April 08, 2024

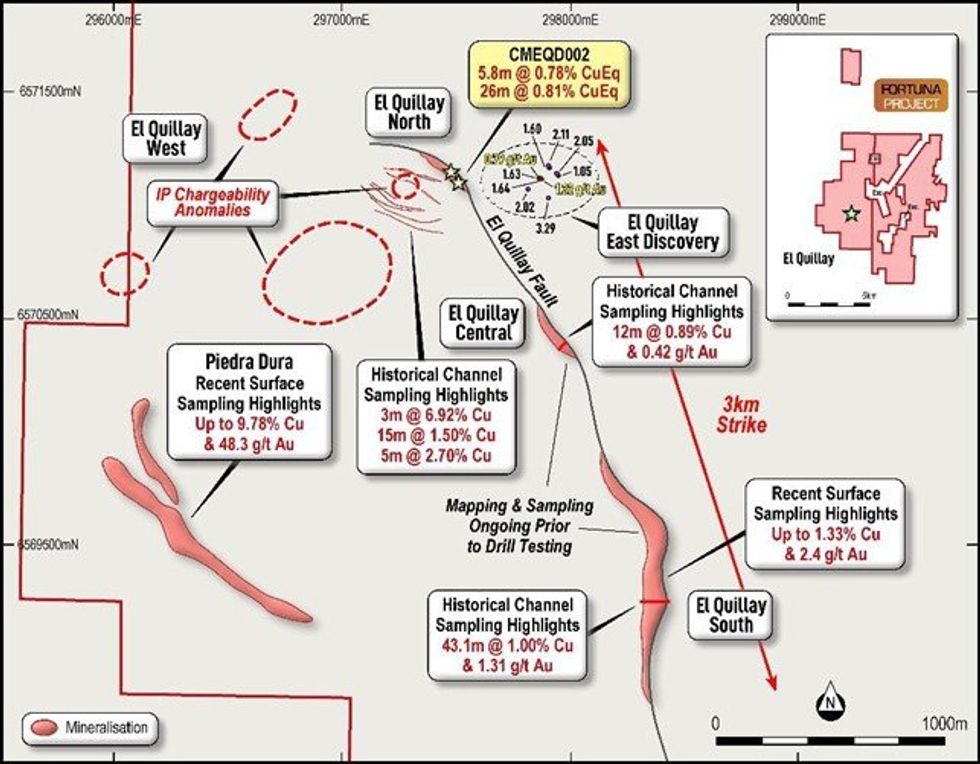

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to announce, that a possible new third zone of copper sulphide mineralisation has been identified within the El Quillay copper trend at its Fortuna Project in Chile (Figure 1). Considerable exploration potential exists within the 3km long trend which hosts high-grade copper mineralisation in a series of parallel structures.

HIGHLIGHTS

- Significant new El Quillay West targets generated through remodelled geophysical data at the Fortuna Project enhancing recent exploration success.

- New target has potential for additional zone of mineralisation 500m to the southwest of the already defined El Quillay Fault Zone (see Figure 1).

- An Induced Polarisation (IP) chargeability anomaly, indicative of copper sulphide mineralisation, has a large footprint of 500m x 300m.

- The new El Quillay West target has had no prior exploration.

- The El Quillay Fault Zone extends for >3km where previous drilling returned an intersection of 26m @ 0.81% CuEq1.

- Upcoming drilling to test lateral and depth extensions of mineralisation within multiple structures proximate to the El Quillay Fault Zone.

- Culpeo’s exploration program continues with new breccia targets at Lana Corina and Vista Montana to be drilled in the coming weeks.

Culpeo Minerals’ Managing Director, Max Tuesley, commented:

“The identification of the new El Quillay West target confirms our belief that a much larger mineralised system exists at El Quillay than previously recognised. Geophysical data remodelling has identified a large chargeability anomaly suggesting the presence of a third zone of parallel mineralisation to the south-west of the El Quillay North Prospect. We look forward to drill testing these targets during 2024.”

RESULTS

During January 2024, Resource Potentials Pty Ltd (ResPot) was commissioned to review, reprocess, model, image and interpret historic Pole-Dipole Induced Polarisiation (PDIP) survey data. ResPot identified four PDIP chargeability anomaly targets from the raw PDIP data, which have potential for copper sulphide mineralisation.

The four PDIP chargeability anomalies are located within the north-western part of the PDIP survey area, including one chargeability anomaly high coincident with known copper sulphide within the El Quillay North Prospect area (Figure 2). Three of the PDIP target areas are untested by existing drilling, including a high-priority target with follow-up ground based exploration planned.

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CPO:AU

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00