(TheNewswire)

April 29, 2024 TheNews w ire Global Stocks News On April 23, 2023 Dolly Varden Silver (TSXV:DV) (OTC:DOLLF) announced plans for its 2024 exploration drilling program at its 100% owned Kitsault Valley Project.

Key Highlights:

-

Three drill rigs mobilising

-

Initial 25,000 meters diamond drilling planned

-

Follow up on new discoveries

-

Focus on Homestake Silver and Wolf Deposits

-

Low snow packs allow for earlier than usual start in May

" The drill program will be split approximately 50/50 between the Dolly Varden Property and the Homestake Ridge Property," states DV, "with an overall project split of 1/3 to Homestake Silver deposit area , 1/3 to Wolf deposit area and 1/3 to project wide exploration targets with new discovery potential."

"Our drill results from Homestake Silver were among the highest-grade gold and silver intercepts anywhere in the Golden Triangle in 2023," states Dolly Varden CEO Shawn Khunkhun .

According to the Corporate Finance Institute (CFI) , the five key responsibilities of a CEO are: 1. Setting and Executing Organizational Strategy, 2. Build the Senior Leadership Team, 3. Making Capital Allocation Decisions, 4. Setting Vision, Values, and Corporate Culture and 5. Communicating Effectively with All Stakeholders .

In the junior markets, it is rare to find a CEO who excels at all five things. Commonly, #5 (Stakeholder Communication) is a glaring weakness. Typically, you find biotech geniuses, technology disrupters and brilliant geologists who are awkward, clumsy communicators.

Shawn Khunkhun was appointed the DV SIlver CEO position on February 18, 2020 , during a period of depressed metal prices. Since then, he has proved to be demonstratively good at all five parts of his job, including communication to the investment community.

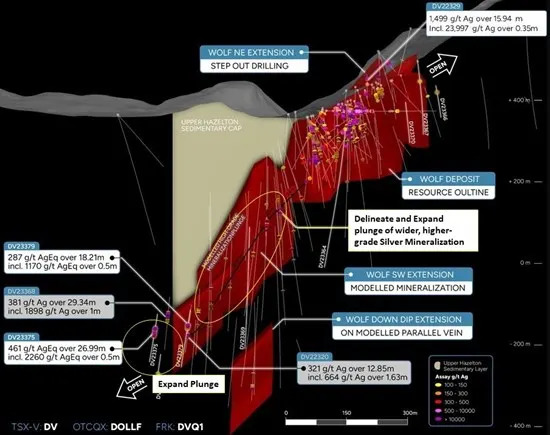

Wolf Vein

At the Wolf Vein, drilling is planned to delineate the width and extent of the southerly plunge of wider and higher-grade silver mineralization. Step out holes that define the trace of the plunge are spaced so that any new mineralization can be included in a future resource update . The Company will implement directional drilling technology with the objective of more cost effective and accurate exploration at Wolf, particularly for deep holes.

Figure 2 . Previously released result highlights (2022 and 2023) on Wolf Vein long section looking northwest showing open zones for follow up and trace of wider, higher-grade plunge as black line.

Homestake Silver

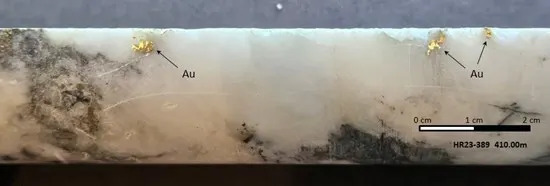

The program planned for Homestake Silver will start with follow up drilling on the newly discovered gold zone at the northern extent of deposit, where coarse-grained native gold in late-stage quartz-carbonate veins (Figure 3.) returned grades of 1,335 g/t Au and 781 g/t Ag over 0.68 meters within a wider interval of stockwork grading 79.49 g/t Au and 60 g/t Ag over 12.45 meters in drill hole HR23-389.

Figure 3 . Visible Gold in quartz carbonate vein from drillhole HR23-389 at 410.00m depth.

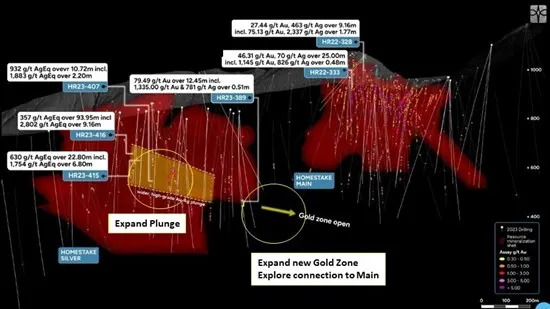

The second part of Homestake Silver drilling will be resource expansion and upgrade holes that target the low angle, north dipping plunge of wide and high-grade gold and silver mineralization encountered in 2023 (Figure 4.).

