August 21, 2023

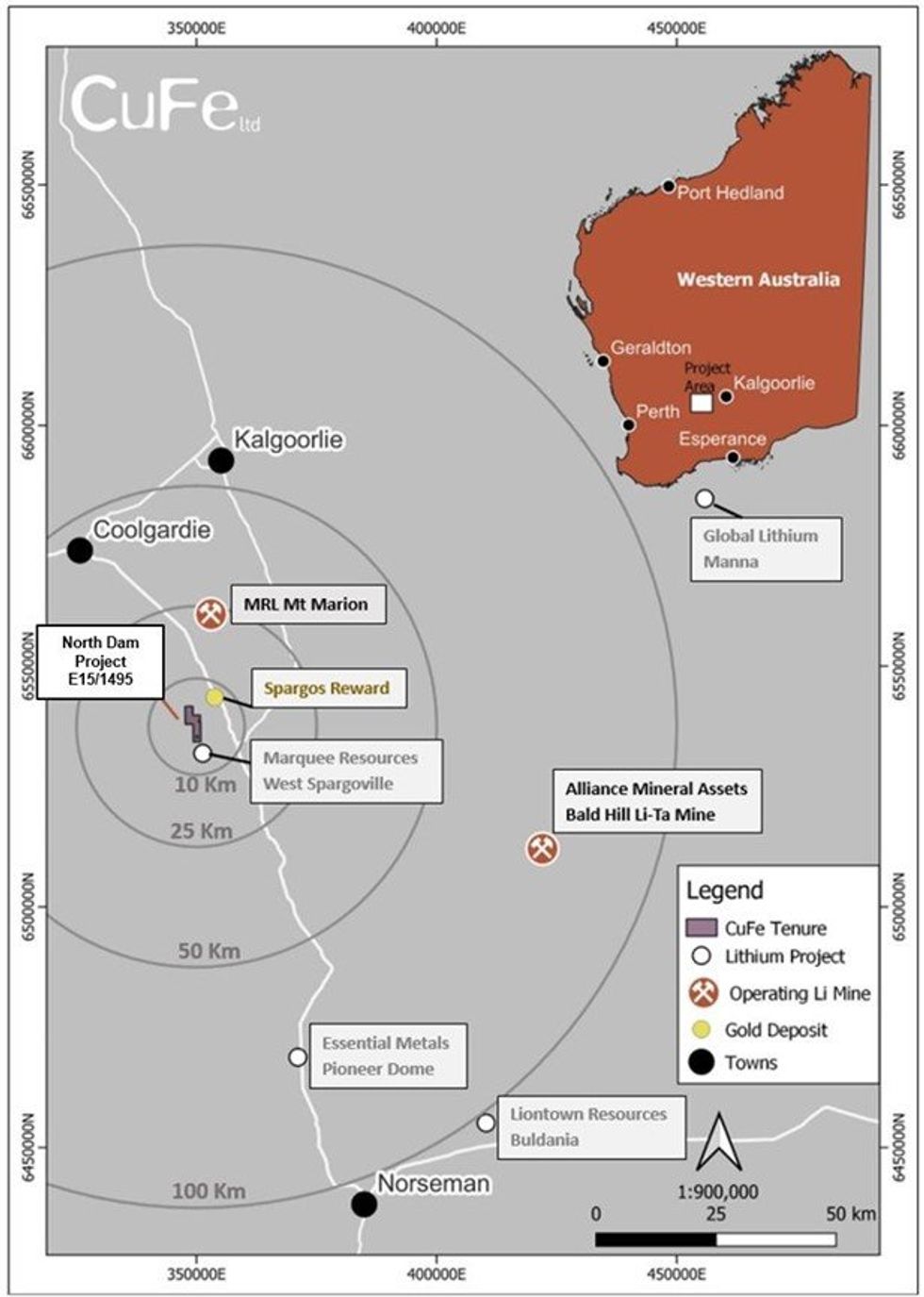

CuFe Ltd (ASX: CUF) (CuFe or the Company) is pleased to advise it has commenced exploration within E15/1495, North Dam Project, over several field and reconnaissance trips, located 29kms south of Mineral Resources Mt Marion Mine, and 50km south, south east of the township of Coolgardie (see Figure 1).

