Critical Elements Lithium Corporation (TSX-V:CRE) (OTCQX:CRECF) (FSE:F12) ("Critical Elements" or the "Corporation") is pleased to announce completion of an Engineering Study for a Lithium Hydroxide Monohydrate plant. Consistent with the Corporation's conservative, phased approach, the study is based on a standalone conversion plant and does not constitute a "mineral project" for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Furthermore, the plant does not form part of the Corporation's Rose Lithium-Tantalum project which consists solely of a mine to produce spodumene and tantalum concentrates (for more details, see press release dated June 13, 2022, announcing the results of a new positive feasibility study on the Rose Lithium project). As at the date hereof, notwithstanding today's announcement, the Corporation is not in a position to confirm that a Lithium Hydroxide Monohydrate plant will ever be implemented

This strategic milestone could enable Critical Elements to become an important player in the North American Lithium market. Generating separate, standalone engineering studies for (i) the Rose Lithium-Tantalum project and (ii) the Lithium Hydroxide Monohydrate plant may optimize the outcome of discussions with potential strategic investors and end-users.

The Engineering Study for a Lithium Hydroxide Monohydrate plant is based on a yearly production of 30,670 tonnes of high-quality battery grade lithium hydroxide monohydrate from 220,587 tonnes of spodumene concentrate purchased solely on the world market on long term contract basis. The study does not rely on or is not based on any purchases of spodumene concentrate from the Corporation's Rose Lithium-Tantalum project. The operating parameters for the Engineering Study were taken from the joint Metso Outotec and Critical Elements Lithium Corporation piloting programs.

Lithium Hydroxide Plant

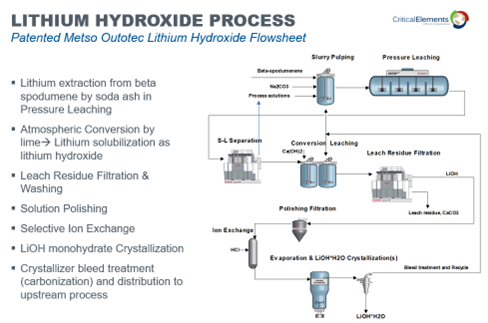

The lithium hydroxide plant design and technology was developed by Metso Outotec. It consists of four main areas; calcination, hydrometallurgy, reagent preparation, and final product packaging. The site infrastructure was designed to enable operation of the Process plant.

The Calcination Area consists of the conversion of the spodumene into a leachable concentrate. This step is required prior to the hydrometallurgical process.

The calcination area includes drying and pre-heating the feed material in a preheating stage, calcination in a fluidized-bed calciner and product cooling in a cooling step and fluidized-bed cooler, respectively. The calciner would be fired with natural gas.

The Hydrometallurgical area includes the pressure leaching, conversion, ion exchange and crystallization stages to produce battery grade lithium hydroxide monohydrate.

Metso Outotec technologies result in a compact footprint lithium hydroxide production plant with optimized energy-efficiency and low chemical consumption to produce 27,000 metric tons per annum of Lithium Carbonate Equivalent (LCE), which corresponds to 30,670 metric tons per annum of battery grade lithium hydroxide monohydrate (LMH).

Figure 1: Process flowsheet

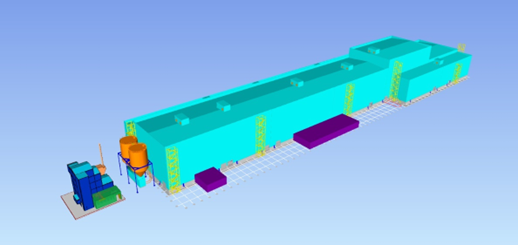

Figure 2: View of the Lithium Hydroxide Conversion Plant

Infrastructure

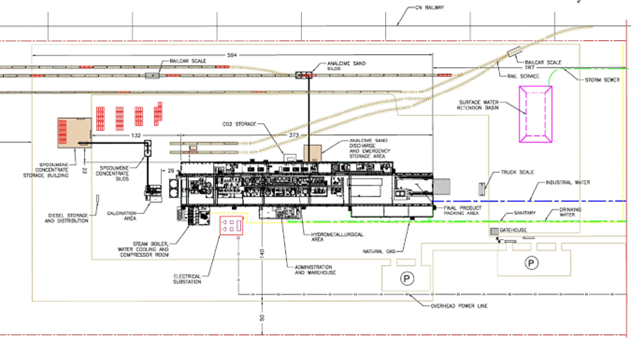

The infrastructure supporting Metso Outotec's lithium hydroxide process plant was designed by WSP and includes the following areas:

- Site Earthwork (road, industrial pad, buried services, parking, etc.);

- Administration building and warehouse;

- Boiler, compressors, and cooling tower building;

- Spodumene handling and storage;

- Analcime sand handling and storage;

- Electrical substation.

