August 06, 2024

Drilling to test newly-identified targets at Kelpie Hill and Windmill Dam, along strike from the high-grade Evergreen zone on the highly prospective Woorara Fault

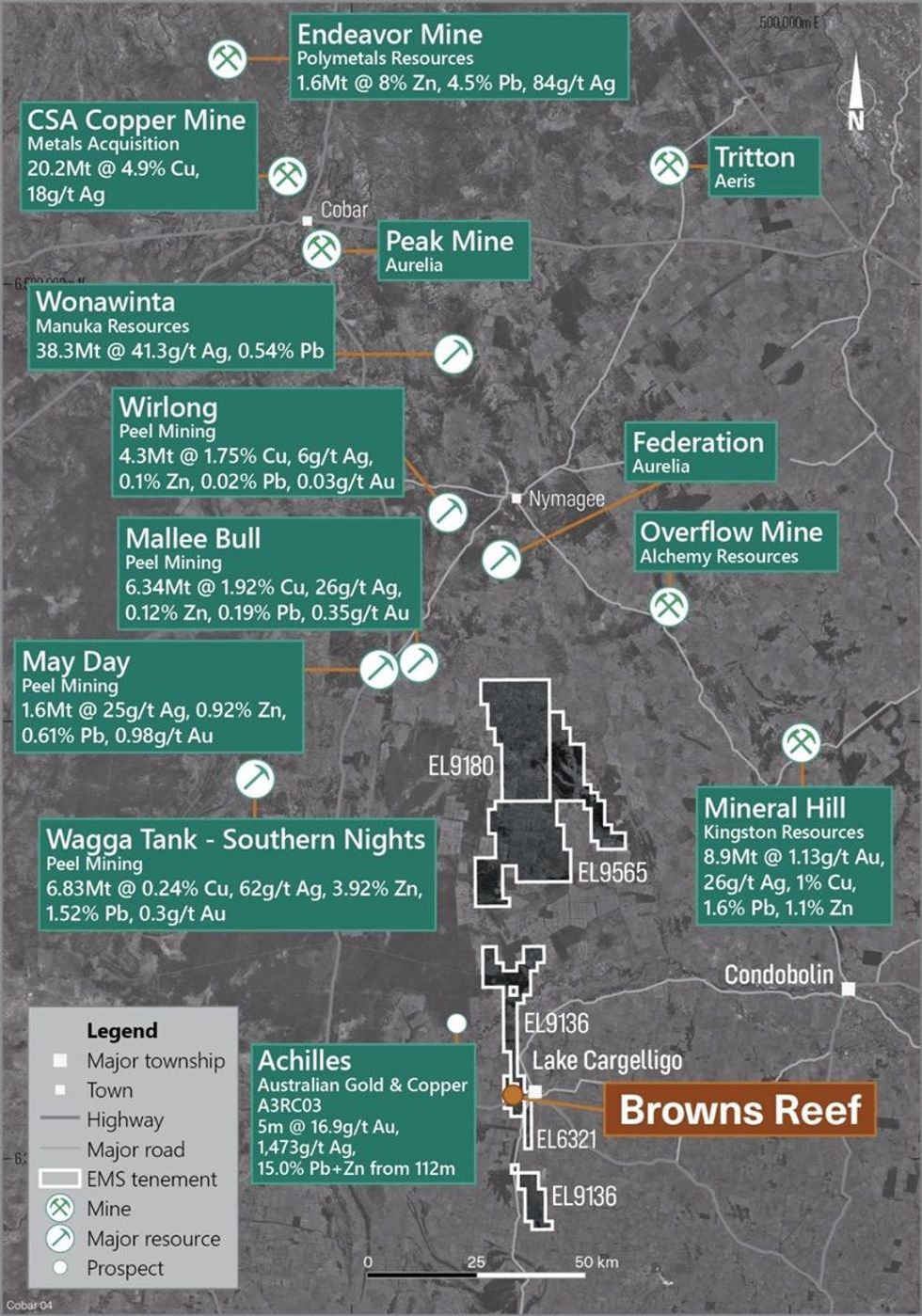

Eastern Metals Limited (ASX: EMS) (“Eastern Metals” or “the Company”) is pleased to advise that Reverse Circulation (RC) drilling has commenced to test newly identified high-priority targets at its Cobar Project in the southern Cobar Basin, NSW (refer to Figure 1).

