October 28, 2024

Copper anomalism confirmed at Windmill Dam, with IP survey planned to define key targets for follow-up drilling

Eastern Metals Limited (ASX: EMS) (“Eastern Metals” or “the Company”) is pleased to report final assay results from recent reconnaissance drilling at its 100%-owned Cobar Project in NSW.

HIGHLIGHTS

- Final assay results received from reconnaissance drilling at the newly defined Windmill Dam target and the advanced Evergreen prospect within the 100%-owned Cobar Project in NSW.

- Results from Windmill Dam show broad intercepts of Cu mineralisation, with assays from hole WDRCDD001 including:

- 20m @ 0.3% Cu from 186m; and

- 30m @ 0.15% Cu from 271m.

- Assay results from hole BRD022 at Evergreen have extended the strike extent of known mineralisation by a further 50m to the NNW:

- 2.4m @ 0.6g/t Au, 5g/t Ag, 1.9% Pb and 3.7% Zn from 163.6m, including 0.5m grading at 1.47g/t Au from 164.5m.

- Latest results follow previously reported assays from the new Kelpie Hill target, where hole KHRC001 intersected significant high-grade gold plus base metal mineralisation:

- 7m @ 4.3g/t Au, 2.7g/t Ag, 0.3% Pb from 50m and 1m @ 4.17g/t Au, 2.7g/t Ag from 82m.

- Induced Polarisation (IP) survey due to commence over the Cobar Project in the coming weeks. Results from the IP survey will help define and prioritise targets for immediate, follow-up drill testing.

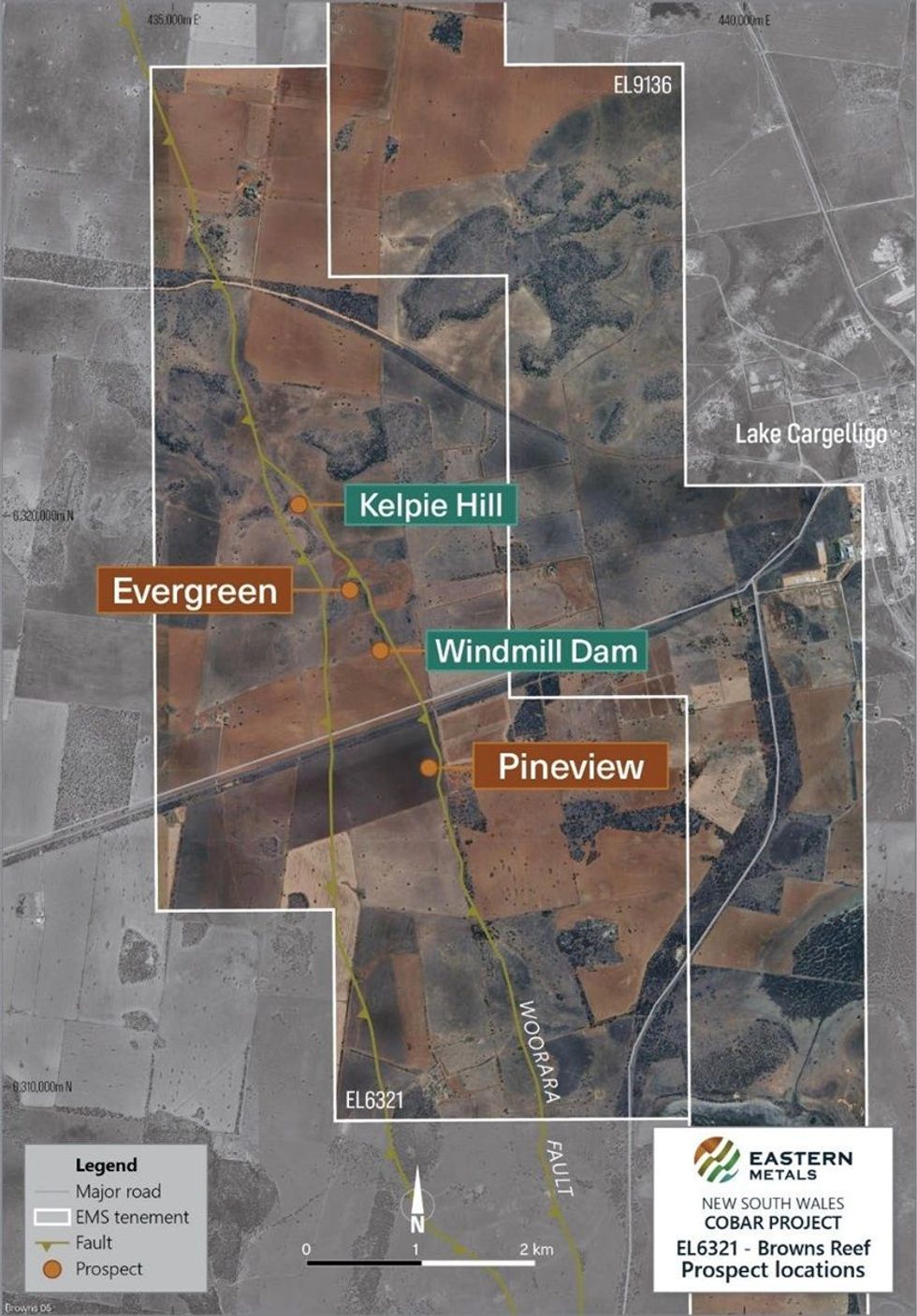

The Company has completed drilling at its two newly defined targets, Kelpie Hill and Windmill Dam, and at the more advanced Evergreen prospect (refer to Figure 1). Assay results are reported in this announcement for two (2) holes completed at Windmill Dam (WDRCDD001) and Evergreen (BRD022). Assay results for Kelpie Hill were reported in the announcement dated 23 October 2024 where KHRC001 returned 7m @ 4.3g/t Au.

