Overview

With the rising movement towards a sustainable and electric-powered world, lithium has the potential to become one of the world’s most valuable resources, powering these electric vehicles.

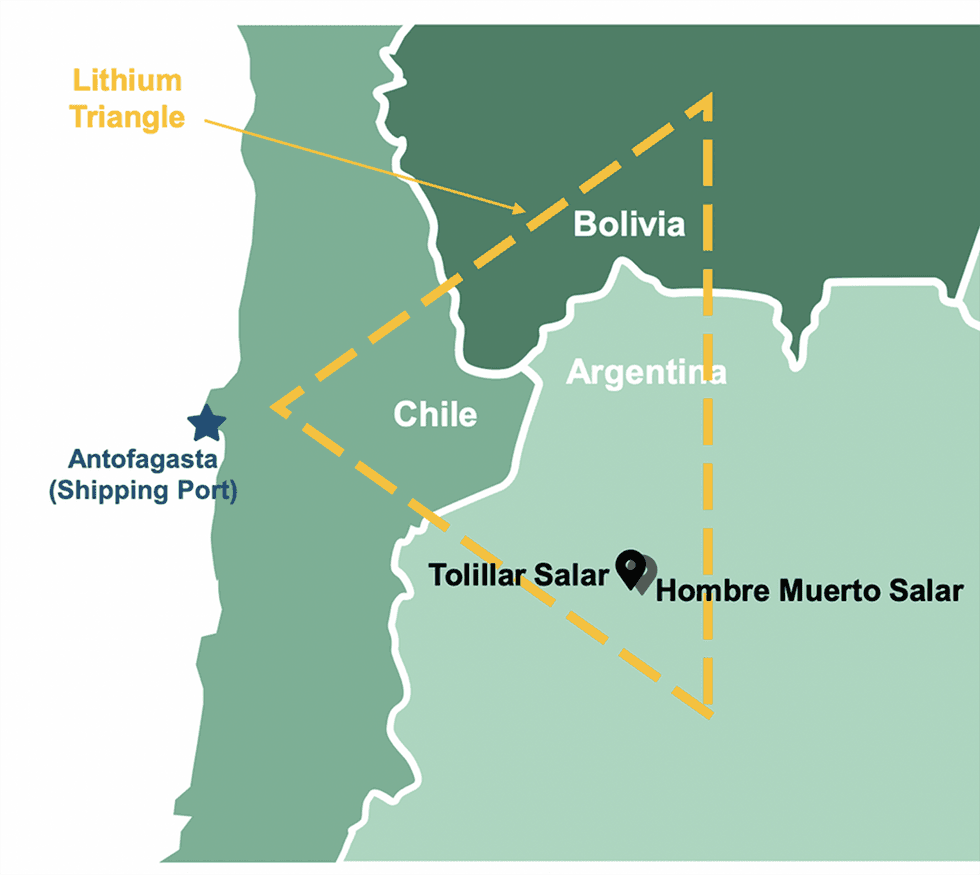

At the forefront of this rapid growth is Argentina, which accounts for 20 percent of the world's reserves and has the world’s largest lithium project pipeline. The famous Triángulo del Litio — the Lithium Triangle — is an under-explored area that is becoming a major host for investor-friendly projects prepared to embrace the potential of a lithium-powered future.

Alpha Lithium (NEO: ALLI,OTC:APHLF,FRB:765) is one of many pursuing lithium in this region, given its potential to be among the last greenfield project opportunities in this section of the world. Alpha Lithium is a development company focused on highly prospective lithium production of its Tolillar Salar project in Salta province, Argentina.