The location of the plant has not yet been identified. There are several potential properties available in the province of Québec, Canada, with the necessary amenities proximal to where the plant could be constructed. Locating the plant on any of these properties is not expected to significantly impact the capital and operating costs of this project. For the purpose of the study, the plant was assumed to be constructed in the Bécancour Industrial Park across the river from Trois-Rivières, an important regional hub on the Saint-Lawrence River offering a central access to Québec highways, railways and the Saint-Lawrence Marine Corridor.

Figure 3: Property General Arrangement

As at the date hereof, the Corporation is not in a position to confirm that a Lithium Hydroxide Monohydrate plant will ever be implemented or that it will be located in the Bécancour area.

Costs

The costs prepared for the study are based on a Class 3 type estimate as defined per the American Association of Cost Engineers (AACE) International Practice 18R-97 (Cost estimate classification system - As applied in Engineering, Procurement, and Construction in the Process industries). The capital cost estimate has an accuracy of +/-15% based on costs of Q2 2022.

Metso Outotec provided capital cost estimates for the process equipment, electrification, instrumentation, automation, piping, engineering, and technical assistance during commissioning. WSP Canada estimated the capital cost construction of the plant building based on quantities provided by Metso Outotec. WSP Canada estimated the capital cost for all site infrastructure and equipment outside the plant's battery limits.

The annual and unit process operating costs for the processing plant were determined for an annual production of 30,670 metric tons per year of battery grade lithium hydroxide monohydrate (LMH). The estimated operating costs for the Lithium Hydroxide Plant include labour, electricity costs, natural gas consumption, potable and industrial water costs, maintenance materials, mobile equipment costs, and reagents. Metso Outotec provided the consumption of reagents and services on which WSP Canada based their respective costs.

Next Steps

Given the positive results of the study, Critical Elements will continue to evaluate possible site locations for a potential future plant. The Corporation is engaged in a process with its financial advisor, Cantor Fitzgerald, to identify a strategic partner for the Rose Lithium-Tantalum project and has been working to maintain strategic flexibility which explains the standalone nature of the Lithium Hydroxide Monohydrate plant. At this time, the Corporation is not in a position to take a decision on implementation of the Lithium Hydroxide Monohydrate plant. Until a definitive agreement is in place with a strategic group, the Corporation's strategy is to maintain that flexibility.

The primary focus of the Corporation continues to be the development of the Rose Lithium-Tantalum project, which has received approval from the Federal Minister of Environment and Climate Change on the recommendation of the Joint Assessment Committee, comprised of representatives from the Impact Assessment Agency of Canada and the Cree Nation Government. The Corporation remains confident in receiving similar approval under the Québec environmental assessment process and believes that receipt of Québec approval may be catalytic in concluding the aforementioned discussions.

Strategic Partner and Project Financing Discussion

Critical Elements continues to work closely with its financial advisor, Cantor Fitzgerald, to evaluate ongoing interest from global strategic partners that seek to accelerate the Rose Lithium-Tantalum project to production.

The process is organized and competitive and interest in the project is strong. In parallel, the Corporation is working with banks and financial institutions to accelerate the debt financing portion of the project.

The Corporation has held discussions with several automobile manufacturers, cathode manufacturers, trading houses and cell manufacturers. A substantial number of non-disclosure agreements with potential strategic partners are now in place, illustrative of the competitive tension in the lithium market. These parties are currently in the process of reviewing the Corporation's extensive data set in the data room.

Given their track-record, end-users recognize the ability of Critical Elements' management to successfully deliver lithium products and our development strategy provides the flexibility to meet all major end-users' current and future needs.

Consultants

The study is the work of several consultants including WSP Canada, Metso Outotec, and Gerrit Fuelling. Metso Outotec was responsible for the spodumene calcination and conversion to LiOH process design and equipment. The calcination of the concentrates was designed by Outotec GmbH & Co. of Germany and the hydrometallurgical conversion to LiOH was designed by Metso Outotec (Finland) Oy of Finland.

WSP Canada was responsible for the infrastructure necessary for the operation of the lithium hydroxide plant and study integration. Gerrit Fuelling provided the market study giving guidance for the price forecast for lithium hydrate monohydrate and spodumene concentrates.

