Forte Minerals Corp. ("Forte"or the"Company") (CSE:CUAU)(OTCQB:FOMNF)(Frankfurt:2OA), has finalized the acquisition of the Miscanthus high sulphidation epithermal gold-Ag ("Au-Ag") and porphyry copper-molybdenum-gold ("Cu-Mo-Au") prospects ("Miscanthus" or the "Property") from its strategic partner Globetrotters Resource Group Inc. ("GlobeTrotters"). Key details include

Property Details: Miscanthus consists of 4 concessions totaling 3,200 hectares.

Previous Ownership: Initially acquired by Globetrotters in 2022 from Sumitomo Metal Mining Perú S.A. ("Sumitomo").

Transfer: The concessions are to be transferred to Forte's Peruvian subsidiary, Cordillera Resources Perú S.A.C.

Acquisition Terms under the Mineral Asset Purchase Agreement dated October 21, 2024 between the Company and Globetrotters

One-time cash payment of US $27,000.00

Issuance of 3,000,000 common shares of Forte at deemed price of $0.23 per share.

1.0% net smelter return royalty ("NSR") interest on the concessions to Globetrotters.

Environmental Approval: Miscanthus has an approved DIA environmental drilling permit, allowing for up to 40 platforms of drilling over 172 hectares, significantly reducing permitting risk.

Property Highlights

Location: Approximately 390 km southeast of Lima at 4,100 meters elevation.

Access: Via a network of paved and gravel roads, 60 km inland from Nazca.

Proximity to Infrastructure: 120 km from Marcona port and near the Mantaro-Southern Perú power grid.

Exploration Potential: Miscanthus is considered highly prospective, with the potential for the discovery of a large, telescoped porphyry Cu-Mo-Au system, overprinted by high-sulphidation epithermal Au-Ag mineralization. (See Figure 1 for more details.)

Figure 1: Location map of the Miscanthus Property.

Previous Exploration Work: Sumitomo acquired the Property in 2018 and carried out detailed geological mapping, geochemical sampling, and geophysical surveys outlining an untested high-sulphidation epithermal Au-Ag target. Upon receiving environmental approval ("DIA") and successfully negotiating an agreement with the local community for the drill permit application, Sumitomo transferred ownership to the Property, along with the approved DIA, to GlobeTrotters in 2022. GlobeTrotters then conducted further detailed geological mapping, geochemical sampling and geophysical surveys on the Property confirming the high-sulphidation epithermal Au-Ag target and identifying a potential large, telescoped porphyry Cu-Mo-Au system at depth.

Geological Features

The Property is situated on the Western Cordillera and associated with Miocene-aged volcanic and volcanoclastic rocks forming part of the Tertiary Volcanic Arc which is known to host several large Miocene-aged epithermal Au deposits including Barrick's Pierina deposit and Newmont's Yanacocha and Minas Conga deposits as well as several large Miocene-aged porphyry Cu-Mo-(+Au) deposits including Chinalco's Toromocho, Southern Copper's Michiquillay and Rio Tinto's La Granja deposit.

High-Sulphidation Epithermal Au-Ag Target

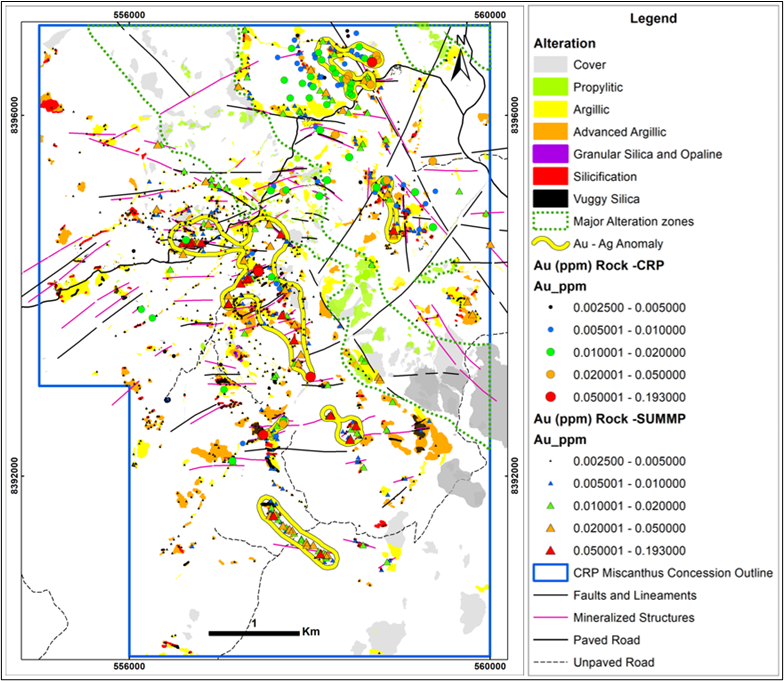

The high-sulphidation epithermal Au-Ag target is characterized by several multidirectional, structurally controlled silica ledges and vuggy silica altered outcrops within an extensive 1,000 metre x 500 metre advanced argillic alteration zone (Figure 2). This advanced argillic alteration is characterized by intense quartz-alunite-kaolinite alteration, hosted within weakly deformed, locally brecciated Miocene-aged volcanic and volcanoclastic rocks of andesitic to dacitic composition.

