iMetal Resources, Inc. (TSX.V:IMR) (OTC PINK:ADTFF) (FRANKFURT:A7V2) ('iMetal' or the 'Company') is pleased to release assay results from the late April 2021 field program at its flagship Gowganda West property in the Shining Tree District part of the Abitibi Greenstone Gold Belt of Northern Ontario (see 2021-May-11 News Release). The program concentrated largely at Zone 1 and Zone 3, in preparation for trenching and drilling. Highlights include

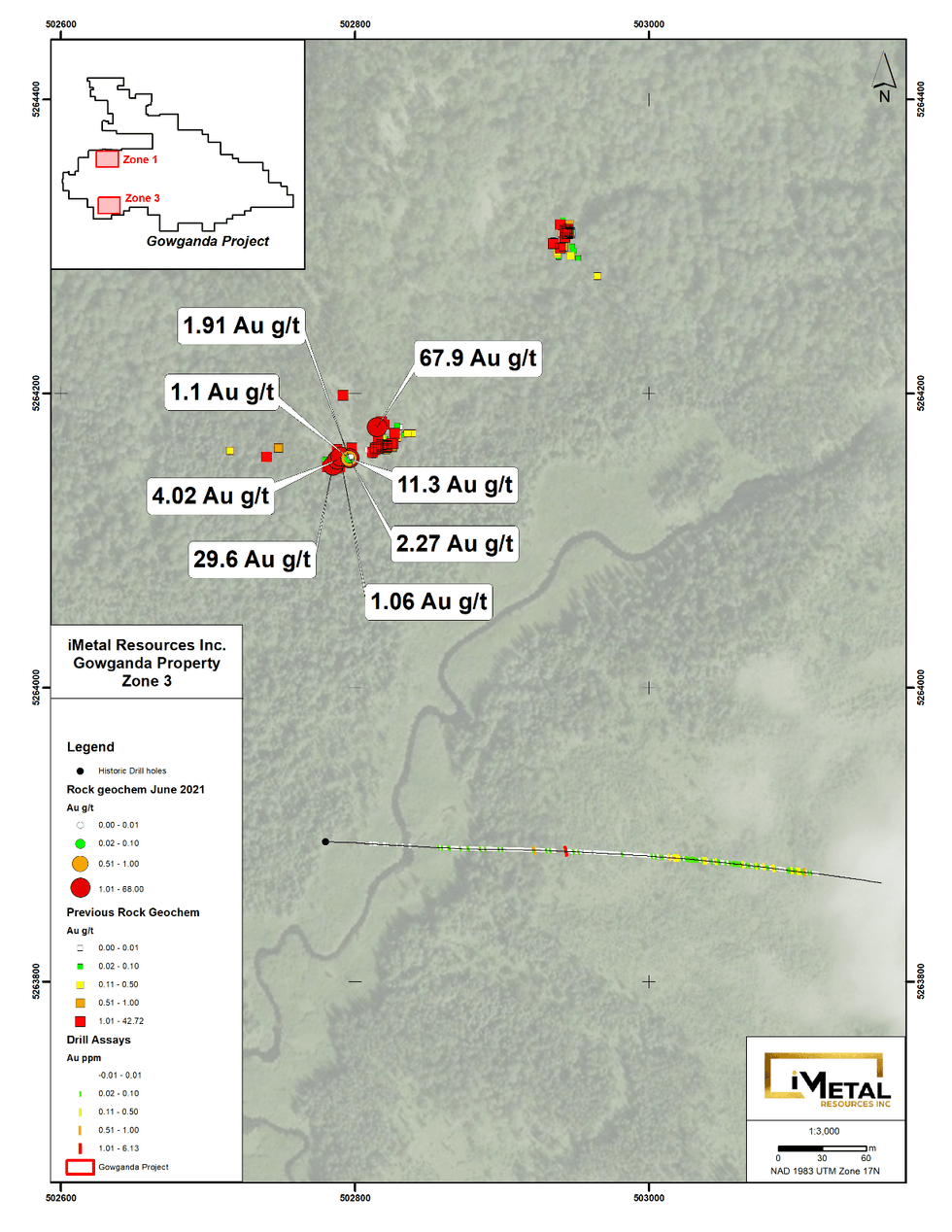

- Zone 3 highlights include: grab sample values of 67.9, 29.6 and 11.3 g/t gold.