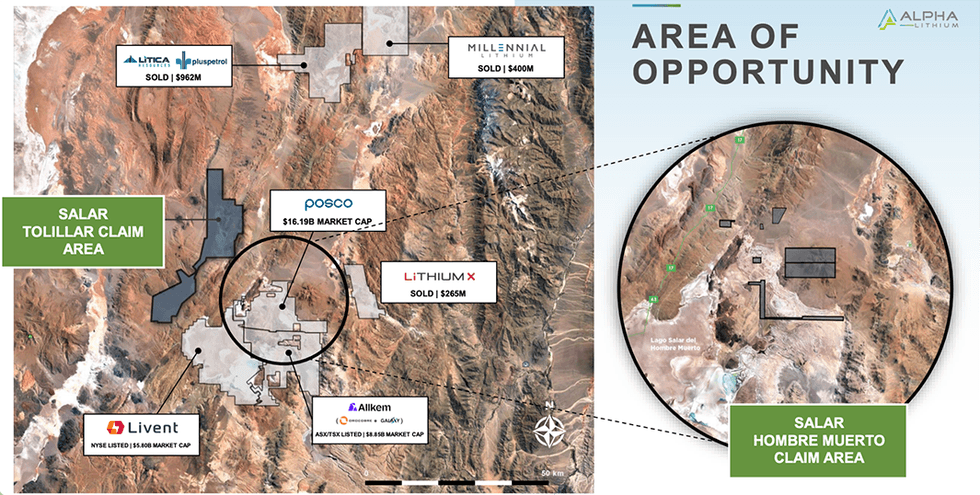

The company leverages its 100-percent ownership of Tolillar Salar and is aiming to repeat the successes of its highly established lithium-producing neighbors.

Alpha Lithium’s flagship Tolillar Solar project is located in Northwest Argentina near the heart of the Lithium Triangle. Its highly accessible infrastructure connects the project site to Salta and San Antonio de Los Cobres through paved road networks, natural gas resources and a skilled local workforce.

Alpha Lithium completed its drilling program at its Salar Tolillar project and announced a maiden resource estimate which includes 2.1 million tonnes of indicated, and 1.2 million tonnes of inferred lithium carbonate equivalent. The resource estimate also includes 7.4 million tonnes of potassium equivalent (KCl) in the indicated category and a further 4.8 million tonnes of KCI in the inferred category. The company recently released an updated PEA indicating US$1.7 billion (C$2.3 billion) after tax NPV8 with an IRR of 25.6 percent; US$8.2 billion (C$11.0 billion) of cumulative free cash flow over a 35-year mine life; and 3.7-year after-tax payback period from the start of production.

Following a series of acquisitions, Alpha Lithium now has 100 percent controlling interest over 5,072 hectares of land in the renowned Salar del Hombre Muerto, Argentina, making the company the second largest landholder (next to Posco) on the Salta side of the famous salar. The company has also concluded a vertical electrical sounding (VES) survey on the property in Hombre Muerto and is planning to acquire an additional 45 VES points.

Alpha Lithium received the licenses to commence exploration operations at Hombre Muerto in January 2023. The company intends to drill up to 12 wellbores on the Hombre Muerto property, in addition to implementing several new VES campaigns.

The management team at Alpha Lithium comprises industry professionals and experienced stakeholders with years of expertise in mining, exploration and capital markets. This well-connected team uses a proven de-risk approach, priming the company for significant growth in the global lithium market.

Company Highlights

- Alpha Lithium is an emerging lithium development company focused on exploring its highly prospective, under-developed lithium assets in Salta province, Argentina.

- Alpha Lithium’s 100-percent owned, flagship Tolillar Salar project is located near the heart of the Lithium Triangle, surrounded by multi-billion dollar lithium producers with decades of active lithium production.

- The project site is strategically positioned near electricity lines, paved road networks, natural gas resources and a skilled local workforce.

- Alpha Lithium also controls a 100-percent interest over 5,072 hectares in the Salar del Hombre Muerto, making it the second largest landholder, after Posco, on the Salta side of the famous salar. The company has already received the licenses to commence exploration work at Hombre Muerto.

- Positive preliminary economic assessment: The Tolillar lithium brine project has a PEA of US$1.7 billion (C$2.3 billion) after tax NPV8 with an IRR of 25.6 percent; US$8.2 billion (C$11.0 billion) of cumulative free cash flow over a 35-year mine life; and 3.7-year after-tax payback period from the start of production.

- Well-funded with over $35 million in cash to continue working towards its lithium carbonate production ambitions in Argentina and 750,000 shares traded daily in Canada, USA and Germany.

- Construction of the 120-tonnes-per-annum (tpa) pilot plant is nearing completion and is expected to commence test production of high-quality lithium carbonate (Li2CO3) in Q3 2023.

Get access to more exclusive Lithium Investing Stock profiles here