- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

August 18, 2025

Empire Metals Limited, theAIM-quoted and OTCQB-tradedexploration and development company,is pleased to report outstanding assay results from its latest drilling campaign at the Pitfield Project in Western Australia ('Pitfield' or the 'Project'). This programme, focused on the in-situ weathered cap at the Thomas Prospect, has delivered some of the highest titanium dioxide ('TiO₂') grades recorded to date and will underpin the Company's maiden JORC-compliant Mineral Resource Estimate ('MRE').

Highlights

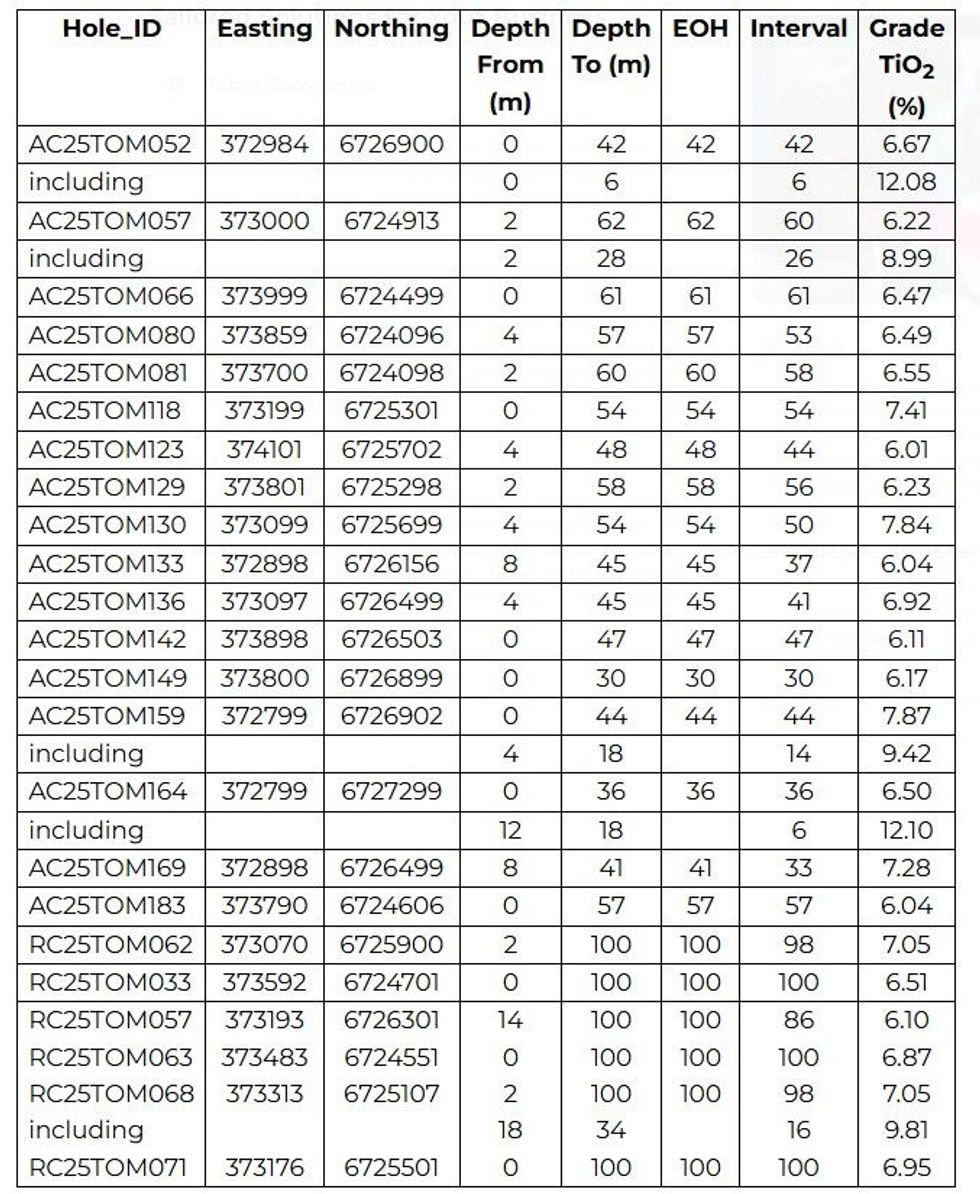

- Selected exceptional intercepts (>6% TiO2), include:

