June 20, 2024

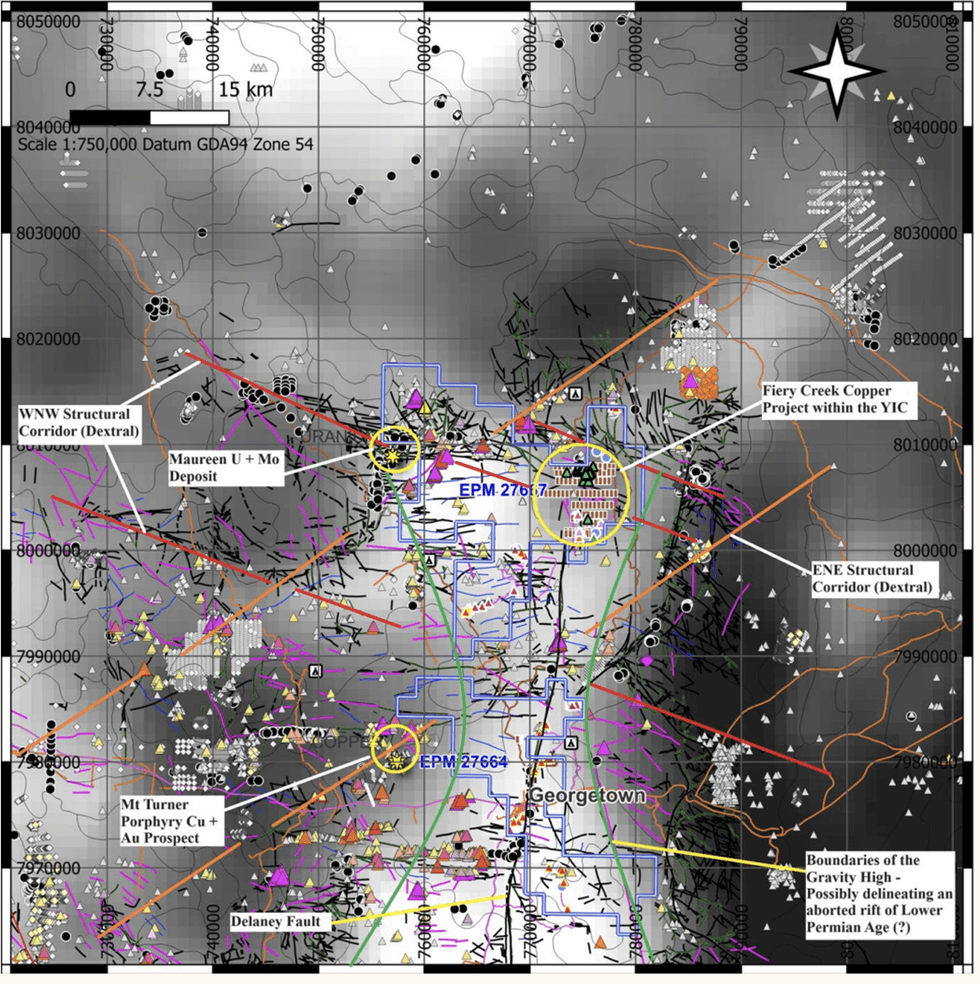

EMU NL (ASX:EMU) is an ASX-listed precious and base metals exploration company accelerating exploration at the highly promising Fiery Creek prospect, located within the Georgetown project in Northern Queensland. Spanning 850 sq. km. in North Queensland, the Georgetown project comprises three exploration permits: Georgetown, Perpendicular Peak and the Fiery Creek copper prospect. Fiery Creek is the most promising and current exploration interest for EMU.

The Georgetown project is located in a resource-rich yet under-explored region in Queensland’s far north, situated within the Georgetown mining district, with a significant history of mining activities and mineral discoveries.

Initial fieldwork has provided strong indications of a potential large-scale copper porphyry system at Fiery Creek. EMU is planning further geological mapping, systematic geochemistry and a geophysics survey to delineate the indicated porphyry system.

Investor Insight

EMU NL is an Australia-focused base and precious metals exploration company offering a compelling opportunity in the highly lucrative copper space. A strategic focus on delineating a potential large-scale copper porphyry system at its Fiery Creek copper deposit in Northern Queensland, combined with a leadership team of significant global experience and expertise, and an upward trending copper market, all make EMU NL worthy of considerable consideration for any investors looking at the copper sector.

This EMU NL profile is part of a paid investor education campaign.*

Click here to connect with EMU NL (ASX:EMU) to receive an Investor Presentation

EMU:AU

The Conversation (0)

19 January 2025

EMU NL

Potential for large-scale copper porphyry discovery in Queensland, Australia

Potential for large-scale copper porphyry discovery in Queensland, Australia Keep Reading...

31 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

EMU NL (EMU:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

19 May 2025

EGM Voting Results

EMU NL (EMU:AU) has announced EGM Voting ResultsDownload the PDF here. Keep Reading...

15 May 2025

Trading Halt

EMU NL (EMU:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 April 2025

Amended Quarterly Activities Report/Appendix 5B

EMU NL (EMU:AU) has announced Amended Quarterly Activities Report/Appendix 5BDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

EMU NL (EMU:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

4h

Selta Project - Gold Exploration Update

First Development Resources plc (AIM: FDR), a UK-based, Australia-focused mineral exploration company with interests in Western Australia and the Northern Territory, is pleased to provide an update on its gold ("Au") focused exploration at the Selta Project ("Selta" or the "Project"), located in... Keep Reading...

8h

Flow Metals Provides Structural Interpretation Update from Sixtymile Gold Project

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to announce a technical update on its Sixtymile Gold Project, Yukon. Recent re-logging of historic drill core has resulted in a revised structural interpretation of gold mineralization.The revised interpretation supports a... Keep Reading...

8h

Tectonic Metals Drills 4.50 g/t Au over 48.77 metres with 7.79 g/t Au over 24.38 metres at New Target, Flat Gold Project, Alaska

First-Ever Drilling by Tectonic at Black Creek Intrusion Delivers High-Grade Gold Six Kilometres North of Chicken Mountain, Validating Multi-Intrusion Gold System Across 99,800-Acre Flat Property VANCOUVER, BC / ACCESS Newswire / January 29, 2026 / Tectonic Metals Inc. ("Tectonic" or the... Keep Reading...

9h

Peruvian Metals Provides Update on the Minas Visca Silver Project in Northern Peru and Announces Financing

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to provide an update on the Company's Minas Visca Silver property (the "Property") located in Northern Peru. Peruvian Metals acquired the Property in 2021 by submitting a superior offer... Keep Reading...

10h

Blackrock Silver Appoints Sean Thompson as Head of Investor Relations

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) (the "Company" or "Blackrock") is pleased to announce the appointment of Sean Thompson as Head of Investor Relations for the Company.Mr. Thompson is a seasoned capital markets professional with over 17 years of experience in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00