March 11, 2025

Initial survey lines highlight large, strike extensive structures consistent with known mineralised silver systems; it is the latest in a growing pipeline of highly prospective areasnext to infrastructure ; Resource update set for this month

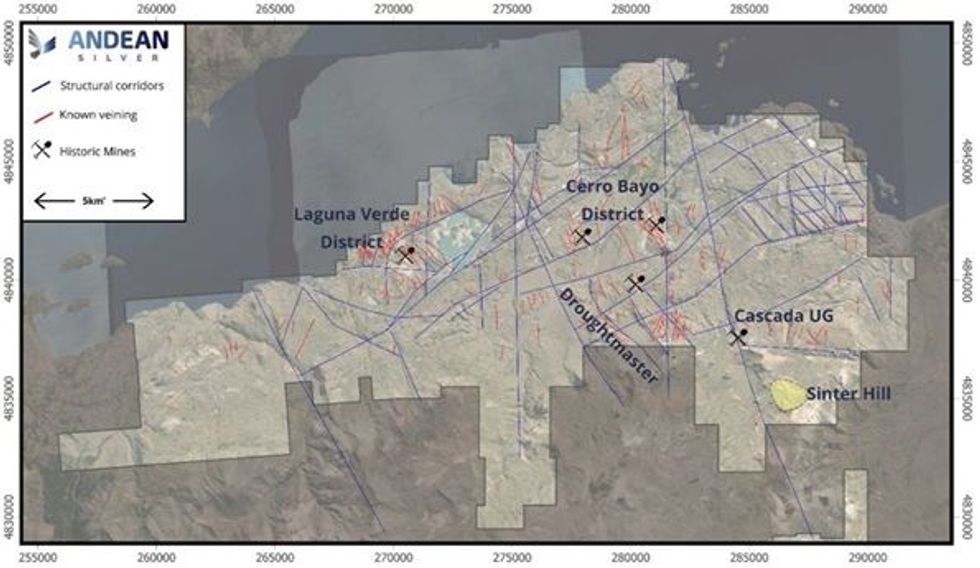

Andean Silver Limited (ASX: ASL) (“Andean” or the “Company”) is pleased to announce that it continues to grow the pipeline of strong exploration targets at its Cerro Bayo Project in Southern Chile, with geophysics identifying another large prospect at the Sinter Hill location.

- Presence of large Sinter Cap at Cerro Bayo indicates potential for an intact epithermal system and corresponding potential for silver and gold mineralisation

- Geophysics survey has supported potential presence of an extended mineralised system, defining over a dozen structural targets extending north from Sinter Hill with many of these corresponding to known surface veins

- New north-south trending structures also identified that demonstrate mineralisation potential over 2km of strike length

- The geophysical results link the target zone at Sinter Hill to the known outcropping veins of Aguila and Meseta with a 2km strike, under shallow cover and previously unexplored

- Only 15% of the Sinter Hill geophysics program completed with key targets of the Cascada trend and south of Sinter Hill yet to be surveyed

- Initial results from Sinter Hill and Pampa La Pera (see ASX release dated 13 February 2025) geophysics programs point to more large-scale targets under shallow cover

- Resource update remains on track for end of this month

Andean Chief Executive Tim Laneyrie said: “The geophysics program continues to show the huge exploration upside at the Cerro Bayo Project. We are rapidly developing a pipeline of strong targets to guide future drill programs and have three rigs currently working on the near mine Laguna Verde resource growth.

“The Sinter Hill feature forms a significant part of the upside potential that Andean saw in the Cerro Bayo Project and we are very excited by the initial results we have seen in the geophysical survey. It has validated the investment to date, and we look forward to seeing the area drilled in the next phase of greenfield exploration drilling.

“The imminent resource update will include Andean’s drilling results for the first time, including the Cristal and Pegaso 7 discoveries announced in 2024.

“The scale of the Cerro Bayo Project continues to grow with every mapping, drilling and geophysics campaign we have completed, which underpins our belief that Cerro Bayo has the potential to be a globally significant silver-gold asset”.

