April 17, 2024

Norfolk Metals Ltd (Norfolk or the Company) has executed an Exclusivity and Due Diligence Deed with Green Shift Commodities Ltd (GCOM), a company incorporated in Canada, to acquire 100% of the Las Alteras uranium project in Chubut, Argentina (Las Alteras). The successful acquisition will position Norfolk as a multinational multi-project uranium exploration company. This is an important step towards Norfolk’s plans to accumulate high value exploration projects in proven regions while maintaining a favorable company structure and cash reserves.

- Norfolk signs exclusivity agreement with Green Shift Commodities Ltd (TSXV GCOM) to acquire Las Alteras uranium project located in Argentina

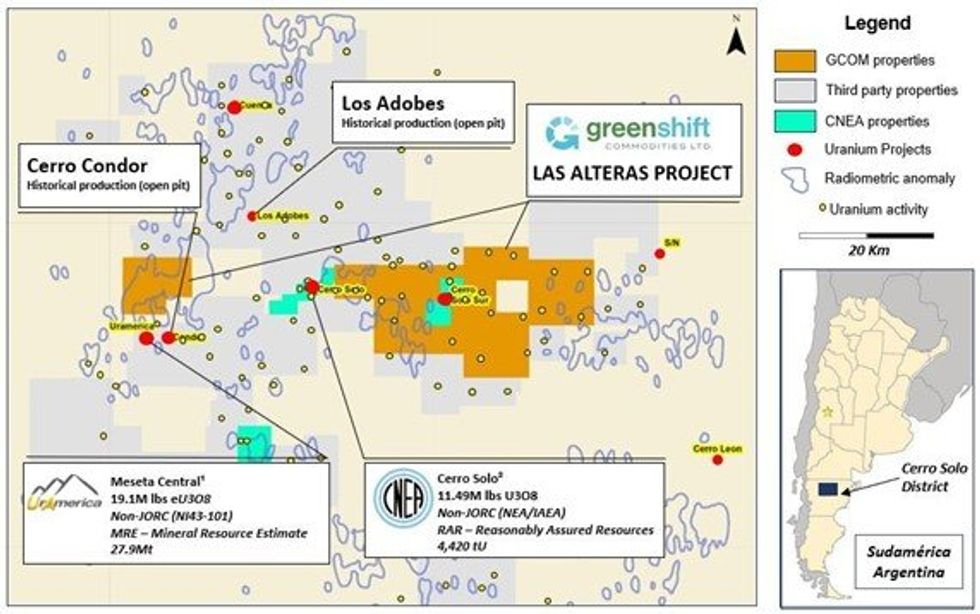

- Las Alteras uranium project surrounded by non-JORC foreign estimates* at URAmerica’s Meseta Central deposit (19.1Mlbs eU308¹), CNEA’s Cerro Solo deposit (11.49Mlbs U308²), ISO Energy’s Laguna Salada deposit (10.1Mlbs U308³) along with the Cerro Condor and Los Adobes historical uranium mines

- Norfolk receives firm commitments for a strategic placement of A$415,746 via ASX Listing Rule 7.1 capacity

- Additional funding to assist in expediting due-diligence on Las Alteras and exploration planning on the Company’s projects

- Strong cash position of A$3.49m as at 31 December 2023

- Norfolk continues to review complementary projects as the Company looks to expand uranium project suite

- Norfolk to conduct executive search for additional Key Management Personal to progress Australia and Argentina uranium exploration projects

Commenting on Norfolk Metals, Executive Chairman, Ben Phillips, states:

“Norfolk has secured an exceptional opportunity in Argentina where we expect to see strong increase in positive sentiment from government, uranium explorers and investors throughout 2024. Las Alteras is surrounded by multiple uranium deposits to the east, west and south with historical mines located to the north and south. We are currently reviewing the historical drill information boarding the eastern block of Las Alteras where uranium has been delineated in the same structures as the flagship Cerro Solo deposit. This uranium trend is increasing as the holes approach Las Alteras ground making this area one of several priorities of our focus.”

Las Alteras Exclusivity

Las Alteras uranium project is surrounded by non-JORC foreign estimates* at URAmerica’s Meseta Central deposit (19.1Mlbs eU308¹), CNEA’s Cerro Solo deposit (11.49Mlbs U308²), ISO Energy’s Laguna Salada deposit (10.1Mlbs U308³) along with the Cerro Condor and Los Adobes historical uranium mines. AlterasAs the uranium market continues to evolve globally it is Norfolk’s view that the Chubut region of the San Jorge Basin hosting the renowned government owned Cerro Solo deposit presents an exceptional opportunity to diversify and grow the Company. The addition of the Las Alteras project suite will allow Norfolk to progress the appointment of Key Management Personnel and advisors.

Please see the Company presentation regarding the Las Alteras uranium project released today on the ASX on the 18th of April 2024.

Click here for the full ASX Release

This article includes content from Norfolk Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NFL:AU

The Conversation (0)

03 August 2021

Norfolk Metals

ASX-listed uranium explorer

ASX-listed uranium explorer Keep Reading...

30 March 2025

Norfolk to earn-into Chilean Copper Project

Norfolk Metals (NFL:AU) has announced Norfolk to earn-into Chilean Copper ProjectDownload the PDF here. Keep Reading...

26 March 2025

Trading Halt

Norfolk Metals (NFL:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Norfolk Metals (NFL:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00