HIGHLIGHTS

- Reverse Circulation (RC) drilling is underway to test new, high-priority areas at the Company’s Cobar Project in the Cobar Basin, NSW.

- The ‘Kelpie Hill’ and ‘Windmill Dam’ targets, located to the north and south of the high-grade Evergreen Zone within EL6321, have previously returned strongly anomalous base metal grades in surface rock chip sampling.

- The drilling is designed to further unlock the potential along the highly prospective Woorara Fault, a key regional structure associated with mineralisation in the southern Cobar Basin.

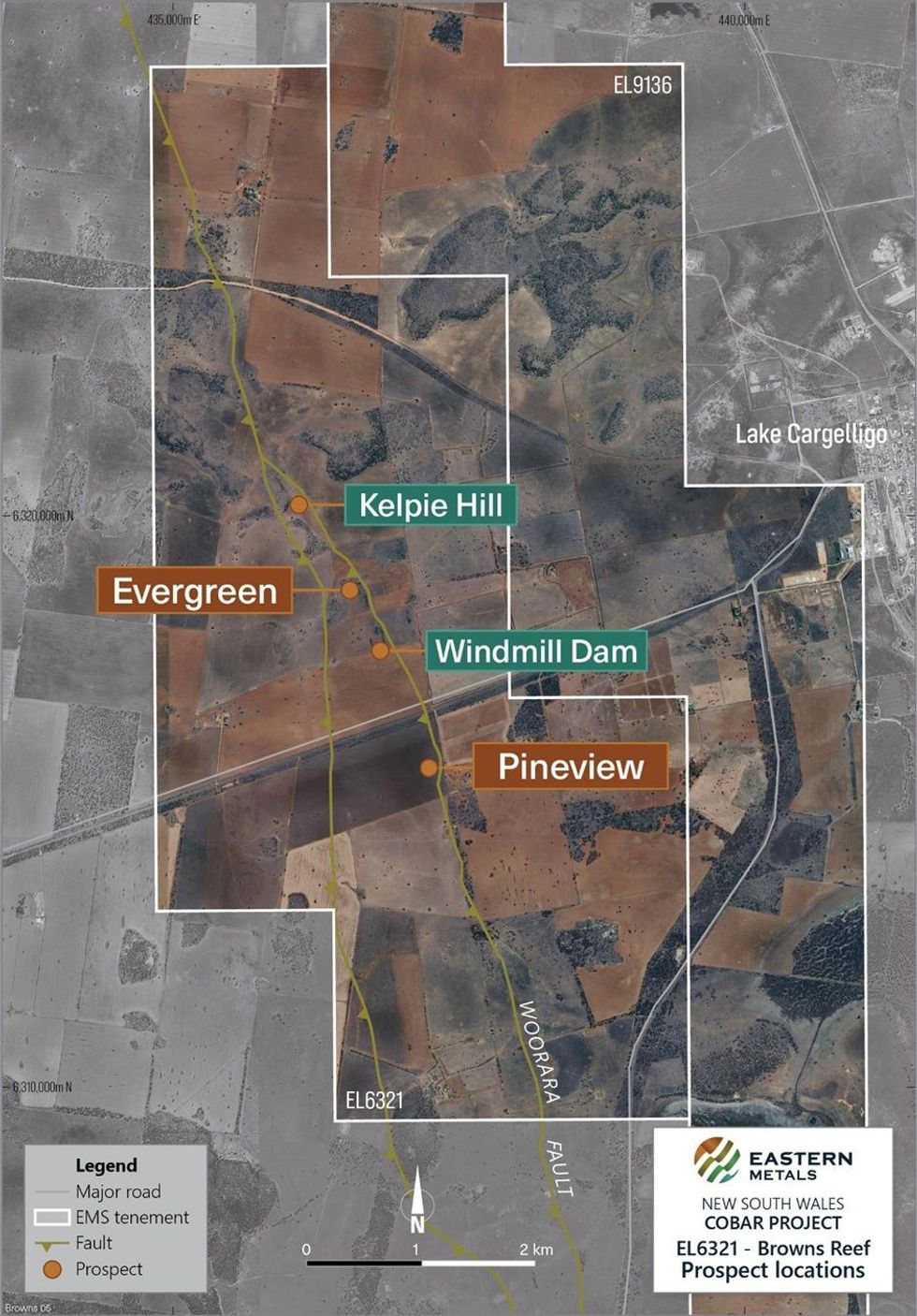

The drilling will initially focus on the Kelpie Hill and Windmill Dam targets, located to the north and south of the high-grade Evergreen Zone at Browns Reef (EL6321), both of which returned highly anomalous grades from surface rock chip sampling. In-fill and extensional drilling is also planned at other areas within the tenement including at Evergreen (refer to Figure 2).

The drilling program, which is expected to comprise approximately 2,000 metres, will be undertaken by Drillit Consulting Pty Ltd – an experienced drilling contractor based in the Cobar Basin. The drilling is expected to take three weeks to complete (weather dependent), with initial assay results expected in September 2024.

Eastern Metals’ Chief Executive Officer Ley Kingdom said: “Strong alteration at surface and rock chip sampling across Kelpie Hill and Windmill Dam have returned anomalous copper, lead, zinc and silver results, which lie along the highly prospective Woorara Fault along strike from Evergreen. We are delighted to now be drill testing these new and exciting base metal targets.”

EL6321 Browns Reef Overview

Browns Reef (EL6321) is an advanced exploration project located 5km west of Lake Cargelligo in the southern Cobar Basin, NSW. It is a structurally controlled, polymetallic system extending along the inferred Woorara Fault and the Preston Formation and Clements Formation contact.

Assay results from recent fieldwork programs to the north and south of the known high-grade mineralisation at Evergreen have returned highly anomalous grades from surface rock chip samples.

Mapping and pXRF traverses along the Woorara Fault, a regional-scale structure related to known mineralisation at the high-grade Pineview and Evergreen zones, identified new anomalous zones north and south of Evergreen, named “Kelpie Hill” and “Windmill Dam”.

Kelpie Hill is located approximately 700 metres to the north-west of Evergreen, and Windmill Dam is 500 metres to the south-east. Refer to Figure 2.