Sinter Hill Prospect

The Sinter Hill prospect is located in the southeast of the Cerro Bayo Project at an elevation of ~1,250mRL, approximately 2.5km south of known mineralisation at the Cascada Vein which sits at an elevation of approximately 850mRL and historically produced 4.23Moz AgEq from 2006-20081 (Figure 1).

The prospect is so-called due to the presence of a geological feature known as a ‘sinter cap’ (Figure 4), which refers to a paleo-surface layer of silica-rich rock formed at the discharge point of a hot spring in an epithermal system, essentially acting as a cap over an underlying mineralised zone. Sinter caps are classic indicators of the presence of an epithermal system due to their direct association with the rising hot, mineral-laden fluids that create the sinter through precipitation as they cool at surface.

An intact epithermal system indicates a high potential for valuable mineral deposits, particularly gold and silver, as the entire process of hydrothermal fluid circulation and mineral precipitation remains undisturbed, preserving the full concentration of precious metals within the system and leading to higher grade deposits.

Sinter Hill therefore represents a high priority prospect for exploration by Andean and the aim of the latest geophysics survey has been to identify potential intact epithermal mineralised zones below and/or extensive vein networks radiating from the Sinter Hill area. The zones identified will form the basis of future exploration and drilling programs, targeting potential significant scale discoveries of high-grade mineralisation which would expand the total resources at the Cerro Bayo Project.

Results of Geophysical Survey

The latest phase of the geophysical survey covered broad spaced lines (400m spacing) over the central zone of the northern mapped Aguila and Meseta veins through to the Sinter outcrop (Figures 2 and 3), with only 15% of the Sinter Hill portion of the program completed to date. Key targets at the Cascada trend and the zone to the south of Sinter Hill have yet to be surveyed.

Significant findings from the latest survey results:

- New north-south trending structures that demonstrate mineralisation potential identified by a coincident enhanced resistivity and chargeability high extending over 2km (Figures 3 and 4) of north-south striking veins at an elevation similar to the known Cascada deposit;

- Over a dozen structural targets defined extending north from Sinter Hill, with multiple subparallel enhanced resistivity anomalies stacked along the northern ridge representing both known and unknown veins (Figures 2, 3 and 4); and

- The expression of the eruption breccias at Sinter Hill at surface appears to expand at depth suggesting it is part of a larger, deeper system (shown in C to C’ in Figures 3 and 4).

Previous geophysics survey results by Andean at Cerro Bayo highlighted the effectiveness of the geophysical technique to map out zones of enhanced resistivity and chargeability, which correlate with known outcropping and buried vein trends (refer ASX release dated 13 February 2025). The results identified potential depth extensions to known mineralisation at the Raul prospect and Cerro Bayo resource area, and a new target under shallow cover at the Pampa La Pera area to the west and sub- parallel of the Claudia area.

Click here for the full ASX Release

This article includes content from Andean Silver, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

13 February

Top 5 Canadian Mining Stocks This Week: Trinity One Surges 105 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV, and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) said they will no... Keep Reading...

11 February

10 Bodies Found as Mexico Probes January Kidnapping at Vizsla Silver Site

Mexican authorities have recovered 10 bodies as part of an investigation into the January abduction of workers from a mining site operated by Vancouver-based Vizsla Silver (TSXV:VZLA) in the northern state of Sinaloa.Mexico’s Attorney General’s Office said the bodies were located in the... Keep Reading...

10 February

Gary Savage: Silver Run Not Over, US$250 is Easy in Next Leg

Gary Savage, president of the Smart Money Tracker newsletter, breaks down gold and silver's recent price activity, saying that while the precious metals have reached the parabolic phase of the bull market, it's typical to see a correction midway through. "The second phase I think will be several... Keep Reading...

09 February

Panelists: Silver in Bull Market, but Expect Price Volatility

Gold often dominates conversations at the annual Vancouver Resource Investment Conference (VRIC), but silver's price surge, which began in 2025 and continued into January, placed the metal firmly in the spotlight. At this year’s silver forecast panel, Commodity Culture host and producer Jesse... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00