Investor Insight

LAURION Mineral Exploration offers a rare combination of district-scale, dual-mineralization advantage (gold and base metals), strong insider alignment, potential for near-term cash-flow optionality and a rapidly advancing, de-risked brownfield project in a top-tier jurisdiction. With expanding high-grade results, robust technical momentum and clear strategic appeal, the company is positioned for meaningful value growth as Ishkōday progresses toward resource definition and development milestones.

Overview

LAURION Mineral Exploration (TSXV:LME,OTCPINK:LMEFF, FSE:5YD) is a Canadian mid-stage exploration and development company focused on unlocking the value of its 100-percent-owned Ishkōday project in Ontario’s Greenstone Belt. Ishkōday spans 57 sq km and hosts both gold and base metal (zinc-copper-silver) mineralization, a rare combination offering multiple value streams and strong leverage to both precious and base metals markets. The project hosts two past-producing mines, and historical stockpiles of approximately 280,000 tonnes grading 1.14 grams per ton gold.

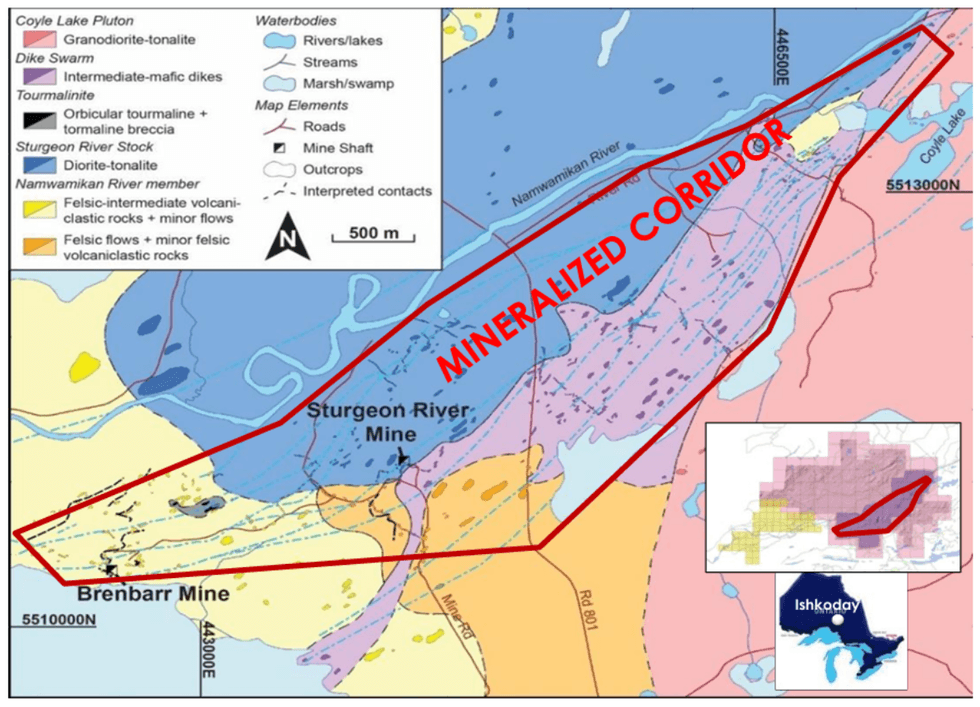

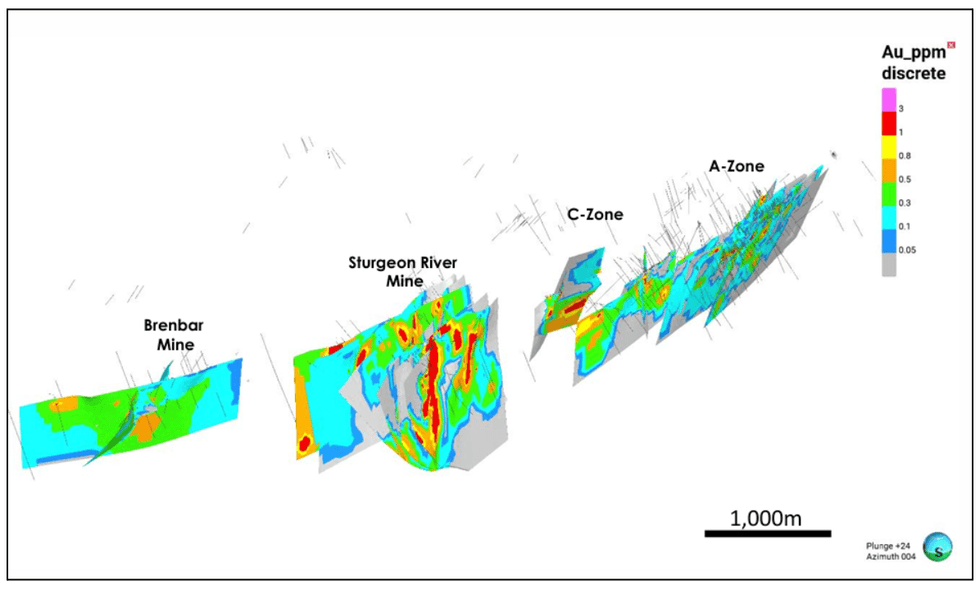

Through ongoing drilling, surface mapping and 3D geological modeling, and partnerships with leading technical, engineering and permitting specialists, LAURION is steadily defining a large mineralized system across a 6 km by 2.5 km corridor, a clear indication of the project’s district-scale potential. LAURION is also progressing its advanced exploration permit (AEP), which will enable underground access and potential processing of surface stockpiles, with an historic estimate containing approximately 10,000 ounces of near-term gold production. This could present near-term cash-flow opportunities that can potentially fund future exploration.

LAURION’s strong insider ownership, approximately 73.6 percent, underscores long-term alignment and confidence in the company’s strategic direction.

TITAN MT and DCIP geophysical surveys completed over the Brenbar and Sturgeon River areas identified deep-rooted structural features, confirmed strong correlations with known mineralized zones and validated Laurion’s 3D geological model. The surveys also outlined several new priority drill targets within the 6-kilometre corridor.

