September 21, 2023

Charger Metals NL (ASX: CHR, ‘Charger’ or ‘the Company’) reports that it has received the majority of the outstanding assay results from the drilling completed at the Bynoe Lithium Project, Northern Territory, adjacent to the Finniss Lithium Mine owned by Core Lithium Ltd (ASX:CXO).

- Assay results have been received for 63 holes drilled across seven prospects at the Bynoe Lithium Project in NT

- Results confirm lithium (Li) and tantalum (Ta) mineralisation in pegmatites at three of the prospects; results for a further 6 holes pending

- Ambient Noise Tomography (ANT) and ground gravity surveys have been completed over a large area in the northeast of the Bynoe Project

- The data from geophysical surveys are being processed and modelled with the aim of detecting any potentially large “blind” pegmatite systems that do not outcrop

- Additional infill surface geochemical sampling and mapping programmes have also been completed in the northeast

- Preparation underway for field programmes at the Lake Johnston Lithium Project, including drilling programmes at the Medcalf Spodumene Prospect and Mt Day Lithium Prospect

Assays have been received for 3 diamond drill-holes and 60 reverse circulation (“RC”) drill-holes from seven prospective target areas at Bynoe, with the results confirming lithium and tantalum mineralisation at three of the prospects: Enterprise, Utopia and 7Up (Figures 2 – 4).

However, the fractionation within the lithium- caesium-tantalum (“LCT”) pegmatites is not homogeneous, with the spodumene content of the pegmatite intersections inconsistent and low-grade.

Significant intersections to-date include:1

- 7m @ 0.96% Li2O from 107m, including

- 5m @ 1.13% Li2O from 108m (CBYRC023);

- 16m @ 0.65% Li2O from 185m, including

- 1m @ 1.91% Li2O from 198m (CBYRC024);2

- 12m @ 0.49% Li2O from 267m, including

- 4m @ 0.84% Li2O from 275m (CBYD003);

- 5m @ 0.73% Li2O from 104m, including

- 1m @ 1.05% Li2O from 108m (CBYRC042); and

- 6m @ 0.50% Li2O from 53m (CBYRC051).

Assay results for a further 6 holes remain outstanding and are expected over the next four weeks.