Figure 2: Alteration map outlining the high-sulphidation epithermal Au target areas with anomalous surface rock Au geochemistry. Source: Globetrotters Resource Group 2023 and 2024, author: Manuel Montoya

This alteration aligns with anomalous surface rock geochemistry, with up to 183 ppb Au and 8.9 ppm Ag, and notable anomalies in Ba, Mo, Pb, As, Sb, and Hg. Furthermore, this target correlates with a sizeable, coincident low magnetic susceptibility and high chargeability - high resistivity geophysical anomaly.

Sumitomo obtained DIA environmental approval for 172 hectares surrounding this target, allowing for up to 40 platforms of drilling.

Copper East Target

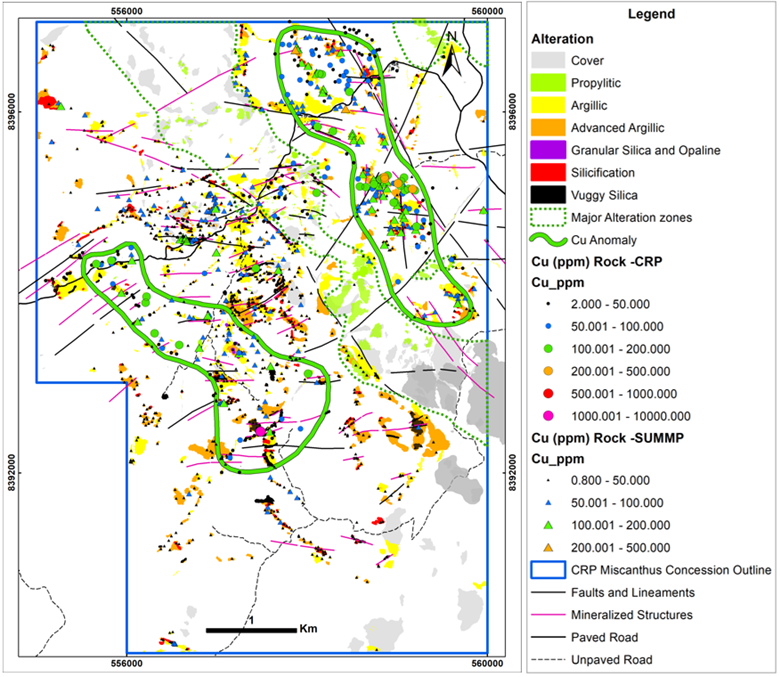

Recent exploration on the eastern side of the Property identified a 3-kilometre x 1-kilometre Cu-Mo surface rock geochemistry anomaly, named the Copper East target (Figure 3). This Cu-Mo target is also hosted within Miocene-aged volcanic and volcaniclastic rocks which seem more deeply eroded into the roots of the high-sulphidation system.

Figure 3: Alteration map outlining the Copper East and Copper SW target areas with anomalous surface rock Cu geochemistry. Source: Globetrotters Resources Group 2023 and 2024, Author: Manuel Montoya

Here, alunite-pyrophyllite-diaspore forms wormy and patchy alteration textures (Figure 4) within more pervasive sericite-clay alteration, accompanied locally by porphyry-related D-type veining (Figure 5). These features indicate the transition to the upper part of a telescoped porphyry Cu-Mo-(Au) system.

Figure 4: Outcrop from the Copper East target area with intense alunite-pyrophyllite alteration as wormy and patchy alteration textures anomalous in surface rock Cu geochemistry with grade of up to 133 ppm Cu.

Figure 5: Outcrop from the Copper East target with intense porphyry related D-type veining anomalous in surface rock Cu geochemistry with grades of up to 108 ppm Cu.

Copper SW Target

Detailed mapping and surface rock geochemistry have outlined a second large 3-kilometre x 1-kilometre Cu-Mo surface rock geochemistry anomaly, known as the Copper SW target. This Cu-Mo target is adjacent to and overlaps with the high-sulphidation epithermal Au-Ag target and correlates with a large IP high chargeability geophysical anomaly. Further exploration work is planned to evaluate these Cu-Mo targets, potentially outlining a cluster of large, telescoped porphyry Cu-Mo-(Au) systems overprinted by high-sulphidation epithermal Au-Ag mineralization on the Property. A qualified person for the Company has not done sufficient work on the Property to verify the work completed by others and the historical results presented in this release should not be relied upon.

