October 29, 2023

GALENA MINING LTD. (“Galena” or the “Company”) (ASX: G1A) reports on its activities for the quarter ended 30 September 2023 (the “Quarter”), focused on the ongoing production ramp-up of both the underground mine and the processing plant to achieve steady-state production by the end of 2023, at its 60%-owned Abra Base Metals Mine (“Abra” or the “Project”) located in the Gascoyne region of Western Australia.

HIGHLIGHTS

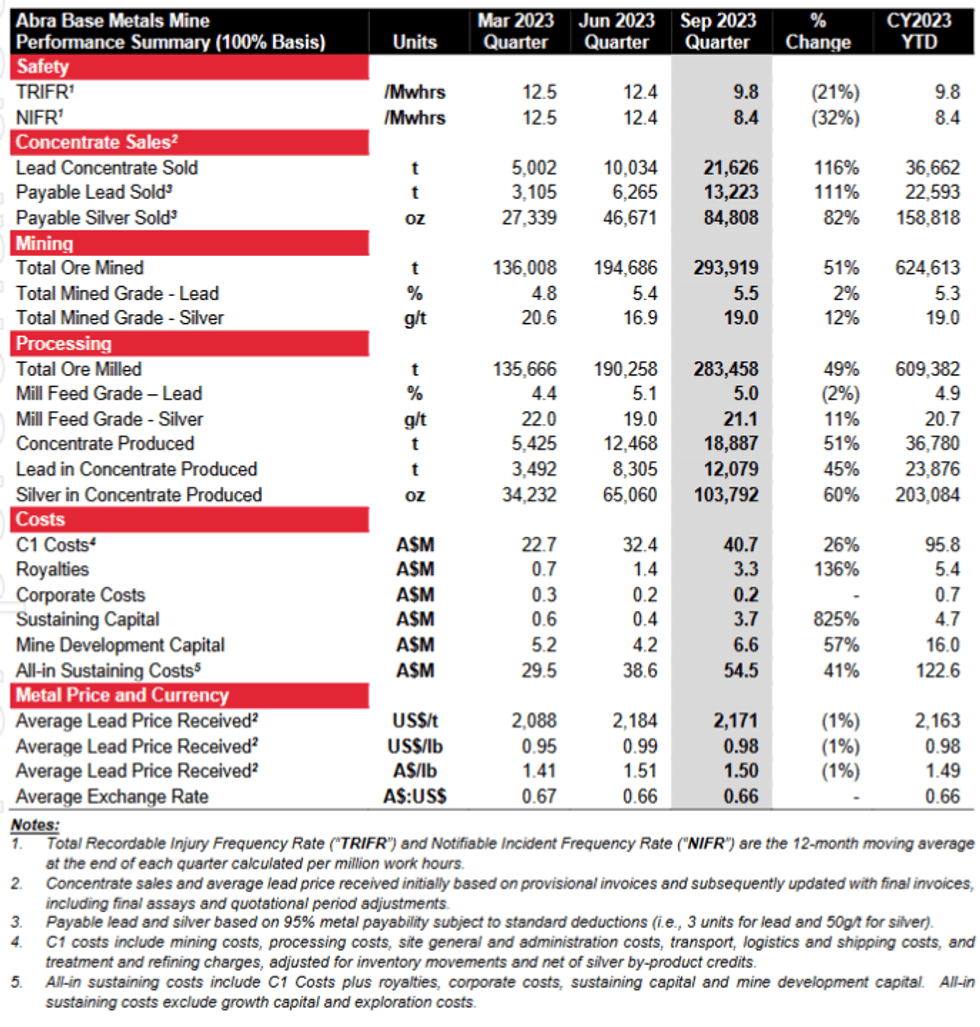

- Quarterly record mining and processing levels achieved – ore mined of 293,919t at 5.5% lead and 19.0g/t silver, and processed 283,458t at 5.0% lead and 21.1g/t silver.

- Three lead concentrate shipments totalling 21,626t completed, more than doubling revenue from the previous quarter to ~A$45.4 million and generating positive operating cash flows.

- Underground development achieved a new quarterly record of 2,140m advance with the decline reaching 1,212mRL (333m vertically below the surface). New quarter underground ore drive development record of 1,202m and stope production record of 199,225t at 6.1% lead.

- Lead grade is expected to improve as new work areas are established and the ratio of stoping ore to development ore increases towards planned levels.

- Paste fill plant commissioned and paste filling of first stope completed in September 2023.

- Abra opening ceremony was held on 13 September 2023. The mine was officially opened by the President of Toho Zinc (Mr. Masahito Ito) and the Galena/Abra Chairman (Mr. Adrian Byass).

- Group cash balance at Quarter-end of A$14.4 million.

- December quarter mining plans set to achieve over 2,400m development and over 320,000t ore production (260,000t stope production) expecting to process over 320,000t of ore in the December quarter. Targeting ~25-30kt of lead concentrate shipments expected to generate increased operating cash flows and net growth in the group cash balance.

- CY2023 guidance updated, mainly due to the slower than expected ramp-up in lead grade during the June and September quarters (see page 10 for more details).

Managing Director, Tony James commented, “Continued improvement was achieved on a quarter-on-quarter basis with new record highs for mining and processing. This improvement is expected to continue in the December quarter as production edges closer to steady-state. The new MRE published in August strongly supports our knowledge of the Abra deposit, re- enforcing the global metal content. This underpins the long mine life and our improved understanding of this orebody and this new mineral province.

Importantly, we are forecasting the December quarter to be the one where our overall group cash levels start to build.

It has also been particularly satisfying seeing the improvement in safety with a reduction in key safety statistics on site. The Abra team continues to work very hard in unlocking the challenges we have faced in 2023, showing real determination and focus to get the mine up to the designed production levels.”

ABRA BASE METALS MINE (60%-OWNED)

Abra comprises a granted Mining Lease, M52/0776 and surrounding Exploration Licence E52/1455, together with several co-located General Purpose and Miscellaneous Leases. The Project is 100% owned by Abra Mining Pty Limited (“AMPL” the Abra Project joint-venture entity), which in turn is 60% owned by Galena and 40% owned by Toho Zinc Co., Ltd. (“Toho”) of Japan.

Abra is fully permitted, and construction of the processing plant and surface infrastructure was completed in December 2022. First production of its lead-silver concentrate occurred in January 2023 with first product shipment achieved in March 2023.

Review of operations

During the Quarter, new quarterly record mining and processing levels were achieved despite mining stope production delays caused by access timing, paste plant commissioning and processing plant downtime associated with unplanned (conveyor belt tears and crusher blockage) and planned maintenance work (first full mill re-line).

In September, a mine development record was set with 807m of lateral and vertical development achieved during the month. To achieve the mine’s production rate and gain access to the required stoping areas, the mine needs to consistently achieve its monthly development target of over 800m well into 2024. This level of development is required for the mine to open as many work areas as possible (particularly higher-grade stopes) to consistently achieve steady-state production levels. Equipment and personnel levels are now well established to achieve the target levels.

Click here for the full ASX Release

This article includes content from Galena Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00