- 44m @ 7.87% TiO2 from surface (AC25TOM159)

- 50m @ 7.84% TiO2 from 4m (AC25TOM130)

- 54m @ 7.41% TiO2 from surface (AC25TOM118)

- 98m @ 7.05% TiO2 from 2m (RC25TOM062)

- 98m @ 7.05% TiO2 from 2m (RC25TOM068)

- Large, high-grade central core identified averaging circa 6% TiO2 across a continuous 3.6km strike length

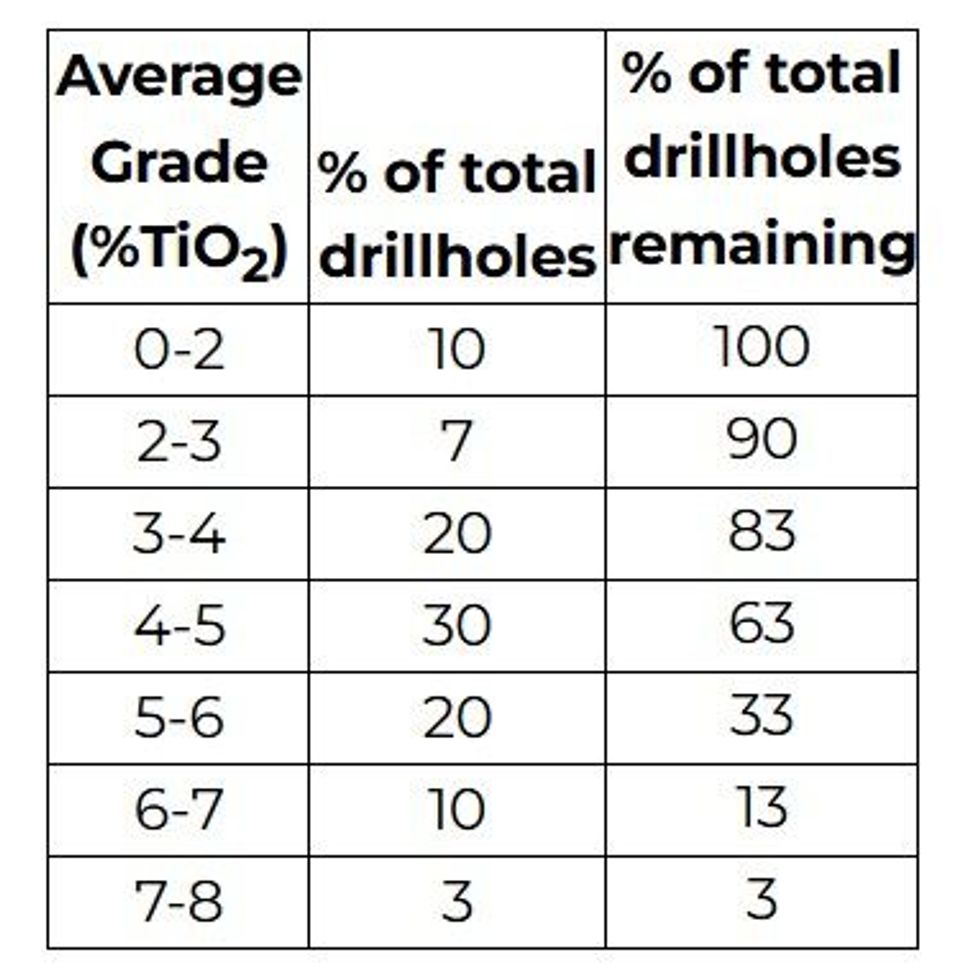

- Nearly two thirds of all drillholes averaged > 4% TiO2, with over 90% exceeding a 2% cut-off.