Permit and Land Rights

Sumitomo conducted an environmental baseline study and an archaeological study as part of the drill permitting process. In March 2022, they received DIA environmental approval, valid for five (5) years, to drill 40 platforms over 172 hectares to test the high-sulphidation epithermal Au-Ag target. This approval was transferred to GlobeTrotters upon obtaining title to these concessions and will be transferred to Cordillera Resources SAC as part of the acquisition. The property land rights are controlled by a local indigenous community and several private landowners, who have provided access for the early exploration work completed to date.

CEO Remarks

Patrick Elliott, President, and CEO, remarked, "This acquisition is another strategic win for Forte. The Miscanthus copper and gold prospects are coherent, well defined and the historical work and capital expended since 2018 by Sumitomo and Globetrotters have significantly de-risked the exploration potential for Forte.

This is a true testament to the strategic partnership between Globetrotters and Forte to generate and deliver high quality, drill ready targets in a highly prospective region of Perú. Forte would like to acknowledge the persistence and determination of our partner, Globetrotters, in securing these prospects. It significantly mitigates the risks associated with the early stages of exploration, discovery and drill permitting in a premier mining jurisdiction.

Exploration projects of this calibre that have drill permits in hand are extremely hard to find let alone acquire. Recently, the DIA drill permitting process can take up to 3 years, so to have this in place is a real bonus which adds tremendous value and optionality to be able to mobilize and drill the targets at any time."

Related Party Transaction

Additionally, as GlobeTrotters is the beneficial owner of more than 10% of Forte's outstanding shares, it is a "related party" to the Company within the meaning of Multilateral Instrument 61-101- Protection of Minority Security Holders in Special Transactions ("MI 61-101"). As such, the acquisition of the Property constitutes a "related party transaction" within the meaning of MI 61-101.

The Company intends to rely on exemptions from the formal valuation and the minority shareholder approval requirements of MI 61-101 found in sections 5.5(a) and 5.7(1)(a) of MI 61-101 as the fair market value of the Property and consideration payable therefore does not constitute more than the 25% of the Company's market capitalization. The Company expects to complete the acquisition within 5 business days. All securities issuable in the acquisition will be subject to a four month and one day hold period pursuant to applicable securities laws and the rules and policies of the CSE.

Qualified Person and NI 43-101 Disclosure

Richard Osmond, P.Geo., is the Company's Qualified Person ("Qualified Person") as defined by National Instrument 43-101 and has reviewed and approved the technical information contained in this news release.

ABOUT Forte Minerals CORP.

Forte Minerals Corp., a junior exploration company that has blended assets in partnership with GlobeTrotters Resources Perú S.A.C., has built a robust portfolio of high-quality Cu and Au assets in Perú. The Company aims to generate significant value growth by strategically situating early-stage and drill-ready targets alongside a historically discovered and drilled porphyry system for Cu and Au resource development. Notwithstanding its resource focus, Forte is deeply committed to community engagement, environmental stewardship, and fulfilling its societal responsibilities.

On behalf of Forte Minerals CORP.

(signed) "Patrick Elliott"

Chief Executive Officer

For further information, please contact:

Glen Watson, Investor Relations

1-844-863-3622

gwatson@forteminerals.com

Forte Minerals Corp.

office: 604-983-8847

info@forteminerals.com

www.forteminerals.com

Certain statements included in this press release constitute forward-looking information or statements (collectively, "forward-looking statements"), including those identified by the expressions "anticipate", "believe", "plan", "estimate", "expect", "intend", "may", "should" and similar expressions to the extent they relate to the Company or its management. The forward-looking statements are not historical facts but reflect current expectations regarding future results or events. This press release contains forward looking statements. These forward-looking statements and information reflect management's current beliefs and are based on assumptions made by and information currently available to the company with respect to the matter described in this new release. Forward-looking statements involve risks and uncertainties, which are based on current expectations as of the date of this release and subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Additional information about these assumptions and risks and uncertainties is contained under "Risk Factors and Uncertainties" in the Company's latest management's discussion and analysis, which is available under the Company's SEDAR+ profile at www.sedarplus.ca, and in other filings that the Company has made and may make with applicable securities authorities in the future.

Forward-looking statements are not a guarantee of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Factors that could cause the actual results to differ materially from those in forward-looking statements include the continued availability of capital and financing, and general economic, market or business conditions. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by such statements. Although such statements are based on management's reasonable assumptions, there can be no assurance that the statements will prove to be accurate or that management's expectations or estimates of future developments, circumstances or results will materialize. The Company assumes no responsibility to update or revise forward-looking information to reflect new events or circumstances unless required by law. Readers should not place undue reliance on the Company's forward-looking statements.

Neither the Canadian Securities Exchange (the "CSE") nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Forte Minerals Corp

View the original press release on accesswire.com