HIGHLIGHTS

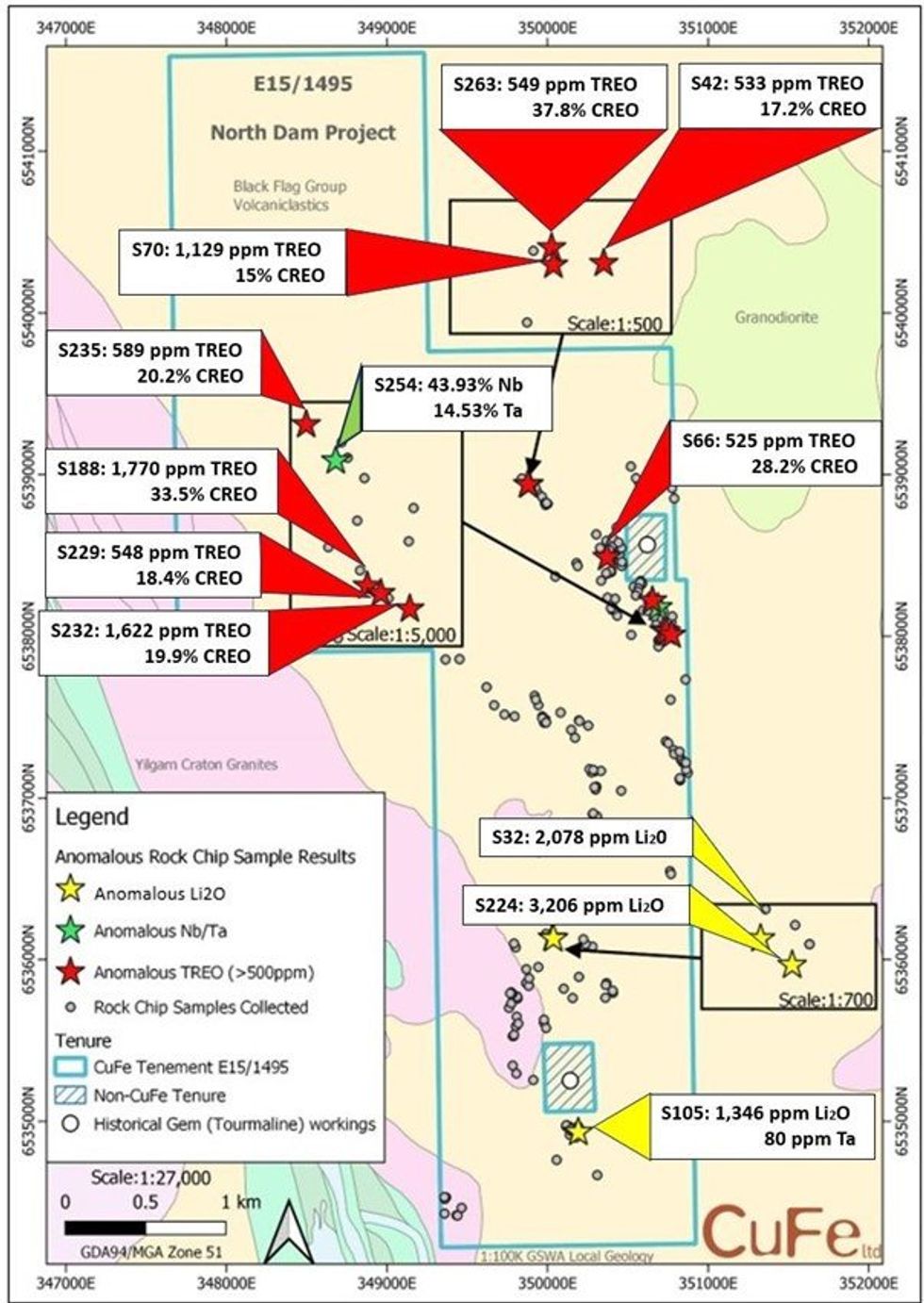

- Early exploration on E15/1495 has produced rock chip sample results anomalous in Rare Earth Elements (REE) (up to 1,770ppm Total Rare Earth Oxides (TREO)), Niobium (43.93% Nb), Tantalum (14.53% Ta) and Lithium Oxide (up to 3,206 ppm Li2O).

- 40% of outcrops within the E15/1495 tenement have been investigated through rock chip sampling and geological mapping which confirms the presence of Lithium Cesium Tantalum (LCT) type, highly fractionated pegmatites.

- Target zones of anomalous Li2O supported by historical soils and auger work have been identified and will be a focus of upcoming exploration works.

- High niobium/tantalum columbite and tantalite chips collected from a shallow stream potentially indicate a nearby source location and is under further investigation.

- A broad zone of weathered pegmatites has reported anomalous REE, with Critical Rare Earth Oxides (CREO) (Nd2O3 + Pr6O11) making up to 37.8% of the TREO.

CuFe Executive Director, Mark Hancock, commented “The results and speed at which our Geology team have generated these results is very pleasing and while its early days, show the potential of this tenement to host deposits of a variety of future facing minerals. There is a lot of outcrop to cover across this tenement and the team are busy on the ground gathering information to help zone in on the more prospective areas, with the aim of planning subsequent drill programs and further works.”

First pass investigations to date have included general reconnaissance, outcrop mapping and rock chip sampling with a significant area across the tenement yet to be covered. 267 rock chips have been collected from North Dam across outcropping pegmatites and weathered regolith.

The tenement hosts numerous pegmatites, ranging in thickness. Typically, the pegmatites outcrop as upright North, North-West (NNW) trending bodies, coincident with more regional trends, however cross cutting East-West structurally controlled bodies have also been identified. Typical pegmatite mineralogies include quartz, mica, feldspar, albite but also include tourmaline, beryl, columbite and tantalite.

A broad rock chip sampling program has been undertaken as an early stage of exploration works (see Figure 2). The results and summary are as follows:

1. Anomalous REE values, in areas of heavily weathered pegmatites and saprolitic outcrops. Eight notable results (See Figure 1 and Table 1) above 500 ppm TREO were collected from outcrops situated along a series of NNW trending pegmatites. The weathered nature of the pegmatites prevents the widths from being determined, however the interpreted corridor has a length of 1.3km from S188 to S42. The highest TREO was recorded in S188 (See Figure 3 and 4). CREO (Nd2O3 + Pr6O11) are as high as 37.8% of the TREO within S263.

2. Presence of columbite and tantalite and high-grade Niobium and Tantalum of 43.93% and 14.53% respectively (see Table 2). Columbite and tantalite chips were collected from an open stream bed represented in sample S254 (see Figure 5), the area sampled comprised 78m2 over 97m of the stream bed (see Figure 6). It is noted that this sample is not representative of the original source location concentration and has been selectively collected from the stream bed and is inherently biased. What it does show is the presence of columbite locally as the chips have been weathered out and deposited at surface in the stream bed. An outcropping pegmatite approximately 15m upstream (see Figure 6) from the creek bed collection point has been identified as a potential source of the columbite and tantalite and is being investigated and sampled as part of future exploration works.

Click here for the full ASX Release

This article includes content from CUFE LTD, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 July 2025

CuFe Limited

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium.

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium. Keep Reading...

Latest News

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00