Shaun Bunn, Managing Director, said:"These results confirm the exceptional scale and grade of titanium mineralisation at Thomas. The continuity of high-grade mineralisation near surface is particularly exciting for future mine development. With assays received ahead of schedule, we can now accelerate resource modelling and move rapidly towards announcing our maiden MRE."

MRE Drilling Programme - Key Results

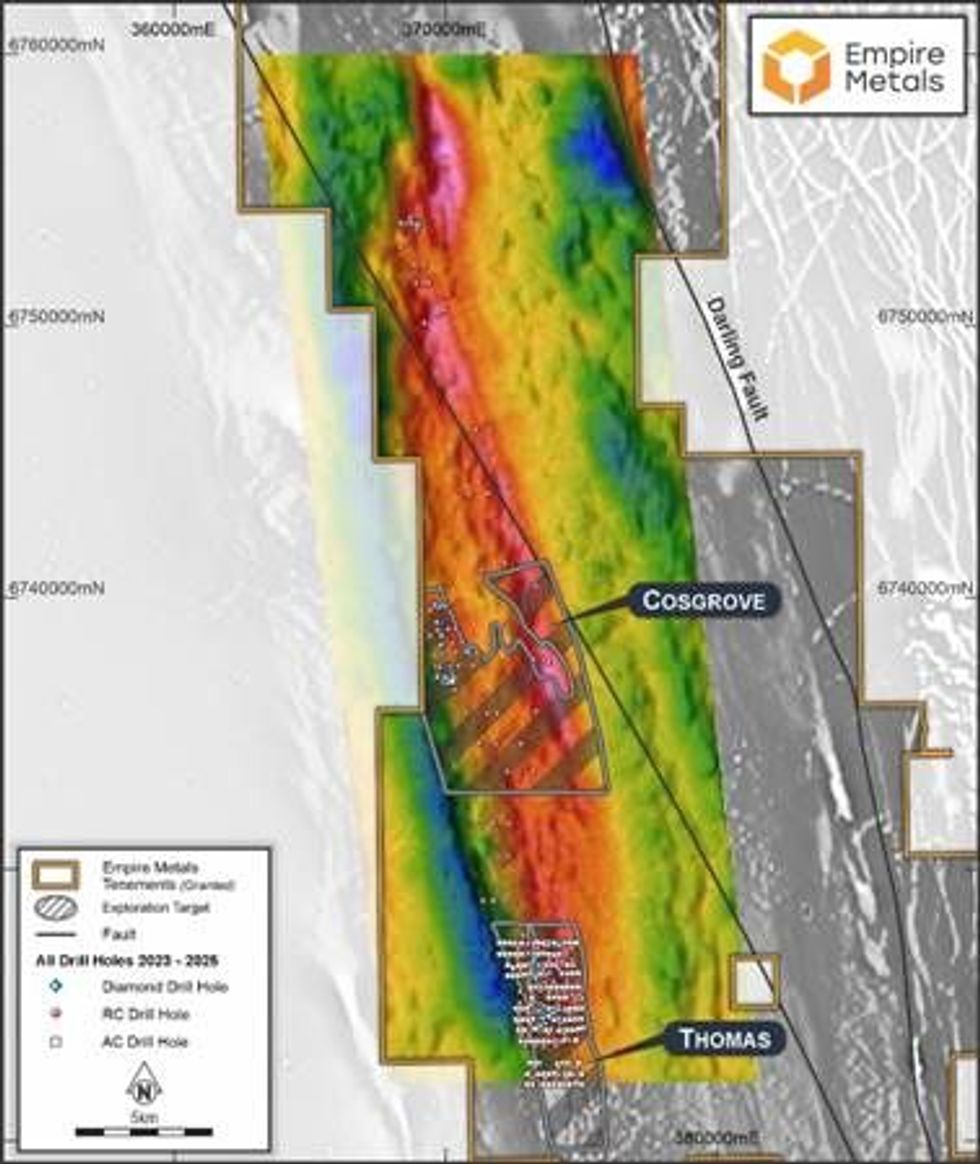

Since commencing the maiden drilling campaign at Pitfield on 27 March 2023 Empire has completed 382 drill holes for a total 32,265 metres (refer Figure 1) comprising:

- 17 Diamond drill holes for 2,704 m

- 140 Reverse Circulation (RC) drill holes for 18,764 m

- 225 Air Core (AC) drill holes for 10,797 m.