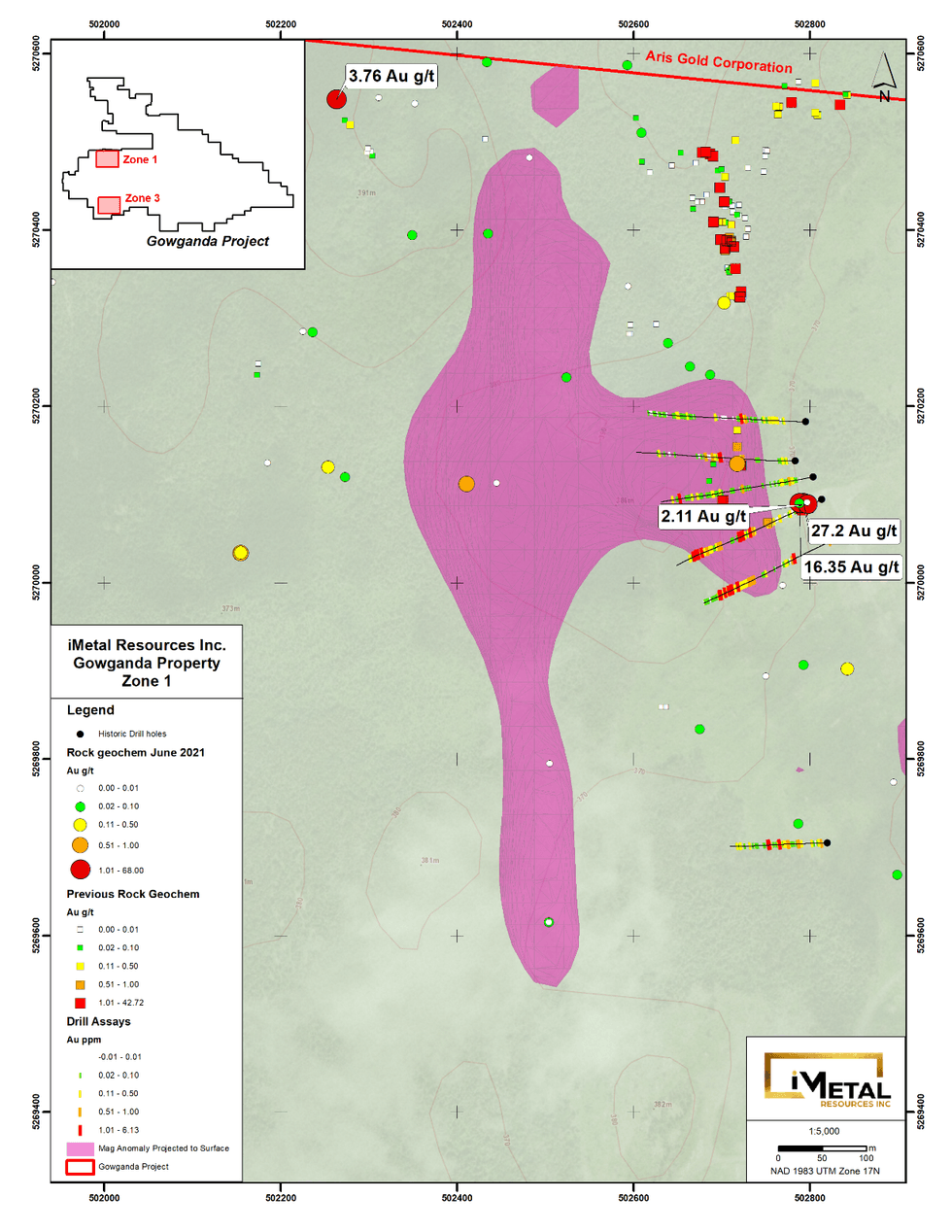

- Zone 1 highlights include: gold g/t grab sample values of 27.2 and 16.35

- A value of 3.72 g/t gold was returned from a location approximately 400 metres to the NW

iMetal cautions investors the grab samples are selective and may not necessarily be representative of the showing as a whole.

