October 22, 2023

Jindalee Resources Limited (Jindalee, the Company) is pleased to advise initial head assay results have been received for metallurgical samples from Jindalee’s 100% owned McDermitt Lithium Project in Oregon, USA (McDermitt, Project).

- Head assays received for McDermitt metallurgical samples being tested at Hazen (US) and managed by Fluor

- Head assays average 1790 ppm Li, 34% higher than average McDermitt resource grade (Indicated and Inferred) of 1340 ppm Li1

- Benefication currently underway expected to further increase head grade prior to acid leach testwork

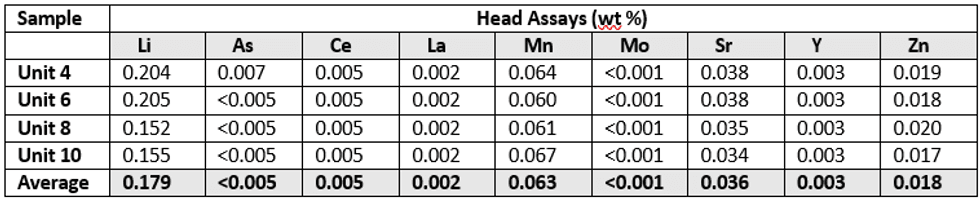

These samples average 0.179% Li (1790 ppm) (Table 1), 34% higher than the average grade of the current McDermitt Indicated and Inferred resource grade of 0.134% Li (1340 ppm)1, suggesting excellent potential to process shallow, higher grade ore early in the mine life, with positive implications for Project economics.

Discussion

In March 2023 Jindalee announced that global engineering, procurement, construction and maintenance (EPCM) company Fluor Corporation (NYSE: FLR) (Fluor) had reviewed metallurgical testwork undertaken at McDermitt and had determined that acid leaching with ore beneficiation (to upgrade the leach head grade) delivered the lowest operating costs and best financial outcome among the alternatives considered2.

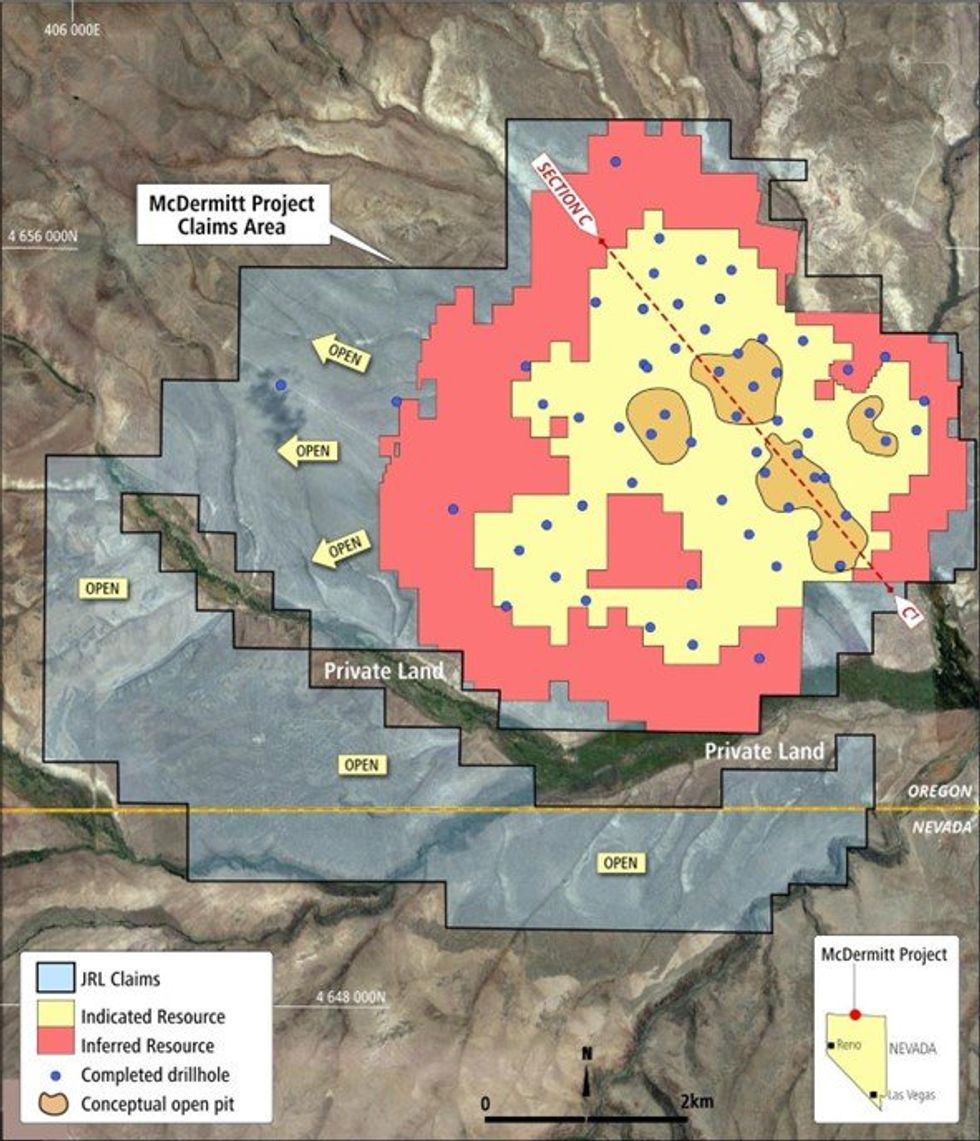

Fluor also noted that the very large Mineral Resource at McDermitt (21.5 Mt LCE, Table 2)1 allows flexibility in development, providing the opportunity to optimise mining and feed higher grade ore early in the mine life and recommended that a comprehensive metallurgical testwork program be undertaken to provide information upon which the preferred flowsheet for the processing of McDermitt ore can be defined.

Jindalee’s geological team has recently relogged all holes drilled at McDermitt and this work has resulted in the recognition of up to 12 distinctive stratigraphic units which can be tracked across the Project (Figure 2). Four of these units (Units 4, 6, 8 and 10) carry elevated lithium grades and selective mining of these units has the potential to deliver higher grade material for processing.

In June 2023 leading mine engineering group Cube Consulting generated conceptual pit shells using the McDermitt MRE geological model (Figures 1 & 2) to assist with selection of samples for the metallurgical testwork program, which is being managed by Fluor3. Samples from Units 4, 6, 8 and 10 within the Indicated portion of Pit Shell 5 (nominal 20 years) were selected and approximately 700kg of drill core was despatched to consultant metallurgists Hazen for testing, with initial results from this work now being reported.

Click here for the full ASX Release

This article includes content from Jindalee Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

JRL:AU

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00