The latest May-June campaign comprised:

- 140 AC drillholes (6,360m) on a 400 x 200m grid, average depth 45.4m

- 40 RC drillholes (3,776m) within the AC grid, average depth 94.4m

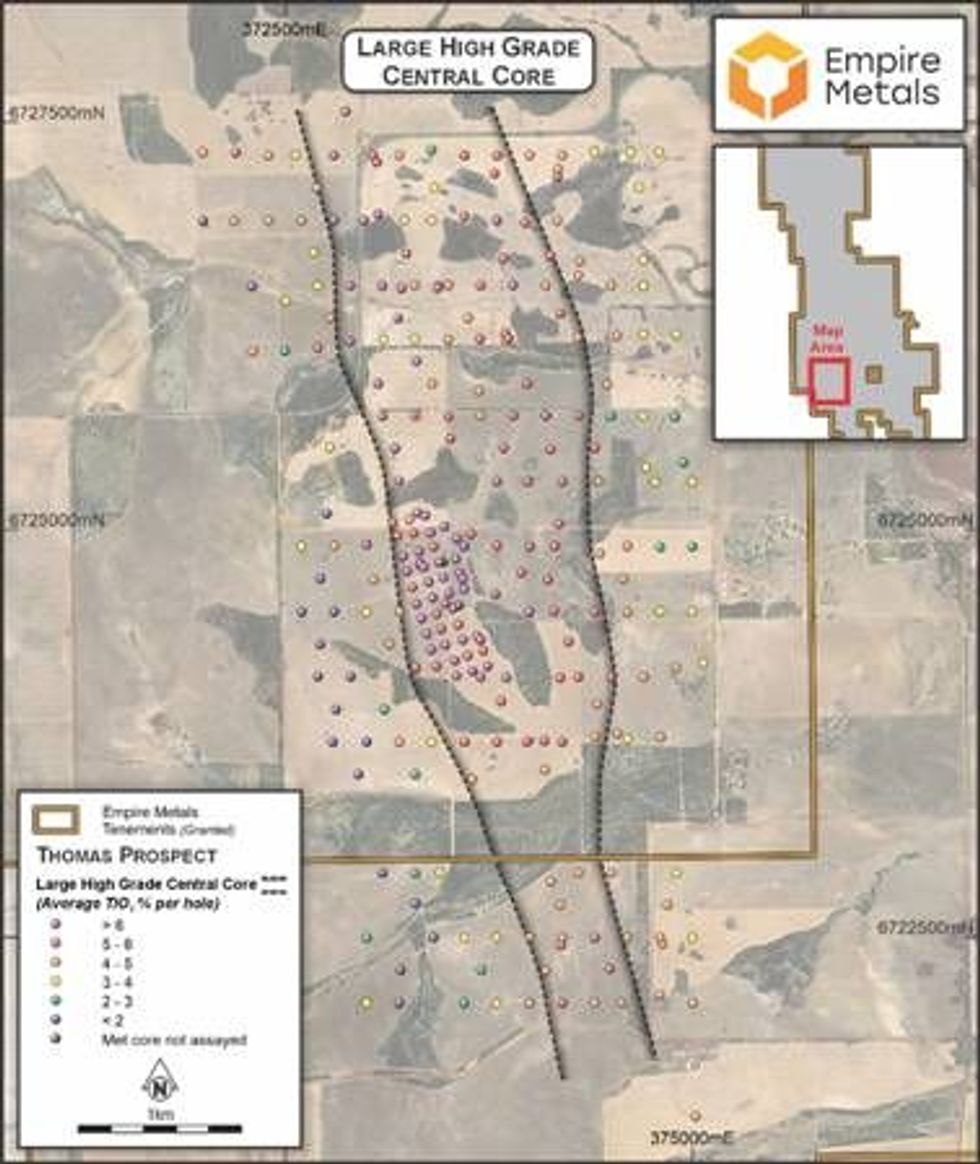

During the campaign all drill holes were subsampled on a 2m interval, resulting in over 5,000 drill samples being collected, logged by our on-site team of geologists and then prepared for shipment to Intertek's Perth based analytical laboratory. The analytical assay results have now been received, showing continuous TiO2-rich mineralisation across the overall drillhole grid, which extends 5.2km by 2.6km and totals an area of 1,352 hectares (refer Figure 2).

