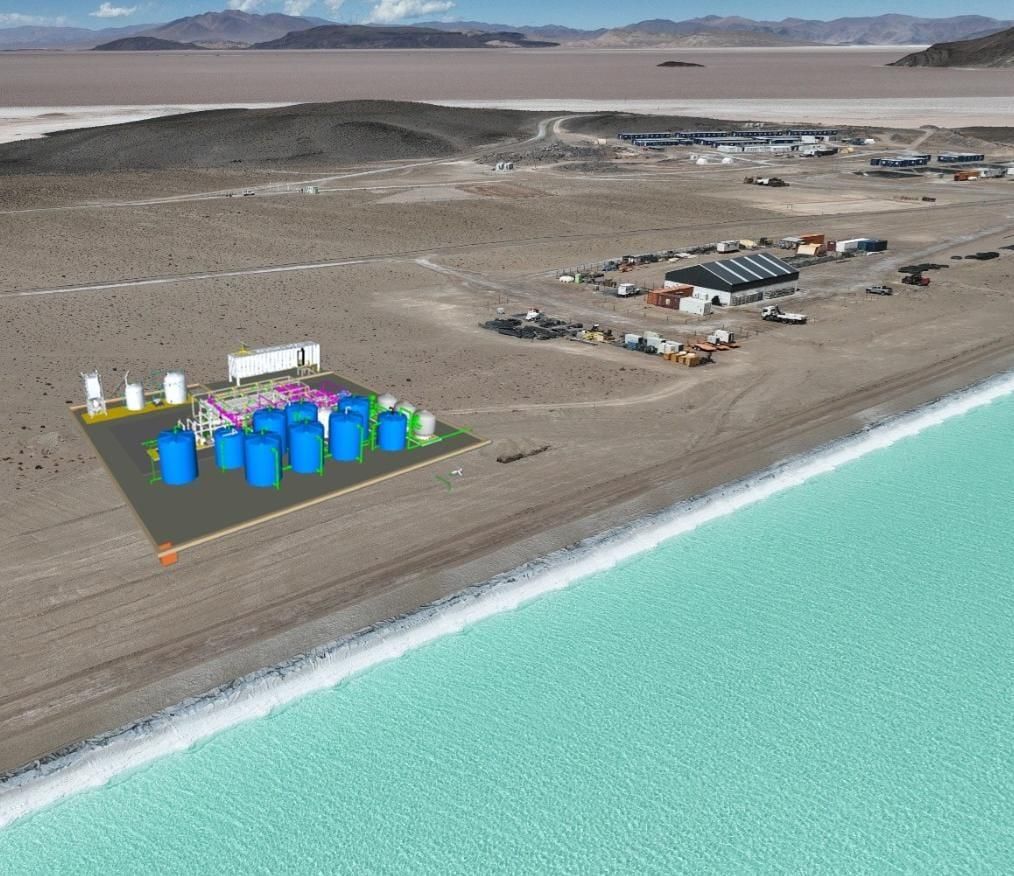

PERTH, AU / ACCESS Newswire / October 31, 2025 / Galan Lithium Limited (Galan or the Company) presents its Quarterly Activities Report for the quarter ended 30 September 2025, along with activities up to the date of this release. Galan continues to focus on the construction of Phase 1 at its 100%-owned HMW lithium brine project in Argentina. With funding secured and regulatory approvals in place, the Company is well-positioned to transition into production in H1 2026.

Figure 1. Construction of Nano-filtration Plant in Sydney is well advanced.

Speaking on the progress achieved this quarter, Managing Director Juan Pablo ("JP") Vargas de la Vega said:

" The September quarter marked a pivotal period for Galan, highlighted by two major achievements - the securing of full Phase 1 construction funding with the support of Clean Elements and the Argentine Government's approval of our RIGI incentive application. Together, these developments provide both the financial and fiscal foundation to complete construction and transition toward first lithium production at HMW in 2026.

Being only the second mining company to be granted approval under the RIGI regime underscores the strength of our project, our relationships in Catamarca and our alignment with Argentina's economic and investment priorities.

Galan is now in a uniquely competitive position as we move closer to becoming a low-cost, high-grade lithium producer. The momentum across all workstreams continues to build and we remain firmly focused on delivering first production in H1 2026 ."