The study is based on a standalone conversion plant and does not constitute a "mineral project" for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Furthermore, the plant does not form part of the Corporation's Rose Lithium project which consists solely of a mine to produce spodumene and tantalum concentrates. As at the date hereof, notwithstanding the results announced today, the Corporation is not in a position to confirm that a chemical plant to produce high quality lithium hydroxide monohydrate will ever be implemented.

About Critical Elements Lithium Corporation

Critical Elements aspires to become a large, responsible supplier of lithium to the flourishing electric vehicle and energy storage system industries. To this end, Critical Elements is advancing the wholly owned, high purity Rose lithium project in Québec. Rose is the Corporation's first lithium project to be advanced within a land portfolio of over 700 square kilometers. On June 13th, 2022, the Corporation announced results of a feasibility study on Rose for the production of spodumene concentrate. The after-tax internal rate of return for the Project is estimated at 82.4%, with an estimated after-tax net present value of US$1.9 B at an 8% discount rate. In the Corporation's view, Québec is strategically well-positioned for US and EU markets and boasts good infrastructure including a low-cost, low-carbon power grid featuring 93% hydroelectricity. The project has received approval from the Federal Minister of Environment and Climate Change on the recommendation of the Joint Assessment Committee, comprised of representatives from the Impact Assessment Agency of Canada and the Cree Nation Government; The Corporation is working to obtain similar approval under the Québec environmental assessment process. The Corporation also has a good, formalized relationship with the Cree Nation.

For further information, please contact:

Patrick Laperrière

Director of Investor Relations and Corporate Development

514-817-1119

plaperriere@cecorp.ca

www.cecorp.ca

Jean-Sébastien Lavallée, P. Géo.

Chief Executive Officer

819-354-5146

jslavallee@cecorp.ca

www.cecorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is described in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary statement concerning forward-looking statements

This news release contains "forward-looking information" within the meaning of Canadian Securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "scheduled", "anticipates", "expects" or "does not expect", "is expected", "scheduled", "targeted", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information contained herein include, without limitation, statements regarding the Corporation's future plans relating to projected a Lithium Hydroxide Monohydrate plant (the "Plant"); potential financing arrangements; the anticipated production of lithium hydroxide monohydrate and related processing methods; the anticipated timing of a final investment decision, construction activities and potential in-service date of the Plant; the anticipated features of the future site of the Plant and expected benefits thereof; Critical Elements' opinions, beliefs and expectations regarding the Corporation's business strategy, development and exploration opportunities and projects, and plans and objectives of management for the Corporation's operations and properties.

Forward-looking information is based on certain estimates, expectations, analysis and opinions of the Corporation and in certain cases, third party experts, that are believed by management of Critical to be reasonable at the time they were made. This forward-looking information was derived utilizing numerous assumptions regarding, among other things, the supply and demand for, deliveries of, and the level and volatility of prices of, intermediate and final lithium products, expected growth, performance and business operation, future commodity prices and exchange rates, prospects and opportunities, general business and economic conditions, results of development and exploration, Critical Elements' ability to procure supplies and other equipment necessary for its business. The foregoing list is not exhaustive of all assumptions which may have been used in developing the forward-looking information. While Critical considers these assumptions to be reasonable based on information currently available, they may prove to be incorrect. Forward-looking information should not be read as a guarantee of future performance or results.

Although Critical Elements has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Factors that may cause actual results to differ materially from expected results described in forward-looking information include, but are not limited to: the Corporation's ability to access funding required to invest in available opportunities and projects (including the proposed Plant) and on satisfactory terms, the current and potential adverse impacts of the COVID-19 pandemic, including future outbreaks and any associated policies or restrictions on business, the risk that Critical will not be able to meet its financial obligations as they fall due, changes in commodity and other prices, Critical Elements' ability to retain and attract skilled staff and to secure feedstock from third party suppliers, unanticipated events and other difficulties related to construction, development and operation of the Plant, the cost of compliance with current and future environmental and other laws and regulations, title defects, competition from existing and new competitors, changes in currency exchange rates, market prices of Critical Elements' securities, as well as those risk factors set out in the Corporation's Management Discussion and Analysis for its most recent quarter ended May 31, 2022 and other disclosure documents available under the Corporation's SEDAR profile at www.sedar.com. Forward-looking information contained herein is made as of the date of this news release and Critical Elements disclaims any obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

SOURCE: Critical Elements Lithium Corporation

View source version on accesswire.com:

https://www.accesswire.com/711731/Critical-Elements-complete-Positive-Engineering-Study-for-a-Lithium-Hydroxide-Monohydrate-Plant