The drilling has confirmed the presence of a large, high-grade central core at the Thomas prospect, this target being selected as the basis for the maiden MRE due to the extensive, thick and high-grade titanium mineralisation known to be hosted within the broad, in-situ weathered zone. Whilst over 90% of all drillhole sample assays show mineralisation well above a 2% TiO2 cut-off grade this central high-grade core, extends over 3.6km north-south, averages around 6% TiO2 (refer Table 1).

Significant analytical assay results for each drillhole above 6% TiO2 are reported in Table 2 further below.

Strategic Significance

The May-June campaign marked a major milestone in the development of Pitfield, laying the foundation for a globally significant MRE and enabling the identification of near-surface, high grade zones to support the development of mine planning and ore scheduling as part of upcoming economic evaluation studies.

The Pitfield Titanium Project

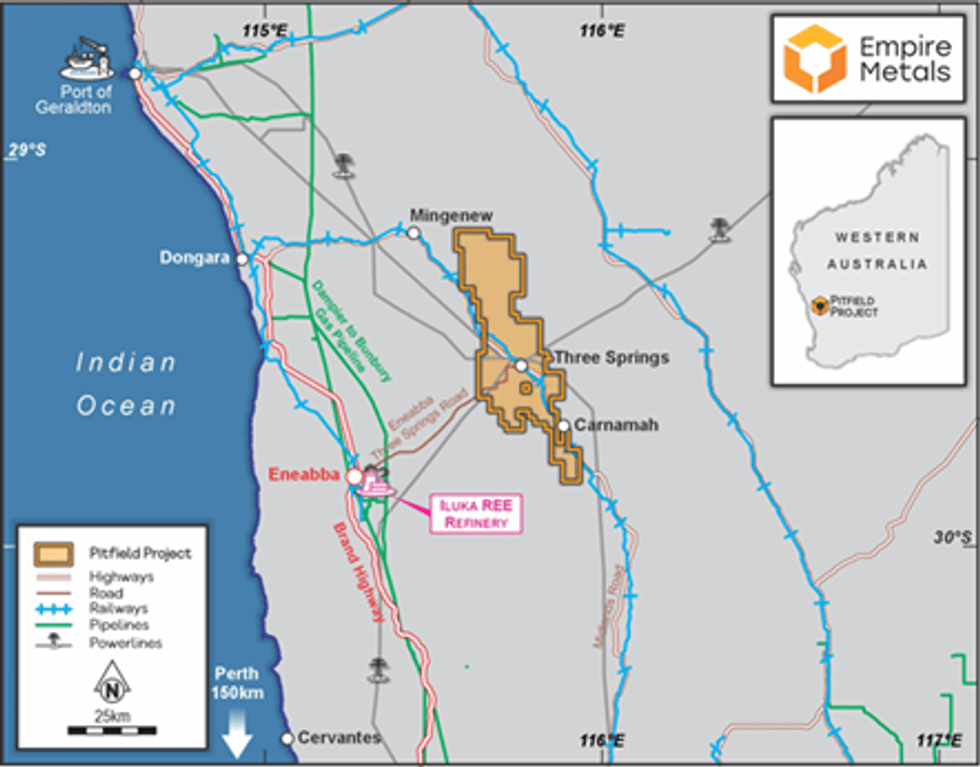

Located within the Mid-West region of Western Australia, near the northern wheatbelt town of Three Springs, the Pitfield titanium project lies 313km north of Perth and 156km southeast of Geraldton, the Mid West region's capital and major port. Western Australia is a Tier 1 mining jurisdiction, with mining-friendly policies, stable government, transparency, and advanced technology expertise. Pitfield has existing connections to port (both road & rail), HV power substations, and is nearby to natural gas pipelines as well as a green energy hydrogen fuel hub, which is under planning and development (refer Figure 3).

