Lead Outlook 2020: Continued Headwinds to Soften Prices

Lead had a volatile 2019, but what’s the lead outlook for 2020? Read on to find out what analysts had to say about the market.

Click here to read the latest lead outlook.

In 2018, the extent that lead prices declined surprised market participants, but 2019 held a different story for the base metal.

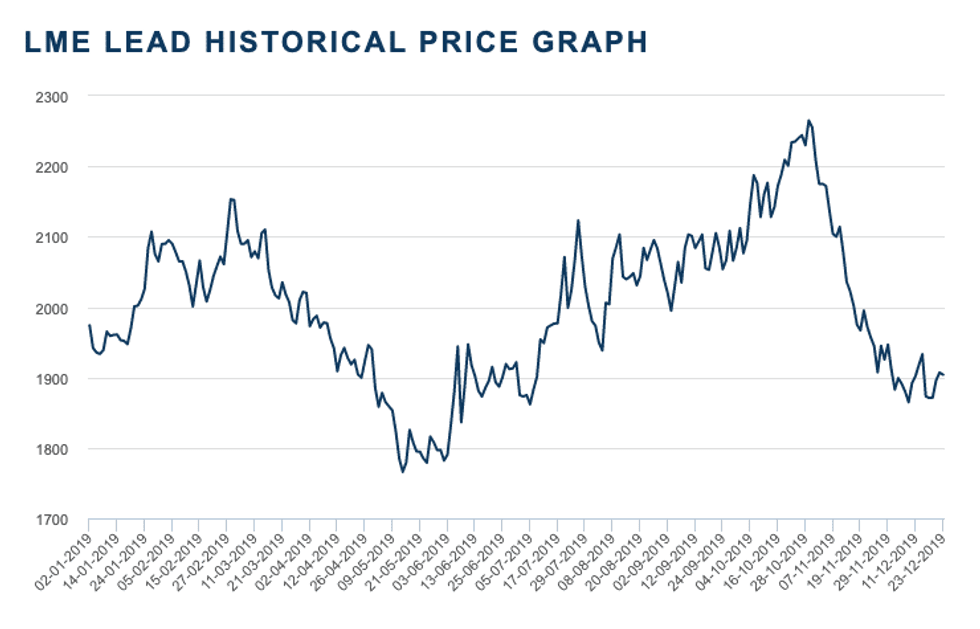

Volatility was the name of the game for lead, with prices finishing the year almost neutral at US$1,907 per metric ton despite hitting a yearly high of US$2,255 in October.

As the year comes to a close, the Investing News Network (INN) is looking back at the main trends in the lead space in 2019 and what’s ahead for prices, supply and demand in the new year. Read on to learn what analysts and market participants had to say.

Lead trends 2019: Price performance review

Lead started the year trading close to the US$2,000 mark, but by the second quarter the metal had lost most of the ground it gained, touching a low of US$1,766 in May.

The ongoing US-China trade war weighed on all base metals prices in 2019, and lead was no exception.

Additionally, the H2 period saw weaker-than-expected factory growth in China paired with a slower expansion in construction activity. China is the world’s largest producer and consumer of lead.

According to FocusEconomics analysts, these factors indicated that the country’s economy was struggling to pick up despite a shot of fiscal stimulus.

Chart courtesy of the London Metal Exchange.

The second half of the year saw lead prices rebound to hit their yearly high on October 30 at US$2,265.

Speaking with INN at the time, Wood Mackenzie Principal Analyst Farid Ahmed said the surge in price was in part due to a tight market.

“There continues to be a tight market — both for concentrates and refined metal — despite the fact that the lead market is currently in the transition phase from four years of deficits into several years of surplus,” said Ahmed. “While not an absolute measure in itself, this is reinforced by London Metal Exchange (LME) lead stocks still reducing further from the lowest levels for a decade.”

As the year came to a close, lead prices started to retreat, losing their gains to remain almost neutral by the end of the last quarter.

FocusEconomics analysts have said that lead prices fell sharply from the end of October as increasing fears over lingering trade tensions and slowing global growth weighed on demand, while supply appeared to remain ample.

Aside from prices, one of the biggest news items in the sector was the extended production cuts at Nyrstar’s (OTC Pink:NYRSY,EBR:NYR) Port Pirie primary lead smelter in Australia.

“The scale of the production loss at Port Pirie (with smaller underperformances at other primary smelters) resulted in 2019 posting a third year in a row of deficit, with tightening metal availability in the Asian market, where nearly all of the Port Pirie lead is sold,” CRU Group Principal Analyst Neil Hawkes said to INN via email.

However, the degree of tightening in Asia and globally was, according to the expert, undoubtedly eased by lackluster lead demand, amid weaker vehicle sales and a broader sluggishness in economic growth around the world.

“The biggest bearish trend this year has been a second year in a row of falling Chinese lead demand, hit not only by a broader slowdown in economic growth (not helped by US-Chinese trade tensions), but also due to policy changes in national standards for the automotive, e-bike and telecoms markets.”

Lead outlook 2020: What’s ahead

Looking ahead and overall, WoodMac’s Ahmed expects prices to eventually weaken to average around US$2,000 next year and nearer to US$1,900 in the years after.

“Short-term prices are vulnerable to the factors mentioned … but overall, as the lead market moves into surplus from next year onwards and (there is) a general weakening in the global economy — not least in automotive demand — we envisage lead prices dropping nearer to US$2,000 for next year and softening further in the following years,” he said.

For his part, CRU Group’s Hawkes said the recent price fall heralds further downside to come in 2020 as this year’s already shrinking global lead market deficit finally flips into surplus.

“Although lead demand is set to pick up a little, it will remain decidedly modest and will be outpaced by a bigger rise in production on a big Port Pirie-led rebound in primary smelter output rejoining further rises in the dominant recycling side of supply,” he said.

CRU Group still sees LME lead prices posting fresh lows into the US$1,700s, and anticipates that the 2020 price average will mark the first sub-US$2,000 outcome since 2016.

“Perhaps the biggest upside price risk is that Port Pirie has more production problems, while the biggest downside risk is that Chinese-led global lead demand has another bad year as the economic picture deteriorates rather than modestly improves,” Hawkes said.

Meanwhile, FocusEconomics analysts see prices climbing next year as demand from the global automotive industry, which uses the metal in the production of car batteries, picks up in the next 12 months.

“Moreover, smelter closures and production cuts amid greater environmental controls in China are expected to weigh on overall output,” analysts at the firm said.

Panelists polled by the firm see lead prices averaging US$2,031 in Q4 2020 and US$2,050 in Q4 2021.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.