August 02, 2022

Copper Fox Metals Inc. (TSXV: CUU) (OTCQX: CPFXF) ("Copper Fox" or the "Company") through its wholly owned subsidiary Northern Fox Copper Inc. is pleased to provide an update on its 100% owned Eaglehead polymetallic porphyry copper project located approximately 50 kilometers ('km') east of Dease Lake, British Columbia. The Eaglehead project covers a large portion (16,492.62 ha) of the Lower Jurassic age (+/-195Ma), Eaglehead stock. Field work commenced in mid-June. A summary of activities completed in anticipation of receipt of the approval to conduct drilling operations are noted below:

Summary of Activities

- Moose Mountain Technical Services has provided its comments and input to the location/orientation of the proposed 2022 drilling program.

- Approval for the Notice of Work ("NoW") to conduct the proposed drilling program is pending.

- Review of specific historical drill core has confirmed the "quartz eye" porphyry as a late-stage intrusive unit (news release dated June 13, 2022).

- Review of historical drill core has located several un-sampled, mineralized (chalcopyrite-bornite) intervals. Sampling of these intervals is now in progress.

- The field portion of the archaeological survey has been completed. Receipt of the study is pending.

- The water quality survey continues with 16 stream water samples being collected and sent for analysis.

- The 2022 mapping/prospecting program has been completed.

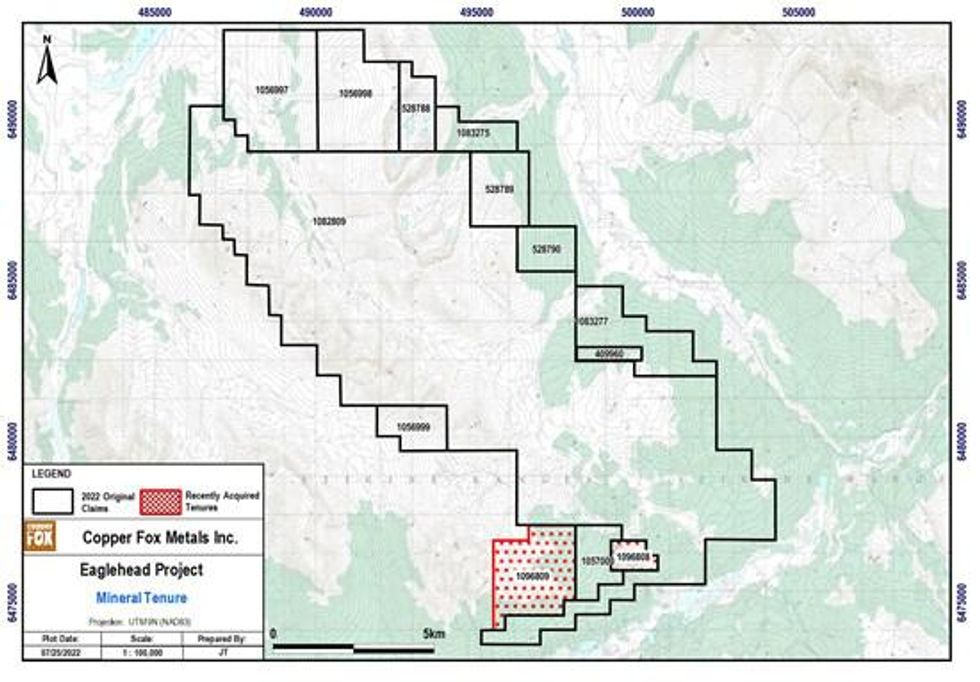

- Two additional mineral tenures have been added to the project. These tenures were located by Copper Fox.

Elmer B. Stewart, President and CEO of Copper Fox stated, "We are cautiously optimistic that the approval for the NoW should be received shortly, and drilling operations can commence. The identification of the "quartz eye" porphyry indicates that the porphyry deposit represented by the Bornite and East zones is more complex than initially modelled and previously un-sampled mineralized intervals suggests that the mineralized envelopes in these zones are larger than initially modelled. Several new copper showings were located during the 2022 mapping/prospecting program. The two new mineral tenures were acquired to cover potential infrastructure sites if the project advances to, and potentially beyond, the resource estimation stage."