Figure 4 . Homestake Ridge Long section looking southwest showing previous results of wide, higher grade plunge and new gold zone at Homestake Silver with 2024 target areas.

Exploration Targets including Moose Vein

The Moose Vein is located 1.5 km up north of the Wolf Vein and is interpreted to be hosted within a similar cross cutting structure as Wolf.

Other Exploration targets on both the Homestake Ridge and Dolly Varden properties include targets within the 5.4 km long area between the southern end of Homestake Silver and Wolf Vein.

Shawn KhunKhun recently spoke with Kerry Lutz, a lawyer and entrepreneur who is now the CEO of "The Financial Survival Network", providing "an alternative to Wall Street's always-be-buying mantra."

"Primary silver mines are rare," Khunkhun told Lutz. "They only represent about 28% of the market. We're located in Canada, that has stable mining laws. We are up North in British Columbia where there are not a lot of tourists. We've demonstrated size through acquisition and discoveries."

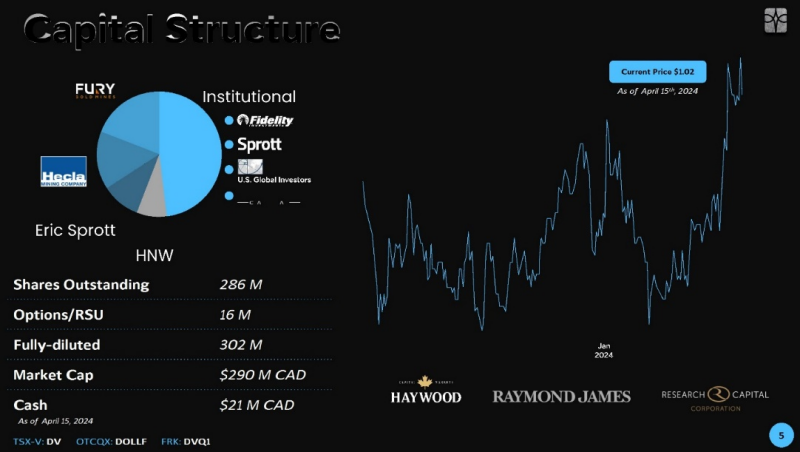

"This has led to a lot of notable shareholders," continued Khunkhun. "Including Hecla, Eric Sprott and institutions like Fidelity."

On November 2, 2023 Dolly Varden Silver announced that it has closed a deal where Hecla Canada invested $10 million in DV Silver , raising its stake in DV Silver from 10.6% to 15.7%.

Hecla Mining has a market cap of USD $3.13 billion and trades on the New York Stock Exchange (NYSE). It is on track to produce 17 million ounces of silver in 2024 .

"Hecla's increased ownership stake is a benefit to us," Khunkhun told Guy Bennett, the CEO of Global Stocks News. "Hecla has demonstrated it is a sticky shareholder. They're looking to expand their North American silver portfolio. "

"V alue-creation is done through growing your mineral inventory, or growing your production," Khunkhun told Lutz, "Dolly Varden is trading at about $1 an ounce in the ground. The average company trades about $4 an ounce in the ground. If I can find more silver for pennies an ounce in the ground, there is a likelihood we're going to be revalued."

"Our priority with this early [drilling] start is to continue with step-outs as well as infill drilling to confirm continuity of the potentially bulk-mineable mineralization ," stated Khunkhun in the April 23, 2024 press release.

"Further south, silver mineralization at Wolf remains wide open for expansion and this seasons' introduction of directional drilling technology will allow for highly accurate placement of drill intercepts."

The currently gold/silver price ratio is 85.

" For the whole of the 20th century, the average gold-silver ratio was 47:1," reports Investopedia . "In the 21st century, the ratio has ranged mainly between the levels of 50:1 and 70:1.

With gold trading at USD $2,350/ounce – 95% of its April 12, 2024 all-time-high of $2,440 - and silver trading at USD $27/ounce, about 60% of its all-time high, it may be an advantageous time in to invest in silver equities.

Disclaimer: Dolly Varden Silver paid GSN CND $1,500 for the research, creation and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com

Copyright (c) 2024 TheNewswire - All rights reserved.