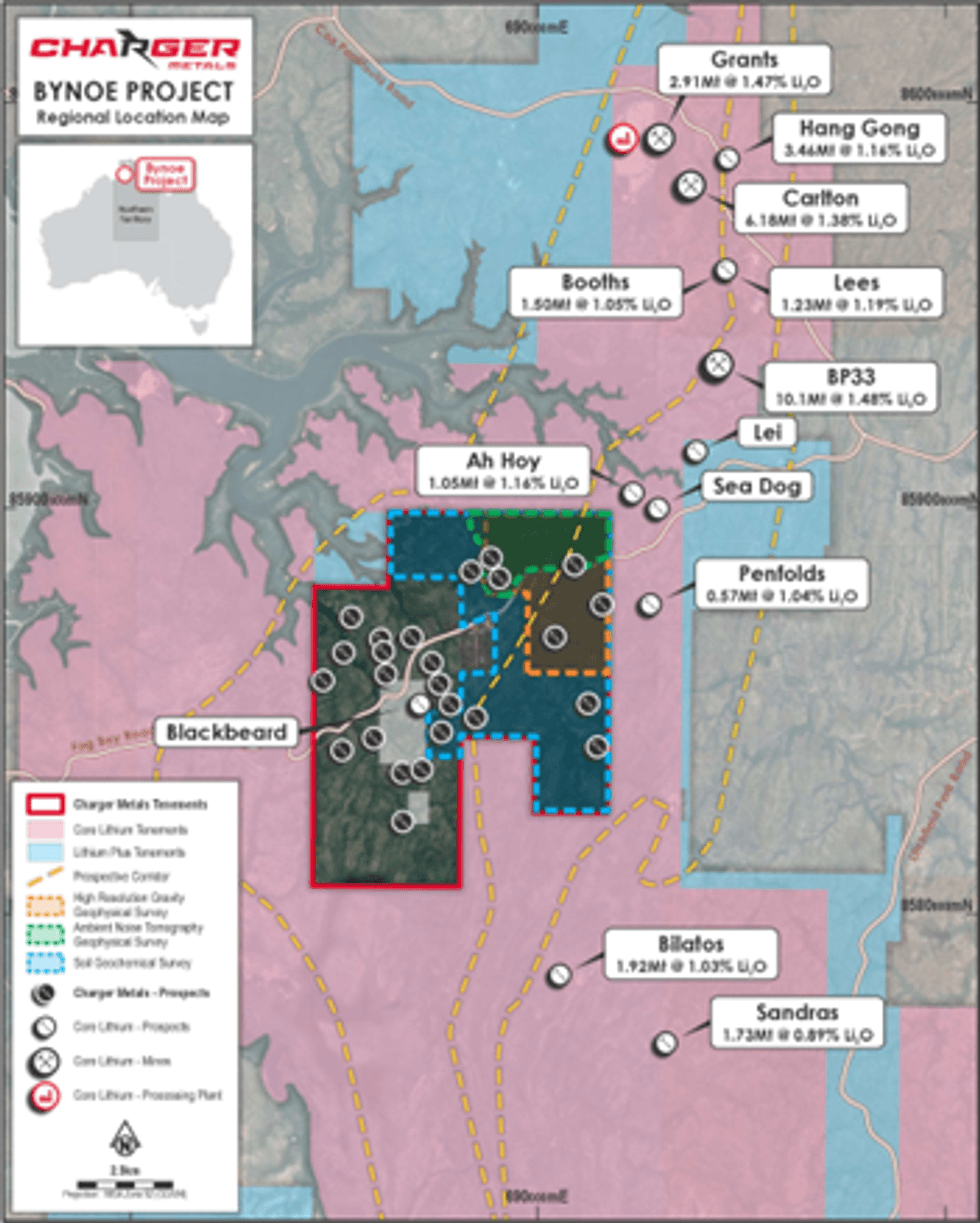

The Company has now completed an ANT geophysical survey in the northeastern portion of the Bynoe tenure (Figures 1 & 2). ANT is a form of passive seismic surveying that uses ambient sound waves to detect contrasting rock units, and has been used to successfully detect “blind” pegmatite systems that cannot be seen at surface. This is a particularly useful exploration tool at Bynoe to “see” below the strong weathering profile at surface to potentially detect large pegmatite systems that do not outcrop.

The Company has also completed a ground gravity survey over the northeastern portion of the Bynoe Project (Figures 1 & 2). Petrophysical testwork completed on drill core from the Company’s diamond drilling has shown a significant density contrast between the pegmatites and the metasedimentary country rock. As such, ground gravity has the potential to detect significant pegmatite systems at Bynoe, particularly when modelled in conjunction with the ANT survey results. Processing of the ANT and gravity data is underway with modelling and target generation expected to be finalised in October.

Concurrent to the geophysical surveys Charger has finalised infill surface geochemical surveys over key prospective areas at Bynoe (Figures 1 & 2). Areas of no previous sampling or wide-spaced (400m) sampling were infilled to 200m line spacing. Assays are pending with results expected in late October.

Charger’s Managing Director, Aidan Platel, commented:

“We are encouraged by the recent assay results, which confirm our observations of spodumene within pegmatites at three of the seven prospects we have drilled to-date at Bynoe. Whilst the lithium results have been low-grade, where there is smoke there is fire, and we remain confident of intersecting economic lithium mineralisation given the numerous (>20) prospect areas identified within the large tenement area.

Given the “masking” effect at surface from the seasonally wet conditions which leach the lithium from the significant weathering profile, lithium exploration at Bynoe is difficult using the more traditional exploration methods (e.g. rock chip sampling). As such, we have completed concurrent ANT and gravity surveys which have the ability to delineate new high priority drill targets that are not apparent at surface, across prospective yet underexplored areas of the Bynoe Project. We look forward to seeing the modelled results of these surveys in October.

In the meantime, preparations are underway to resume exploration programmes at our Lake Johnston Project, in Western Australia, which will include diamond and RC drill programmes at the Medcalf Spodumene Prospect.”

Click here for the full ASX Release

This article includes content from Charger Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CHR:AU

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00