With a robust treasury, favourable technical fundamentals and excellent infrastructure, including highway access, power, water and a skilled local workforce, LAURION is well-positioned to advance Ishkōday toward future resource definition and development milestones. The company’s focus on consistent exploration results, derisking through permitting, and cultivating strategic partnerships contributes to a clear pathway for value creation.

Company Highlights

- Dual-mineralization, district-scale opportunity: The Ishkōday project features an uncommon pairing of two mineral systems in a single district: 1) a gold dominant orogenic system and gold with silver-zinc-copper epithermal system.

- Brownfield advantage: Anchored by two historic past-producing mines within a 57 sq km land package in Ontario’s prolific Greenstone Belt.

- Exceptional insider alignment: Approximately 73.6 percent insider, friends-and-family ownership demonstrates long-term confidence in the project.

- Robust technical foundation: Nearly 100,000 metres of drilling, advanced 3D geological modeling, and partnerships with leading engineering, geoscience and ESG firms.

- Near-term cash-flow potential: Surface stockpile and tailings with an historic estimation, containing roughly 10,000 ounces (280kt @ 1.14 g/t Au) of gold pending advanced exploration permit approval.

- Strategic rerating and M&A appeal: Ongoing derisking, resource growth and permitting progress position Ishkōday as a future development or acquisition candidate in a Tier-1 jurisdiction.

Key Project

Ishkōday Gold and Base Metal Project

LAURION’s 100-percent-owned Ishkōday project is a 57 sq km brownfield exploration asset located 220 km northeast of Thunder Bay in Ontario’s prolific Greenstone Belt. The project hosts an extensive 6 km by 2.5 km mineralized corridor with both gold-dominant orogenic systems and gold with silver-zinc-copper epithermal-style mineralization. The project presents an uncommon dual-mineralization environment that materially expands discovery and development potential. Anchored by the historic Sturgeon River and Brenbar mines, Ishkōday offers a proven high-grade foundation alongside significant upside across multiple zones.