Drilling

Approval of the NoW that is required to conduct the proposed 2022 drilling program is pending. The site visit portion of the approval process and the field work portion of the archaeological survey have been completed. The proposed drilling will test the 500-meter-long interval (the "Gap") between the Bornite and East zones to test continuity of the mineralization. Location of the proposed 2022 drilling program were shown in a news release dated June 13, 2022.

Geological Modeling

A review of selected historical drill holes has confirmed and better informed the spatial distribution of the "quartz-eye" porphyry; a late-stage intrusive within the Bornite and East zones. This unit is variably mineralized, exhibits distinct quartz phenocrysts and intense phyllic alteration.

Archaeology and Water Quality Surveys

The field work portion of the archaeological survey of the access route and the proposed location for the 2022 drilling program have been competed. Preliminary results indicate no areas of historical, cultural or habitation sites. Findings of the survey will be announced on receipt of the final survey report. The first round of the stream water monitoring program has been completed. A total of 16 samples were collected and analytical results are pending. This survey is being completed to establish a background water quality data base for the project.

Mineral Tenures

Copper Fox has added two mineral tenures to the Eaglehead project. These tenures were acquired to secure specific areas for potential future use should the project advance to, or beyond, the resource estimation stage (see news release dated June 13, 2022).

Elmer B. Stewart, MSc. P. Geol., President and CEO of Copper Fox, is the Company's non-independent, nominated Qualified Person pursuant to National Instrument 43-101, Standards for Disclosure for Mineral Projects, and has reviewed and approves the scientific and technical information disclosed in this news release.

For additional information contact: Investor line 1-844-464-2820 or Lynn Ball, at 1-403-264-2820.

On behalf of the Board of Directors

Elmer B. Stewart

President and Chief Executive Officer

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of the Canadian securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "budgets", "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions. Forward-looking information in this news release include statements about: receiving the NoW; confirmation that the "quartz eye" is a late-stage intrusive unit; several new copper showings were located; mineral tenures acquired to cover potential infrastructure sites; project advancing to and potentially beyond the resource estimation stage.

In connection with the forward-looking information contained in this news release, Copper Fox and its subsidiaries have made numerous assumptions regarding, among other things: obtaining the NoW approval and permits; completing the 2022 program on time and within budget; the geological, metallurgical, engineering, financial and economic advice that Copper Fox has received is reliable and is based upon practices and methodologies which are consistent with industry standards; the speed of field studies and the stability of economic and market conditions. While Copper Fox considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies.

Additionally, there are known and unknown risk factors which could cause Copper Fox's actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. Known risk factors include among others: the 2022 work program may not be completed as planned, or at all; the drilling targets may not provide the results anticipated; the new copper showings may not provide any additional exploration potential; uncertainties relating to interpretation of the previous results; the overall economy may deteriorate; uncertainty as to the availability and terms of future financing; fluctuations in commodity prices and demand; currency exchange rates; and uncertainty as to timely availability of permits and other governmental approvals.

A more complete discussion of the risks and uncertainties facing Copper Fox is disclosed in Copper Fox's continuous disclosure filings with Canadian securities regulatory authorities at www.sedar.com. All forward-looking information herein is qualified in its entirety by this cautionary statement, and Copper Fox disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments, except as required by law.

CUU:CC

The Conversation (0)

09 August 2019

Copper Fox Metals

Copper Exploration and Development in North America

Copper Exploration and Development in North America Keep Reading...

8h

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

22 January

Red Metal Resources Closes First Tranche of Financing

RED METAL RESOURCES LTD. (CSE: RMES) (OTC Pink: RMESF) (FSE: I660) ("Red Metal" or the "Company") announces that it has closed the first tranche of its previously announced non-brokered private placement financing (the "Offering") (see news releases dated January 7, 2026, and January 19, 2026)... Keep Reading...

22 January

Questcorp Mining and Riverside Resources Chip Channel Sample 30 Meters @ 20 g/t Gold and 226 g/t Silver at the Mexican Union Project

Questcorp Mining Inc. (CSE: QQQ) (OTCQB: QQCMF) (FSE: D910) (the "Company" or "Questcorp") along with its partner Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY0) ("Riverside"), is pleased to report a high grade interval of 20.2 g/t gold and 226 g/t silver with 2.7% zinc over a 30... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00