Overview

Nickel is an important critical element in the electric vehicle market due to its ability in conducting higher energy density and larger storage capacities in batteries. In 2021, the sales of electric vehicles reached 6.75 million with the demand for electric battery production also increasing by 11 percent or 196,000 metric tonnes (mt) and is expected to grow to 855,000 mt in 2026.

With the EV market playing a significant role in achieving the zero emissions target by 2050, nickel exploration and mining companies are seen to be gearing up for it.

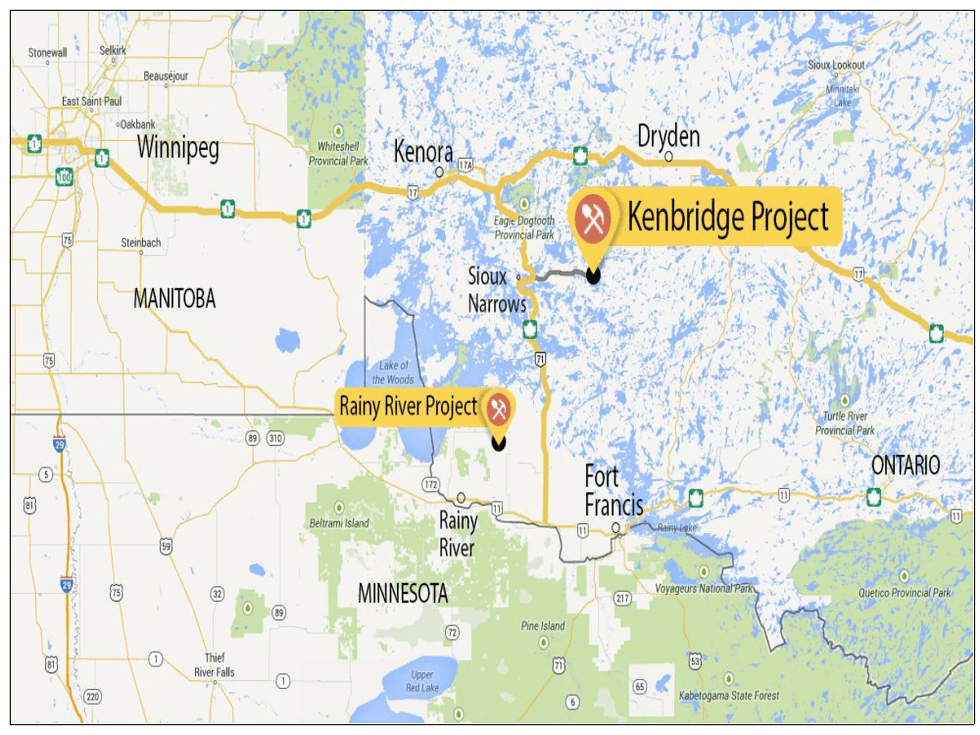

Tartisan Nickel Corp (CSE:TN; OTCQX:TTSRF)(FSE:A2D) is a Canadian battery metals exploration and development company focuses on developing the Kenbridge nickel–copper–cobalt project located in Northwestern Ontario, Canada.

The company commenced construction on an all-season access road into the Kenbridge Nickel Project and completed a positive Preliminary Economic Assessment (PEA) independently prepared by P&E Mining Consultants Inc of Brampton, Ontario. The PEA is focused solely on mining the Mineral Resources at the Kenbridge Nickel Project underground mine and provides a solid base case for moving the Kenbridge Project forward. The PEA indicated a 9-year mine plan based on a 1,500 tonne per day underground mining and processing operation. The Measured, Indicated and Inferred Mineral Resources assume an overall dilution of 47 percent and a 94 percent mine recovery factor.*Disclaimer: This profile is sponsored by Tartisan Nickel Corp. ( CSE:TN ). This profile provides information which was sourced by the Investing News Network (INN) and approved by Tartisan Nickel Corp. in order to help investors learn more about the company. Tartisan Nickel Corp. is a client of INN. The company's campaign fees pay for INN to create and update this profile.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Tartisan Nickel Corp. and seek advice from a qualified investment advisor.