The pXRF demonstrated that soil anomalism of lead (Pb) and arsenic (As) were readily traceable within the soil profiles and decreasing Pb results could effectively map out the basalt and Clements Formation contact zones. Rock chip samples paired with the pXRF readings were able to distinguish further prospective zones to the south and north of Evergreen.

The RC program has been designed to test whether the anomalous grades from surface rock chip samples and results from pXRF soil readings represent further zones of mineralisation between Pineview and Evergreen and, potentially, to the north of Evergreen.

Forward-Looking Statements

This document may include forward-looking statements. Forward-looking statements include, but are not limited to, statements concerning the Company’s planned activities, including mining and exploration programs, and other statements that are not historical facts. When used in this document, the words such as “could”, “plan”, “estimate”, “expect”, “intend”, “may”, “potential”, “should” and similar expressions are forward-looking statements. In addition, summaries of Exploration Results and estimates of Mineral Resources and Ore Reserves could also be forward looking statements.

Although Eastern Metals believes that its expectations reflected in these forward-looking statements are reasonable, such statements involve risks and uncertainties and no assurance can be given that actual results will be consistent with these forward-looking statements.

Click here for the full ASX Release

This article includes content from Eastern Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EMS:AU

The Conversation (0)

07 October 2024

Eastern Metals

Exploring for strategic metals vital to energy security in Australian, resource-rich provinces

Exploring for strategic metals vital to energy security in Australian, resource-rich provinces Keep Reading...

31 January 2025

Quarterly Activities and Cash Flow Reports 31 December 2024

Eastern Metals (EMS:AU) has announced Quarterly Activities and Cash Flow Reports 31 December 2024Download the PDF here. Keep Reading...

17h

What's Next for the Silver Price After $100 Per Ounce?

First Majestic Silver (TSX:AG,NYSE:AG) CEO Keith Neumeyer’s silver price prediction of over US$100 per ounce came true in 2026. When will silver prices make a more lasting hold in triple digit territory?The silver price was up over 189 percent year-on-year as of March 2, 2026, on the back of... Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

26 February

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00