Copper Price Update: Q1 2023 in Review

How did copper perform in Q1, and what's ahead for the rest of 2023? The Investing News Network caught up with analysts to find out.

Copper prices have been performing well since the beginning of the year, trading above the U$8,500 per metric ton (MT) mark for most of the first quarter.

But this time last year, the red metal had rallied to an all-time high, surpassing the US$10,500 level. Could copper prices hit a record again in 2023?

With Q2 already in motion, the Investing News Network (INN) caught up with analysts, economists and experts alike to find out what’s ahead for copper supply, demand and prices. Here's what they had to say.

How did copper prices perform in Q1?

Copper prices kicked off the first quarter of the year trading above US$8,300, staying steady from where they ended 2022.

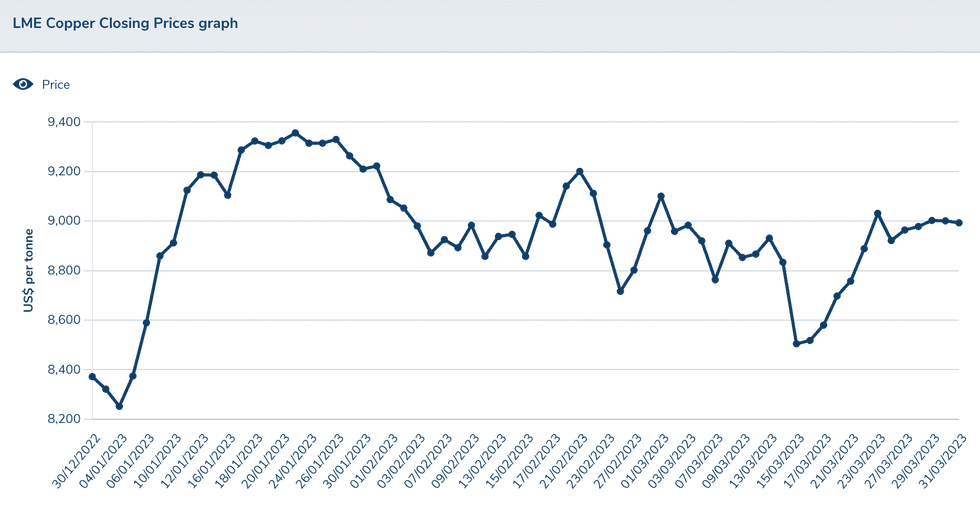

Copper's price performance in Q1.

Chart via the London Metal Exchange.

The red metal's highest point of the quarter came on January 23, when it was changing hands for U$9,356. Prices performed in a choppy fashion throughout Q1, but remained well above US$8,500. Copper touched its lowest point of the period on January 4, when it hit US$8,252.

Speaking with INN about major trends seen in the copper space in the first quarter, Karen Norton of Refinitiv said it was a period where slow supply growth met sluggish demand.

“This fit in with our earlier reading of how things would pan out in the early months of this year, with prices largely rangebound,” she said. “China’s demand recovery has been somewhat subdued to date.” China is the world's top consumer of copper.

All in all, prices ended the three month period up by more than US$600, increasing over 7 percent since the beginning of the year. Copper finished Q1 trading at US$8,993.

Copper supply and demand dynamics in 2023

Copper is widely used in building construction, electrical grids, electronic products, transportation equipment and home appliances. But demand for the red metal has been under pressure from macroeconomic factors, as well as developments in China.

Demand from the Asian country has been weaker than analysts had expected, while the global macroeconomic outlook also put the red metal under pressure during the first three months of the year. That said, the demand outlook for the rest of 2023 is somewhat optimistic.

Chinese state-backed research house Antaike is forecasting that demand for refined copper in China will grow 2.7 percent this year to reach 13.68 million MT. Meanwhile, CRU Group is expecting refined copper consumption in China to rise 2.8 percent to 13.98 million MT in 2023.

“We believe, for copper, China’s COVID policy change should prove supportive for demand in the medium to long run, although rising COVID infections could weigh on demand in the immediate term,” ING’s Ewa Manthey said in a note. “However, global macroeconomic headwinds are likely to persist in 2023 and the risk of global recession will remain a threat to the demand recovery in China, capping further gains.”

It's possible supply will fall short of current market expectations and give prices upwards momentum.

“We feel this is more likely than it overshooting to the upside of most forecasts, although we still feel that relatively unspectacular demand growth will limit upside potential,” Norton said. “First quarter numbers are only just starting to come in, but as these start to filter in, it does look as if our production growth forecast for this year will more likely need to be tempered rather than raised.”

In terms of copper projects to keep an eye out for, Norton said she continues to monitor with interest the progress of the Quebrada Blanca Phase 2 project in Chile, as well as Kisanfu in the Democratic Republic of Congo (DRC). The former in particular is expected to make a substantial contribution to supply growth this year.

Chile is the world’s largest copper producer, putting out 5.2 million MT of copper in 2022, while the DRC is in second place at 2.2 million MT.

“Also we are keeping an eye out for updates on the Udokan project in Russia as news is quite sketchy,” Norton said. “Beyond that, we also track progress closely on the further expansion of the already sizable Kamoa-Kakula mine in the DRC and Oyu Tolgoi in Mongolia.”

What's ahead for the copper market in 2023?

For copper-focused investors, there are few catalysts that could impact the sector as the year continues to unfold.

Merger and acquisition activity in the copper space picked up pace in the past quarter, with all eyes on Glencore’s (LSE:GLEN,OTC Pink:GLCNF) bid for Canada's Teck Resources (TSX:TECK.A,TSX:TECK.B,NYSE:TECK). The move shows the appetite for copper resources as supply tightness looms.

“While it would have a longer-term influence, increasing M&A activity remains interesting, raising the possibility that projects that may appear to have stalled will gather fresh momentum and progress sooner,” Norton said.

Another catalyst to watch for, according to the expert, is the possible diversification of other industrial sectors into the mining space as they seek to secure the materials they need for the energy transition.

For example, electric vehicles use about four times more copper than internal combustion engine cars, as per the International Copper Study Group. Copper is used in batteries, windings and the copper rotors used in electric motors, as well as wiring, busbars and charging infrastructure.

“Copper cannot be substituted in (electric vehicles) or wind and solar energy, and its appeal to investors as a key green metal will support higher prices over the next few years,” ING's Manthey said.

Looking at the short term, key factors to watch include the speed of China’s recovery, possible sanctions on Russian copper and labor unrest at mines in Chile and Peru, FocusEconomics analysts said.

“Prices are seen losing ground in the coming quarters, dented by the global economic slowdown,” they explained.

Panelists polled by the firm see copper averaging US$8,575 in Q4 2023 and US$8,444 in Q4 2024.

For Norton, prices may well remain around that level in the second quarter.

“Perhaps with more of an upwards bias if China’s demand numbers start to look better on a year-on-year comparison, even if that comparison is with a COVID-affected period,” she added.

For its part, ING expects prices to continue to recover from the second quarter onwards on the back of improving reopening sentiment and tight inventories, with prices hovering around US$9,100 in the fourth quarter.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.