Hole WDRCDD001 at Windmill Dam returned broad intercepts of copper mineralisation in both the Clements and Preston formations, with 20m @ 0.3% Cu from 186m and 30m @ 0.15% Cu from 271m along with silver, lead, zinc and gold suggesting intrusion-related mineralisation.

Assay results from hole BRD022 at Evergreen returned 2.4m @ 0.6g/t Au, 5g/t Ag, 1.9% Pb and 3.7% Zn from 163.6m, including 0.5m grading at 1.47g/t Au from 164.5m. Refer to Table 1 for a summary of significant intercepts.

The Company is finalising the design of an Induced Polarisation (IP) survey, which is due to commence in the coming weeks. Results from the IP survey will help define and prioritise targets for follow-up drill testing.

Eastern Metals’ Chief Executive Officer Ley Kingdom said: “The broad intercepts of copper mineralisation at Windmill Dam provide an enticing target for follow-up exploration, suggesting the potential for an intrusion-related mineral system. Drilling has also successfully extended the mineralised footprint at the Evergreen prospect by 50m to the north-northwest.

We are now completing planning for an IP survey across the Cobar Project area to help define and prioritise targets for follow-up drilling. This will include Windmill Dam and Evergreen, as well as the high-priority Kelpie Hill target where recent drilling returned high-grade intercepts of up to 7m @ 4.3g/t Au.”

Key Points

- Assays results have been received for one drillhole at the newly identified target, Windmill Dam, and one drill-hole at the advanced Evergreen prospect within the 100% owned Cobar Project in NSW.

- Drilling at Windmill Dam intersected two broad low grade copper zones of 20m @ 0.3% Cu from 186m and 30m @ 0.15% Cu from 271m down-hole.

- Alteration assemblages intersected downhole within WDRCDD001 include chlorite-carbonate and phyllic (quartz-sericite-pyrite) alteration with significant breccia associations, and stringer style vein fill and fracture-controlled chalcopyrite and Pb-Zn mineralisation. These suggest the presence of an intrusion-related heat, fluid and metal source, a mineralisation style that has not previously been described at Browns Reef despite the presence of rhyolites observed in diamond core (e.g. BRD013).

- An Induced Polarisation survey will be undertaken in the coming weeks to identify targets for further drilling.

- BRD022 extended the strike of known mineralisation at the advanced Evergreen prospect 50m to the NNW, intersecting base and precious metal mineralisation for 2.4m @ 0.6g/t Au, 5g/t Ag, 1.9% Pb, 3.7% Zn from 163.6m, including 0.5m grading at 1.47g/t Au from 164.5m.

Click here for the full ASX Release

This article includes content from Eastern Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EMS:AU

The Conversation (0)

07 October 2024

Eastern Metals

Exploring for strategic metals vital to energy security in Australian, resource-rich provinces

Exploring for strategic metals vital to energy security in Australian, resource-rich provinces Keep Reading...

31 January 2025

Quarterly Activities and Cash Flow Reports 31 December 2024

Eastern Metals (EMS:AU) has announced Quarterly Activities and Cash Flow Reports 31 December 2024Download the PDF here. Keep Reading...

11h

Tartisan Nickel Corp.

Get access to more exclusive Nickel Investing Stock profiles here Keep Reading...

19h

10 Bodies Found as Mexico Probes January Kidnapping at Vizsla Silver Site

Mexican authorities have recovered 10 bodies as part of an investigation into the January abduction of workers from a mining site operated by Vancouver-based Vizsla Silver (TSXV:VZLA) in the northern state of Sinaloa.Mexico’s Attorney General’s Office said the bodies were located in the... Keep Reading...

10 February

Gary Savage: Silver Run Not Over, US$250 is Easy in Next Leg

Gary Savage, president of the Smart Money Tracker newsletter, breaks down gold and silver's recent price activity, saying that while the precious metals have reached the parabolic phase of the bull market, it's typical to see a correction midway through. "The second phase I think will be several... Keep Reading...

09 February

Panelists: Silver in Bull Market, but Expect Price Volatility

Gold often dominates conversations at the annual Vancouver Resource Investment Conference (VRIC), but silver's price surge, which began in 2025 and continued into January, placed the metal firmly in the spotlight. At this year’s silver forecast panel, Commodity Culture host and producer Jesse... Keep Reading...

09 February

Southern Silver Intersects 5.8 metres averaging 781g/t AgEq at Cerro Las Minitas Project in Durango, México

Southern Silver Exploration Corp. (TSXV: SSV,OTC:SSVFF) (the "Company" or "Southern Silver") reports additional assays from drilling which continues to outline extensions of mineralization on the recently acquired Puro Corazon claim and identified further thick intervals of high-grade and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00