'The 2021 results confirm the earlier sampling and have defined the target areas for the upcoming trenching and drilling programs,' commented iMetal CEO, Saf Dhillon. 'The recent gold samples collected well to the west of the known mineralization at Zone 1 argues for additional structures at Gowganda, fitting in with our theory of a significant mineralized system at Gowganda,' he continued. 'We expect to commence the fully permitted trenching program forthwith, in preparation for a follow-up drilling program,' he concluded.

Zone 1 is associated with Timiskaming type metasedimentary rocks comprising siltstone, sandstone and predominately conglomerate. Gold mineralization is found where conglomerate transitions into finer grained rock types. The conglomerate contains clasts of jasper rich, banded iron formation and is highly magnetic. In additional, the conglomerate contains significant amounts of pyrite, resulting in the unit showing as strongly conductive in induced polarization surveys. The 2018 airborne mag and 2019 IP surveys have allowed mapping of the conglomerate and its boundaries.

Figure1. Zone 1 Sampling

Zone 1 mineralization seems to occur within northward trending structures at or near geological boundaries with conglomerate and finer grained sediments. Exposures in cleared areas from historical work shows potassic alteration and silica flooding over significant widths. Recent sampling in Zone 1 has confirmed previous sampling and shows a north-south trend to gold mineralization. Faulting in this area also trends north south and has served as corridors for late diabase dikes that have intruded into the existing weaker bedrock. Gold mineralization is associated with narrow, quartz-carbonate-pyrite veins hosted within wider zones of ankerite-albite-silica-sericite alteration and variable amounts of fine-grained, disseminated pyrite. Gold appears to be associated with pyrite, the higher the pyrite content generally the higher the gold content.

Figure1. Zone 3 Sampling

Zone 3 similarly is hosted in metasedimentary rocks, however, the mineralization is oriented northeast-southwest and dips westward. Fifteen samples were taken from this area in April eight of which returned gold values over 1 g/t gold with a highlight value of 67 g/t gold. The highest-grade samples were found in larger areas of silica flooding associated with narrow units of felsic intrusive rock. Past sampling in this area also returned high grade gold. The Zone 3 exposure is found in a recently logged area and does not appear to have seen any past exploration.

A total of 121 samples were taken during the April program with 26 returning values in excess of 0.1 g/t gold. Twelve of the 26 returned values in excess of 1 g/t gold, of which 5 were in excess of 10 g/t gold.

Table 1. Grab Samples from 2021 prospecting work in Excess of 0.1 g/t Gold

Sample ID | g/t gold | Location |

| Sample ID | g/t gold | Location |

167303 | 67.9 | Zone 3 | 167397 | 27.2 | Zone 1 | |

167252 | 29.6 | Zone 3 | 167398 | 16.35 | Zone 1 | |

167015 | 11.3 | Zone 3 | 167003 | 2.11 | Zone 1 | |

167008 | 4.02 | Zone 3 |

|

|

| |

167009 | 2.27 | Zone 3 | 167312 | 3.76 | Zone 1 W | |

167010 | 1.91 | Zone 3 |

| |||

167014 | 1.1 | Zone 3 |

| |||

167354 | 1.06 | Zone 3 |

|

|

|

|

QAQC

All grab samples were delivered by the geological contractor to ALS Minerals in Thunder Bay, an ISO/IEC 17025:2017 accredited facility. All samples were analyzed with ALS's AuME-TL43 procedure, a 25 gram aqua regia digestion with an ICP-MS finish with a 1 gram upper limit for gold. All overlimit gold values were fire assayed with a 30 gram sample and a gravimetric finish, ALS's Au-GRA21 procedure.

About Gowganda West

The Gowganda West property covers approximately 147 sq km in the Shining Tree volcano-sedimentary succession of the southwestern Abitibi Greenstone Gold Belt contiguous to the north and west of Aris Gold Corp.'s (TSX: ARIS) (formerly Caldas Gold Corp.) Juby Gold deposit, a series of four mineralized alteration zones along the Tyrrell Shear Zone. Gold mineralization at Juby is associated with narrow quartz-carbonate-pyrite veins hosted within 20 to 330 metre wide zones of ankerite-albite-silica-sericite alteration and variable amounts of fine-grained, disseminated pyrite and also with multiple lenses containing narrow (iMetal cautions investors mineralization at Juby is not necessarily indicative of similar mineralization at Gowganda West.

