March 24, 2024

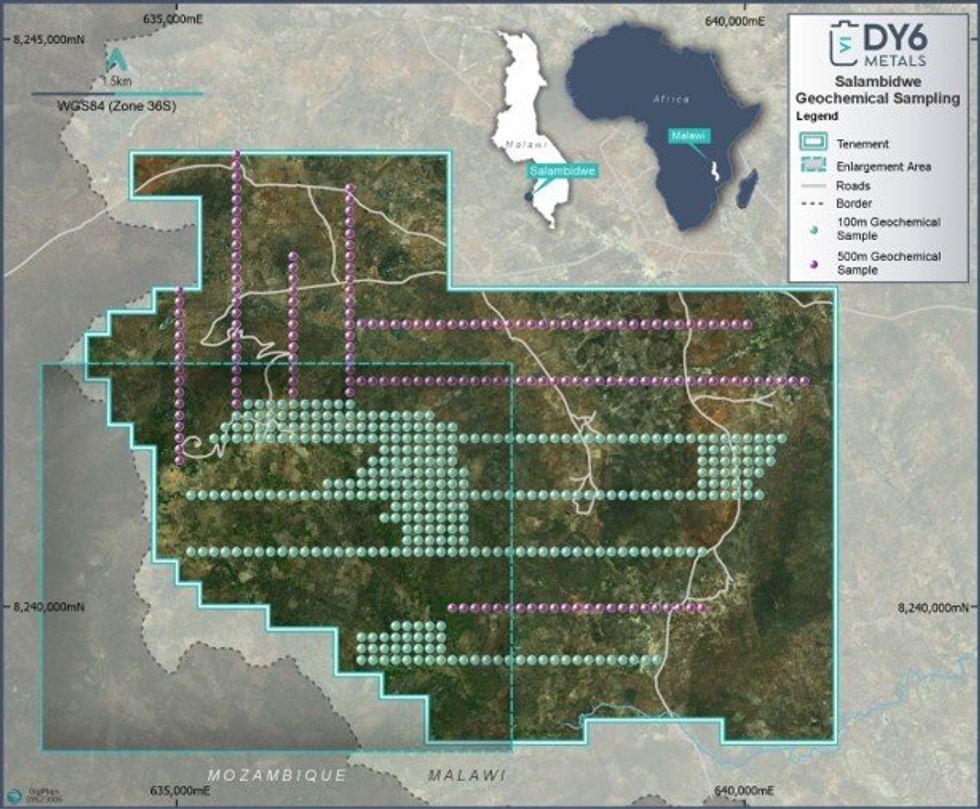

DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to provide this update to shareholders on its extensive geochemical and geophysical sampling program at the highly prospective Salambidwe REE and niobium (Nb) project in southern Malawi. A total of 514 soil and rock chip samples were collected over a 50km grid from outcrops across the licence area (Table 1) along with completion of an airborne geophysical program consisting of 45-line kilometres of electromagnetic plus radiometric surveying to map the magnetic and conductive properties of the geology of Salambidwe.

HIGHLIGHTS

- DY6 has completed the initial geochemical and geophysical exploration programs at the Salambidwe REE and Nb project.

- Assay results have been received for the grid-based soil and rock chip sampling. Results from the 128 soil and 386 rock chips expand the known area of anomalous responses.

- Maximum values from separate rock chip samples were 1.21% TREO & 0.12% Nb2O5

- The 45-line kilometre airborne geophysical program confirmed the highly concentric nature of the intrusive complex.

- DY6 is assessing the combined geochemical and geophysical data to refine targets prior to a maiden drill program.

Ground based grid controlled geochemical sampling (Figure 1) was undertaken to confirm historical exploration results of Globe Metals and Mining (“Globe”) and to expand the footprint of anomalous responses. Previous activity had not closed off the anomalous zones, nor had airborne geophysical surveys covered the area due to its proximity to the border with Mozambique.

Globe completed a sampling and ground radiometric survey over part of the central ring complex area of the intrusion outlining several zones of strongly anomalous TREO and Nb responses, numerous zones extended to the limits of the sampling. DY6’s sampling was specifically aimed at either extending or closing off these anomalous zones to the northern and western part of the licence.

