- WORLD EDITIONAustraliaNorth AmericaWorld

September 16, 2025

Earthwise Minerals (CSE:WISE,FSE:966) is an emerging gold exploration company leveraging a data-driven strategy to unlock significant upside in a tier-one Canadian jurisdiction. The company is advancing its Iron Range project in southeastern British Columbia—a district-scale land package with geological analogues to some of North America’s most prolific polymetallic systems.

Earthwise Minerals is pursuing a measured growth strategy that blends investor outreach with disciplined exploration. By integrating over $8 million of historic data with modern techniques, the company is advancing the Iron Range Gold Project efficiently and cost-effectively. A staged four-year option agreement provides a low-entry framework for exploration and supports a clear path toward drilling.

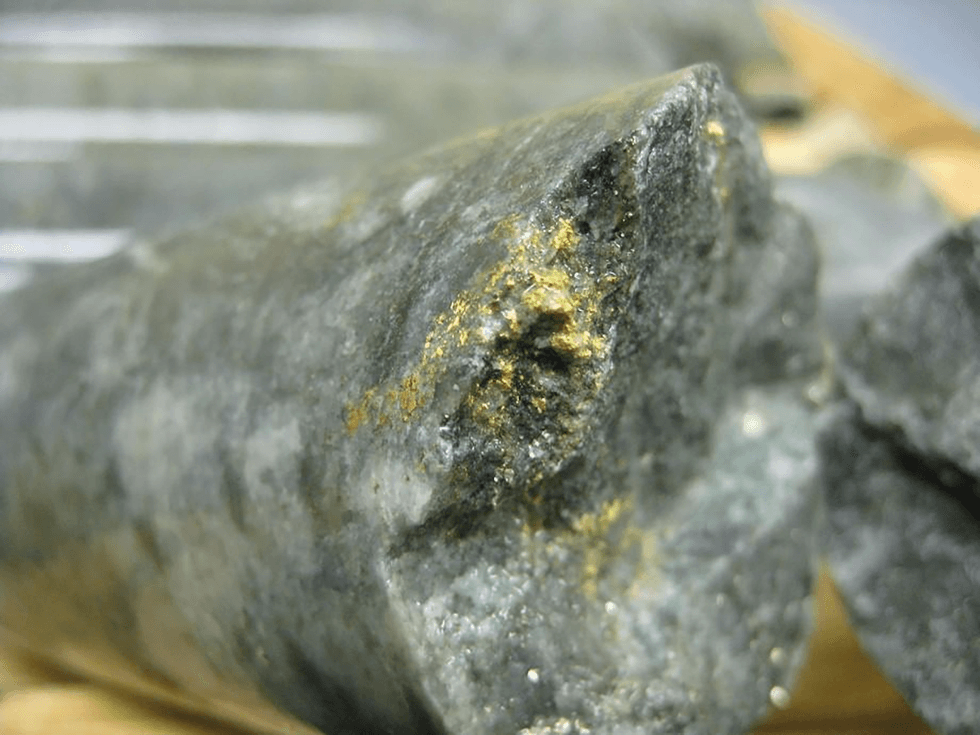

The Iron Range Gold Project is Earthwise Minerals’ flagship asset, spanning 21,437 hectares in southeastern British Columbia, just northeast of Creston. The property sits along the Iron Mountain Fault Zone (IMFZ), a major regional structure within the Purcell Supergroup that also hosts the world-class Sullivan SEDEX deposit. Earthwise controls over 50 kilometres of strike length along the IMFZ and its associated splays. The project benefits from excellent infrastructure, including Highway 3 crossing the property, Canadian Pacific rail access, and nearby BC Hydro power, natural gas, and water. Exploration is further streamlined by a multi-year area-based (MYAB) permit, enabling trenching, geophysics, road access, and drilling without the need for annual approvals.

Company Highlights

- Tight Capital Structure: Only 37.2 million shares fully diluted, providing strong leverage to exploration success without heavy dilution

- Flagship Iron Range Gold Project: District-scale property covering 21,437 hectares, strategically located along the Iron Mountain Fault Zone, within the same stratigraphy as the legendary Sullivan SEDEX deposit

- Strong Geological Foundation: Over $8 million of historical exploration, including geophysics, geochemistry, and drilling, provides a data-rich base for new high-impact targeting

- Low-cost Option Agreement: Earthwise can earn up to 80 percent of Iron Range from Eagle Plains Resources through staged payments and exploration commitments totaling $4 million over four years

- World-class Infrastructure: The project is road accessible, bisected by Highway 3 and Canadian Pacific rail, with nearby power, natural gas and water resources

- Proven Leadership: CEO Mark Luchinski and VP exploration George Yordanov bring capital markets expertise and technical discovery experience, supported by a well-rounded board with financial and digital strategy capabilities

This Earthwise Minerals profile is part of a paid investor education campaign.*

Click here to connect with Earthwise Minerals (CSE:WISE) to receive an Investor Presentation

WISE:CC

Sign up to get your FREE

Earthwise Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 February

Earthwise Minerals

Data-driven exploration targeting district-scale gold discovery in British Columbia

Data-driven exploration targeting district-scale gold discovery in British Columbia Keep Reading...

8h

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

10h

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

Latest News

Sign up to get your FREE

Earthwise Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00