Source: Technical Report on the Updated Mineral Resource Estimate for the Juby Gold Deposit for Caldas Gold Corp. (named currently changed to Aris Gold Corp.) Dated 2020-Oct-05 By: J. Campbell, A. Sexton, D. Studd, and A. Armitage.

iMetal acquired Gowganda West in 2016, discovering Zone 1 and Zone 3 through focused exploration proximal to the Aris property border, and subsequently completing programs of prospecting, channel sampling, airborne VTEM, ground IP and limited diamond drilling.

Zone 1 has excellent access and has been traced over 500m south from the Juby property boundary. Two distinct outcrop areas approximately 300m apart have been sampled, Zone 1 and Zone 1 South. Highlight grab samples include: 6.47 g/t Au from Zone 1 and 39.3 g/t Au, and 16.9 g/t Au from Zone 1 South. Five holes were subsequently drilled in 2019 and one in 2020 at Zone 1, focusing on a short 150 strike length of Zone 1S. Highlight drill intersections included: 2.95 g/t Au over 2.5 metres, 1.43 g/t Au over 4.6 metres and longer intervals of 0.37 g/t au over 29.4 metres and 0.32 g/t au over 30.25 metres.

Zone 3 consists of two distinct areas separated by 225 metres, 3A and 3B are located approximately 6 kilometres due south of Zone 1,. Highlights from Zone 3A grab sample results include 56.59 g/t Au and 34.81 g/t Au, while highlight Zone 3B grab sample results include 14.74 g/t Au and 12.7 g/t Au. Zone 3A and Zone 3B remain undrilled.

About iMetal Resources Inc.

A Canadian based junior exploration company focused on the exploration and development of its portfolio of resource properties in Ontario and Quebec. iMetal's is focused on advancing its Gowganda West Project that borders the Juby Project, an advanced exploration-stage gold project located within the Shining Tree area in the southern part of the Abitibi greenstone belt about 100 km south-southeast of the Timmins gold camp.

The Company is also focused on the Oakes Gold Project which forms part of a portfolio of projects it recently acquired from Riverside Resources Inc. (TSXV: RRI) who is now a strategic investor/partner. The Oakes Gold Project is located in the Oakes Township just north of Canadian National Highway 11 and about 2km north of the town of Long Lac, Ontario. The Oakes Township is part of the well-endowed Beardmore-Geraldton Greenstone Belt region, located northeast of Thunder Bay, Ontario and the region has a long and rich mining history that has produced 4.1 million ounces of gold over the past 100 years including the combined MacLeod-Cockshutt Mine, which produced 1.5 million ounces of gold. More recently, the Hardrock Project held 50% by Equinox Gold Corp. (TSX: EQX) has elevated attention to the area by announcing their intention to mine their gold resource near Geraldton, Ontario.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by R. Tim Henneberry, PGeo (British Columbia), a Director of iMetal, and a 'qualified person' as defined in National Instrument 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS,

Saf Dhillon

President & Chief Executive Officer

iMetal Resources Inc.

saf@imetalresources.ca

Tel. (604-484-3031)

Suite 510, 580 Hornby Street, Vancouver, British Columbia, V6C 3B6.

https://imetalresources.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may include forward-looking statements that are subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward looking. Forward-looking statements in this news release include, but are not limited to: statements with respect to future exploration and drilling of the Company; statements with respect to the release of assays and exploration results; and statements with respect to the Company's geological understanding of its mineral properties. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include results of exploration, variations in results of mineralization, relationships with local communities, market prices, continued availability of capital and financing, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements except as required under the applicable laws.

SOURCE: iMetal Resources, Inc.

View source version on accesswire.com:

https://www.accesswire.com/651223/iMetal-Returns-Highlights-of-697-GT-Gold-from-Grab-Samples-at-Gowganda