Strategic and Funding Developments

During the quarter, Galan successfully satisfied all conditions for the $20 million equity placement with Clean Elements. The placement, conducted at a premium to market, validates the strategic value and quality of the HMW Project. Tranche 1 settlement ($10 million) occurred shortly after shareholder approval on 22 August 2025, with Tranche 2 ($10 million) scheduled to settle by November 2025. This funding ensures completion of Phase 1 construction and delivery of first lithium chloride concentrate in H1 2026.

Régimen de Incentivo para Grandes Inversiones (RIGI) Incentive Regime

The Argentine Government approved the Régimen de Incentivo para Grandes Inversiones ( RIGI ) for HMW in July 2025. This marked a significant milestone for Galan, as HMW became only the second mining project in Argentina (outside of Rio's Rincon project) to receive the RIGI. The framework provides long-term fiscal stability, including a reduced corporate income tax rate, customs and tariff exemptions, and improved foreign exchange access for imports and repatriation. The approval underscores the Government's recognition of HMW's strategic importance to Argentina's lithium sector.

Galan continued to strengthen its collaboration with the Catamarca Government and local stakeholders. Authium Limited's ( Authium ) Founder and Director Cameron Stanton, together with Managing Director JP Vargas de la Vega and members of Galan's Legal and Community Relations teams met with Governor Raúl Jalil and Mining Minister Marcelo Murúa to discuss progress at HMW and the benefits arising from the RIGI approval. The Catamarca Government has promoted the development of a sealed road between Antofagasta de la Sierra and the Hombre Muerto Salar as priority initiative. Galan, together with industry partners, will contribute towards the development of the road, which is the primary road to Galan's HMW operations.

Figure 2. Meeting between Juan Pablo Vargas de la Vega (Galan), Cameron Stanton (Authium) and Raúl Jalil(Governor of Catamarca)

Project Execution - Hombre Muerto West

Phase 1 construction activities at HMW advanced steadily throughout the quarter. Detailed design and procurement for Pond 4 construction was completed and scheduled site civil engineering works are underway. Authium and Galan have been working closely together on engineering design, construction planning and the development of project schedules to support efficient project execution. To assist with project execution, Authium representatives have recently undertaken a site visit to HMW where the site preparation works for the nano-filtration plant have commenced.

Authium progressed fabrication of the nano-filtration plant in Sydney, completing structural steelwork and major equipment orders. Laboratory testing confirmed excellent impurity rejection (99% sulphate removal) and strong filtration performance. Commissioning of the nano-filtration plant remains scheduled for early 2026, with first production from HMW on track for the first half of 2026.

Figure 3. Nano-filtration site, adjacent to Pond 3, cleared in preparation for plant foundations

Figure 4. Assembly of Nano-filtration plant and filters in Sydney.

Greenbushes South

Galan strategically expanded its Western Australian exploration portfolio through the grant of exploration licence E70/4889 and associated prospecting licences. The new tenure is located approximately 2 km along strike and closest to, the world-class Greenbushes Lithium Mine and lies directly over the mineralising fault zone controlling this Tier 1 deposit. This position provides Galan with compelling targets to test structural continuity between its Greenbushes South holdings and the main Greenbushes system. Planned work includes stakeholder engagement, reinterpretation of geophysics, ground-based surveys, geochemical sampling and follow-up drilling, with timing and budgets to be finalised.

Figure 5. Drone photo showing new tenements relative to the Greenbushes Mine

While Galan's primary focus remains on Phase 1 construction and development of the HMW project in Argentina, this acquisition creates an opportunity to advance targeted exploration in Australia in parallel. The Company is actively evaluating strategic options to accelerate value from Greenbushes South and its James Bay interests, including potential joint ventures, divestments or a spin-off. These pathways would only be pursued where they enhance shareholder value and align with Galan's disciplined capital allocation strategy.

Other Projects

No material work was undertaken on the Company's 50% owned James Bay projects in Canada during the quarter.

Financial Position

As at 30 September 2025, Galan held approximately $11 million in cash and liquid assets. The Company remains debt-free and on receipt of Tranche 2 Clean Elements funds, will be funded to complete Phase 1 construction activities. Payments to related parties during the quarter totalled approximately $0.35 million for director and consulting fees.

The Galan Board has authorised the release of this September 2025 Quarterly Activities Report.

For further information contact:

COMPANY | MEDIA |

Juan Pablo ("JP") Vargas de la Vega | Matt Worner |

Managing Director | Vector Advisors |

+ 61 8 9214 2150 | +61 429 522 924 |

SOURCE: Galan Lithium Limited

View the original press release on ACCESS Newswire