Freeman Gold Corp. (TSXV: FMAN) (OTCQB: FMANF) (FSE: 3WU) ("Freeman" or the "Company") is pleased to announce the successful completion of its 2025 metallurgical testwork program for the Lemhi Gold Project ("Lemhi" or the "Project") in Idaho, USA. This program, which builds upon three previous phases of metallurgical studies, was conducted by Base Met Labs ("BML") in Kamloops, BC, and independently reviewed by Ausenco Engineering Canada ULC ("Ausenco"). Results confirm that Lemhi supports a simple, conventional processing flowsheet and demonstrates consistently high gold recoveries across all major zones of the deposit.

Highlights

- Gold leach extraction of 91.2% to 97.4% - averaging 95.4% across 2025 variability and composite samples

- Simple, conventional flowsheet - based on 120 µm P80 primary grind and standard CIL cyanidation

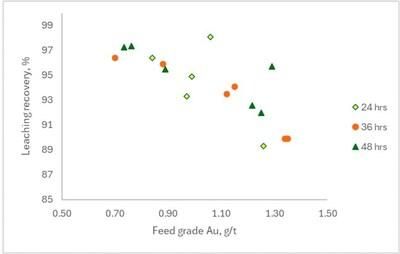

- Fast leach kinetics - leach extraction substantially complete within 24 hours

- Moderate reagent consumption - average NaCN and lime consumption of 1.28 kg/t and 1.01 kg/t, respectively

- Low abrasion index - ore characterized as soft supporting low-cost conventional milling

- Excellent metallurgical performance confirmed across variability and production composites

Metallurgical Program Overview

The 2025 program included:

- 18 drill-core variability composites from the Main Pit which included samples representing later year production (according to the PEA mineplan)

- One composite each from the Beauty Zone and SW Zone

- Three production composites (early, mid, late mine life, based on the PEA mineplan)

- Five reverse-circulation (RC) samples representing the central core of the Main Pit

Test work evaluated head assays, mineralogy, gravity concentration, cyanide leaching, comminution, and cyanide destruction. Bottle-roll leach tests were repeated under oxygenated conditions to validate leach kinetics and improve accuracy.

Gold Metallurgical Performance

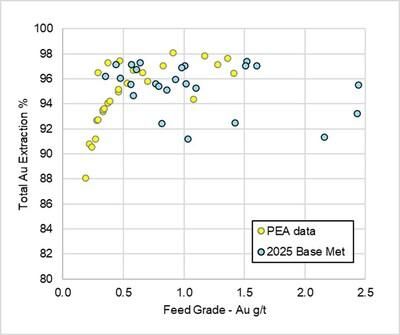

Across all 2025 samples, total gold leach extraction ranged from 91.2% to 97.4%, averaging 95.4%. Results are presented in Figure 2, compared against the PEA data set.

- Cyanide consumption averaged 1.28 kg/t.

- Lime consumption averaged 1.01 kg/t.

- Bond Ball Mill Work Index averaged 16.4 kWh/t.

- SMC tests on 11 drill core samples returned an average Axb value of 138, which indicates that the ore is soft and not competent with respect to SAG breakage.

- Abrasion index tests averaged 0.13 grams.

Cyanide destruction tests using the SO₂/Air process successfully reduced CNWAD from ~1,270 ppm to below 5 ppm, well within typical discharge criteria. Reagent consumption requirements were consistent with expectations for this process.

"These metallurgical results reinforce Lemhi's potential as a high-quality, free-milling gold project with excellent recoveries and a simple, low-risk processing flowsheet," stated Bassam Moubarak, CEO and Director of Freeman. "The combination of high gold extraction, moderate reagent use, and soft ore characteristics provides a strong foundation for future development and underscores the project's economic robustness."

Next Steps

Freeman will integrate the 2025 metallurgical dataset into ongoing engineering and mine planning work. Further optimization, including confirmatory intensive leach testing and reagent consumption modelling, is planned as the Company advances Lemhi toward its next phase of technical studies.

About the Company and Project

Freeman Gold Corp. is a mineral exploration company focused on the development of its 100% owned Lemhi Gold property. The Project comprises 30 square kilometres of highly prospective land, hosting a near-surface oxide gold resource. The pit constrained National Instrument 43-101 ("NI 43- 101") compliant mineral resource estimate is comprised of 988,100 ounces gold ("oz Au") at 1.0 gram per tonne ("g/t") in 30.02 million tonnes (4.7 million tonnes Measured (168,800 oz) & 25.5 million tonnes Indicated (819,300 oz)) and 256,000 oz Au at 1.04 g/t Au in 7.63 million tonnes (Inferred). The Company is focused on growing and advancing the Project towards a production decision. To date, 525 drill holes and 92,696 m of drilling has historically been completed (Murray K., Elfen, S.C., Mehrfert, P., Millard, J., Cooper, Schulte, M., Dufresne, M., NI 43-101 Technical Report and Preliminary Economic Assessment, dated November 20, 2023; www.sedarplus.ca).

The recently updated price sensitivity analysis (see Freeman's news release dated April 9, 2025) shows a PEA with an after-tax net present value (5%) of US$329 million and an internal rate of return of 28.2% using a base case gold price of US$2,200/oz; Average annual gold production of 75,900 oz Au for a total life-of-mine of 11.2 years payable output of 851,900 oz Au; life-of-mine cash costs of US$925/oz Au; and, all-in sustaining costs of US$1,105/oz Au using an initial capital expenditure of US$215 million*.

*Note: Mineral resources that are not mineral reserves do not have demonstrated economic viability. The preliminary economic assessment is preliminary in nature, that it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

The technical content of this release has been reviewed and approved by Dean Besserer, P. Geo., VP Exploration of the Company and a Qualified Person as defined by the NI 43-101.

On Behalf of the Company

Bassam Moubarak

Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements: This press release contains "forward‐looking information or statements" within the meaning of Canadian securities laws, which may include, but are not limited to, all statements related to the 2023 PEA, statements relating to exploration, results therefrom, and the Company's future business plans, and statements regarding the price sensitivity analysis and impact thereof on the evaluation of the Project's economic potential. All statements in this release, other than statements of historical facts that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ from those in the forward-looking statements. Such forward-looking information reflects the Company's views with respect to future events and is subject to risks, uncertainties, and assumptions. The reader is urged to refer to the Company's reports, publicly available on SEDAR+ at www.sedarplus.ca for a more complete discussion of such risk factors and their potential effects. The Company does not undertake to update forward‐looking statements or forward‐looking information, except as required by law.

SOURCE Freeman Gold Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2025/09/c1489.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2025/09/c1489.html