May 02, 2025

Empire Metals Limited (LON:EEE)(OTCQB:EPMLF), the AIM-listed and OTCQB-traded resource exploration and development company, is pleased to inform investors of its upcoming participation in two key industry events:

- RIU Sydney Resources Round-up (6-8 May 2025 at the Hyatt Regency in Sydney, NSW), where the Company will be delivering a presentation to delegates and will meet existing and prospective investors at its booth in the exhibition area; and

- OTC Metals & Mining Virtual Investor Conference (6-8 May 2025), where Empire will present to a global online audience of investors and industry participants. Investors can learn more about the event and register at www.virtualinvestorconferences.com.

These events provide an opportunity for the Company to update shareholders and potential investors on recent developments and strategic plans, including highlights from the ongoing exploration and development activities at the Pitfield Project and other key announcements made in recent weeks.

An updated corporate presentation, reflecting the Company's latest developments, is available on the Company's website at: https://www.empiremetals.com/investors/shareholder-documents/presentations/.

**ENDS**

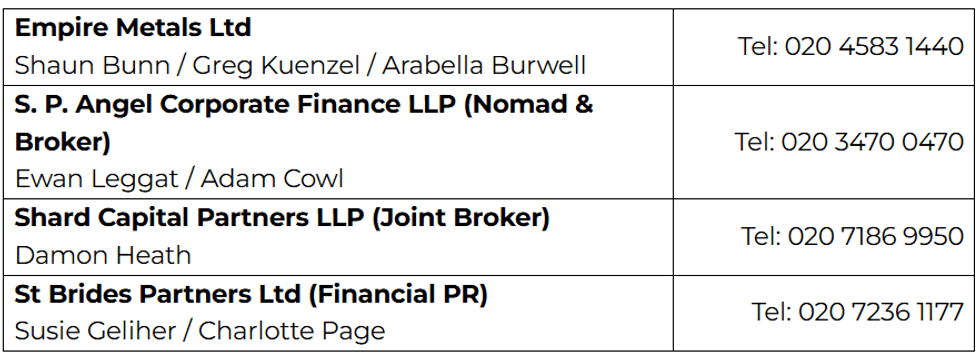

For further information please visit www.empiremetals.co.uk or contact:

About Empire Metals Limited

Empire Metals is an AIM-listed and OTCQB-traded exploration and resource development company (LON:EEE)(OTCQB:EPMLF) with a primary focus on developing Pitfield, an emerging giant titanium project in Western Australia.

The high-grade titanium discovery at Pitfield is of unprecedented scale, with airborne surveys identifying a massive, coincident gravity and magnetics anomaly extending over 40km by 8km by 5km deep. Drill results have indicated excellent continuity in grades and consistency of the mineralised beds and confirm that the sandstone beds hold the higher-grade titanium dioxide (TiO₂) values within the interbedded succession of sandstones, siltstones and conglomerates. The Company is focused on two key prospects (Cosgrove and Thomas), which have been identified as having thick, high-grade, near-surface, bedded TiO₂ mineralisation, each being over 7km in strike length.

An Exploration Target* for Pitfield was declared in 2024, covering the Thomas and Cosgrove mineral prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Empire is now accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit.

The Company also has two further exploration projects in Australia; the Eclipse Project and the Walton Project in Western Australia, in addition to three precious metals projects located in a historically high-grade gold producing region of Austria.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

This information is provided by Reach, the non-regulatory press release distribution service of RNS, part of the London Stock Exchange. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

EPMLF

The Conversation (0)

17 February

Empire Metals Limited Announces Major Drilling Campaign to Commence at Pitfield

LONDON, UK / ACCESS Newswire / February 17, 2026 / Empire Metals Limited (LON:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the commencement of a major drilling campaign at the Pitfield Project in Western Australia ('Pitfield' or... Keep Reading...

17 February

Empire Metals Limited Announces Major Drilling Campaign to Commence at Pitfield

LONDON, UK / ACCESS Newswire / February 17, 2026 / Empire Metals Limited (LON:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the commencement of a major drilling campaign at the Pitfield Project in Western Australia ('Pitfield' or... Keep Reading...

17 February

Empire Metals Limited Announces Major Drilling Campaign to Commence at Pitfield

LONDON, UK / ACCESS Newswire / February 17, 2026 / Empire Metals Limited (LON:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the commencement of a major drilling campaign at the Pitfield Project in Western Australia ('Pitfield' or... Keep Reading...

27 January

Empire Metals Limited Announces Pitfield Project Development Update

LONDON, UNITED KINGDOM / ACCESS Newswire / January 27, 2026 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded leading exploration and development company, is pleased to provide an update on the Pitfield titanium Project in Western Australia ('Pitfield' or the... Keep Reading...

30 December 2025

Empire Metals Limited Announces Conditional Sale of 75% of Eclipse Gold Project

LONDON, UNITED KINGDOM / ACCESS Newswire / December 30, 2025 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce that it has entered into a conditional sale and purchase agreement for its 75% interest in the... Keep Reading...

17h

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00