Competent Person Statement

The technical information in this report that relates to the Pitfield Project has been compiled by Mr Andrew Faragher, an employee of Empire Metals Australia Pty Ltd, a wholly owned subsidiary of Empire. Mr Faragher is a Member of the Australian Institute of Mining and Metallurgy. Mr Faragher has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Faragher consents to the inclusion in this release of the matters based on his information in the form and context in which it appears.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of Regulation (EU) No 596/2014, as incorporated into UK law by the European Union (Withdrawal) Act 2018, until the release of this announcement.

**ENDS**

For further information please visit www.empiremetals.co.uk or contact:

About Empire Metals Limited

Empire Metals is an AIM-listed and OTCQB-traded exploration and resource development company (LON: EEE) with a primary focus on developing Pitfield, an emerging giant titanium project in Western Australia.

The high-grade titanium discovery at Pitfield is of unprecedented scale, with airborne surveys identifying a massive, coincident gravity and magnetics anomaly extending over 40km by 8km by 5km deep. Drill results have indicated excellent continuity in grades and consistency of the mineralised beds and confirm that the sandstone beds hold the higher-grade titanium dioxide (TiO₂) values within the interbedded succession of sandstones, siltstones and conglomerates. The Company is focused on two key prospects (Cosgrove and Thomas), which have been identified as having thick, high-grade, near-surface, bedded TiO₂ mineralisation, each being over 7km in strike length.

An Exploration Target* for Pitfield was declared in 2024, covering the Thomas and Cosgrove mineral prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Empire is now accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit.

The Company also has two further exploration projects in Australia; the Eclipse Project and the Walton Project in Western Australia, in addition to three precious metals projects located in a historically high-grade gold producing region of Austria.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

Click here to connect with Empire Metals (OTCQB:EPMLF, AIM:EEE) to receive an Investor Presentation

EPMLF

Sign up to get your FREE

Empire Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

14 October 2025

Empire Metals

Advancing a game-changing, globally significant titanium project in Western Australia.

Advancing a game-changing, globally significant titanium project in Western Australia. Keep Reading...

27 January

Empire Metals Limited Announces Pitfield Project Development Update

LONDON, UNITED KINGDOM / ACCESS Newswire / January 27, 2026 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded leading exploration and development company, is pleased to provide an update on the Pitfield titanium Project in Western Australia ('Pitfield' or the... Keep Reading...

30 December 2025

Empire Metals Limited Announces Conditional Sale of 75% of Eclipse Gold Project

LONDON, UNITED KINGDOM / ACCESS Newswire / December 30, 2025 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce that it has entered into a conditional sale and purchase agreement for its 75% interest in the... Keep Reading...

01 December 2025

Empire to Present at the Precious Metals & Critical Minerals Virtual Investor Conference

Empire Metals Limited (AIM: EEE, OTCQX: EPMLF), announces that Greg Kuenzel (Finance Director) will present live at the Precious Metals & Critical Minerals Virtual Day Conference in partnership with OTC Markets and hosted by VirtualInvestorConferences.com, on December 4 th at 9am ET. The... Keep Reading...

13 November 2025

Empire Metals Limited Announces Appointment of Joint Corporate Broker

Empire Metals Limited, the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the appointment of Canaccord Genuity Limited ("Canaccord") as joint corporate broker with immediate effect. Canaccord will work alongside S. P. Angel Corporate Finance LLP and Shard... Keep Reading...

13 November 2025

Empire Metals Limited Announces Appointment of Joint Corporate Broker

LONDON, UK / ACCESS Newswire / November 13, 2025 / Empire Metals Limited, the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the appointment of Canaccord Genuity Limited ("Canaccord") as joint corporate broker with immediate effect. Canaccord will work... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Sign up to get your FREE

Empire Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00