Ishkōday geology overview

Project Highlights

- Large, continuously mineralized system with 22 defined mineralized structures modeled in 3D through modern drilling, geophysics, mapping and historical data integration.

- Nearly 100,000 metres drilled to date, confirming strike continuity and depth potential across both gold and base metal zones.

- High-grade gold legacy with historic production of 78,600 oz at grades exceeding 1 oz/ton from the Sturgeon River and Brenbar mines.

- Recent high-grade drill results, including 12.89 grams per ton (g/t) gold over 2.00 m and 17.73 g/t gold over 1.40 m - LME23-034 near the Brenbar Shaft, expanding known mineralized envelopes.

- Multiple target areas, including Sturgeon River Mine corridor, Brenbar corridor, A-Zone and McLeod Zone, each yielding strong gold and/or gold-base metal intercepts.

- 63.93 m @ 0.58 g/t gold, 6.10 g/t silver, 1.92 percent zinc, 0.11percent copper (LBX20-003) Including 16.16 m @ 1.12 g/t gold, 16.61 g/t silver, 5.00 percent zinc.

- Strong infrastructure advantages, with highway access, proximal power and water, and year-round accessibility, reducing exploration and future development costs.

- Near-term monetization potential via ~280,000 tonnes of surface stockpiles/tailings historically grading ~1.14 g/t gold, representing ~10,000 ounces pending AEP approval and further technical studies.

For investors, Ishkōday offers a strategic combination of scale, grade potential, infrastructure and near-term optionality. The district-scale mineralized corridor provides multiple avenues for resource growth, while the brownfield nature materially reduces geological and permitting risk.

A total of 22 mineralized structures are currently defined in 3D (model)

Dual mineralization provides exposure to both gold and key base metals. Combined with potential early cash flow from surface stockpiles and strong momentum toward the AEP, Ishkōday positions LAURION for significant value creation as it advances toward resource definition and future development milestones.

ESG and Partnerships

LAURION integrates ESG principles into its project development strategy through long-standing partnerships and transparent engagement practices. The company has established strong working relationships with the AZA, BNA and BZA First Nations. The company recognizes that First Nations engagement is essential not only for permitting, but also for building the community capacity required to support future mining operations, ensuring local employment, skills development and long-term project sustainability.

LAURION also maintains a network of specialized technical and ESG partners, including Blue Heron Environmental for permitting and baseline studies, Onyen for ESG reporting, Ronacher McKenzie Geoscience for project management, and Nordmin for engineering support. The company’s relationship with Metals House provides future optionality for dore sourcing and bullion sales. These partnerships allow LAURION to operate efficiently while leveraging best-in-class expertise across exploration, engineering and environmental management.

Management Team

Cynthia Le Sueur-Aquin – President & CEO

Cynthia Le Sueur-Aquin brings more than 45 years of mine management and international experience in the precious metals sector, with a background spanning global exploration and production operations.

Tyler Dilney – Chief Financial Officer

Tyler Dilney is a chartered professional accountant with over a decade of experience across the mining, technology, and oil and gas industries.

Michael Burmi – Director

Michael Burmi is an entrepreneur with 25 years of experience leading high-end technology manufacturing organizations. He has extensive expertise in scaling high-revenue, high-growth engineering and manufacturing operations, contributing strategic and operational insight to LAURION’s board.

Jonathan Covello – Director

Jonathan Covello is CEO and president of Covello Financial Group and has deep experience in raising strategic capital across global markets, including within the mining industry.

Vikram Jayaraman – Director

Vikram Jayaraman holds a Masters in Metallurgy from McGill University and an MBA from the University of Toronto. Formerly the vice-president of Solutions Sales at Outotec, he brings global experience in process solutions and mining-sector commercialization to LAURION s board.