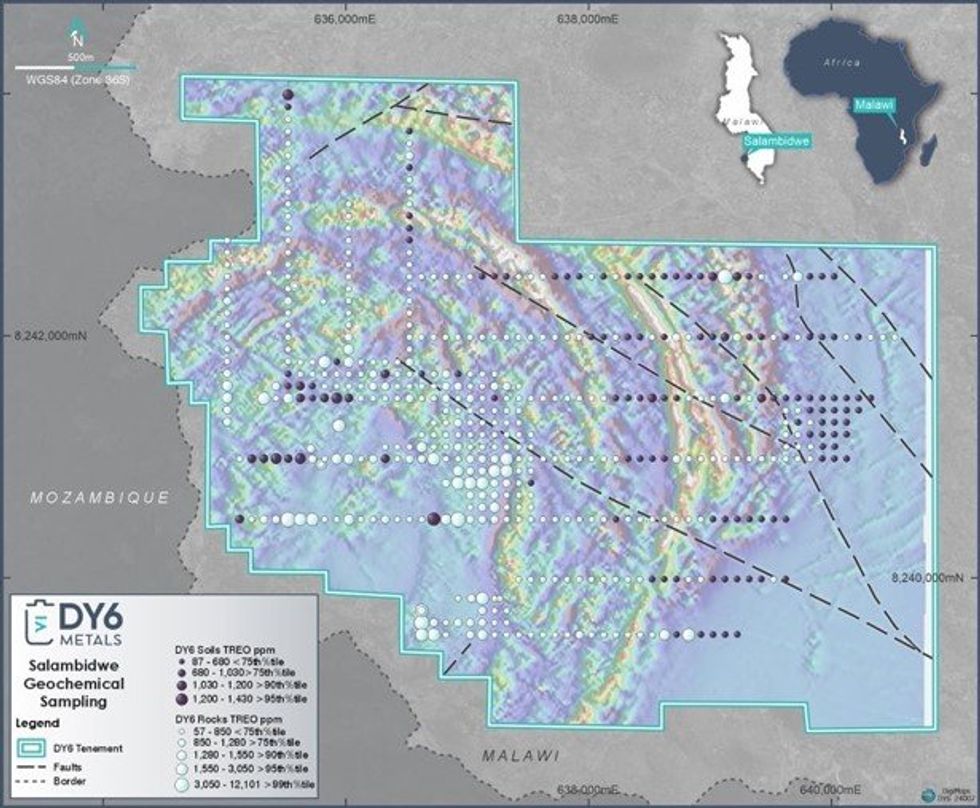

The area of the historical sampling was not resampled, but several traverses were made across the outlined anomalous areas to ensure consistency and coherency of results (Figure 2). Absolute values obtained from the DY6 exploration appear to be slightly lower in tenor than the historical data; it is interpreted that this is due to the majority of the DY6 sampling being peripheral to the historical sampling and extending away from the central anomalous area.

DY6 detailed sampling expanded the anomalous areas on 100m x 100m spacing and the more regional and confirmatory sampling was at 100m intervals along lines 500m apart.

The airborne data shown in Figure 2 shows the strong circular and concentric character of the intrusive syenite units at Salambidwe; note the area of anomalism seems to show a more subdued magnetic character, presumably due to alteration. Strong radiometric responses coincide with this area as shown below in Figure 3.

Figure 3 shows the extent of the historical TREO anomalism overlaid on the Total Count (TC) radiometrics image and the anomalous extensions generated by DY6’s exploration sampling.

Though a portion of the western anomalous zone is outside the current tenure; being too close to the Mozambique/Malawi border; this anomalous trend is now >2km long. The anomalous zone to the west of the western zone which does not overlay strong radiometric response requires further exploration. Both soils and rock chips return anomalous responses in this zone.

The eastern zone is approximately 1,700m long and nearly 1,000m wide near its northern limits.

Click here for the full ASX Release

This article includes content from DY6 Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

DY6:AU

The Conversation (0)

10 July 2024

DY6 Metals

Developing new sources of critical minerals to power the green energy transition

Developing new sources of critical minerals to power the green energy transition Keep Reading...

24 July 2024

Quarterly Activities Report for the Period Ended 30 June 2024

Heavy rare earths and critical metals explorer DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to present its quarterly activities report for the June 2024 quarter. Tundulu (REE)Historical high-grade drill intercepts reported at Tundulu including1:101m @ 1.02% TREO, 3.6% P2O5 from... Keep Reading...

02 July 2024

Reconnaissance Sampling Program Commences at Ngala Hill PGE Project to Follow up Historical Targets

DY6 Metals Ltd (ASX: DY6, “DY6” or the “Company”), a strategic metals explorer targeting Heavy Rare Earths (HREE) and Niobium (Nb) in southern Malawi, is pleased to report it is preparing for commencement of a reconnaissance program at the Company’s highly prospective PGE project at Ngala Hill... Keep Reading...

29 June 2023

Heavy Rare Earths & Niobium Explorer DY6 Metals Lists On ASX Following Successful $7M IPO

Heavy rare earths and niobium explorer DY6 Metals Limited (ASX: DY6) (“DY6”, “the Company”) is pleased to announce that its shares will begin trading on the Australian Securities Exchange at 9am Perth today. $7 million successfully raised via IPO, including $2.5 million from Hong Kong- based... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00